8 Optimum farm organization for a representative irrigated farm in... by Gerald Melvin Schaefer

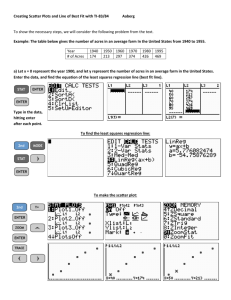

advertisement