Update on IPD's EcoPAS Measurement Service Breakfast Seminar Thursday 22 November 2012

advertisement

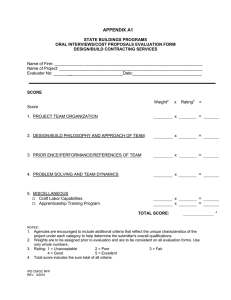

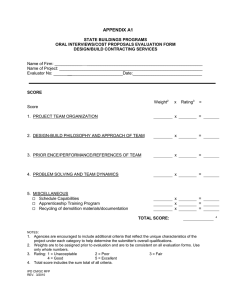

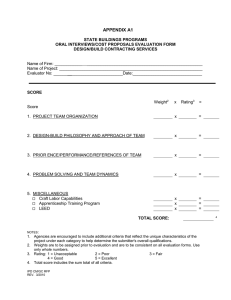

Update on IPD's EcoPAS Measurement Service Breakfast Seminar Thursday 22 November 2012 Copyright © 2012 by K&L Gates LLP. All rights reserved. Update on IPD’s EcoPAS Measurement Service Jess Stevens 22 November 2012 © IPD 2012 ipd.com 1 Very many thanks to our sponsors... © IPD 2012 ipd.com 2 Agenda • IPD EcoPAS - Background and Product Overview - 2012 Contributors - Sample Size • 2012 IPD EcoPAS feedback - Process - Feedback - Data quality • IPD EcoPAS results and analysis (as at Q3 2012) • Next Steps for EcoPAS and IPD Global Sustainability Update © IPD 2012 ipd.com 3 Background • Since 2009, IPD has produced ISPI (IPD Sustainable Property Indicator) • IPD has been unable to draw any conclusions about any outperformance by the more sustainable properties due to: - small samples sizes - the fact that sustainability had not yet been priced into market valuations; and - no standard definition of a ‘sustainable property’ in the UK • In order to bridge this gap, the IPD, RICS,CBRE, AVIVA Investors, Henderson Global Investors, Hermes, L&G and Prupim joined together to create a new, higher level of portfolio-wide environmental metrics • This has represented a transition from ISPI to EcoPAS in the short-term, but in the medium to long term, IPD will continue to produce headline performance results on how sustainability impacts investment performance © IPD 2012 ipd.com 4 IPD Eco-Portfolio Analysis Service (EcoPAS) • Comprehensive benchmarking service that: - measures the environmental risk of every asset in a portfolio; - identifies what the precise sources of those risks are; - determines whether a portfolio is exposed to greater risk than its competitors; and - recognises whether a portfolio is reducing its risk over time and if it is doing so as fast as its competitors • It is NOT a management tool, NOR a certification tool. It is a whole portfolio service to which portfolio managers are subscribing. It is a service created by investors and valuers, for investors and valuers. © IPD 2012 ipd.com 5 EcoPAS Questions © IPD 2012 ipd.com 6 2012 EcoPAS Contributors Investors Aviva Investors Henderson Global Investors Hermes Real Estate L&G Prupim Standard Life The Crown Estate Valuers Allsop DTZ BNP Paribas Gerald Eve Capita Jones Lang LaSalle CBRE Knight Frank Colliers Montagu Evans Crown Estates © IPD 2012 ipd.com 7 The IPD EcoPAS sample size as at Q3 2012 Sustainability data received from: EcoPAS Universe UK Quarterly Universe 2,023 Properties 21% 9,573 Properties £32.5bn 30% £108.8bn Comparison between the quality of EcoPAS and UK Quarterly: Split by Capital Value and Equivalent Yield 6.8% 8.2% 6.0% 8.5% 7.7% 6.8% 7.0% © IPD 2012 ipd.com 8 EcoPAS Process 2012 © IPD 2012 ipd.com 9 IPD EcoPAS feedback • Excellent first step for EcoPAS • Only a few difficulties: - EPC ratings at unit level - Flood risk ratings and flood defences - Different templates used between valuer, client and IPD Questions answered well Questions answered poorly Energy consumption GPS coordinates Energy source Flood defences Water Energy use Waste Adaptability © IPD 2012 ipd.com 10 ‘Unknown’ and ‘known’ EcoPAS data by ERV for EPC data and CV for all other environmental categories Where ‘unknown’ for BREEAM and EPC includes both ‘not rated’ and ‘unknown’ data © IPD 2012 ipd.com 11 EPC analysis: Breakdown by ERV • 5,184 units with an EPC rating (30% total units) • 614 units with an F&G rating (4% total units) • 11,992 units with an Unknown rating (70% total units) • ERV of £1.5bn with an F,G and Unknown EPC rating (65% of total ERV) Known EPC ratings as a Percentage of ERV © IPD 2012 Breakdown of Unknown EPCs by Number ipd.com 12 EPC analysis: Breakdown by ERV and market sector © IPD 2012 ipd.com 13 EPC analysis: Breakdown by number of total EPC ratings and market sector 2, 386 © IPD 2012 1, 606 826 ipd.com 366 14 Flood Risk Analysis: Breakdown by Capital Value EcoPAS flood risk ratings, as a percentage of Capital Value • 192 properties with significant and moderate flood risk ratings (10% total) • 27 properties with unknown flood risk ratings (1.3% total) • Capital Value of £4.3bn with significant, moderate and unknown flood risk ratings (15.8% of total CV) © IPD 2012 ipd.com 15 Flood Risk Analysis: Breakdown by Capital Value and market sector © IPD 2012 ipd.com 16 Water Efficient Practices Analysis: Breakdown by Capital Value • 600 properties with no water efficient practices (30% of total) • 869 properties with unknown water data (43% total) • Capital Value of £18.4bn for properties with no water efficient practices or unknown water data (60.3% of total CV) © IPD 2012 ipd.com 17 Water Efficient Practices Analysis: Breakdown by contribution to Capital Value and Market Sector © IPD 2012 ipd.com 18 Waste Analysis: Breakdown by Capital Value • 285 properties with no waste recycling practices (14% of total) • 768 properties with unknown waste data (38% of total) • Capital Value of £13.8bn for properties with no waste recycling practices or unknown waste data (45.5% of total CV) © IPD 2012 ipd.com 19 Waste Analysis: Breakdown by contribution to Capital Value and Market Sector © IPD 2012 ipd.com 20 Adaptability analysis: Breakdown by Capital Value • 749 properties that are not adaptable to alternative use types (37% of total) • 338 properties with unknown adaptability data (17% of total) • Capital Value of £19.8bn for properties that are not adaptable to alternative use types or have unknown adaptability data (67.3% of total CV) © IPD 2012 ipd.com 21 Accessibility Analysis (time to nearest well-used public transport node): Breakdown by Capital Value • 510 properties greater than 15 minutes from a well-used public transport (26% of total) • 260 properties with inadequate accessibility data (13% of total) • Capital Value of £12.2bn for properties greater than 15 minutes from a well-used public transport node or with inadequate accessibility data (37.1% of total CV) © IPD 2012 ipd.com 22 Accessibility Analysis: Breakdown by Capital Value and Market Sector © IPD 2012 ipd.com 23 Conclusions... • Industry-lead EcoPAS is an excellent example of how the industry has organised itself to create a solution for a shared-problem • Driven by IPD IPD follows an independent and transparent measurement approach, which is crucial to the development and progress of this initiative • In order to ensure sustainability’s place in core real estate analysis Although the first EcoPAS pilot is a good step in the right direction and has achieved great market coverage, sustainability can only grow in its importance of being considered a key driver in investment performance © IPD 2012 ipd.com 24 Next steps for IPD EcoPAS • • Feedback from existing EcoPAS participants and valuers: - Data collection process (valuer, investor, IPD) - Questions (amendments/additions) - Difficulties/challenges - EcoPAS Benchmark Report (current data analysis) Further enhance and grow EcoPAS in the UK: - RICS support (seminars, conferences, guidance) - Increase the current EcoPAS sample size to continually improve findings and make them more meaningful - IPD Sustainability /EcoPAS Training • Expansion of EcoPAS to other markets - France - Netherlands © IPD 2012 ipd.com 25 IPD Global Sustainability Update • Oceania - IPD Australia Green Property Index - IPD New Zealand Green Property Indicator • Canada - Soon to release a Sustainable Property Indicator for the Canadian market • France – Green Building Indicator, produced since 2011 • The Netherlands, Germany, Switzerland, Denmark and Austria – Collect EPC data and provide a few clients with analysis on how their EPC ratings relate to their performance © IPD 2012 ipd.com 26 Thank you for your time Jess Stevens Sustainability Risk Analyst +44 (0)20 7336 9664 jessica.stevens@ipd.com IPD, 1 St. Johns Lane, London, EC4M 4BL, UK Intellectual Property Rights and use of IPD statistics as benchmarks Whether in the public domain or otherwise, IPD's statistics are the intellectual property of Investment Property Databank Limited. It is not permissible to use data drawn from this presentation as benchmarks. © Investment Property Databank Limited (IPD) 2012. Database Right, Investment Property Databank Limited (IPD) 2011. All rights conferred by law of copyright and by virtue of international conventions are reserved by IPD Nov-12 © IPD 2012 27 ipd.com Institutional Investor Perspective Will Edwards Fund Manager – Legal & General Property Introduction • Legal & General Property (LGP) • 18 Funds in the UK with total AUM of c. £10.5bn • One of the 7 investment houses who are submitting data to EcoPAS • LGP have submitted data from 5 balanced UK Funds with total AUM of c. £4.0bn • My experience of EcoPAS • The Fund that I am responsible for submitted data to IPD in Q3 2012 • The Fund is a balanced UK commercial property Fund comprising 45 assets with an NAV of c. £700m Why is sustainability important? • From a fund management perspective sustainability is about protecting the medium to long term value of a portfolio • There is an increasing awareness that sustainability risk is a real threat and future proofing portfolios against this is prudent and will be necessary to deliver long term performance • More value is being attached to positive corporate social behaviour • This behavioural change is also due to regulation obliging owners of real estate to measure aspects of sustainability – particularly energy usage. • EcoPAS aims to chart the correlation between sustainability attributes of buildings, and rental growth and values Data collection - how does it work in practice? IPD’s questions for EcoPAS 2012 Section A: Energy A1 What are the EPC ratings for the asset for each lettable unit? Valuer/Investor A2 In which year was the EPC rating taken? Valuer/Investor A3 Where is the buildings energy sourced from? Valuer A4 What is the total annual energy consumption for the building? Investor A5 What is the energy provided by the owner used for? Investor A6 What is the Net Lettable Area of the whole building? IPD/Investor Section B: Flooding (Environment Agency’s website) B1 What is the asset’s flood risk rating? Valuer B2 Are there on-site flood defences in place at the asset? Valuer B3 Are there flood defences in place that cover the asset’s location? Valuer B4 What are the XY coordinates of the asset? (GPS Coordinates) Valuer IPD’s questions for EcoPAS 2012 Section C: Water C1 Is there any evidence of on-site water efficient practices? Valuer Section D: Waste D1 Is there any evidence of on-site or off-site waste recycling? Valuer Section E: Adaptability E1 Is this property capable of conversion for alternative uses? Valuer Section F: Accessibility F1 How close is the asset to a well-used public transport node IPD IPD’s questions for EcoPAS 2012 Section G: Quality G1 Does the building have a recognised building quality rating? (BREEAM Offices 2008 or similar) IPD/Investor G2 What is the date of the BREEAM (or equivalent) rating? IPD/Investor G3 What is the construction date of the asset? IPD/Investor G4 If there has been a major refurbishment on the asset, what was the year of the last one? IPD/Investor Summary • EcoPAS is an independent measurement of the portfolio’s sustainability credentials by a reputable organisation • Data collection is a simple exercise • Useful tool to help Fund Managers and Investors understand the current environmental condition of their assets and portfolios and how much potential risk they are exposed to • It will show whether we are more or less exposed to risk than our peers; and provide information on whether we are reducing our risk over time • The importance of understanding sustainability and positioning for the future will grow • Those that ignore the issue will be left behind Disclaimer • Legal & General Investment Management does not provide advice on the suitability of its products or services for pension fund clients • The FTSE UK, FTSE All-World™ and FTSE4Good™ index series are calculated by FTSE International Limited (“FTSE”). FTSE does not sponsor, endorse or promote these funds. The FTSE Global Bond index series is operated by FTSE International Limited in conjunction with Reuters, the Institute of Actuaries and the Faculty of Actuaries. FTSE, Reuters, the Institute of Actuaries and the Faculty of Actuaries accept no liability in connection with the trading of any products on these indices. • All copyright in the indices’ values and constituent lists belong to FTSE. Legal & General Investment Management Ltd has obtained full licence from FTSE to use such copyright in the creation of this product. • ““FTSE™”, “FT-SE®” and “Footsie®” are trade marks of the London Stock Exchange Plc and The Financial Times Limited and are used by FTSE International Limited (“FTSE”) under licence. “All-Share”, “All-World” and “FTSE4Good™” are trade marks of FTSE.” • “Macquarie®” is a trade mark of Macquarie Bank Limited and its related entities and both marks are used by FTSE International Limited (“FTSE”) under license. Neither FTSE nor Macquarie nor the Exchange nor the FT shall be liable (whether in negligence or otherwise) to any person for any error in the Index and neither FTSE or Macquarie or Exchange or FT shall be under any obligation to advise any person of any error therein. Legal & General Investment Management Limited has obtained a license from FTSE to use such copyrights and database rights in the creation of the Global Infrastructure Equity Index Fund. • “NAREIT®” is the trade mark of the National Association of Real Estate Investment Trusts (“NAREIT”) and “EPRA®” is a trade mark of the European Public Real Estate Association (“EPRA”) and all are used by FTSE under license. The FTSE EPRA/NAREIT Global Real Estate Index is calculated by FTSE. Neither FTSE, Euronext N.V., NAREIT nor EPRA sponsor, endorse or promote this product and are not in any way connected to it and do not accept any liability in relation to its issue, operation and trading. All copyright and database rights within the index values and constituent list vest in FTSE, Euronext N.V., NAREIT and EPRA. Legal & General Investment Management Limited has obtained full license from FTSE to use such copyright and database rights in the creation of this product. • LPX is a trademark of LPX GmbH, Basel (Switzerland) and has been licensed for the use related to the marketing of funds by Legal & General. LBP GmbH is an independent Index Provider. Funds based on the LPX Composite Index or any other LPX Index are not sponsored, endorsed, sold or promoted by LPX GmbH. • The ultimate holding company of Legal & General Assurance (Pensions Management) Limited is Legal & General Group Plc • Legal & General Assurance (Pensions Management) Limited, is a life insurance company using a unit linked policy. The policy is divided into a number of sections “the pooled funds”. Investment management and marketing is delegated to Legal & General Investment Management Limited. • Both companies are authorised and regulated by the Financial Services Authority EcoPAS The Surveyor’s Perspective Lee Bruce - CBRE CBRE Role • Development of CBRE Sustainability Checklist in 2010/11. • Checklist that could be used to differentiate properties based on agreed ‘sustainability characteristics’. • Evolved to support collection of data for ISPI • Sponsored the IPD initiative in 2011 and checklist adopted by RICS/IPD. • Recorded data on one third of the EcoPAS funds this year representing approximately 600 properties (£10.5bn in CV). CBRE | Page 38 The Challenges • National inspection programme. • Internal Inspections • Tight time-schedule • Surveyor education – No ‘one’ Green team! • London workshop • Regional ‘road shows’ • Liaison between valuer, managing agent and fund manager – worked very efficiently on the whole. • Reporting of data late August/September. CBRE | Page 39 Areas to improve.... • Clearer definitions: • GPS location on a large estate • Adaptability – what is a reasonable cost? • No quantification of water and waste practices • Accessibility – Most business parks have bus stops but does that make them as sustainable as an in-town location? • Reduction in number of ‘unknowns’ in data. CBRE | Page 40 Outcomes • Comprehensive database of sustainability information on 30 real estate funds. • Ongoing roll out of sustainability data gathering across our client portfolios. • Increased sustainability awareness among valuers and fund managers. • Stronger position to respond to future market and sustainability developments. CBRE | Page 41 Update on IPD's EcoPAS Measurement Service Breakfast Seminar Thursday 22 November 2012 Copyright © 2012 by K&L Gates LLP. All rights reserved.