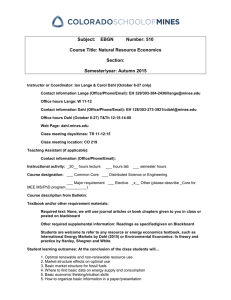

Subject: EBGN/ENGY ... Course Title: Energy Economics Section:

advertisement

Subject: EBGN/ENGY Number: 330 Course Title: Energy Economics Section: Semester/year: Spring 2016 Instructor or Coordinator: Ian Lange Contact information (Office/Phone/Email): EH 329 Office hours: TR 1-2, W 10-11 Class meeting days/times: TR 11-12:15 Class meeting location: BE 108 Web Page/Blackboard link (if applicable): Teaching Assistant (if applicable): Contact information (Office/Phone/Email): Instructional activity: ___ hours lecture __0_ hours lab ___ semester hours Course designation: __x_ Common Core ___ Distributed Science or Engineering ___ Major requirement _x__ Elective ___ Other (please describe ___________) Course description from Bulletin: Textbook and/or other requirement materials: Required text: None Other required supplemental information: Readings as specified/given on Blackboard Students are welcome to refer to any resource or energy economics textbook, such as International Energy Markets by Dahl or Environmental Economics: In theory and practice by Hanley, Shogren and White Student learning outcomes: At the conclusion of the class students will… 1. Optimal renewable and non-renewable resource use 2. Market structure effects on optimal use 3. Set-up of electricity markets 4. Basic market structure for fossil fuels 5. Economic reserves & what sustainability means in this context 6. Where to find basic data on energy supply and consumption 7. How to organize basic information in a paper/presentation 8. How to write/present your thoughts in a clear and concise manner Brief list of topics covered: 1. Optimal harvest of a forest 2. Optimal extraction of a non-renewable resource (coal, oil, minerals, etc) 3. Structure of electricity markets 4. Markets for non-renewable resources 5. Reserves of non-renewables 6. Energy efficiency policy 7. Law of natural resources Policy on academic integrity/misconduct: The Colorado School of Mines affirms the principle that all individuals associated with the Mines academic community have a responsibility for establishing, maintaining an fostering an understanding and appreciation for academic integrity. In broad terms, this implies protecting the environment of mutual trust within which scholarly exchange occurs, supporting the ability of the faculty to fairly and effectively evaluate every student’s academic achievements, and giving credence to the university’s educational mission, its scholarly objectives and the substance of the degrees it awards. The protection of academic integrity requires there to be clear and consistent standards, as well as confrontation and sanctions when individuals violate those standards. The Colorado School of Mines desires an environment free of any and all forms of academic misconduct and expects students to act with integrity at all times. Academic misconduct is the intentional act of fraud, in which an individual seeks to claim credit for the work and efforts of another without authorization, or uses unauthorized materials or fabricated information in any academic exercise. Student Academic Misconduct arises when a student violates the principle of academic integrity. Such behavior erodes mutual trust, distorts the fair evaluation of academic achievements, violates the ethical code of behavior upon which education and scholarship rest, and undermines the credibility of the university. Because of the serious institutional and individual ramifications, student misconduct arising from violations of academic integrity is not tolerated at Mines. If a student is found to have engaged in such misconduct sanctions such as change of a grade, loss of institutional privileges, or academic suspension or dismissal may be imposed. The complete policy is online. Grading Procedures: Test 1: 25% Test 2: 25% Final: 30% Group Presentation: 20% Tests are a mixture of definitions and short answer. Class will vote on the preferred specification of the final exam. For the group presentation, approximately four students will put together a 10 minute presentation on: (i)The energy balance of a country [what resources do they have, consume, export, import, etc] or (ii) An evaluation of a proposed piece of energy policy [what is it, merits, drawbacks, who is for/against it] or (iii) A report or academic article of interest to the group, or (iv) A board meeting where the presenters are trying to convince upper management to invest in a project, enter a new market, or related decisions. Please have the topic of your group’s presentation approved by me. The goal behind the presentations is to provide the class with additional information about energy policy outside of my lectures. Presentations will be marked on their clarity, depth of understanding shown, and quality. It is expected that each member of the group will speak during the presentation. In the first meeting, I will provide guidance on giving a presentation. There will be no more than two presentations at each meeting, not including tests, beginning with the week of January 26. Coursework Return Policy: The goal is to get coursework feedback within two week. Absence Policy (e.g., Sports/Activities Policy): Please notify me ahead of time if you will be absent for tests or the final. Detailed Course Schedule: Week 1 (January 11): Introduction to Course Week 2 (January 18): Background Information on Energy Markets Week 3 (January 25): Optimal Use of Renewable and Non-renewable resources Brown (Section 3.2, p 887-889); Krautkraemer (Section 1 and 2; p 2065-2069); Week 4 (February 1): More Optimal Extraction of Non-Renewable Resource Hotelling; Anderson, Kellogg, and Salant; Week 5 (February 8): No class Tuesday for Career Day; Thursday: Exploration Incentives Lin; Philip Haile, Kenneth Hendricks, and Robert Porter Week 6 (February 15): Reserves of Non-renewables Krautkraemer (Section 5; p 2087-2091) Week 7 (February 22): Review & Test 1 Week 8 (February 29): Issues in Petroleum-Forecasting and Speculation Mu and Ye; Buyuksahin and Harris Week 9 (March 7): Legal & Regulatory Issues around energy business Libecap and Smith; Stigler Week 10 (March 14): No class-Spring break Week 11 (March 21): Hedging in Energy Markets Week 12 (March 28): Behavioral Energy Issues Tuesday; No class Thursday Allcott, H. and Mullainathan Week 13 (April 4): Review and Test 2 Week 14 (April 11): Basics of the Electricity Markets & Regulation Bushnell and Borenstein Week 15 (April 18): Energy Efficiency Policy Allcot and Greenstone; Fowlie, Greenstone, and Wolfram Week 16 (April 25): Anything else? What do you want to know about? Week 17 (May 2): Catch-Up\Review for Final List of Readings (In Order): Gardner Brown. Renewable Natural Resource Management and Use without Markets. Journal of Economic Literature Vol 38, No. 4 (Dec 2000 )pp 875-914 http://www.jstor.org/stable/2698664 Jeffrey A. Krautkraemer. Nonrenewable Resource Scarcity. Journal of Economic Literature, Vol. 36, No. 4 (Dec., 1998), pp. 2065-2107 http://www.jstor.org/stable/2565047 Harold Hotelling. The Economics of Exhaustible Resources. The Journal of Political Economy, Vol. 39, No. 2 (Apr., 1931), pp. 137-175 http://www.jstor.org/stable/1822328 Soren Anderson, Ryan Kellogg, and Stephen Salant. Hotelling Under Pressure. NBER Working paper 20280 (2014) http://www-personal.umich.edu/~kelloggr/HotellingPressure_140103.pdf Cynthia Lin. Strategic decision-making with information and extraction externalities: A structural model of the multi-stage investment timing game in offshore petroleum production. Review of Economics and Statistics, 95 (5), (2013) 1601-1621. http://www.des.ucdavis.edu/faculty/Lin/oil_investtiming_struc_paper.pdf Philip Haile; Kenneth Hendricks; Robert Porter. Recent U.S. Offshore Oil and Gas Lease Bidding: A Progress Report International Journal of Industrial Organization, 28, (July 2010) 390-396. http://ssc.wisc.edu/~hendrick/publications/ProgressReportonRecentOffshoreAuctions.pdf Bahattin Buyuksahin and Jeffery Harris, Do Speculators Drive Crude Oil Futures Prices? The Energy Journal Vol 32, No 2 (2011) pp167-202 On Blackboard Shawn Mu and Haichun Ye. Small Trends and Big Cycles in Crude Oil Prices. Energy Journal. 2014;36(1), 49-71 On Blackboard Gary Libecap & James Smith. 2002. The Economic Evolution of Petroleum Property Rights in the United States. Journal of Legal Studies, Vol. 31(2), pages S589-608. http://www.icer.it/docs/wp2002/libecap25-02.pdf George J. Stigler. 1971. The Theory of Economic Regulation. Bell Journal of Economics, Vol. 2(1), pages 3-21. http://www.jstor.org/stable/3003160 James Bushnell and Severin Borenstein. Electricity Restructuring: Deregulation or Reregulation. Regulation. Vol 23(2), 46-52. http://faculty.haas.berkeley.edu/borenste/download/Regulation00ElecRestruc.pdf Meredith Fowlie, Michael Greenstone, and Catherine Wolfram. Do Energy Efficiency Investments Deliver? Evidence from the Weatherization Assistance Program https://economics.stanford.edu/files/Fowlie-Greenstone-Wolfram%20-%20Do%20Energy%20Efficiency%20Investments%20Deliver.pdf Allcott H. and Greenstone, M. Is there an energy efficiency gap? Journal of Economic Perspectives Vol 26, No 1, (Winter 2012) pp 3-28 http://pubs.aeaweb.org/doi/pdfplus/10.1257/jep.26.1.3 Allcott, H. and Mullainathan, S., Behavior and Energy Policy, Science, Vol 327 (March 5 2010), Supplement https://files.nyu.edu/ha32/public/research/Allcott%20and%20Mullainathan%202010%20-%20Behavioral% 20Science%20and%20Energy%20Policy.pdf Note: You must be accessing the links through the CSM server in order to view most of them.