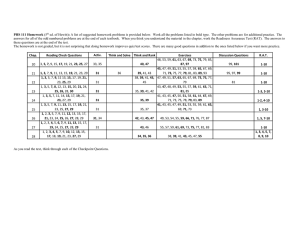

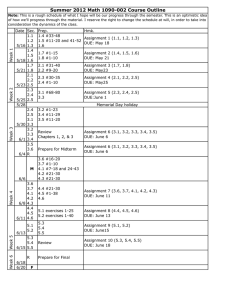

Reality Checks: A Comparative Analysis of Future Benefits

advertisement