Basics of Option Pricing Theory & Applications in Business Decision Making

advertisement

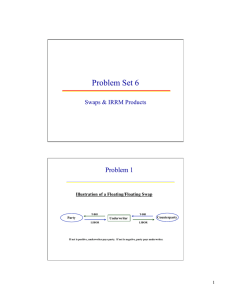

Basics of Option Pricing Theory & Applications in Business Decision Making Purpose: • Provide background on the basics of Option Pricing Theory (OPT) • Examine some recent applications -1- What are options? • Options are financial contracts whose value is contingent upon the value of some underlying asset • Such arrangements are also known as contingent claims – because equilibrium market value of an option moves in direct association with the market value of its underlying asset. • OPT measures this linkage -2- The basics of options Calls and puts defined • Call: privilege of buying the underlying asset at a specified price and time • Put: privilege of selling the underlying asset at a specified price and time -3- The basics of options Regional differences • American options can be exercised anytime before expiration date • European options can be exercised only on the expiration date • Asian options are settled based on average price of underlying asset -4- The basics of options • Options may be allowed to expire without exercising them • Options game has a long history – at least as old as the “premium game” of 17th century Amsterdam – developed from an even older “time game” • which evolved into modern futures markets • and spawned modern central banks -5- Put-Call Parity Consider two portfolios • Portfolio A contains a call and a bond: C(S,X,t) + B(X,t) • Portfolio B contains stock plus put: S + P(S,X,t) -6- Put-Call Parity Consider two portfolios • Portfolio A contains a call and a bond: C(S,X,t) + B(X,t) • Portfolio B contains stock plus put: S + P(S,X,t) VA VB S*<X 0 +X =X X-S +S =X S*>X S-X +X =S 0 +S =S -7- Put-Call Parity C(S,X,t) + B(X,t) = S + P(S,X,t) • News leaks about negative event • Informed traders sell calls and buy puts -8- Put-Call Parity S,X,t) ( P + S ,t) = X ( B + ) C(S,X,t • News leaks about negative event • Informed traders sell calls and buy puts • Arbitrage traders buy the low side and sell the high side -9- Put-Call Parity C(S,X,t) + B(X,t) = S + P(S,X,t) • News leaks about negative event • Informed traders sell calls and buy puts • Arbitrage traders buy the low side and sell the high side • Stock price falls — “the tail wags the dog” - 10 - Boundaries on call values C(S,X,t) + B(X,t) = S + P(S,X,t) • Upper Bound: Call C(S,X,t) < S Stock - 11 - Boundaries on call values C(S,X,t) + B(X,t) = S + P(S,X,t) • Upper Bound: • Lower bound: Call C(S,X,t) < S C(S,X,t) ≥ S – B(X,t) B(X,t) Stock - 12 - Call values Call C(S,X,t) = S - B(X,t) + P(S,X,t) Stock B(X,t) - 23 - S C P X C P R C P t C P σ C P Call Keys for using OPT as an analytical tool C(S,X,t) = S - B(X,t) + P(S,X,t) B(X,t) Stock - 24 - Basic Option Strategies • • • • • • • Long Call Long Put Short Call Short Put Long Straddle Short Straddle Box Spread - 25 - Long Call $ 0 -C X S X+C - 26 - Long Call Short Call $ C $ 0 -C 0 S X X+C X+C S X - 27 - $ 0 -C $ 0 -P S X X+C Short Call Long Call Long Put $ C 0 X+C X S X-P X S - 28 - Long Put $ 0 -C S X X+C $ Short Call Long Call Short Put X -P 0 X+C S X $ P X-P 0 $ C 0 S X S X-P - 29 - 0 -C S X X+C Long Put $ X-P 0 X -P $ 0 -(P+C) S Short Call $ Short Put Long Call Long Straddle $ C 0 X+C S X $ P 0 X S X-P X-P-C X S X+P+C - 30 - 0 -C S X X+C X-P 0 X -P Long Straddle Long Put $ $ 0 -(P+C) S $ C Short Call $ X+C 0 S X $ P Short Put Long Call Short Straddle 0 X X-P $ P+C X-P-C X+P+C 0 S X S X+P+C X X-P-C S - 31 - Box Spread • Long call, short put, exercise = X • Same as buying a futures contract at X $ 0 X S - 32 - Box Spread • Long call, short put, exercise = X • Short call, long put, exercise = Z $ 0 Z X S - 33 - Box Spread • You have bought a futures contract at X • And sold a futures contract at Z $ 0 Z X S - 34 - Box Spread • Regardless of stock price at expiration – you’ll buy for X, sell for Z – net outcome is Z - X $ 0 Z X S Z-X - 35 - Box Spread • How much did you receive at the outset? + C(S,Z,t) - P(S,Z,t) - C(S,X,t) + P(S,X,t) $ 0 Z X S Z-X - 36 - Box Spread Because of Put/Call Parity, we know: C(S,Z,t) - P(S,Z,t) = S - B(Z,t) - C(S,X,t) + P(S,X,t) = B(X,t) - S $ 0 Z X S Z-X - 37 - Box Spread • So, building the box brings you S - B(Z,t) + B(X,t) - S = B(X,t) - B(Z,t) $ 0 Z X S Z-X - 38 - Assessment of the Box Spread • At time zero, receive PV of X-Z • At expiration, pay Z-X • You have borrowed at the T-bill rate. $ 0 S X Z Z-X - 39 - Impact of Limited Liability • Equity = C(V,D,t) • Debt = V - C(V,D,t) Equity C(V,D,t) = V - B(D,t) + P(V,D,t) B(D,t) V - 40 - Swaps - 41 - Floating-Fixed Swaps Illustration of a Floating/Fixed Swap Party Variable Variable Underwriter Fixed Counterparty Fixed If net is positive, underwriter pays party. If net is negative, party pays underwriter. - 42 - Floating to Floating Swaps Illustration of a Floating/Floating Swap T-Bill Party T-Bill Underwriter LIBOR Counterparty LIBOR If net is positive, underwriter pays party. If net is negative, party pays underwriter - 43 - Parallel Loan Illustration of a parallel loan United States Germany U.S. Parent Principal in $ Debt service in $ U.S. subsidiary of German Firm Loan guarantees German Parent Principal in Euro Debt service in Euro German subsidiary of U.S. Firm - 44 - Currency Swap Illustration of a straight currency swap $1,500,000 $1,500,000 1 1 Borrow in US, invest in Europe € 1,000,000 € 1,000,000 German rate x €1,000,000 German rate x €1,000,000 2 2 U.S. rate x $1,500,000 U.S. rate x $1,500,000 Borrow in Europe, invest in US € 1,000,000 € 1,000,000 3 3 $1,500,000 $1,500,000 Step 1 is notional Steps 2 & 3 are net - 45 - Swaps Illustration of an Equity Return Swap Equity Index Return* Investor Underwriter Libor ± Spread *Equity index return includes dividends, paid quarterly or reinvested - 46 - Swaps Illustration of an Equity Asset Allocation Swap Foreign Equity Index Return* A Investor Underwriter Foreign Equity Index Return* B *Equity index return includes dividends, paid quarterly or reinvested - 47 - Equity Call Swap Illustration of an Equity Call Swap Equity Index Price Appreciation* Investor Underwriter Libor ± Spread * No depreciation—settlement at maturity - 48 - Equity Asset Swap Asset Income Stream Equity Index Return* Investor Underwriter Income Stream * Equity index return includes dividends, paid quarterly or reinvested - 49 - Bringing these innovations to the retail level - 50 - 1% Coupon $5mm + Appreciation Fixed BT PEFCO SCPERS $5 mm Undisclosed Flow Counterpary PENs Appreciation Appreciation - 51 - Equity Call Swap Illustration of an Equity Call Swap Equity Index Price Appreciation* Investor Underwriter Libor ± Spread * No depreciation—settlement at maturity - 52 - Nikkei Put Warrants (Bringing Dep Public Market Option Premium At Beginning Depriciation At Maturity Dep Flow Kingdom of Denmark Flow Goldman Sachs Counterparty innovation to retail) - 53 - App App Flow Dep Price Public Market Flow Kingdom of Denmark $5mm + App Fixed BT 1% PEFCO SCPERS $5 mm Goldman Sachs Alternative Plan Dep Volatility Dynamic Hedge - 54 -