A comparative demographic analysis of EU28

advertisement

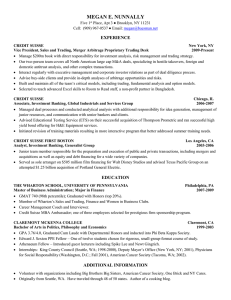

17 December 2013 Global Demographics and Pensions Research http://www.credit-suisse.com/researchandanalytics A comparative demographic analysis of EU28 Global Demographics and Pensions Research Research Analysts Amlan Roy +44 20 7888 1501 amlan.roy@credit-suisse.com Sonali Punhani +44 20 7883 4297 sonali.punhani@credit-suisse.com Angela Hsieh 44 20 7883 9639 angela.hsieh@credit-suisse.com Our comparative demographic analysis of EU28 is detailed for 12 countries (Denmark, Finland, France, Germany, Greece, Ireland, Italy, Netherlands, Portugal, Spain, Sweden and the UK) with an outline for the remaining 16 countries. EU28’s consumers and workers are very different and this has economic, social and political implications. We present these differences highlighting that sustainability as a political union for the EU28 requires acknowledging, appreciating and responding to these differences. EU28 is very heterogeneous. Germany is 192 times Malta’s population size. Within our 12 selected countries (a) for labour force growth: Germany has the lowest (-0.3% p.a.) in contrast to Ireland (1.2% p.a.) over 2010-2015 (b) for old age dependency ratio (the number of 65+ aged persons per 100 working age persons): Germany has the highest ratio (32) whereas Ireland has the lowest ratio (17) in 2010. Demographics leads to high and rising age-related government expenditures on public pensions, health care and long-term care which adds to the existing debt burden of some countries. EU27’s age-related expenditures of 20.5% in 2015 are projected to be 22.8% of GDP in 2035. We believe EU28 needs to renegotiate the pensions, health and long-term care promises as fiscal sustainability worsens for younger generations. Demographics also affects EU28 GDP growth through working age population growth, labour productivity growth and labour utilization growth. While France and Germany both posted 1.3% GDP growth over the 20002012 period, the shares of contributing factors are very different; the factor contributions are also very different for the same country over different periods 1980-90 vs. 2000-2012 (Exhibit 26). The ECB and other central banks need to factor in the fact that conventional monetary policy is much less effective in an aging and demographically changing world. This has implications for the monetary transmission mechanism, objectives as well as communications and guidance. Household structures and median ages have changed in a historically unprecedented manner, affecting consumer expenditure patterns, savings, debt, wealth accumulation and aggregate capital flows. At an aggregate level, they affect asset prices which lead to changed asset allocations and regional as well as sectoral shifts. We highlight urbanization differences suggesting that policy makers pay attention to geography and population densities as they have implications for congestion, pollution, real estate, quality of health and life. City planning and environmental issues come to the fore in expanding metropolises. DISCLOSURE APPENDIX AT THE BACK OF THIS REPORT CONTAINS IMPORTANT DISCLOSURES AND ANALYST CERTIFICATIONS. CREDIT SUISSE SECURITIES RESEARCH & ANALYTICS BEYOND INFORMATION® Client-Driven Solutions, Insights, and Access 17 December 2013 This report updates our previous two reports on the EU’s underlying demographics and the demographic underpinnings of European fiscal sustainability1. We focus on the core demographic indicators as well as analyzing the differences in the areas of health, pensions, education, growth, savings, trade and size of markets. Our detailed analysis is restricted to 12 countries: Denmark, Finland, France, Germany, Greece, Ireland, Italy, Netherlands, Portugal, Spain, Sweden and the UK. EU28 is very heterogeneous and one of the most glaring difference lies in population size. In this report, Exhibit 1 illustrates at a glance the population sizes across countries as follows: those shaded in orange (>40 mn.), in blue (10-40 mn.), in purple (5-10 mn.) and in green (< 5 mn.). Germany’s population size (82.7 million) is nearly 192 times larger than that of Malta (0.4 million). Exhibit 1: EU28 countries by population size, 2013 Color shaded: Countries with population greater than 40mn are shaded in orange; population size between 10-40 mn: blue; population size between 5-10 mn: pink; less than 5mn population size: green Source: UN, Credit Suisse Exhibit 1 also illustrates the geographical differences across these countries, indicating how geography is strategic to some countries in terms of location, trade and migration. Exhibit 36 and Exhibit 37 in the Appendix show how different all the countries are in terms of their population’s age distributions. Exhibit 38 displays the timeline of the progression of the European Union from its six-member version to its current 28-member status. The report is arranged as follows. In section 1 we focus on the core demographic and economic cross-country comparisons. Section 2 shows that consumption trends vary across the countries and they in turn affect savings, capital flows and trade. This is discussed in section 2. In Section 3, we present and discuss labour force, productivity and education trends while section 4 focuses on health and pensions. Section 5 describes the urbanization patterns across the countries along with its implications on sustainability and infrastructure. Section 6 concludes. 1 Credit Suisse Demographics Research, "Spotlighting the European Union's Demographics" (Dec 2011) and "European Demographics & Fiscal Sustainability" (Jan 2013). A comparative demographic analysis of EU28 2 17 December 2013 1. Core demographic and economic indicators We present (in Exhibit 2) the scale of differences across 12 selected countries in terms of the aggregate value of output GDP (current prices) as well as GDP per capita and also rank them. Across the selected countries, the GDP per capita differences are nearly of order 3:1 (highest:lowest) and nearly 20:1 (highest:lowest) for GDP. Note that the country rankings change when they are ranked in terms of GDP relative to when they are ranked on GDP per capita. Germany with the highest GDP in 2013 is ranked 6 th in terms of GDP per capita due to its large population size. Denmark on the other hand is ranked 8 th in terms of GDP but it has the highest GDP per capita owing to its smaller population. We present the comparative economic and demographic characteristics for the remaining 16 of the EU28 countries in Exhibit 39 in the Appendix where Luxembourg stands out as the highest GDP per capita country, with a level roughly twice that of Denmark. Thus population size matters in terms of economic well-being as captured by GDP per capita. Exhibit 2: Economic and demographic characteristics of selected 12 European countries GDP, 2013 Current prices (USD billion) Denmark 324 Finland GDP per capita, 2013 Population, 2013 Population density, 2010 Rank Current prices (USD) Rank Millions Rank Population per square km 8 57,999 1 5.6 10 129 5 260 9 47,625 5 5.4 11 16 12 France 2,739 2 42,991 7 64.3 2 115 6 Germany 3,593 1 43,952 6 82.7 1 233 3 Greece 243 10 21,617 11 11.1 7 84 9 Ireland 221 11 47,882 3 4.6 12 64 10 Italy Rank 2,068 4 33,909 9 61.0 4 201 4 Netherlands 801 6 47,651 4 16.8 6 407 1 Portugal 219 12 20,663 12 10.6 8 115 6 1,356 5 29,409 10 46.9 5 91 8 552 7 57,297 2 9.6 9 21 11 2,490 3 39,049 8 63.1 3 254 2 Spain Sweden UK Source: IMF, UN, Credit Suisse Exhibit 2 illustrates the stark differences across both population size and population density. The highest to lowest ratio in terms of population (Germany vs. Ireland) is 18:1. This has implications for voting in the union as well as sustainability. In terms of population density, Netherlands’ population density is 25 times that of Finland. Of the EU28 countries, Malta has the highest population density of 1,344 people per square km. Our demographic perspective focuses mainly on people as “consumers and workers”. We next present how different the population growth rates (Exhibit 3) and labour force growth rates (Exhibit 4) are across the selected countries. Population growth rates contribute to increasing numbers of consumers and labour force growth rates contribute to increasing numbers of workers. The differences at a broad level influence aggregate consumption expenditures and GDP. Population growth has remained low for most of our sample countries except Ireland, the only country with a population growth rate greater than 1% p.a. Germany’s natural population change (births less deaths) has been declining over the last three decades and it is the only country with negative population growth rate in our sample (Exhibit 3) over 2010-2015. As Exhibit 39 shows, the full set of EU28 countries have other countries that are projected to have a declining population over 2010-2015: Bulgaria, Croatia, Estonia, Hungary, Latvia, Lithuania and Romania. A comparative demographic analysis of EU28 3 17 December 2013 Exhibit 3: Population growth rate, 1980-1985 & 20102015 Exhibit 4: Labour force growth rate, 1990-1995 & 2010-2015 Rate per annum (%) Rate per annum (%) 1.1 1.2% 2.0% 1990-1995 1.0% 1980-1985 2010-2015 1.5% 0.8% 0.7 0.5 0.6% 0.4% 0.2 0.2% 0.3 0.3 0.4 1.2 1.0% 0.6 0.6 0.4 0.5% 0.2 0.2 0.3 0.3 0.3 0.4 0.4 0.5 0.0% 0 0 -0.1 -0.5% 0.0% -0.2% 2010-2015 -0.1 -0.3 -1.0% Source: UN, Credit Suisse Source: ILO, Credit Suisse Slow population growth has typically been followed by slow labour force growth as shown in Exhibit 4. Germany and Finland are projected to have negative labour force growth over 2010-2015 in contrast to Ireland which is projected to have the highest population growth and is also projected to have the highest labour force growth. In Exhibit 5, we present the total fertility rate for the selected 12 countries over 1980-1985 and 2010-2015. Over 1980-1985, Ireland was the only country with its total fertility rate higher than the replacement level of 2.1 children per woman. However, in the current period 2010-2015, the total fertility rate for all 12 countries is below the replacement rate. In terms of fertility rate changes, over the last three decades, Portugal and Ireland have experienced a significant fertility rate decline while countries such as Denmark and Sweden have seen an increase in fertility rates. Exhibit 5: Total fertility & life expectancy at birth Exhibit 6: Old age dependency ratio, 1980 & 2010 1980-1985 & 2010-2015 Ratio of population aged 65 years and over per 100 people aged 15-64 years Total Fertility Rate (Children per woman) Denmark Finland Life Expectancy at Birth (Years) 1980-1985 2010-2015 1980-1985 2010-2015 1.4 1.9 74.4 79.3 1.7 1.9 74.3 80.5 France 1.9 2.0 74.7 81.7 Germany 1.5 1.4 73.7 80.7 Greece 2.0 1.5 74.5 80.7 Ireland 2.8 2.0 73.1 80.6 Italy 1.5 1.5 74.8 82.3 Netherlands 1.5 1.8 76.1 80.9 Portugal 2.0 1.3 72.3 79.8 Spain 1.9 1.5 75.9 82.0 Sweden 1.6 1.9 76.3 81.7 UK 1.8 1.9 74.1 80.4 Source: UN, Credit Suisse A comparative demographic analysis of EU28 35 33 31 29 27 25 23 21 19 17 15 1980 25 2010 25 25 31 26 26 27 28 32 29 23 17 Source: UN, Credit Suisse 4 17 December 2013 Life expectancy at birth has improved significantly over 1980-85 to 2010-2015 as shown in Exhibit 5. Portugal, Italy and Ireland show the largest increases in projected life expectancy (7.5 years) of the 12 sample countries whereas Denmark and Netherlands show moderate increases of 4.8 years. Currently (2010-2015), life expectancy at birth is the highest for Italy at 82.3 years, followed by Spain and Sweden. Later in the report we present and discuss another life expectancy indicator (life expectancy at age 65) as this affects health and long-term care expenditures in the later stages of life. Exhibit 6 presents the high old-age dependency ratios (defined as the ratio of population aged 65+ per 100 population aged 15-64) which are caused by low fertility rates and increased life expectancies. Germany, again has the highest old age dependency ratio reflecting the heaviest burden of its ageing population. In our previous report 2 , we highlight the characteristics and differences across the five oldest countries in the world. Of the five oldest countries, four are from Europe – Germany, Italy, Greece and Sweden. Ireland has the lowest old age dependency ratio of the 12 selected countries, while Cyprus has the lowest ratio of the EU28 countries. Exhibit 7 decomposes overall population change into two components: natural population change (births minus deaths) and net migration. The patterns of migration differ across the selected countries. Italy, Sweden, Portugal and Spain have high levels of immigration dominating their overall population growth. In Germany, net immigration was large enough to offset the negative natural population change from 1985 to 2005, which led to a positive overall population growth rate during this time period. However, since 2005, the negative natural population change has been greater than the positive net immigration change. Therefore, the overall population of Germany has started to decline and with it the number of domestic German consumers has declined too. Exhibit 7: Population change components: natural population change & net migration, 1980-2020 Thousands 4,000 Germany Greece 600 Italy 2,000 500 3,000 1,500 2,000 1,000 1,000 500 0 0 400 300 200 -1,000 1980-1985 100 0 1990-1995 2000-2005 2010-2015 -100 1980-1985 1990-1995 2000-2005 Spain 4,000 200 2010-2015 Sweden 350 300 3,000 250 150 2,000 200 50 1,000 150 0 0 100 100 50 -50 -1001980-1985 2000-2005 2010-2015 400 Portugal 250 1990-1995 -200 -500 1980-1985 -1,0001980-1985 1990-1995 2000-2005 1990-1995 2000-2005 2010-2015 2010-2015 Natural Population Change -150 Net Migration 0 1980-1985 1990-1995 2000-2005 2010-2015 Source: UN, Credit Suisse Within the EU28, Austria and Czech Republic also have a very high levels of net migration dominating their overall population change. In contrast, the following EU28 countries had negative net levels of migration i.e., outward migration or emigration dominated – Bulgaria, Romania, Poland, Lithuania and Croatia. 2 A comparative demographic analysis of EU28 Credit Suisse Demographics Research, "Macro Fiscal Sustainability to Micro Economic Conditions of the Old in the Oldest Five Countries" (2011) 5 17 December 2013 2. Consumption, savings and capital flows We stress that population size is very simply the number of domestic consumers within a country. Our selected countries have different economic structures (we consider the share of household consumer expenditures to GDP) as shown in Exhibit 8. The share of household final consumption expenditure in overall GDP ranges from 45% in Netherlands to 74% in Greece. Since 1980, the share of household final consumption expenditures in GDP has decreased for Ireland by 17% but has increased significantly for Greece by 9%. Exhibit 8: Household final consumption expenditure, 1980 & 2012 Exhibit 9: Consumption by type of goods, 2012 Share of GDP (%) Share of total consumption (%) 100% 74 Greece Portugal 66 UK 66 80% 61 Italy France 58 Germany 58 57 1980 30.5 32.4 28.4 13.3 11.6 57.0 57.4 58.5 57.7 38.1 35.0 32.3 31.3 4.8 7.5 9.1 11.0 13.3 0% 48 Sweden 26.2 14.4 48 Ireland 58.3 20% 49 Denmark 56.0 62.2 57.6 60.4 30.2 24.0 12.2 15.7 40% 2012 Finland 56.1 60% 59 Spain 59.4 29.9 7.9 45 Netherlands 40 50 60 Source: World Bank, Credit Suisse 70 80 Durable goods Non-durable goods Services Source: OECD, Credit Suisse (*2011 data) Exhibit 9 illustrates the breakdown of total consumption expenditure in terms of durables, non-durables and services in 2012. The share of durables in total consumption expenditures was the lowest for Greece and the highest for the UK. Spain spent the highest share of its consumer expenditures on services while France spent the lowest. Detailed analysis of consumption differences across these countries requires an understanding of their household structure. In Exhibit 10, we show the distribution of households by household size and how it has changed over time. The general trend across these countries is an increase in the share of one and two person households and a decline in the share of four and five persons or more households. Household size matters as the expenditure patterns of larger sized households differ from the expenditure patterns of smaller sized households. The share of one person households is the highest in Sweden and Denmark (47% and 40% of total households) and the lowest in Portugal (21% of total households) of the 12 selected countries. Since 1980, Sweden and Spain have experienced the highest increase in the share of one person households. Ireland has the highest share of 5 people or more households and it has also experienced a dramatic decline in the share of 5+ households by 21% since 1980. A comparative demographic analysis of EU28 6 17 December 2013 Exhibit 10: Households distribution (by size): 2012 & change since 1980 Share of total households (%) 1 person 2012 2 people Change from 1980 to 2012 (2012- 1980) 2012 3 people Change from 1980 to 2012 4 people Change from 1980 to 2012 2012 Denmark 40 11 33 2 11 -5 Finland 39 14 36 10 11 France 34 11 33 5 15 Germany 39 10 35 7 Netherlands 37 14 33 Sweden 47 15 Greece 23 Ireland 2012 5 people or more Change from 1980 to 2012 Change from 1980 to 2012 2012 11 -5 5 -3 -9 9 -10 5 -5 -5 12 -6 6 -6 13 -6 10 -6 4 -5 4 12 -5 13 -9 6 -4 26 -5 11 -4 11 -4 5 -2 9 31 6 20 -0 17 -7 9 -8 24 8 32 12 17 2 15 -0 12 -21 Italy 30 12 30 7 19 -3 16 -5 5 -10 Portugal 21 9 34 9 22 0 17 -6 6 -13 Spain 25 15 29 7 19 -0 19 -3 8 -19 UK 34 6 33 6 16 -1 13 -1 5 -9 Source: Euromonitor, Credit Suisse Changing family structure has implications for household consumption expenditures which then translate to aggregate consumption expenditures too. The consumption basket of a one-person household is very different compared to that of a four-person household. Age structure matters too. As shown in Exhibit 11, middle aged people consume very differently compared to the old, for example in France and Greece the 60+ spend more on health and food/ beverages and less on clothing, housing and recreation compared to the 30-39 year olds. In countries such as Denmark, Italy and Portugal, the 30-39 year olds tend to spend higher on health compared to the 60+. One possible reason could be that the young professional people in advanced countries are recognizing the need for better health and lifestyles as they live and work longer than previous corresponding cohorts did. Exhibit 11: Share of consumption by age of household head and by type of goods, 2012 Share of consumption by type of goods (%) Denmark Finland France Germany Greece Ireland 30-39 60+ 30-39 60+ 30-39 60+ 30-39 60+ 30-39 60+ 30-39 Clothing/ Footwear 4.3 4.4 6.3 3.9 5.1 3.8 5.9 4.4 4.0 3.4 4.4 60+ 4.3 Housing 31.3 33.8 25.4 33.6 28.1 25.6 25.0 27.4 28.0 24.2 26.9 17.1 Health/ Medical 3.1 2.9 3.2 7.5 3.4 5.2 3.4 7.5 6.1 7.8 4.3 6.6 Recreation/ Education 17.0 17.7 21.1 16.1 17.7 15.2 17.5 16.9 21.0 18.6 22.8 23.3 Food/ Beverages/ Tobacco 15.9 15.5 16.7 18.7 15.8 20.0 15.8 15.6 19.5 23.5 15.0 19.9 Other 28.4 25.7 27.3 20.1 29.8 30.2 32.3 28.2 21.4 22.5 26.5 29.0 30-39 60+ 30-39 60+ 30-39 60+ 30-39 60+ 30-39 60+ 30-39 Clothing/ Footwear 7.9 8.0 6.5 4.5 6.4 6.6 5.5 5.2 6.4 3.7 7.2 5.0 Housing 23.8 25.5 23.1 31.1 15.6 16.9 19.7 25.1 25.9 31.8 24.6 26.4 Italy Netherlands Portugal Spain Sweden UK 60+ Health/ Medical 3.3 2.6 2.1 4.4 6.7 5.7 3.0 4.1 1.7 5.4 1.4 2.5 Recreation/ Education 19.9 20.1 16.5 14.8 20.7 21.0 29.1 24.5 19.3 15.5 23.9 21.8 Food/ Beverages/ Tobacco 18.4 18.1 14.0 16.5 20.5 20.9 16.8 19.1 14.6 17.1 12.7 16.2 Other 26.7 25.8 37.8 28.6 30.0 28.9 25.9 22.0 32.1 26.5 30.2 28.1 Source: Euromonitor, Credit Suisse A comparative demographic analysis of EU28 7 17 December 2013 The contra of household consumption expenditures is household savings as household savings is the part of disposable income that is not consumed. Household savings rates vary significantly across these countries, ranging from -7.5% of gross disposable income in Greece to 16.1% in Germany (Exhibit 12). These household saving differences (via aggregate savings) have implications for the overall debt and fiscal sustainability across these countries. Varying debt levels and fiscal sustainability make it difficult for a common set of rules to work in an uniform manner across these very diverse economies. Exhibit 12: Gross savings rate of households & NPISH**, 2000 & 2013 Exhibit 13: Stock, private bond and public bond market capitalization, 1990 & 2011 As a percentage of gross disposable income Share of GDP 20 2000 2013 13.5 14.4 15.4 Stock market capitalization 16.1 Private bond market capitalization Public bond market capitalization 1990 2011 1990 2011 1990 2011 Denmark 32 64 100 181 52 39 Finland 21 51 35 21 4 12 5 France 30 65 49 56 23 63 0 Germany* 19 37 40 24 20 50 Greece 11 19 5 34 37 53 Ireland 41 16 2 113 52 29 Italy 15 17 26 38 77 91 Netherlands 52 78 22 72 40 48 Portugal 14 32 6 69 34 49 Spain 25 76 12 54 27 45 Sweden 48 104 51 55 27 26 UK 87 127 13 12 25 59 15 12.2 9.7 10.2 10 5.6 10.5 6.2 -5 -10 -7.5 Source: AMECO, Credit Suisse (*Ireland data is for 2002) 12.4 Source: World Bank, Credit Suisse (*Germany data is for 1992) **NPISH: Non-profit institutions serving households. The way these savings are channelized depends on the development of financial markets in these economies. One measure of financial market development is the size of the stock and bond markets (public and private) as shown in Exhibit 13. The UK in 2011 had the highest stock market capitalization as a share of GDP, while Ireland had the least. Sweden has seen the largest increase in its stock market capitalization since 1990. Private bond market capitalization ranged from 12% in the UK to 181% in Denmark in 2011 while public bond market capitalization ranged from 12% in Finland to 91% in Italy. Our previous research3 highlighted strong statistical links between private savings, current account and budget deficits according to the equation below: Sp = I + CA + (G – T) where Sp = Private Saving, G = Government Expenditures, T = Taxes, CA = Current Account Balance, and I = Investments. A country’s private saving can thus be absorbed into one of the following: a) Budget deficit; b) Purchase of wealth from foreigners; and c) Investment in domestic capital. Exhibit 14 presents the savings, investments and current account balance in Germany and Greece over 1980-2012. Germany has gross national savings higher than investment and a positive current account balance whereas Greece has gross national savings lower than investment and a negative current account balance. Saving-investment patterns along with the budget deficits are related to the current account balance and trade dynamics and it is important to note the differences across the countries. Savings are also affected by the term structure of interest rates (the yield curve) which is influenced at shorter maturities by monetary policy. In a demographically changing world, monetary policy effectiveness is reduced.4 Credit Suisse Demographics Research, "Demographics, Capital Flows and Exchange Rates" (2007) 3 4 See end of report references to J. Bullard et al (2012) and P Imam (2013). A comparative demographic analysis of EU28 8 17 December 2013 Exhibit 14: Savings, investments & current account balance, Germany & Greece, 1980- 2012 Exhibit 15: Share of exports, imports and trade openness, 2012 Share of GDP (%) Share of GDP (%); Trade openness- Sum of exports and imports Germany 8 30 Ireland 6 108 Netherlands 25 87 79 166 4 2 Denmark 55 Germany 52 15 Sweden 49 10 Finland 40 40 Portugal 39 39 UK 32 34 Spain 32 31 Italy 30 29 59 Greece 27 32 59 France 27 30 20 0 -2 -4 1980 1985 1990 1995 2000 2005 2010 Greece 0 35 -5 25 -10 15 -15 -20 5 1980 1985 1990 1995 2000 Current account balance (LHS) Gross national savings (RHS) 2005 2010 0 Total investment (RHS) 50 105 46 98 43 91 80 78 66 63 Trade openness: 57 50 Exports Source: IMF, Credit Suisse 192 84 100 150 200 Imports Source: World Bank, Credit Suisse The current account balance is related to the trade balance which is affected by the trade openness of a country (defined as the sum of the share of exports and imports in GDP). Exhibit 15 shows Ireland has the highest trade openness (192% of GDP) and France has the lowest (57% of GDP). Exhibit 16 shows the top export destinations of countries in 2012. Exhibit 16: Exports by destination, 2012 Denmark Finland France Germany Greece Ireland Share of exports (%) EU27 57.1 EU27 51.5 EU27 59 EU27 56.2 EU27 43 EU27 59.1 Norway 6.6 Russia 9.9 USA 6.1 USA 7.9 Turkey 10.8 USA 19.8 USA 5.5 USA 6 China 3.5 China 6.1 USA 3.8 Switzerland 5.5 China 2.5 China 4.5 Switzerland 3.2 Switzerland 4.5 FYR Macedonia 3 Japan 2.3 Hong Kong 1.8 Norway 3.1 Russia 2.1 Russia 3.5 Libya 2.9 China 1.7 Italy Netherlands Portugal Spain Sweden UK Share of exports (%) EU27 55.5 EU27 72.7 EU27 69.8 EU27 61.1 EU27 55.4 EU27 48.5 USA 6.1 USA 4.6 Angola 6.6 USA 4.1 Norway 10.1 USA 13.3 Switzerland 5.5 China 1.8 USA 4.1 Morocco 2.4 USA 6 Switzerland 3.4 China 2.7 Russia 1.6 China 1.7 Turkey 2.1 China 3.2 China 3.3 Turkey 2.5 Switzerland 1.3 Brazil 1.5 Switzerland 2.1 Russia 1.9 Hong Kong 1.9 Source: WTO, Credit Suisse A comparative demographic analysis of EU28 9 17 December 2013 The highest share of exports of these countries goes to other European countries. US and China also figure in the list of the top five export destinations of most of the countries. As Exhibit 17 shows the largest share of imports of the selected countries also come from within EU27. China, US and Russia also figure in the list of the top five countries from where imports of most of the selected countries originated in 2012. Exhibit 17: Imports by origin, 2012 Denmark Finland France Germany Greece Ireland Share of imports (%) EU27 70.3 EU27 50.3 EU27 58.6 EU27 56 EU27 45 EU27 China 7 Russia 17.6 China 8 China 8.6 Russia 12.4 USA 13 Norway 5.3 China 7.7 USA 6.4 USA 5.7 Saudi Arabia 5.5 China 5.6 USA 2.8 Norway 3.6 Switzerland 2.3 Russia 4.7 China 4.7 Switzerland Russia 1.2 USA 3.1 Russia 2.3 Switzerland 4.2 South Korea 3.9 Norway Italy Netherlands Portugal Spain Sweden 58.9 2 1.9 UK Share of imports (%) EU27 53.4 EU27 51.6 EU27 64.2 EU27 49.1 EU27 67.6 EU27 47.4 China 7.4 China 8.2 China 4.7 China 7 Norway 9.1 USA 8.9 Russia 4.2 USA 6.8 Angola 3.2 USA 3.9 Russia 5.3 China 8.2 USA 3.2 Russia 5.2 Algeria 2.6 Russia 3.2 China 4.1 Norway 4.8 Switzerland 2.8 Norway 3.1 Brazil 2.5 Nigeria 2.8 USA 3.2 Switzerland 4 Source: WTO, Credit Suisse 3. Labour force: activity rates, employment, education and productivity In order to better understand the drivers of economic growth, it is important to understand the productivity and the skills base of the country. The contribution to economic growth comes not only by focusing on numbers of workers but also on their relative labour productivity and hours worked. Economic activity rates refer to the percentage of people of the working age group that are actively employed. Exhibit 18 presents the gender activity gap (male less female activity rates) across countries, highlighting that governments and societies need to encourage and embrace higher female labour force participation as women are a highly educated and skilled part of the labour force. Exhibit 18: Gap between male and female economic activity rates, 1990 & 2013 Exhibit 19: Economic activity rate by age- Greece, 1990 & 2013 Male – female economic activity rates (%) % 40 1990 35 2013 30 25 20 20 16 15 10 8 9 9 11 12 13 5 0 Source: ILO, Credit Suisse A comparative demographic analysis of EU28 13 13 16 22 100 90 80 70 60 50 40 30 20 10 0 1990 2013 EAR increase from 1990-2013: 35-39 yr olds: 10% 55-59 yr olds : 10% Source: ILO, Credit Suisse 10 17 December 2013 This requires changes in labour market practices and institutions but mostly in attitudes. Exhibit 19, Exhibit 20 and Exhibit 21 display the change in economic activity rates between 1990 and 2013, over the work life-cycle for a typical worker in Greece, Italy and Spain. While the economic activity rates have increased, they have not extended in the latter part of the work life cycle at ages beyond 50 and they need to in order to keep pace with increased life expectancies. It is important to stress that females live longer than males and EU28 needs to modernize labour markets to allow women’s education and skills to be better utilized than that which is being done currently. Exhibit 20: Economic activity rate by age - Italy, 1990 & 2013 Exhibit 21: Economic activity rate by age - Spain, 1990 & 2013 % % 90 1990 100 90 80 70 60 50 40 30 20 10 0 2013 80 70 60 50 EAR increase from 1990-2013: 35-39 yr olds: 4% 55-59 yr olds : 13% 40 30 20 10 0 Source: ILO, Credit Suisse 1990 2013 EAR increase from 1990-2013: 35-39 yr olds: 16% 55-59 yr olds : 16% Source: ILO, Credit Suisse Rising youth unemployment and income inequality 5 has become a major issue in the advanced world since the onset of the 2008 credit crisis. In 2012, Greece and Spain had the highest youth unemployment rate (of total labour force aged 15-24 years) amongst the EU28 countries, more than double their overall unemployment rates (Exhibit 22). Exhibit 22: Total vs. youth unemployment, 2012 % 60 55 Total unemployment (% of total labour force) 50 53 Youth unemployment (% of labour force aged 15-24) 40 38 35 % 30 30 20 10 25 24 24 19 8 10 8 5 8 21 16 15 14 24 11 9 5 8 8 0 Source: ILO, Credit Suisse 5 A comparative demographic analysis of EU28 Credit Suisse Demographics Research, "Youth unemployment and income inequality", part of Credit Suisse 2014 Global Outlook (2013) 11 17 December 2013 Over 2000-2012, Italy, Portugal and Spain saw the most significant rise in their youth unemployment rate. Austria, Germany and Netherlands are the only three countries out of the EU28 with youth unemployment rate below 10%. Income inequality, which is measured by the Gini coefficient, also shows a wide disparity across the 28 countries. Latvia has the highest Gini ratio of 35.9 (i.e. lower income inequality) compared to Slovenia’s lowest Gini ratio of 23.7 in 2012. Exhibit 23 highlights the productivity differences within our sample while looking at value added per worker in agriculture, industry and services. The productivity differences are quite stark even across the larger more advanced European countries. They are very different across the 16 other countries. Part of the productivity differences are attributable to education as well as the employment structures across different countries. Exhibit 24 presents the differences in tertiary education levels across the countries within our sample – the share of population aged 15-64 years with tertiary education in 2012 ranged from 13.8% in Italy to 34.7% in the UK. Exhibit 23: Gross value added per worker, 2011 Exhibit 24: Share of population aged 15-64 years with tertiary education, 2012 Thousands of current USD % Agriculture Industry Services 60.5 118.3 103.8 40 62.9 111.3 87.9 35 60.6 81.9 102.8 30 46.3 88.3 79.0 16.0 65.0 72.9 25 56.0 178.1 94.7 20 45.2 74.3 92.5 15 57.7 145.5 92.2 10 9.3 36.5 50.9 44.6 92.8 71.4 91.6 138.3 94.1 40.5 89.8 71.2 Denmark Finland France Germany Greece Ireland Italy Netherlands Portugal Spain Sweden UK Source: UN, ILO, Credit Suisse 34.7 34.7 32.8 27.9 23.0 28.6 28.6 29.6 30.1 24.8 16.8 13.8 Source: Eurostat, Credit Suisse In terms of Human Development Index (a quality of life index) for 2012, Netherlands is ranked the highest (rank 4), Portugal the lowest within the selected 12 countries (rank 43) and Bulgaria the lowest within EU28 (rank 57) as shown in Exhibit 25. Exhibit 25: Human Development Index, Global Gender Gap Index, and Corruption Perception Index for the 12 selected countries Human Development Index 2012 Rank Global Gender Gap Index 2013 Corruption Perception Index 2012 Country Value Rank Country Score Rank Country Score 4 Netherlands 0.921 2 Finland 0.84 1 Denmark 90 5 Germany 0.92 4 Sweden 0.81 1 Finland 90 7 Ireland 0.916 6 Ireland 0.78 4 Sweden 88 7 Sweden 0.916 8 Denmark 0.78 9 Netherlands 84 15 Denmark 0.901 13 Netherlands 0.76 13 Germany 79 20 France 0.893 14 Germany 0.76 17 UK 74 21 Finland 0.892 18 UK 0.74 22 France 71 23 Spain 0.885 30 Spain 0.73 25 Ireland 69 25 Italy 0.881 45 France 0.71 30 Spain 65 26 UK 0.875 51 Portugal 0.71 33 Portugal 63 29 Greece 0.86 71 Italy 0.69 72 Italy 42 43 Portugal 0.816 81 Greece 0.68 94 Greece 36 Source: UNDP, World Economic Forum, Transparency International, Credit Suisse A comparative demographic analysis of EU28 12 17 December 2013 Gender equality is measured by the Global Gender Gap Index created by the World Economic Forum. We note that in 2013 Finland outperforms the other EU28 countries whereas Greece and Hungary underperform. In terms of the Corruption Perception Index, Finland again is on top of the list with the highest ranking along with Denmark (rank=1 i.e., the lowest corruption perception) while Greece has the highest corruption perception (rank= 94) in 2012. While education and productivity differences are important to note, what really matters in the aggregate is how that translates to GDP and GDP growth. Exhibit 26 depicts a growth accounting decomposition of the demographic drivers 6: working age population growth, labour productivity growth and labour utilization growth for France, Germany, Italy, Greece, Spain and the UK. Not only are the cross-country growth patterns important to compare over time periods 1980-1990 vs. 2000-2012, but are also at least as important as the differing contributions of these three drivers to the GDP growth trends across these countries. Understanding the demographic dynamics of these drivers is essential to understanding and appreciating the growth dynamics. Labour productivity growth has been a dominant contributor to GDP growth for France, Germany, Italy and the UK, while working age population growth was important in explaining GDP growth in Greece in the 1980s and in Spain over 2000-2012. Exhibit 26: GDP growth decomposed: demographic drivers, 1980-2012 Rate per annum (%) Germany France 4 4 Real GDP: 2.2 2 2.7 1 0 -1 0.9 1.3 2 1.1 1 0.5 -0.4 0 -1.3 -1 1980-1990 Greece 5 1.6 1.0 0.8 0.0 3 1.0 -0.4 -0.1 -0.3 -0.5 -1 -1.0 2000-2012 1.7 -0.3 0.5 0.8 0.0 -0.2 0.3 0.2 -0.1 1980-1990 2000-2012 2000-2012 3.0 Spain 3.1 2.5 0.4 UK 2.2 1.7 2.0 3.4 0.9 -1.2 1.9 1.5 1.0 1.0 1.1 -0.3 0.5 0.0 2.1 1.4 0.4 -0.3 0.5 -0.2 1980-1990 2000-2012 -0.5 -2 1980-1990 1.5 -0.5 1 0 2.0 1.0 -1.4 2 1.2 2.3 1.2 4 1.0 0.5 0.6 1980-1990 2000-2012 2.0 1.5 1.3 0.4 2.7 -2 -2 2.5 2.5 3 3 Italy 3.0 1.9 1980-1990 2000-2012 Source: UN, GGDC, Credit Suisse 6 A comparative demographic analysis of EU28 Credit Suisse Demographics Research, "A demographic perspective of economic growth" (2009) 13 17 December 2013 4. Health and pensions Exhibit 27 presents the forecasts for age-related government expenditure, including public pensions, health care and long-term care, as a percentage of GDP across the 12 selected countries. The total age-related expenditure is projected to increase in all the countries, with Netherlands showing the most significant increase from 17.6% in 2010 to 26.3% in 2060. France, on the other hand, is projected to spend the greatest amount on age-related items throughout the period (2010-2060). By 2060, the French government is projected to spend 28.7% of its GDP on age-related expenditures whereas the UK is projected to spend the least 20.2% of GDP. While most countries are projected to devote a greater share of government spending on pensions, health care and long-term care, Italy and Denmark present a contrast to the dominant trend with a fall in their pensions expenditure over 2010-2060. The increasing promises on age-related expenditure and fiscal sustainability concerns have prompted us to study the impact of demographic variables on a country’s sovereign rating7 detailed in a previous research report. Exhibit 27: Forecasted age-related expenditure components, 2010-2060 Age-related Expenditure Components (as % of GDP) Pensions Health Care Long-term Care 2010 2035 2060 2010 2035 2060 2010 2035 10.1 10.5 9.5 7.4 8.2 8.4 4.5 6.4 8 Finland 12 15.5 15.2 6 6.9 7 2.5 4.4 5.1 France 14.6 15.2 15.1 8 9.1 9.4 2.2 3.2 4.2 Germany 10.8 12.4 13.4 8 9.1 9.4 1.4 2.2 3.1 Greece 13.6 14.6 14.6 6.5 6.9 7.4 1.4 1.8 2.6 Ireland 7.5 9.4 11.7 7.3 7.9 8.3 1.1 1.6 2.6 Italy 15.3 15 14.4 6.6 7 7.2 1.9 2.3 2.8 Netherlands 6.8 10 10.4 7 8 8 3.8 6.1 7.9 Portugal 12.5 13.1 12.7 7.2 7.5 8.3 0.3 0.4 0.6 Spain 10.1 11.3 13.7 6.5 7.2 7.8 0.8 0.9 1.5 Sweden 9.6 10.2 10.2 7.5 8 8.1 3.9 5.2 6.4 UK 7.7 8 9.2 7.2 7.9 8.3 2 2.5 2.7 Denmark 2060 Source: European Commission, Credit Suisse Exhibit 28 presents gross pension replacement rates for the average male earner in 2012. The replacement rate is the ratio of gross pension entitlement divided by pre-retirement income. There exist big differences across our selected countries, with gross pension replacement rate ranging from 33% in the UK to 91% in Netherlands. Countries with a higher than 50% replacement rate promise on public pensions will impose a greater fiscal burden on younger generations, making the current sustainability pressures worse due to weaker growth, higher unemployment and rising inequality. 8 Unlike replacement rates that only look at the benefit level at the point of retirement, gross pension wealth which takes into account life expectancy, retirement age and indexation of pensions, provides a more comprehensive measure of the stock of future flows of pension benefits. We present pension wealth statistics for our selected countries in Exhibit 29. Countries with higher pension replacement rates tend to have higher pension wealth such as Netherlands and Denmark. UK, with the lowest pension replacement rate also has the lowest pension wealth amongst the 12 countries. A NETSPAR paper on pension wealth9 7 Credit Suisse Demographics Research, "Demographics, Debt & Sovereign ratings" (2013) 8 See "Rising Youth Unemployment: a Threat to Growth and Stability" and "Youth Unemployment and Income Inequality", previous reports by Credit Suisse's Demographics Research team. 9 R. Alessie, V. Angelini & P. Santen, "Pension wealth and household saving in Europe - Evidence from Sharelife", NETSPAR discussion paper (2011) A comparative demographic analysis of EU28 14 17 December 2013 estimates the displacement effect of pension wealth on household savings. We believe that gross pension wealth multiples of more than 10 impose inequitable and unsustainable burdens on younger generations. In a previous research report titled “Why Increasing Longevity Matters to Us All? 10” we highlighted that that these pensions challenges will need to be comprehensively tackled at various levels by: individuals and families, governments, insurance companies, pension funds, asset managers and corporates. Exhibit 28: Gross pension replacement rates for the average male earner, 2012 Exhibit 29: Gross pension wealth for the average earner, 2012 Gross pension entitlement divided by gross pre-retirement incomes Gross pension wealth is the total value of lifetime flow of pension incomes, measured as a multiple of gross annual individual earnings Netherlands Denmark Spain Italy France EU27 Sweden Finland Portugal OECD34 Greece Germany Ireland UK 25 91 Men 79 74 71 20 59 58 56 55 55 54 54 Women 15 10 5 42 0 37 33 0 20 40 60 80 100 Source: OECD, Credit Suisse Source: OECD, Credit Suisse We believe that in addition to studying life expectancy at birth, it is also very important to consider conditional life expectancy i.e. life expectancy remaining at a given age, typically 65 or 80 years, as that matters more for examining the ageing burden and managing longevity risk. In Exhibit 30 we show life expectancy at age 65, which measures the length of remaining life at age 65 across the 12 countries. Exhibit 30: Life expectancy at age 65, 2012 Exhibit 31: Healthy life years at age 65, 2011 Years Years 22 21.7 21.5 20.8 21 20.5 20 19.5 19.6 19.6 19.6 19.6 19.9 19.8 19 19 18.5 18 17.5 Source: Eurostat, Credit Suisse (* Data is for 2011) 19.9 19.9 20.9 Germany Portugal Italy Finland EU 27 Greece Spain France Netherlands Ireland UK Denmark Sweden Males Females 6.7 7.9 8.1 8.4 8.6 9.1 9.7 9.7 10.4 10.9 11.1 12.4 13.9 7.3 6.4 7 8.6 8.6 7.8 9.2 9.9 9.9 11.7 11.9 13 15.2 Source: Eurostat, Credit Suisse The indicator Healthy Life Years (HLY) at age 65 measures the number of years that a person at age 65 is still expected to live in a healthy condition. 10 A comparative demographic analysis of EU28 Credit Suisse Demographics Research, "How Increasing Longevity Affects Us All?: Market, Economic & Social Implications (March 2012) 15 17 December 2013 France, Italy and Spain have the highest life expectancy at age 65 whereas Denmark has the lowest. In Exhibit 31 we present healthy life expectancy at age 65, i.e., how many years a person aged 65 is still expected to live in a healthy condition. Interestingly, longer life expectancy at 65 does not necessarily translate into longer healthy life at 65 in the case of France and Italy. Denmark, on the other hand, with relatively short life expectancy at 65, has a longer healthy life at 65 for both males and females than that of France and Italy. Of the 12 selected countries, Netherlands had the highest health expenditure per capita in 2011 (5,123 international dollar) while Portugal had the lowest (2,624 international dollar) as shown in Exhibit 32. Netherlands’ health expenditure per capita, despite being the highest amongst the 12 countries, is still 60% lower than that of the USA. In Exhibit 33, we decompose the health expenditure into private spending and public spending. Netherlands’ total health expenditure accounted for 12% of its GDP, and a significant share of the spending came from public funding in 2011 (10.2% of GDP). This contrasts with Greece where public and private funded health spending account for 6.6% and 4.2% of GDP (more equal share) respectively in 2011. Exhibit 32: Health expenditure per capita, 2011 Exhibit 33: Health expenditure, 2011 PPP, Constant 2005 international $ Share of GDP 5,500 Finland UK Sweden Ireland Spain Italy Portugal Greece Germany Denmark France Netherlands 5,000 4,500 4,000 3,500 3,000 2,500 2,000 2.2 1.6 1.8 2.8 2.5 2.2 3.7 4.2 2.7 1.7 2.7 1.7 0 Source: WHO, Credit Suisse 2 6.6 7.7 7.6 6.6 7.0 7.3 Total: 8.9 9.3 9.4 9.4 9.4 9.5 10.4 6.6 6.6 8.4 9.5 8.9 10.2 4 6 8 Health expenditure as % of GDP Private Public 10.8 11.1 11.2 11.6 12 10 12 Source: WHO, Credit Suisse The Survey of Health, Aging and Retirement in Europe (SHARE) is a cross- national panel database of micro data on the health, socio-economic status and social networks of people from 19 European countries aged 50 or over. A paper comparing the health among 16 SHARE countries11 found that Germany shows almost the same high levels of adverse health outcomes as East European countries. Differences in institutional factors have a major impact on health disparities and must be addressed to increase healthy and active ageing in Europe. 11 A comparative demographic analysis of EU28 M. Eriksen, S. Vestergaard & K. Andersen-Ranberg "Health among Europeans- a cross sectional comparisons of 16 SHARE countries" (2013) 16 17 December 2013 5. Urbanization In Exhibit 34, we compare the urbanization rates across the selected countries in 1980 and 2015. Of the 12 countries, the projected urbanization rate for 2015 ranges from 62% in Greece to 88% in France. Over 1980-2015, Portugal and Netherlands have seen a significant increase in their urbanization rates. Exhibit 34: Urban population, 1980 & 2015 Exhibit 35: Distribution of urban population, 2015 Share of total population (%) Share of urban population (%) 100 100% 90 1980 2015 84 86 87 80 78 80 85 74 62 63 90% 80% 70% 19.6 12.8 17.9 24.3 9.5 9.3 6.5 35.3 49.5 20.4 60% 69 70 88 7.1 18.2 14.5 11.7 7.5 50% 63 12.9 40% 60 30% 50 77.7 75.0 64.6 55.3 20% 57.1 55.6 37.6 10% 40 0% France Source: UN, Credit Suisse Germany Greece Italy <0.5 mn 0.5-1mn 1-5 mn Spain 5-10 mn Sweden > 10mn UK Source: UN, Credit Suisse In Exhibit 35, we emphasize that it is not enough to only focus on the sheer size of the urban population but that it is equally important to consider the distribution of urban population. Germany and Sweden have a more sustainable urbanization model, with about 75% of its urban population residing in smaller city sizes which have less than 0.5 million population. France, on the other hand, has nearly 20% of its urban population clustering in mega cities with more than 10 million residents. This speaks to the SRI concerns of investors as well as policy makers. While population densities of countries vary between 16 people per square km in Finland to 407 in Netherlands, the densities in major cities are often in the multiples of thousands. While these create economies of scale, there are congestion and pollution costs associated with larger metropolises. Many older European cities are having to deal with expansion due to population increases while being unable to change large parts of the old traditional infrastructure . 6. Conclusions In this report, we highlight EU28’s varying and changing demographics, many of which have been overlooked by countries. The underlying demographics affects the EU28 at multiple levels—political, economic and social. Our demographic focus is not only on the “number of people” but on the “changing nature of people as consumers and workers”. The changing behavior of consumers and workers affect balance sheets of households, corporates as well as countries. How demographically heterogeneous is EU28? We outline some differences by highlighting the extremes across the countries: population ranges from 0.43 million in Malta to 82.7 million in Germany in 2013, total fertility rate ranges from 1.3 in Portugal to 2 in Ireland and France over 2010-2015 and old age dependency ratio ranges from 16 in Cyprus to 32 in Germany in 2010. We present scores and rankings that capture quality of life, gender equality and corruption index, which are also related to demographics. A comparative demographic analysis of EU28 17 17 December 2013 Apart from looking at the standard demographic variables to make our point, we believe our main contribution is to link demographics (consumer and worker characteristics) to macroeconomic aggregates like GDP growth, unemployment, government budgets, trade deficits and capital flows. Consumer demand for goods and services and worker supply of goods and services are both vital to understand GDP. People are not only living longer but much more importantly they are living differently in a global economy which is technologically changing and evolving in terms of its inter-connectedness. Rising youth unemployment and income inequality have been gaining attention as important economic and social issues in Europe. Income inequality also shows wide disparity across the 28 countries with Gini ratios ranging from 23.7 in Slovenia to 35.9 in Latvia (i.e., lowest income inequality) in 2012. Education, health, urbanization and employment (or unemployment) as well as distribution of income and wealth (inequality) underlie both the social and economic dynamics of households, societies and countries. Any framework for a reconstituted EU needs to better understand and incorporate the underlying demographic heterogeneity to avoid the mistakes of the past where political agreements ignored the economic and demographic differences across member states. A comparative demographic analysis of EU28 18 17 December 2013 References Credit Suisse Demographics Research, "Youth unemployment and income inequality", part of Credit Suisse 2014 Global Outlook (2013) Credit Suisse Demographics Research, “Demographics, Debt & Sovereign ratings” (2013) Credit Suisse Demographics Research, "Rising youth unemployment: A threat to growth and stability" (2013) Credit Suisse Demographics Research, "European Demographics & Fiscal Sustainability" (2013) Credit Suisse Demographics Research, "How Increasing Longevity Affects Us All?: Market, Economic & Social Implications (2012) Credit Suisse Demographics Demographics" (2011) Research, "Spotlighting the European Union's Credit Suisse Demographics Research, "Macro Fiscal Sustainability to Micro Economic Conditions of the Old in the Oldest Five Countries" (2011) Credit Suisse Demographics Research, "A demographic perspective of economic growth" (2009) Credit Suisse Demographics Research, "Demographics, Capital Flows and Exchange Rates" (2007) J. Bullard et. al., “Demographics, Redistribution & Optimal Inflation”, Federal Reserve Bank of St. Louis Review (2012) M. Eriksen, S. Vestergaard & K. Andersen-Ranberg "Health among Europeans - a cross sectional comparisons of 16 SHARE countries" (2013) P. Imam, “Shock from Graying: Is the Demographics Shift Weakening Monetary Policy Effectiveness”, IMF Working Paper (2013) R. Alessie, V. Angelini & P. Santen, "Pension wealth and household saving in EuropeEvidence from Sharelife", NETSPAR discussion paper (2011) A comparative demographic analysis of EU28 19 17 December 2013 Appendix: Exhibit 36: Age and gender distribution of population of selected 12 countries, 2015 In thousands Denmark France Finland 80+ 80+ 80+ 70-74 70-74 70-74 60-64 60-64 60-64 50-54 50-54 50-54 40-44 40-44 40-44 30-34 30-34 30-34 20-24 20-24 20-24 10-14 10-14 10-14 0-4 0-4 300 200 100 0 100 200 300 0-4 300 200 100 0 100 200 300 3,000 80+ 80+ 70-74 70-74 70-74 60-64 60-64 60-64 50-54 50-54 50-54 40-44 40-44 40-44 30-34 30-34 30-34 20-24 20-24 20-24 10-14 10-14 10-14 0-4 0-4 0 2,000 4,000 Share of age 80+: 5.8% 500 0 Share of age 80+: 4.4% 500 Male 400 1,000 70-74 70-74 70-74 60-64 60-64 60-64 50-54 50-54 50-54 40-44 40-44 40-44 30-34 30-34 30-34 20-24 20-24 20-24 10-14 10-14 10-14 0-4 0-4 200 400 600 200 100 0 100 200 300 3,000 80+ 70-74 70-74 70-74 60-64 60-64 60-64 50-54 50-54 50-54 40-44 40-44 40-44 30-34 30-34 30-34 20-24 20-24 20-24 10-14 10-14 10-14 0-4 0-4 200 400 Share of age 80+: 5.4% 600 400 3,000 1,000 0 1,000 2,000 3,000 2,000 3,000 UK 80+ 0 200 Share of age 80+: 6.6% Spain Portugal 200 2,000 Share of age 80+: 2.9% 80+ 400 0 0-4 300 Share of age 80+: 6% 600 3,000 Italy 80+ 0 2,000 Share of age 80+: 5.2% 80+ 200 200 Female Ireland Greece 400 1,000 0-4 1,000 80+ 600 0 Sweden Netherlands Germany 2,000 1,000 Share of age 80+: 5.9% 80+ 4,000 2,000 Share of age 80+: 5.1% Share of age 80+: 4.3% of total population 0-4 2,000 1,000 Share of age 80+: 5.8% 0 1,000 Male 2,000 Female 3,000 3,000 2,000 1,000 0 1,000 Share of age 80+: 4.9% Source: UN, Credit Suisse A comparative demographic analysis of EU28 20 17 December 2013 Exhibit 37: Age and gender distribution of population of the remaining 16 of EU28 countries, 2015 In thousands Croatia Belgium Austria Bulgaria 80+ 80+ 80+ 80+ 70-74 70-74 70-74 70-74 60-64 60-64 60-64 60-64 50-54 50-54 50-54 50-54 40-44 40-44 40-44 40-44 30-34 30-34 30-34 30-34 20-24 20-24 20-24 20-24 10-14 10-14 10-14 10-14 0-4 0-4 0-4 400 200 0 200 600 400 400 200 0 200 400 600 0-4 200 300 200 100 0 100 200 300 100 0 100 200 400 Hungary Czech Republic Cyprus Estonia 80+ 80+ 80+ 80+ 70-74 70-74 70-74 70-74 60-64 60-64 60-64 60-64 50-54 50-54 50-54 50-54 40-44 40-44 40-44 40-44 30-34 30-34 30-34 30-34 20-24 20-24 20-24 20-24 10-14 10-14 10-14 10-14 0-4 0-4 0-4 0-4 60 40 20 0 20 40 60 600 80 400 200 0 200 400 600 600 60 40 20 0 20 40 400 200 0 200 400 600 60 Malta Lithuania Latvia Luxembourg 80+ 80+ 80+ 70-74 70-74 70-74 60-64 60-64 60-64 50-54 50-54 50-54 40-44 40-44 40-44 30-34 30-34 30-34 20-24 20-24 20-24 10-14 10-14 10-14 0-4 0-4 0-4 100 50 0 50 150 100 100 50 0 50 100 150 80+ 70-74 70-74 70-74 60-64 60-64 60-64 50-54 50-54 50-54 40-44 40-44 40-44 30-34 30-34 30-34 20-24 20-24 20-24 10-14 10-14 10-14 0-4 0-4 0-4 0 50-54 40-44 30-34 20-24 10-14 0-4 20 20 1,000 1,000 2,000 500 10 0 10 20 0 500 1,000 10 0 10 20 30 Slovenia Slovakia 80+ 1,000 60-64 30 80+ 2,000 70-74 Romania Poland 80+ 80+ 70-74 60-64 50-54 40-44 30-34 20-24 10-14 0-4 300 200 100 0 100 200 300 100 50 0 50 100 Source: UN, Credit Suisse Exhibit 38: Timeline of the European Union Original Members Year 1951 Member States Belgium, France, West Germany, Italy, Luxembourg, Netherlands New Members Added 1973 + Denmark, Ireland, UK 1981 + Greece + 1986 1995 2004 Portugal, Spain Austria, Finland, Sweden Cyprus, Czech Republic, Estonia, Hungary, Latvia, Lithuania, Malta, Poland, Slovakia, Slovenia + + 2007 2013 + Romania, + Bulgaria Croatia Source: European Commission, Credit Suisse A comparative demographic analysis of EU28 21 17 December 2013 Exhibit 39: Key demographic and economic highlights of the remaining 16 of EU 28 countries, current year GDP Current prices (USD billion) GDP per capita Population Current prices (USD) Millions Population density Population Total fertility Life expectancy growth rate rate at birth Old-age dependency ratio Population per square km Rate per annum (%) Children per woman Years Population aged 65+ per 100 population 15-64 2013 2013 2013 2010 2010-2015 2010-2015 2010-2015 2010 Austria 418 49,256 8.50 100.2 0.4% 1.47 81.0 26 Belgium 507 45,537 11.10 358.4 0.4% 1.85 80.4 26 Bulgaria 54 7,411 7.22 66.6 -0.8% 1.53 73.5 27 Croatia 59 13,312 4.29 76.7 -0.4% 1.50 77.0 26 Cyprus 22 24,706 1.14 119.0 1.1% 1.46 79.8 16 Czech Republic 199 18,868 10.70 133.8 0.4% 1.55 77.6 22 Estonia 24 18,127 1.29 28.8 -0.3% 1.59 74.3 26 Hungary 131 13,172 9.95 107.6 -0.2% 1.41 74.5 24 Latvia 30 14,924 2.05 32.4 -0.6% 1.60 72.1 27 Lithuania 47 15,633 3.02 47.0 -0.5% 1.51 72.1 22 Luxembourg 61 110,573 0.53 196.4 1.3% 1.67 80.5 20 Malta 9 22,323 0.43 1,344.1 0.3% 1.36 79.7 21 Poland 514 13,334 38.22 118.2 0.0% 1.41 76.3 19 Romania 184 8,630 21.70 91.7 -0.3% 1.41 73.7 21 Slovakia 97 17,929 5.45 110.8 0.1% 1.39 75.3 17 Slovenia 47 22,719 2.07 101.4 0.2% 1.50 79.5 24 Source: UN, IMF, Credit Suisse A comparative demographic analysis of EU28 22 GLOBAL FIXED INCOME AND ECONOMIC RESEARCH Dr. Neal Soss Global Head of Economics and Demographics Research (212) 325 3335 neal.soss@credit-suisse.com Eric Miller Co-Head, Securities Research & Analytics (212) 538 6480 eric.miller.3@credit-suisse.com ECONOMICS AND DEMOGRAPHICS RESEARCH GLOBAL / US ECONOMICS Dr. Neal Soss (212) 325 3335 neal.soss@credit-suisse.com Jay Feldman (212) 325 7634 jay.feldman@credit-suisse.com Dana Saporta (212) 538 3163 dana.saporta@credit-suisse.com Isaac Lebwohl (212) 538 1906 isaac.lebwohl@credit-suisse.com Casey Reckman (212) 325 5570 casey.reckman@credit-suisse.com Argentina, Venezuela Daniel Chodos (212) 325 7708 daniel.chodos@credit-suisse.com Latam Strategy Di Fu Juan Lorenzo Maldonado (212) 538 4125 (212) 325 4245 juanlorenzo.maldonado@credit-suisse.com di.fu@credit-suisse.com Colombia, Peru Daniel Lavarda 55 11 3701 6352 daniel.lavarda@credit-suisse.co Iana Ferrao 55 11 3701 6345 iana.ferrao@credit-suisse.com Leonardo Fonseca 55 11 3701 6348 leonardo.fonseca@credit-suisse.com LATIN AMERICA (LATAM) ECONOMICS Alonso Cervera Head of Latam Economics 52 55 5283 3845 alonso.cervera@credit-suisse.com Mexico, Chile BRAZIL ECONOMICS Nilson Teixeira Head of Brazil Economics 55 11 3701 6288 nilson.teixeira@credit-suisse.com Paulo Coutinho 55 11 3701-6353 paulo.coutinho@credit-suisse.com EURO AREA / UK ECONOMICS Neville Hill Head of European Economics 44 20 7888 1334 neville.hill@credit-suisse.com Christel Aranda-Hassel 44 20 7888 1383 christel.aranda-hassel@credit-suisse.com Giovanni Zanni 44 20 7888 6827 giovanni.zanni@credit-suisse.com Axel Lang 44 20 7883 3738 axel.lang@credit-suisse.com Steven Bryce 44 20 7883 7360 steven.bryce@credit-suisse.com Mirco Bulega 44 20 7883 9315 mirco.bulega@credit-suisse.com Violante di Canossa 44 20 7883 4192 violante.dicanossa@credit-suisse.com EASTERN EUROPE, MIDDLE EAST AND AFRICA (EEMEA) ECONOMICS Berna Bayazitoglu Head of EEMEA Economics 44 20 7883 3431 berna.bayazitoglu@credit-suisse.com Turkey Sergei Voloboev 44 20 7888 3694 sergei.voloboev@credit-suisse.com Russia, Ukraine, Kazakhstan Carlos Teixeira 27 11 012 8054 carlos.teixeira@credit-suisse.com South Africa Alexey Pogorelov 7 495 967 8772 alexey.pogorelov@credit-suisse.com Russia, Ukraine, Kazakhstan Natig Mustafayev 44 20 7888 1065 natig.mustafayev@credit-suisse.com EM and EEMEA cross-country analysis Nimrod Mevorach 44 20 7888 1257 nimrod.mevorach@credit-suisse.com EEMEA Strategy, Israel JAPAN ECONOMICS NON-JAPAN (NJA) ECONOMICS Hiromichi Shirakawa Head of Japan Economics 81 3 4550 7117 hiromichi.shrirakawa@credit-suisse.com Dong Tao Head of NJA Economics 852 2101 7469 dong.tao@credit-suisse.com China Robert Prior-Wandesforde 65 6212 3707 robert.priorwandesforde@credit-suisse.com Regional, India, Indonesia, Australia Christiaan Tuntono 852 2101 7409 christiaan.tuntono@credit-suisse.com Hong Kong, Korea, Taiwan Santitarn Sathirathai 65 6212 5675 santitarn.sathirathai@credit-suisse.com Regional, Malaysia, Thailand Michael Wan 65 6212 3418 michael.wan@credit-suisse.com Singapore, Philippines Weishen Deng 852 2101 7162 weishen.deng@credit-suisse.com China Takashi Shiono 81 3 4550 7189 takashi.shiono@credit-suisse.com GLOBAL DEMOGRAPHICS & PENSIONS RESEARCH Dr. Amlan Roy Head of Global Demographics 44 20 7888 1501 amlan.roy@credit-suisse.com Sonali Punhani 44 20 7883 4297 sonali.punhani@credit-suisse.com Angela Hsieh 44 20 7883 9639 angela.hsieh@credit-suisse.com Gergely Hudecz 33 1 7039 0103 gergely.hudecz@credit-suisse.com Czech Republic, Hungary, Poland Disclosure Appendix Analyst Certification Amlan Roy, Sonali Punhani and Angela Hsieh each certify, with respect to the companies or securities that the individual analyzes, that (1) the views expressed in this report accurately reflect his or her personal views about all of the subject companies and securities and (2) no part of his or her compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this report. References in this report to Credit Suisse include all of the subsidiaries and affiliates of Credit Suisse operating under its investment banking division. For more information on our structure, please use the following link: https://www.credit-suisse.com/who_we_are/en/This report may contain material that is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would subject Credit Suisse AG or its affiliates ("CS") to any registration or licensing requirement within such jurisdiction. All material presented in this report, unless specifically indicated otherwise, is under copyright to CS. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of CS. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of CS or its affiliates. The information, tools and material presented in this report are provided to you for information purposes only and are not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. CS may not have taken any steps to ensure that the securities referred to in this report are suitable for any particular investor. CS will not treat recipients of this report as its customers by virtue of their receiving this report. The investments and services contained or referred to in this report may not be suitable for you and it is recommended that you consult an independent investment advisor if you are in doubt about such investments or investment services. Nothing in this report constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to your individual circumstances, or otherwise constitutes a personal recommendation to you. CS does not advise on the tax consequences of investments and you are advised to contact an independent tax adviser. Please note in particular that the bases and levels of taxation may change. Information and opinions presented in this report have been obtained or derived from sources believed by CS to be reliable, but CS makes no representation as to their accuracy or completeness. CS accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that such liability arises under specific statutes or regulations applicable to CS. This report is not to be relied upon in substitution for the exercise of independent judgment. CS may have issued, and may in the future issue, other communications that are inconsistent with, and reach different conclusions from, the information presented in this report. Those communications reflect the different assumptions, views and analytical methods of the analysts who prepared them and CS is under no obligation to ensure that such other communications are brought to the attention of any recipient of this report. CS may, to the extent permitted by law, participate or invest in financing transactions with the issuer(s) of the securities referred to in this report, perform services for or solicit business from such issuers, and/or have a position or holding, or other material interest, or effect transactions, in such securities or options thereon, or other investments related thereto. In addition, it may make markets in the securities mentioned in the material presented in this report. CS may have, within the last three years, served as manager or co-manager of a public offering of securities for, or currently may make a primary market in issues of, any or all of the entities mentioned in this report or may be providing, or have provided within the previous 12 months, significant advice or investment services in relation to the investment concerned or a related investment. Additional information is, subject to duties of confidentiality, available on request. Some investments referred to in this report will be offered solely by a single entity and in the case of some investments solely by CS, or an associate of CS or CS may be the only market maker in such investments. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a judgment at its original date of publication by CS and are subject to change without notice. The price, value of and income from any of the securities or financial instruments mentioned in this report can fall as well as rise. The value of securities and financial instruments is subject to exchange rate fluctuation that may have a positive or adverse effect on the price or income of such securities or financial instruments. Investors in securities such as ADR's, the values of which are influenced by currency volatility, effectively assume this risk. Structured securities are complex instruments, typically involve a high degree of risk and are intended for sale only to sophisticated investors who are capable of understanding and assuming the risks involved. The market value of any structured security may be affected by changes in economic, financial and political factors (including, but not limited to, spot and forward interest and exchange rates), time to maturity, market conditions and volatility, and the credit quality of any issuer or reference issuer. Any investor interested in purchasing a structured product should conduct their own investigation and analysis of the product and consult with their own professional advisers as to the risks involved in making such a purchase. Some investments discussed in this report may have a high level of volatility. High volatility investments may experience sudden and large falls in their value causing losses when that investment is realised. Those losses may equal your original investment. Indeed, in the case of some investments the potential losses may exceed the amount of initial investment and, in such circumstances, you may be required to pay more money to support those losses. Income yields from investments may fluctuate and, in consequence, initial capital paid to make the investment may be used as part of that income yield. Some investments may not be readily realisable and it may be difficult to sell or realise those investments, similarly it may prove difficult for you to obtain reliable information about the value, or risks, to which such an investment is exposed. This report may provide the addresses of, or contain hyperlinks to, websites. Except to the extent to which the report refers to website material of CS, CS has not reviewed any such site and takes no responsibility for the content contained therein. Such address or hyperlink (including addresses or hyperlinks to CS's own website material) is provided solely for your convenience and information and the content of any such website does not in any way form part of this document. Accessing such website or following such link through this report or CS's website shall be at your own risk. This report is issued and distributed in Europe (except Switzerland) by Credit Suisse Securities (Europe) Limited, One Cabot Square, London E14 4QJ, England, which is authorised by the Prudential Regulation Authority ("PRA") and regulated by the Financial Conduct Authority ("FCA") and the PRA. This report is being distributed in Germany by Credit Suisse Securities (Europe) Limited Niederlassung Frankfurt am Main regulated by the Bundesanstalt fuer Finanzdienstleistungsaufsicht ("BaFin"). This report is being distributed in the United States and Canada by Credit Suisse Securities (USA) LLC; in Switzerland by Credit Suisse AG; in Brazil by Banco de Investimentos Credit Suisse (Brasil) S.A or its affiliates; in Mexico by Banco Credit Suisse (México), S.A. (transactions related to the securities mentioned in this report will only be effected in compliance with applicable regulation); in Japan by Credit Suisse Securities (Japan) Limited, Financial Instruments Firm, Director-General of Kanto Local Finance Bureau (Kinsho) No. 66, a member of Japan Securities Dealers Association, The Financial Futures Association of Japan, Japan Investment Advisers Association, Type II Financial Instruments Firms Association; elsewhere in Asia/ Pacific by whichever of the following is the appropriately authorised entity in the relevant jurisdiction: Credit Suisse (Hong Kong) Limited, Credit Suisse Equities (Australia) Limited, Credit Suisse Securities (Thailand) Limited, having registered address at 990 Abdulrahim Place, 27 Floor, Unit 2701, Rama IV Road, Silom, Bangrak, Bangkok 10500, Thailand, Tel. +66 2614 6000, Credit Suisse Securities (Malaysia) Sdn Bhd, Credit Suisse AG, Singapore Branch, Credit Suisse Securities (India) Private Limited regulated by the Securities and Exchange Board of India (registration Nos. INB230970637; INF230970637; INB010970631; INF010970631), having registered address at 9th Floor, Ceejay House, Dr.A.B. Road, Worli, Mumbai - 18, India, T- +91-22 6777 3777, Credit Suisse Securities (Europe) Limited, Seoul Branch, Credit Suisse AG, Taipei Securities Branch, PT Credit Suisse Securities Indonesia, Credit Suisse Securities (Philippines ) Inc., and elsewhere in the world by the relevant authorised affiliate of the above. Research on Taiwanese securities produced by Credit Suisse AG, Taipei Securities Branch has been prepared by a registered Senior Business Person. Research provided to residents of Malaysia is authorised by the Head of Research for Credit Suisse Securities (Malaysia) Sdn Bhd, to whom they should direct any queries on +603 2723 2020. This report has been prepared and issued for distribution in Singapore to institutional investors, accredited investors and expert investors (each as defined under the Financial Advisers Regulations) only, and is also distributed by Credit Suisse AG, Singapore branch to overseas investors (as defined under the Financial Advisers Regulations). By virtue of your status as an institutional investor, accredited investor, expert investor or overseas investor, Credit Suisse AG, Singapore branch is exempted from complying with certain compliance requirements under the Financial Advisers Act, Chapter 110 of Singapore (the "FAA"), the Financial Advisers Regulations and the relevant Notices and Guidelines issued thereunder, in respect of any financial advisory service which Credit Suisse AG, Singapore branch may provide to you. This research may not conform to Canadian disclosure requirements. In jurisdictions where CS is not already registered or licensed to trade in securities, transactions will only be effected in accordance with applicable securities legislation, which will vary from jurisdiction to jurisdiction and may require that the trade be made in accordance with applicable exemptions from registration or licensing requirements. Non-U.S. customers wishing to effect a transaction should contact a CS entity in their local jurisdiction unless governing law permits otherwise. U.S. customers wishing to effect a transaction should do so only by contacting a representative at Credit Suisse Securities (USA) LLC in the U.S. Please note that this research was originally prepared and issued by CS for distribution to their market professional and institutional investor customers. Recipients who are not market professional or institutional investor customers of CS should seek the advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents. This research may relate to investments or services of a person outside of the UK or to other matters which are not authorised by the PRA and regulated by the FCA and the PRA or in respect of which the protections of the PRA and FCA for private customers and/or the UK compensation scheme may not be available, and further details as to where this may be the case are available upon request in respect of this report. CS may provide various services to US municipal entities or obligated persons ("municipalities"), including suggesting individual transactions or trades and entering into such transactions. Any services CS provides to municipalities are not viewed as "advice" within the meaning of Section 975 of the Dodd-Frank Wall Street Reform and Consumer Protection Act. CS is providing any such services and related information solely on an arm's length basis and not as an advisor or fiduciary to the municipality. In connection with the provision of the any such services, there is no agreement, direct or indirect, between any municipality (including the officials, management, employees or agents thereof) and CS for CS to provide advice to the municipality. Municipalities should consult with their financial, accounting and legal advisors regarding any such services provided by CS. In addition, CS is not acting for direct or indirect compensation to solicit the municipality on behalf of an unaffiliated broker, dealer, municipal securities dealer, municipal advisor, or investment adviser for the purpose of obtaining or retaining an engagement by the municipality for or in connection with Municipal Financial Products, the issuance of municipal securities, or of an investment adviser to provide investment advisory services to or on behalf of the municipality. If this report is being distributed by a financial institution other than Credit Suisse AG, or its affiliates, that financial institution is solely responsible for distribution. Clients of that institution should contact that institution to effect a transaction in the securities mentioned in this report or require further information. This report does not constitute investment advice by Credit Suisse to the clients of the distributing financial institution, and neither Credit Suisse AG, its affiliates, and their respective officers, directors and employees accept any liability whatsoever for any direct or consequential loss arising from their use of this report or its content. Principal is not guaranteed. Commission is the commission rate or the amount agreed with a customer when setting up an account or at any time after that. Copyright © 2013 CREDIT SUISSE AG and/or its affiliates. All rights reserved. Investment principal on bonds can be eroded depending on sale price or market price. In addition, there are bonds on which investment principal can be eroded due to changes in redemption amounts. Care is required when investing in such instruments. When you purchase non-listed Japanese fixed income securities (Japanese government bonds, Japanese municipal bonds, Japanese government guaranteed bonds, Japanese corporate bonds) from CS as a seller, you will be requested to pay the purchase price only.