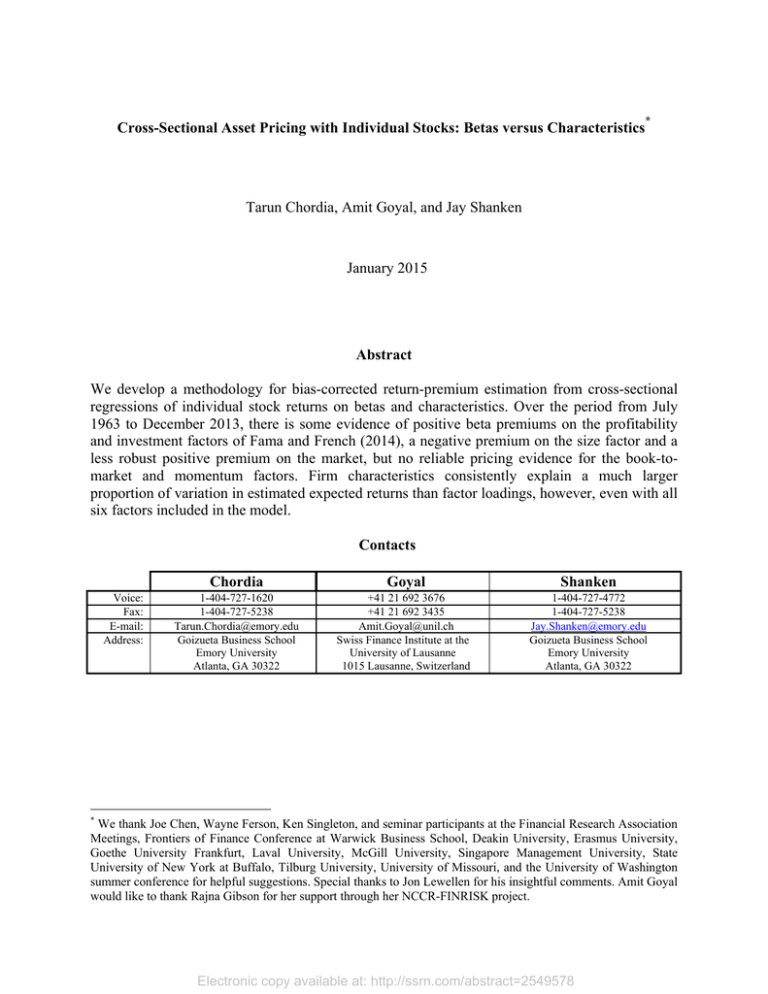

Cross-Sectional Asset Pricing with Individual Stocks: Betas versus Characteristics Abstract

advertisement