Problem Set 1 Problem 1 Equilibrium in Futures Markets Profit = $200,000

advertisement

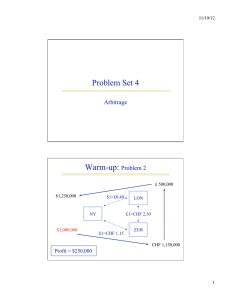

1/26/16 Problem Set 1 Equilibrium in Futures Markets Problem 1 £ 600,000 $1,000,000 $1=£0.60 NY $1,200,000 LON £1 = € 1.40 $1 = € 0.70 FRA € 840,000 Profit = $200,000 1 1/26/16 Problem 2 £ 600,000 $1,200,000 $1=£0.50 NY $1,000,000 LON £1=CHF 1.50 $1=CHF 0.90 ZUR CHF 900,000 Profit = $200,000 Basis too big, Problem 3 500,000 bu. $1,050,000 Money $2.00 = 1 bushel today Storage $0.10 10% $1,103,071.41 Money 30 later $2. = 1 bushel $1,150,000 Profit = $46,928.59 Wheat today Wheat later 500,000 bu. Return is 18.45% 2 1/26/16 Basis too small, Problem 4 500,000 bu. $1,000,000 Money $2.00 = 1 bushel today Wheat today Storage $0.10 10% $1,050,544.20 Money 03 later $2. = 1 bushel Wheat later $1,015,000 500,000 bu. Profit = $35,544.20 Borrow at 3.02% Problem 13 $1,000,000 €770,000 FRA today $1 = € 0.77 3% €781,475.99 FRA later €803,954.90 Profit = €22,478.90 NY today 1% $1 = € 0.80 NY later $1,004,943.62 What is not balanced? 3 1/26/16 Problem 14: Gold 1000 oz. $1,700,000 NY today $1.00 = £ 0.60 Spot £1020 Future £1050.60 1% $1,708,404.15 NY later LON today $1.00 = £ 0.58 LON later $1,811,379.31 1000 oz. Profit = $102,975.16 What is not balanced? Problem 14: Silver 50,000 oz. $1,700,000 NY today $1.00 = £ 0.60 Spot £20.40 Future £21.012 1% $1,708,404.15 NY later LON today $1.00 = £ 0.58 $1,811,379.31 Profit = $102,975.16 LON later 50,000 oz. What is not balanced? 4 1/26/16 Problem 14: Tin 155,000 lbs $1,700,000 NY today $1.00 = £ 0.60 Spot £6.5806 Future £6.7781 1% $1,708,404.15 NY later LON today $1.00 = £ 0.58 LON later $1,811,379.31 155,000 lbs What is not balanced? Profit = $102,975.16 Problem 15 $ 1,000,000 €770,000 FRA today $1 = €0.77 Spot 1324 Future 1363.72 Dividend 1.5% R = 5% €789,220.98 FRA later €836,000.00 Profit = €46,779.02 NY today $1 = €0.80 NY later $ 1,045,000 What is not balanced? 5 1/26/16 Problem 16 $ 1,000,000 CHF 910,000 ZUR today $1 = CHF 0.91 Spot 1324 Future 1363.72 Dividend 1.5% R = 3% ZUR later CHF 923,562.53 NY today $1 = CHF 0.90 NY later CHF 940,500.00 $ 1,045,000 Profit = CHF 16,937.47 What is not balanced? Problem 18 This is includes a Floating/Floating Swap BW Homes Net for RRNB: extra 1% each year T + 2% LIBOR + 1% RRNB LIBOR CitiCorp T-Bill + 1% Counterparty T-Bill LIBOR + 1% HSBC Bank $10,000 per year profit! 6 1/26/16 Bonds as commodities (Problem 20) $1,003,705.40 1.50% $1,000,000 NY today NY 90 days $1,003,804.40 1.52% 1.53% NY 180 days $1,007,573.58 Profit = $99.00 Bonds as commodities (Problem 21) $1,017,408.41 7.00% $1,000,000 NY today NY 90 days 7.50% 7.25% NY 270 days $1,055,739.13 Profit = $650.46 $1,055,088.67 7 1/26/16 Bonds as commodities (Problem 22) $1,035,630.37 7.10% $1,000,000 NY today NY 180 days $1,035,758.04 7.5% 7.25% NY 270 days $1,055,088.67 Profit = $127.67 Bonds as commodities (Problem 23) $1,017,408.41 7.00% $1,000,000 NY today $1,017,634.17 7.15% 7.12% Profit = $225.76 NY 90 days NY 180 days $1,035,732.50 8 1/26/16 Problem 24 • Suppose the futures price of Plantonium (a mineral which your firm uses heavily) is $55 per unit for delivery in six months. At the same time the spot price is $60. Assuming that the futures market is reasonably efficient, which of the following is the best choice? a. The market expects a significant increase in available supplies of plantonium between now and the delivery date. Problem 25 • After the Chernobyl nuclear disaster in Russia, the prices of agricultural commodities were quickly bid much higher in active trading on the U.S. spot and futures markets. b. Automatically, without government intervention, this put in place incentives to reduce consumption and increase production of basic foodstuffs; in turn leading to an increase in potential future supplies c. This action was motivated by the desire for profits d. Both b and c 9