Agricultural resource allocation in the Cauca Valley of Colombia

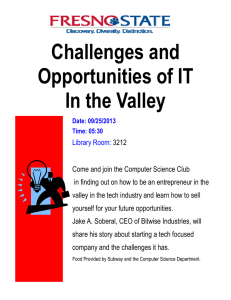

advertisement