THE ECONOMIC VALUE OF CARCASS TRAITS, by

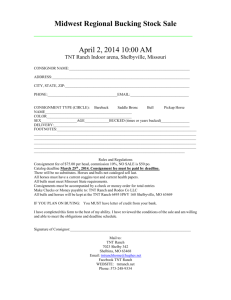

advertisement