Asset Allocation and Portfolio Performance: Evidence from University Endowment Funds Lorenzo Garlappi

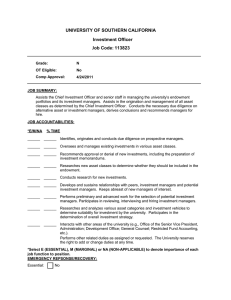

advertisement