MEMORANDUM OF COOPERATION ON THE ESTABLISHMENT AND IMPLEMENTATION OF

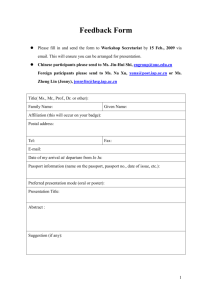

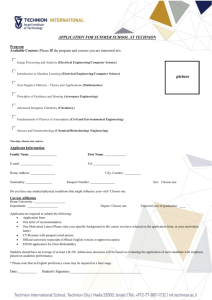

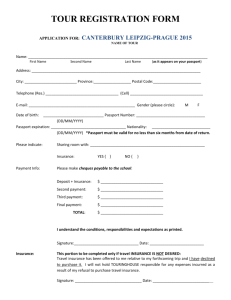

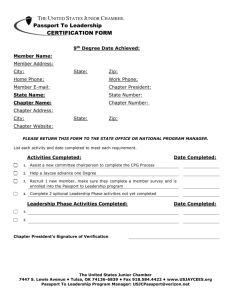

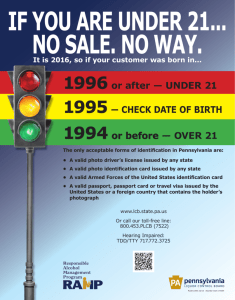

advertisement