For: Infrastructure

& Operations

Professionals

The State And Direction Of Service

Management: Progression, Deceleration,

Or Stagnation?

by Courtney Bartlett, March 17, 2014

Key Takeaways

Service Management Has Both Progressed And Plateaued

While data from the third annual Forrester/itSMF US survey supports SMA’s positive

influence on the business by way of improved service quality, productivity, and cost

reduction, demands are rising and other areas of service management are struggling to

keep up, resulting in stasis and potential decline of the industry.

Realism And Visibility Must Remain Top Of Mind

“Unknown knowledge” and quixotic self-assessments continue to hinder progress

as too many SMA professionals lack visibility and realism into their state of service

management affairs. This must change, as the only way to progress is to understand both

what you’re up against as well as how solid your foundation truly is.

What’s Hot: Strategic Thought, Cost Transparency, Service-Centricity,

And SaaS

Strategic processes like service portfolio management and demand management are

garnering more attention from your peers, as are initiatives areas like service catalog and

IT financial management. 2013 is also the breakout year for SaaS, as it leads purchasing

plans for management and automation software within the next two years.

Forrester Research, Inc., 60 Acorn Park Drive, Cambridge, MA 02140 USA

Tel: +1 617.613.6000 | Fax: +1 617.613.5000 | www.forrester.com

For Infrastructure & Operations Professionals

March 17, 2014

The State And Direction Of Service Management:

Progression, Deceleration, Or Stagnation?

Benchmarks: The Service Management and Automation Playbook

by Courtney Bartlett

with Eveline Oehrlich and Michelle Mai

Why Read This Report

“How do we stack up against our peers?” is perhaps the most common question asked of Forrester,

and never has this information been more important for service management and automation (SMA)

professionals. Forrester’s third annual survey of SMA professionals, done in conjunction with the USA

chapter of the IT Service Management Forum (itSMF), shows that since 2011, areas like process maturity,

service catalog development, DevOps, and strategic thinking have improved, but not by much and not

enough to keep up. Demand from the business is growing exponentially, while technology management’s

ability to support it is progressing linearly, and though service management is an integral part of IT, it is

not immune to obsolescence. SMA professionals should use this benchmarks report to understand their

service management program’s status, strengths, and weaknesses and where they should focus future

attention and investments to transform this borderline stasis into substantial progress.

Table Of Contents

Notes & Resources

2 Change How You Think About Yourselves,

Your Silos, And Your Services

Forrester interviewed and surveyed 184

service management professionals in

enterprise IT organizations as well as

consultants and technology providers for

the Forrester/itSMF Q3 2013 US ITSM

Online Survey.

Break Down Barriers With DevOps And

Business Service Management

5 ITIL: Turning A Solid Foundation Into Fuel For

Success

9 Maturity Versus Adaptability: Rethinking How

We Measure Progress

13 The SIS, Service Catalog, And ITFM: Where

To Focus Attention In 2014

17 The Service Desk Landscape Gets SaaS-y

22 Supplemental Material

Related Research Documents

Transform Infrastructure And Operations For

The Future Technology Management Cycle

February 13, 2014

Technology Management In The Age Of The

Customer

October 10, 2013

Five Concerted Steps To Maximize The

Business Value Of IT

December 10, 2013

© 2014, Forrester Research, Inc. All rights reserved. Unauthorized reproduction is strictly prohibited. Information is based on best available

resources. Opinions reflect judgment at the time and are subject to change. Forrester®, Technographics®, Forrester Wave, RoleView, TechRadar,

and Total Economic Impact are trademarks of Forrester Research, Inc. All other trademarks are the property of their respective companies. To

purchase reprints of this document, please email clientsupport@forrester.com. For additional information, go to www.forrester.com.

For Infrastructure & Operations Professionals

The State And Direction Of Service Management: Progression, Deceleration, Or Stagnation?

2

Change How You Think About Yourselves, Your Silos, And Your Services

The way we think forms the basis of our actions, and as technology management professionals, we

often focus too much on the technology itself rather than on the business requirements that drive

it. Service management, as a theory and practice, is rooted in product marketing and management

principles that place the customer at the center of all decision-making within the service provider

organization.1 Unfortunately, this extreme customer focus is often lost when the principles are

applied to technology management, producing the well-known discipline of IT service management

(ITSM). In today’s age of the customer, this absence is unacceptable.2 Forrester recommends that

I&O leaders start focusing on the services they are offering to their business partners and that they

adopt automation to increase efficiency and agility across all of I&O. Prompt this focus by changing

the name of your IT service management program to service management and automation, or SMA.

This directs attention to what truly matters — the outcome (services delivered faster, cheaper, and at

a higher quality) and the enabler of those outcomes (automation).3

While it may seem trivial, changing what you call your effort changes how you think about yourself

at a foundational level, which can have resounding effects. There’s a certain gestalt to a successful

SMA organization — subtle mind shifts, iterative standardization, gradual automation — and when

executed in the right way, such pieces can come together to equal something much greater than the

sum of their parts. Our survey results show that some of these pieces are progressing but that others

have stalled. While the progression is great news and SMA professionals should be proud of these

steps, they are just steps — and at this point, they should be strides, as this journey began with the

onset of the Information Technology Infrastructure Library (ITIL) in the early 1980s.

Break Down Barriers With DevOps And Business Service Management

DevOps and business service management (BSM) are two movements that break down silos and

focus on leveraging technology to support and enable the business rather than on technology

for technology’s sake. DevOps depends on two once-disparate departments moving past

their differences and toward seamless collaboration. Business service management requires a

deep knowledge of business services and the technical components supporting those services,

necessitating thinking not just about the delivery of a service but about the complete management

of that service, with a constant focus on the business. The survey results show that:

■ DevOps relationships are improving. The relationship between the application development

and operations groups has been historically, and notoriously, conflicted. However, demand from

the business to deliver business value quicker has compelled these two teams to overcome their

discord, understand each other’s worth, and join forces in a movement commonly known as

DevOps.4 The walls between development and operations are coming down as more SMA

professionals in 2013 than in 2011 rate the relationship between Dev and Ops as hopeful,

collaborative, or seamless (see Figure 1-1). Though just a slight improvement, this is encouraging.

DevOps is a byproduct of great service management and exemplifies a new age of collaboration

© 2014, Forrester Research, Inc. Reproduction Prohibited

March 17, 2014

For Infrastructure & Operations Professionals

The State And Direction Of Service Management: Progression, Deceleration, Or Stagnation?

3

that has already proven quite successful in leading organizations such as Amazon.com, Facebook,

and Google. For example, Amazon executes an application release cycle every 11.6 seconds; to

put that into perspective, release cycles are typically monthly or, aggressively, biweekly.5

■ Business service management has still not taken off. Forrester defines BSM as the concept

of dynamically linking business-focused technology services to the underlying technology

infrastructure.6 There are varying levels of maturity, but essentially, BSM is business-focused

rather than IT-focused service management, and 50% of respondents either are not practicing

BSM on any level or do not have enough visibility into their environments to describe their

current state within their IT operations space (see Figure 1-2). This is partly because BSM’s

(and arguably service management’s as a whole) Achilles heel is the configuration management

database (CMDB). However, the intent behind both the CMDB (an accurate, reliable

information model) and the intent behind BSM are correct and worthy of pursuit. Complete

knowledge of the services you deliver and their dependencies, coupled with an understanding

of not just service delivery but the full management of a service, are paramount to support and

enable your business in serving your customers.

Expert tip: Understand where your organization stands relative to BSM and DevOps around

mission-critical and business-critical services for a particular line of business. List these services

and their dependencies and understand the required service levels. Then check to see if you have

managed these services to their expected and agreed service levels. The findings will get you started

in potentially changing how you transition and then manage and operate these services.

© 2014, Forrester Research, Inc. Reproduction Prohibited

March 17, 2014

For Infrastructure & Operations Professionals

The State And Direction Of Service Management: Progression, Deceleration, Or Stagnation?

4

Figure 1 Break Down Barriers With DevOps And Business Service Management

1-1

DevOps relationships are improving

“How would you characterize the relationship between application development

and operations in your organization?”

9%

7%

Isolated

Détente

10%

2011

2013*

14%

31%

34%

Hopeful

40%

41%

Collaborative

6%

8%

Seamless

Base: 491 SMA professionals

*Base: 181 SMA professionals

Source: Forrester/itSMF Q2 2011 US ITSM Online Survey

*Source: Forrester/itSMF Q3 2013 US ITSM Online Survey

106921

© 2014, Forrester Research, Inc. Reproduction Prohibited

Source: Forrester Research, Inc.

March 17, 2014

For Infrastructure & Operations Professionals

The State And Direction Of Service Management: Progression, Deceleration, Or Stagnation?

5

Figure 1 Break Down Barriers With DevOps And Business Service Management (Cont.)

1-2

Business service management has still not taken off

“Please select the statement that best describes your current state within

your IT operations space.”

BSM 1.0: We bridge the view from

the end user, who sees mostly

applications, and IT, which sees

only infrastructure components in

technology silos (mapping the

dependencies).

I can’t answer the question

(not in operations, don’t have

visibility, or don’t know).

19%

19%

We have not done any of

the above.

14%

31%

BSM 2.0-plus: All of the above,

plus we have adopted financial

and resource analysis so the

business better understands the

cost of service operations and

demand management.

7%

10%

BSM 1.0-plus: All of the above, plus

we are working on application

performance management, and we

understand the performance of an

application across its components.

BSM 2.0: All of the above, plus we

map business services to the

enterprise application portfolio and

are now reporting on the quality of

service at the business level.

Base: 181 SMA professionals

Source: Forrester/itSMF Q3 2013 US ITSM Online Survey

106921

Source: Forrester Research, Inc.

ITIL: Turning A Solid Foundation Into Fuel For Success

ITIL, as a best-practice framework for service management and automation, was slow to gain

a foothold in the US after its proliferation across Europe throughout the 1990s and early 2000s,

but around 2004, awareness within North American enterprises started to accelerate. Today, the

adoption of ITIL programs is commonplace, and organizations that have not officially adopted ITIL

often employ common-sense practices that mirror the framework. By targeting the professionals

who actually put ITIL principles into practice, we can determine just how effective ITIL has been at

improving or diminishing organizational and personal performance; for the third year in a row, its

impact is significantly positive.

With ITIL’s help, service management organizations enjoy better service quality and higher

operational productivity as well as cost savings; even ITIL certifications have increased in benefit

(see Figure 2-1 and see Figure 2-2). However, technology management’s reputation with the

business plateaued, which raises the question, “If everything else increased in benefit, why did

© 2014, Forrester Research, Inc. Reproduction Prohibited

March 17, 2014

For Infrastructure & Operations Professionals

The State And Direction Of Service Management: Progression, Deceleration, Or Stagnation?

6

reputation remain the same?” The answer is “inertia.” Technology management’s reputation

has been dismal for years. Neither ITIL nor any other framework can fix the friction between

technology management and the business, but best practices can improve service quality and

technology management productivity and can also save costs. Building on the positive results from

our 2013 survey, SMA professionals should focus on these areas of opportunity:

■ Service quality: Build on your success. In 2013, 73% of service management professionals

report that ITIL has a positive impact on service quality; that is a fantastic foundation upon

which to continue to define, align, and automate your services. The more defined your processes

and services, the easier they are to automate, resulting in consistent execution, fewer errors, and

higher quality delivery.

■ Operational productivity: Automate everything you can. Exponential gains are not

achieved via manual methods, and anything hand-operated can fall victim to human error.

When automation tools are applied to good processes, productivity increases to a level

unattainable manually. Standardized processes simplify execution; automation yields fewer

(or zero) mistakes; and you are able to do more with less. Employees have more time to focus

on innovative tasks, like standardizing and automating even more processes and services,

producing a positive feedback loop of productivity.7 Again, in 2013, 73% of respondents tout

ITIL’s ability to improve productivity; the fuel behind that is automation.

■ Operational costs: Have patience and keep tackling what you don’t know. While it’s

impressive that 42% of SMA professionals listed ITIL’s impact on operational expenses as

beneficial in 2013, it pales in comparison with the impacts on quality and productivity. ITIL and

SMA require an investment, which initially may offset some of the savings, but if pursued with

diligence, these investments will eventually, and continually, reap rewards. A significant finding

with regard to operational expenses is the drop of respondents in the “don’t know” camp, from

23% in 2012 to 18% in 2013. You cannot control, you cannot manage, and you certainly cannot

improve upon what you do not know or do not understand. SMA professionals must continue

to eliminate this “unknown knowledge.”

■ Certifications: Proven ITIL capability pays off. Both the return on investment (ROI) of

certifications and the number of SMA professionals with certifications have grown. In 2013,

“high return” was the most popular choice when respondents were asked how beneficial they

found their ITIL certifications to be, while none of the respondents deemed them useless. Also,

the number of those who do not have a certification dropped down to 6% in 2013, from 13%

in 2012. Certification is an investment of both real time and real money — this proliferation

of certification indicates a strong interest and commitment by senior management of ITIL

adoption and awareness.

© 2014, Forrester Research, Inc. Reproduction Prohibited

March 17, 2014

For Infrastructure & Operations Professionals

The State And Direction Of Service Management: Progression, Deceleration, Or Stagnation?

7

Expert tip: Continue your best-practice journey and measure your results. This means that you

must be able to determine the value of your service management and automation work with

regard to quality, productivity, and costs. By measuring your organization’s work, you can prove

the benefits and therefore continue your journey. You should communicate these results to your

business executives in terms they understand and in relationship to their goals.

Figure 2 ITIL’s Influence

2-1

ITIL certifications increase in benefit

“How beneficial have you found your ITIL certification(s) to be?”

2011

2012*

2013†

29%

27%

34%

High return: My certification has opened

new career opportunities for me

31%

31%

32%

Limited: My certification is recognized,

but career boost is less than expected

Questionable: My certification helps me

understand my operation better, but it seems to

offer little benefit to my career growth

25%

27%

35%

Useless: My certification was a waste of my 0%

time and has either done nothing for my

3%

career or has harmed it 0%

I don’t have

certification

4%

6%

13%

Base: 491 SMA professionals

*Base: 194 SMA professionals

†

Base: 182 SMA professionals

(percentages may not total 100 because of rounding)

Source: Forrester/itSMF Q2 2011 US ITSM Online Survey

*Source: Forrester/itSMF Q3 2012 US ITSM Online Survey

†

Source: Forrester/itSMF Q3 2013 US ITSM Online Survey

106921

© 2014, Forrester Research, Inc. Reproduction Prohibited

Source: Forrester Research, Inc.

March 17, 2014

For Infrastructure & Operations Professionals

8

The State And Direction Of Service Management: Progression, Deceleration, Or Stagnation?

Figure 2 ITIL’s Influence (Cont.)

2-2

ITIL continues to positively affect the business

“How has ITIL impacted the following?”

Detrimental

Significantly

detrimental

Beneficial

Significantly

beneficial

Don’t know

ITIL’s impact

Service quality

2011

2012*

1%

1%

2%

2013†

2%

62%

54%

21%

10%

59%

6%

10%

14%

7%

Operational productivity

2011

2012*

1%

2%

2%

2013†

2%

61%

57%

24%

14%

59%

14%

4%

7%

5%

Operational costs

2011

2012*

2013†

3%

1% 4%

6%

24%

35% 6%

23%

32% 5%

34%

18%

8%

Reputation with the business

2011

2012*

2%

1%

2%

2013†

2%

49%

42%

38%

10%

13%

16%

8%

13%

13%

Base: 491 SMA professionals

*Base: 194 SMA professionals

†

Base: 183 SMA professionals

Source: Forrester/itSMF Q2 2011 US ITSM Online Survey

*Source: Forrester/itSMF Q3 2012 US ITSM Online Survey

†

Source: Forrester/itSMF Q3 2013 US ITSM Online Survey

106921

© 2014, Forrester Research, Inc. Reproduction Prohibited

Source: Forrester Research, Inc.

March 17, 2014

For Infrastructure & Operations Professionals

The State And Direction Of Service Management: Progression, Deceleration, Or Stagnation?

9

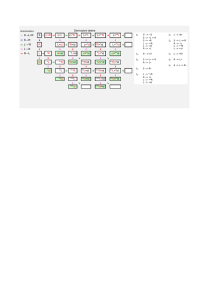

Maturity Versus Adaptability: Rethinking How We Measure Progress

Service management professionals continue to be good firefighters and bad strategists, and an

important goal of this survey is to understand service management process maturity. Forrester asked

respondents to self-assess their maturity across 20 SMA processes, based on ITIL and Forrester’s

service management and automation assessment framework methodology (see Figure 3-1).8

How did SMA professionals fare? At a high level, the results from 2012 and 2013 appear quite similar,

with classic firefighting processes showing the highest maturity rating and the more strategic

processes at the lower end. But if we take a closer look at the year-over-year results, we find that:

■ Strategic processes maturity soars. Though they’re still in last place, service portfolio

management, strategy management, and demand management all jumped approximately half a

maturity point, more than any other processes. This is great news, as service management must

move away from firefighting and must focus on more strategic processes to support the business

with the right services and technology while ensuring a quality and cost balance. Your peers are

making the shift; so should you.

■ Incident management declines in maturity yet improves in reality. SMA professionals rated

themselves slightly less mature in 2013 than in 2012, though incident management actually

advanced year-over-year (see Figure 3-2). Mean time to resolution (MTTR), a good indicator

of incident management success as it changes over time, improved by 10 percentage points

overall (“increased” went down by three percentage points, while “decreased” went up by seven

percentage points). The contradiction here is a result of increased realism, another theme

scattered throughout the 2013 results. SMA professionals tended to rate themselves a little too

rosily in past surveys, and further data, such as the question regarding MTTR, has proved that

things weren’t as sturdy as they seemed.

■ Change management still has an unhealthy ratio of chaos to control. Change management

declined in the maturity self-assessments (see Figure 3-3). Even so, SMA professionals are not

as mature at the process as they suggest. This group dropped by eight percentage points from

2012 to 2013. If more than 70% of your incidents are caused by changes, you are living in a very

dangerous state of chaos; 5% fall into this group. Combine that with the 19% in the secondworst group of 40% to 70%, and nearly a quarter of SMA professionals are living with poor or

terrible change management. However, these folks are actually in a better state than the 26%

who fall into the “don’t know” category because at least they can identify their challenges.

© 2014, Forrester Research, Inc. Reproduction Prohibited

March 17, 2014

For Infrastructure & Operations Professionals

The State And Direction Of Service Management: Progression, Deceleration, Or Stagnation?

10

■ “Unknown knowledge” improves but is still too high. Too many service management

professionals fall into the dangerous “don’t know” category. While “unknown knowledge”

dropped for both incident and change management, the percentages still hover at around a

quarter of respondents. These “don’t know” organizations suffer from unknown unknowns

(enemies impossible to fight because you don’t know where they are) and are therefore at the

greatest risk of serious consequences.9

Expert tip: Do maturity assessments, self-assessments, and models measure or strive for the right

thing? Maturity seems like an ideal end result but only when measured on a continual base. An

organization’s processes must be constantly revisited, revamped, and reinstated to better serve an

ever-changing business environment. Adaptability, flexibility, and agility are additional key topics

to define an ideal state of processes. Forrester invites all SMA professionals to take a step back and

think about this maturity versus adaptability debate. If we keep doing the same things, we cannot

expect different results, and as a community, we must join together and direct the change necessary

to weather our competitors. Be the change, or be changed.

© 2014, Forrester Research, Inc. Reproduction Prohibited

March 17, 2014

For Infrastructure & Operations Professionals

The State And Direction Of Service Management: Progression, Deceleration, Or Stagnation?

11

Figure 3 Reality Checks And Visibility Influence Process Maturity

3-1

Classic firefighting processes are mature, and strategic process gain momentum

“How would you assess your organization’s maturity in the following processes?”

(Responses on a scale of 1 [not mature at all] to 5 [completely mature])

3.26

3.17

Incident management

3.03

2.88

Change management

2012

2013*

2.46

2.45

Service request management

2.23

2.41

Event management

1.99

Business relationship management

2.28

2.35

2.27

Problem management

Release management

2.10

2.24

Financial management

2.09

2.23

2.08

2.19

Service continuity management

1.85

Availability management

2.19

Asset management

2.12

2.13

Supplier management

1.90

2.10

Knowledge management

1.98

2.10

Service-level management

1.96

2.07

Configuration management

2.04

2.07

1.87

1.99

Capacity management

1.53

Strategy management

Service portfolio management

1.37

Demand management

1.34

1.84

1.81

1.77

Base: 179 SMA professionals

*Base: 163 SMA professionals

Source: Forrester/itSMF Q3 2012 US ITSM Online Survey

*Source: Forrester/itSMF Q3 2013 US ITSM Online Survey

106921

© 2014, Forrester Research, Inc. Reproduction Prohibited

Source: Forrester Research, Inc.

March 17, 2014

For Infrastructure & Operations Professionals

The State And Direction Of Service Management: Progression, Deceleration, Or Stagnation?

12

Figure 3 Reality Checks And Visibility Influence Process Maturity (Cont.)

3-2

Incident management declines in maturity yet improves in reality

“How has your incident MTTR changed over the past 12 months?”

15%

12%

Increased

2012

2013*

Remained

the same

34%

32%

27%

Decreased

34%

25%

23%

Don’t know

Base: 217 SMA professionals

*Base: 182 SMA professionals

Source: Forrester/itSMF Q3 2012 US ITSM Online Survey

*Source: Forrester/itSMF Q3 2013 US ITSM Online Survey

3-3

Change management still has an unhealthy ratio of chaos to control

“How many of your incidents can be related to changes?”

<10%

Ideal

15%

20%

23%

10% to 39%

Decent

27%

33%

34%

16%

14%

19%

40% to 70%

Poor

>70%

Terrible

2011

2012*

2013†

6%

5%

9%

22%

Don’t know

Chaos

26%

30%

Base: 491 SMA professionals

*Base: 217 SMA professionals

†

Base: 182 SMA professionals

(percentages may not total 100 because of rounding)

Source: Forrester/itSMF Q2 2011 US ITSM Online Survey

*Source: Forrester/itSMF Q3 2012 US ITSM Online Survey

†

Source: Forrester/itSMF Q3 2013 US ITSM Online Survey

106921

© 2014, Forrester Research, Inc. Reproduction Prohibited

Source: Forrester Research, Inc.

March 17, 2014

For Infrastructure & Operations Professionals

The State And Direction Of Service Management: Progression, Deceleration, Or Stagnation?

13

The SIS, Service Catalog, And ITFM: Where To Focus Attention In 2014

The service information system (SIS), also known as CMDB; the service catalog; and IT financial

management are just three areas that, when executed well and applied and implemented in

conjunction, can equal something much greater than the sum of their parts. Forrester is confident

these areas of interest will remain key priorities and sources of investment for 2014 and beyond.

■ CMDB intentions are correct but struggle to materialize . . . When asked to rate their level

of development with regard to CMDB, 45% of survey respondents responded, “rudimentary,”

while another 10% selected “nonexistent” (see Figure 4-1). This should be better, but it’s not

surprising. The CMDB has a dark past riddled with unreliability, which is one of the reasons

Forrester encourages renaming it as SIS to better reflect its true intentions. As with the ITSM

versus SMA debate, using a different name is the first step in evolving away from a huge,

all-encompassing relational database and toward the realization of what this should be: an

information system that is contextual, behavioral, agile, and trustworthy. The SIS is the brain of

your organization — something that takes in and pushes out information quickly and accurately.

■ . . . yet SMA professionals are optimistic about the future. Nearly 70% of survey respondents

characterize CMDB market maturity as good, very good, or excellent, and looking forward to 2015,

80% predict that market maturity will fall into those categories (see Figure 4-2 and see Figure 4-3).

Also encouraging are the most popular selections of forces driving CMDB development: the

demand for better service visibility; change management; and increased automation (see Figure

4-4). These imperatives are the fuel behind the true intent of the SIS and support the servicecentric mind shift necessary to keep SMA relevant and progressing. The SIS/CMDB is the

cornerstone of BSM; you cannot have great business-focused service management without the

fundamental knowledge of service assets and the deeper relationships among those assets.

■ There is less planning and more implementing of service catalogs. Few endeavors are more

important to the future of I&O than service portfolio management (SPM), and the embodiment

of SPM is the service catalog.10 In 2013, funding was much less of an issue for service catalog

initiatives, proving that the value of a catalog is understood by the necessary stakeholders

(see Figure 5). Also, more SMA professionals are currently working on, rather than planning,

their catalogs. Further along in the life cycle, however, progress plateaus, with the number of

respondents who have realized or exceeded the anticipated benefits of their catalogs remaining

the same as in 2012, and those who have received no benefit from their initiatives dropping a

mere one percentage point. Proper planning and implementation take time; benefits are not

going to materialize overnight.

© 2014, Forrester Research, Inc. Reproduction Prohibited

March 17, 2014

For Infrastructure & Operations Professionals

The State And Direction Of Service Management: Progression, Deceleration, Or Stagnation?

14

■ IT financial management improves slightly . . . To operate as a true business function, IT

needs to apply financial principles and run its function as a business. In the 2013 results, more

SMA professionals describe their financial management capabilities as “good” and “optimized”

than in 2012 (see Figure 6-1), However, more also describe them in 2013 than in 2012 as “poor.”

Overall maturity did shift slightly in the right direction, though.

■ . . . but still sits below average maturity. We believe that SMA professionals were again too

optimistic in their self-assessment. While the fact that 22% of organizations are performing

chargeback and an additional 12% are performing show back is encouraging, this isn’t enough

to support mature, or even average, financial maturity (see Figure 6-2). You cannot be “good”

at financial management without transparency. The notorious “don’t know” group dropped by

seven percentage points year-over-year, but the fact that a full 40% of respondents do not know

whether chargeback is even in place suggests poor financial maturity.

Expert tip: Transparency of your technology management costs is fundamental to understanding

your technology spending. Technology management organizations face pressure to reduce costs of

technology management on one hand while delivering more value on the other. The only successful

strategy is the effective management of demand, ensuring that technology resources are applied to

the maximum benefit for the business. Cost transparency is the first critical step to fulfill this and

should be the first step in your financial management journey.

© 2014, Forrester Research, Inc. Reproduction Prohibited

March 17, 2014

For Infrastructure & Operations Professionals

15

The State And Direction Of Service Management: Progression, Deceleration, Or Stagnation?

Figure 4 The CMDB Story In 2013

4-1

CMDB development is rudimentary

4-2

“Please rate your level of development

with regard to CMDB.”

CMDB market maturity is good

“How do you feel about the

market maturity with CMDB?”

What is CMDB?

2%

Extensive

Nonexistent

9%

10%

Don’t know

8%

Excellent

Poor

4%

2%

Very good

Fair

22%

21%

Good

34%

Rudimentary

45%

Good

43%

Base: 181 SMA professionals

4-3

SMA professionals are optimistic about the

future

Base: 179 SMA professionals

4-4

Service visibility drives future CMDB

development

“What is driving future CMDB development?”

Demand for better

service visibility

“Where do you think the CMDB

market maturity will be by 2015?”

Don’t know

11%

Poor

1%

Excellent

12%

Increased automation

11%

Other (please specify)

11%

Incident/

problem analysis

Service portfolio

management

Very good

43%

Base: 183 SMA professionals

21%

Change management

Fair

9%

Good

25%

25%

10%

8%

ITIL compliance

4%

Don’t know

4%

Service desk integration

3%

Vendors are infusing the

capability into their tools

3%

Base: 183 SMA professionals

(multiple responses accepted)

(percentages do not total 100 because of rounding)

Source: Forrester/itSMF Q3 2013 US ITSM Online Survey

106921

© 2014, Forrester Research, Inc. Reproduction Prohibited

Source: Forrester Research, Inc.

March 17, 2014

For Infrastructure & Operations Professionals

16

The State And Direction Of Service Management: Progression, Deceleration, Or Stagnation?

Figure 5 Less Planning And More Implementation Of Service Catalogs

“Which of the following best describes your service catalog initiative?”

31%

2012

2013*

25%

18%18%

16%

12%

17%

16%

13%

7%

2%

7% 7%

3%

3% 3%

2% 2%

We are

We are not We are

interested interested planning

for a

but

in a

service

currently

service

catalog

lack the

catalog

funds to

commence

an initiative

We are

currently

working

on our

service

catalog

initiative

We have a We have a We have

killed

service

service

our failed

catalog

catalog

service

and have but have

catalog

not

realized or

initiative

exceeded realized

the

the

anticipated anticipated

benefits

benefits

Don’t

know

Other

Base: 174 SMA professionals

*Base: 182 SMA professionals

(percentages may not total 100 because of rounding)

Source: Forrester/itSMF Q3 2012 US ITSM Online Survey

*Source: Forrester/itSMF Q3 2013 US ITSM Online Survey

106921

© 2014, Forrester Research, Inc. Reproduction Prohibited

Source: Forrester Research, Inc.

March 17, 2014

For Infrastructure & Operations Professionals

17

The State And Direction Of Service Management: Progression, Deceleration, Or Stagnation?

Figure 6 IT Financial Management Improves And Gains More Visibility

6-1

IT financial management improves

6-2

IT financial management gains visibility

“How would you describe IT financial

management capabilities within your

organization?”

2012

“Are [you] doing or planning

chargeback or show back?”

2013*

2012

47%

2013*

40%

33%

29%

24%

19%

d

M

at

ur

in

g

O

pt

im

ize

d

Pl

an

ni

ng

sh

ow

oo

G

M

ixe

d

Po

or

Di

si

nt

er

es

te

d

ba

ck

10%

6%

5%

2%

sh

Pl

ow

an

ni

ba

ng

ck

ch

ar

ge

Do

ba

in

ck

g

ch

ar

ge

ba

ck

Do

n’

tk

no

w

15%

11%

21% 22%

16%

13%

11%12%

8% 9%

Base: 173 SMA professionals

*Base: 178 SMA professionals

Do

in

g

25%

21%

Base: 173 SMA professionals

*Base: 179 SMA professionals

Source: Forrester/itSMF Q3 2012 US ITSM Online Survey

*Source: Forrester/itSMF Q3 2013 US ITSM Online Survey

106921

Source: Forrester Research, Inc.

The Service Desk Landscape Gets SaaS-y

Any discussion on SMA eventually comes down to the tools required to put service management

processes into action — in particular, service desk tools and the vendors who provide them. The

number of solutions and the different business models — SaaS or on-premises — stays pretty much

the same, but vendors are eager to snatch customers from their competitors.

■ Major vendor satisfaction slightly slips again, while small vendors get more of a grip. Across

the board, for the past three years, vendor satisfaction has greatly exceeded dissatisfaction, but

there are also some telling fluctuations (see Figure 7-1). Major vendor satisfaction dropped another

two percentage points from 2012 to 2013, which is nothing too serious on its own, but coupled

with the fact that small vendor satisfaction rose four percentage points, this is a faint warning that

larger vendors must continue their efforts to improve their products and customer relations.

© 2014, Forrester Research, Inc. Reproduction Prohibited

March 17, 2014

For Infrastructure & Operations Professionals

The State And Direction Of Service Management: Progression, Deceleration, Or Stagnation?

18

■ SaaS as a solution is taken off its pedestal. SaaS solutions continue to lead the pack, with 83%

of respondents expressing satisfaction, yet this is the third year in a row that satisfaction has

dropped. However, this decline has less to do with SaaS as a solution than it does SaaS as an idol

(i.e., something worshipped). In 2011, nearly all (96%) service management professionals with

a SaaS solution were satisfied with it. But SaaS is merely a business model. While it may solve

issues surrounding upgrades and reduced management, it is not a substitute for good service

management. Now the novelty has worn off and customers of SaaS have realized that no matter

what the delivery method, vendor pains, tool pains, and adoption issues still exist.

■ Service desk loyalty is still very high, and SMA professionals are more decisive. Ultimately,

vendor sentiment can be measured by customer flight to another choice (see Figure 7-2). The

group of service management professionals who are planning a switch in the next two years rose

in 2013 by two percentage points, but so did the group planning to stay put. The rise in both

of these groups is due to decisiveness, as those who either didn’t know or hadn’t decided their

plans dropped by six percentage points.

■ The vendor landscape stagnates. We asked SMA professionals to rate their vendors’ ability

to solve their management and automation needs; not much has changed since last year, and

in this case, no news is news (see Figure 7-3). ServiceNow took a large jump, surpassing all of

the big five except for Microsoft. HP and IBM increased slightly, while BMC Software and CA

Technologies decreased slightly.

■ 2013 is the breakout year for SaaS. Software-as-a-service (SaaS) has been a topic on a tear

across almost all aspects of business technology, and in 2013, SaaS overtook “classic perpetual

license” as the future delivery and purchase model for SMA tools (see Figure 8). Although the

classic licensing model is still popular, it is clear that the simplicity of pricing models and the

time-to-value of SaaS have proven very attractive to enterprises.

Expert tip: The service desk is the wow factor of your organization, so treat it as such. Current

trends such as implementing self-service and personalizing your services to increase customer

experience are the right investments. SaaS solutions are one way to shift your focus onto the benefits

of ITSM rather than the management and technical implementation of it. The vendors have made

great investments in their SaaS solutions and are eager to get you started, but you must know your

key goals and understand how to make your SaaS purchase successful.11

© 2014, Forrester Research, Inc. Reproduction Prohibited

March 17, 2014

For Infrastructure & Operations Professionals

19

The State And Direction Of Service Management: Progression, Deceleration, Or Stagnation?

Figure 7 The SMA Tool And Vendor Landscape In 2013

7-1

Major vendor satisfaction slips, while small vendors get more of a grip

“What’s your current state with the service desk?”

2011

2012*

2013†

2011

2012*

2013†

31%

32%

34%

69%

68%

66%

Small vendor

29%

71%

41%

37%

2011

2012*

2013†

2011

2012*

2013†

Dissatisfied

Satisfied

Major vendor

4%

14%

17%

29%

36%

31%

59%

63%

SaaS

96%

86%

83%

Homebrew

71%

64%

69%

Base: 491 SMA professionals

*Base: 174 SMA professionals

†

Base: 181 SMA professionals

7-2

Service desk loyalty remains high, though SMA professionals are more decisive

“Do you plan to switch your service desk solution to another vendor’s in the next two years?”

21%

21%

23%

Yes

57%

53%

57%

No

Don’t know or

haven’t decided

2011

2012*

2013†

22%

26%

20%

Base: 491 SMA professionals

*Base: 174 SMA professionals

†

Base: 181 SMA professionals

Source: Forrester/itSMF Q3 2011 US ITSM Online Survey

*Source: Forrester/itSMF Q3 2012 US ITSM Online Survey

†

Source: Forrester/itSMF Q3 2013 US ITSM Online Survey

106921

© 2014, Forrester Research, Inc. Reproduction Prohibited

Source: Forrester Research, Inc.

March 17, 2014

For Infrastructure & Operations Professionals

20

The State And Direction Of Service Management: Progression, Deceleration, Or Stagnation?

Figure 7 The SMA Tool And Vendor Landscape In 2013 (Cont.)

7-3

The vendor landscape stagnates

“Please rate each of the following major vendors for their ability to solve your broader

challenges (not point tools) for management and automation software.”

(Responses on a scale of 1 [no value] to 5 [valued partner])

Big five

BMC Software

CA Technologies

2011

2012*

2013†

3.11

2.86

2.83

2.80

2.47

2.44

3.28

2.87

2.92

HP

3.18

2.95

2.96

IBM

3.38

3.48

3.42

Microsoft

Challengers

ASG

2.01

1.80

1.78

Fujitsu

3.40

3.47

3.34

Cisco Systems

Citrix Systems

Compuware

Dell‡

EMC

3.04

3.10

2.53

2.29

2.03

2.55

2.94

2.77

3.11

2.80

2.83

NetIQ§

Oracle

Symantec

ServiceNow

VMware

1.67

2.00

2.26

2.27

2.32

3.21

3.21

3.00

3.04

2.71

2.77

3.23

3.74

3.67

3.46

Base: 491 SMA professionals

*Base: 174 SMA professionals

†

Base: 181 SMA professionals

Source: Forrester/itSMF Q3 2011 US ITSM Online Survey

*Source: Forrester/itSMF Q3 2012 US ITSM Online Survey

†

Source: Forrester/itSMF Q3 2013 US ITSM Online Survey

‡

In 2011, this was Quest, since acquired by Dell.

§

In 2011, this was Novell, since acquired by NetIQ.

106921

© 2014, Forrester Research, Inc. Reproduction Prohibited

Source: Forrester Research, Inc.

March 17, 2014

For Infrastructure & Operations Professionals

21

The State And Direction Of Service Management: Progression, Deceleration, Or Stagnation?

Figure 8 2013 Is The Breakout Year For SaaS

“How do you plan to purchase management and automation software within two years?”

31%

2011

2012*

2013†

25% 25%

25%

22%

19%

7%

5%

8% 8%

6%

5%

8%

7%

4%

C

la

ss

So

ic

f tw

pe

a

m re

rp

ai

et

nt ren

ua

ai ta

l

i

ce l

n

lik l/le

n

se

e as

Pa

pe in

ck

g

rp

ag

et (in

ed

ua st

l m all/

in

a

od

ph

el

y

)

Pa

si

c

ck

al

ag

ap

ed

pl

ia

Pr

in

nc

eb

a

e

ui

v

ir t

lt

ua

in

to

la

an m

pp

d an

lia

ap ag

nc

pl ed

e

C

ic

la

at inf

ss

r

i

on as

ic

ou

co tru

ts

m ctu

o

po re

pr urc

ne

ov in

nt

id g m

s

er

o

is de

De

do l (

liv

in se

er

g rv

ed

it ic

fo e

vi

ru

an a S

s)

d aa

pr S

es (a

en uto

te m

d a

vi ted

a

W

eb

)

5%

9%

8%

th

er

9%

11%

O

10%

11%

10%

11%

Base: 491 SMA professionals

*Base: 174 SMA professionals

†

Base: 155 SMA professionals

(multiple responses accepted)

Source: Forrester/itSMF Q3 2011 US ITSM Online Survey

*Source: Forrester/itSMF Q3 2012 US ITSM Online Survey

†

Source: Forrester/itSMF Q3 2013 US ITSM Online Survey

106921

© 2014, Forrester Research, Inc. Reproduction Prohibited

Source: Forrester Research, Inc.

March 17, 2014

For Infrastructure & Operations Professionals

The State And Direction Of Service Management: Progression, Deceleration, Or Stagnation?

22

Supplemental Material

Methodology

In Q3 2013, Forrester and itSMF USA launched the Forrester/itSMF Q3 2013 US ITSM Online

Survey, a web-based survey designed to gain perspective on the sentiments and status of IT service

management (ITSM) among technology management professionals focused on ITSM. Forrester

now refers to ITSM as service management and automation; therefore, we are designating our 2013

survey respondents as “SMA professionals.”

One hundred eighty-four Forrester clients, itSMF members, and Twitter followers responded

to this survey. Please note that sample sizes vary by question, as not every respondent answered

every question.

In 2011, 95% of total responses originated from North America, while in 2012, that figure was 89%.

Due to this overwhelmingly North American response in previous years and the fact that this survey

is done in conjunction with the USA chapter of itSMF, we did not ask respondents to list their

country of origin in 2013.

Seventy-four percent of respondents’ firms/organizations employ more than 1,000 people. Thirtynine percent employ more than 20,000 people. Eighty-four percent of respondents hold a bachelor’s

degree or higher; 29% of respondents hold a degree in computer science/engineering; and 32% hold

a degree in business.

Endnotes

“Service management” originated with the product marketing and management theories of Theodore

Levitt and Richard Normann. Early service management research and thinking can be attributed to

Theodore Levitt. Modern-day service management as a term is attributed to Richard Normann. Source:

Theodore Levitt, Marketing Myopia, Harvard Business Review Press, 1975 and Richard Normann, Service

Management: Strategy and Leadership in Service Business, Wiley, 2011.

1

2

Forrester defines the age of the customer as a 20-year business cycle in which the most successful

enterprises will reinvent themselves to systematically understand and serve increasingly powerful

customers. To learn more about how technology management must adapt in this rapidly changing world,

see the October 10, 2013, “Technology Management In The Age Of The Customer” report and see the

October 10, 2013, “Competitive Strategy In The Age Of The Customer” report.

For more information on this evolution of ITSM to SMA and the trends that I&O leaders need to

understand to plan for the future, see the February 6, 2012, “Become Customer-Centric, Service-Focused,

And Automated” report.

3

© 2014, Forrester Research, Inc. Reproduction Prohibited

March 17, 2014

For Infrastructure & Operations Professionals

The State And Direction Of Service Management: Progression, Deceleration, Or Stagnation?

23

Inspired by innovations in Agile software development and the application of the Lean principle of

continuous improvement, development and operations have been chipping away at the obstacles that

have prevented faster delivery of value to the business. Joining together, the movement, called DevOps by

some, has been gaining momentum and achieving impressive results. For information on the seven main

principles of DevOps, see the September 3, 2013, “The Seven Habits Of Highly Effective DevOps” report.

4

Source: “Velocity 2011: Jon Jenkins, ‘Velocity Culture,’” YouTube, June 20, 2011 (www.youtube.com/

watch?v=dxk8b9rSKOo).

5

Business service management (BSM) is a way to bridge the user’s view of applications and services to the IT

operations’ view of infrastructure; it maps business services to the components used to deliver them. The

promise is that this insight will provide visibility into IT from a business service standpoint and give IT the

ability to resolve issues faster, focus on key business services, and better align IT management processes

with business needs. For more information, see the September 24, 2012, “Business Service Management:

Beyond 2012” report.

6

Positive feedback loops is a concept Forrester will be exploring more in our upcoming industrial revolution

of I&O report series. Just as the 18th-century Industrial Revolution altered the concept of labor, the

21st-century IT industrial revolution is altering the concept of computing, and much can be learned

from comparing these two periods of upheaval. Throughout the original Industrial Revolution, many

advancements fueled or refined other advancements, creating self-sustaining and steady progression. How

we get from point A to points B, C, and D is no longer a straight line but a cycle, with each step along

the way fueling the next one or refining a previous one. This is how we will go from linear to exponential

progress.

7

Forrester’s service management and automation assessment framework consists of four SMA domains

(oversight, technology, process, and people) and 26 SMA functions. See the June 5, 2012, “Forrester’s

Service Management And Automation Assessment Framework” report.

8

In a US Department of Defense news briefing on February 12, 2002, US Defense Secretary Donald

Rumsfeld gave a confusing but accurate account on the challenges of battling terrorist threats. He

infamously identified threats to be battles with varying degrees of difficulty. Introducing the public to terms

such as “known knowns,” “known unknowns,” and “unknown unknowns,” he earned a place in comedic

history, but his statements were technically correct. Source: “DoD News Briefing — Secretary Rumsfeld and

Gen. Myers,” US Department of Defense, February 12, 2002 (http://www.defense.gov/transcripts/transcript.

aspx?transcriptid=2636).

9

A service catalog can be so much more than a catalog of the capabilities and services IT offers to the

business. It can, and should, be a strategic control point for your entire organization. To learn more about

how a service catalog can enable visibility, agility, and control, as well as understand where you fall in terms

of maturity and how to choose the best tool for you, see the June 12, 2013, “Master The Service Catalog

Solution Landscape In 2013” report.

10

For more information and advice on making SaaS purchasing successful, see the January 22, 2013, “SaaS

Capabilities Maturity Assessment” report.

11

© 2014, Forrester Research, Inc. Reproduction Prohibited

March 17, 2014

About Forrester

A global research and advisory firm, Forrester inspires leaders,

informs better decisions, and helps the world’s top companies turn

the complexity of change into business advantage. Our researchbased insight and objective advice enable IT professionals to

lead more successfully within IT and extend their impact beyond

the traditional IT organization. Tailored to your individual role, our

resources allow you to focus on important business issues —

margin, speed, growth — first, technology second.

for more information

To find out how Forrester Research can help you be successful every day, please

contact the office nearest you, or visit us at www.forrester.com. For a complete list

of worldwide locations, visit www.forrester.com/about.

Client support

For information on hard-copy or electronic reprints, please contact Client Support

at +1 866.367.7378, +1 617.613.5730, or clientsupport@forrester.com. We offer

quantity discounts and special pricing for academic and nonprofit institutions.

Forrester Focuses On

Infrastructure & Operations Professionals

You are responsible for identifying — and justifying — which technologies

and process changes will help you transform and industrialize your

company’s infrastructure and create a more productive, resilient, and

effective IT organization. Forrester’s subject-matter expertise and

deep understanding of your role will help you create forward-thinking

strategies; weigh opportunity against risk; justify decisions; and optimize

your individual, team, and corporate performance.

«

Ian Oliver, client persona representing Infrastructure & Operations Professionals

Forrester Research (Nasdaq: FORR) is a global research and advisory firm serving professionals in 13 key roles across three distinct client

segments. Our clients face progressively complex business and technology decisions every day. To help them understand, strategize, and act

upon opportunities brought by change, Forrester provides proprietary research, consumer and business data, custom consulting, events and

online communities, and peer-to-peer executive programs. We guide leaders in business technology, marketing and strategy, and the technology

industry through independent fact-based insight, ensuring their business success today and tomorrow.

106921