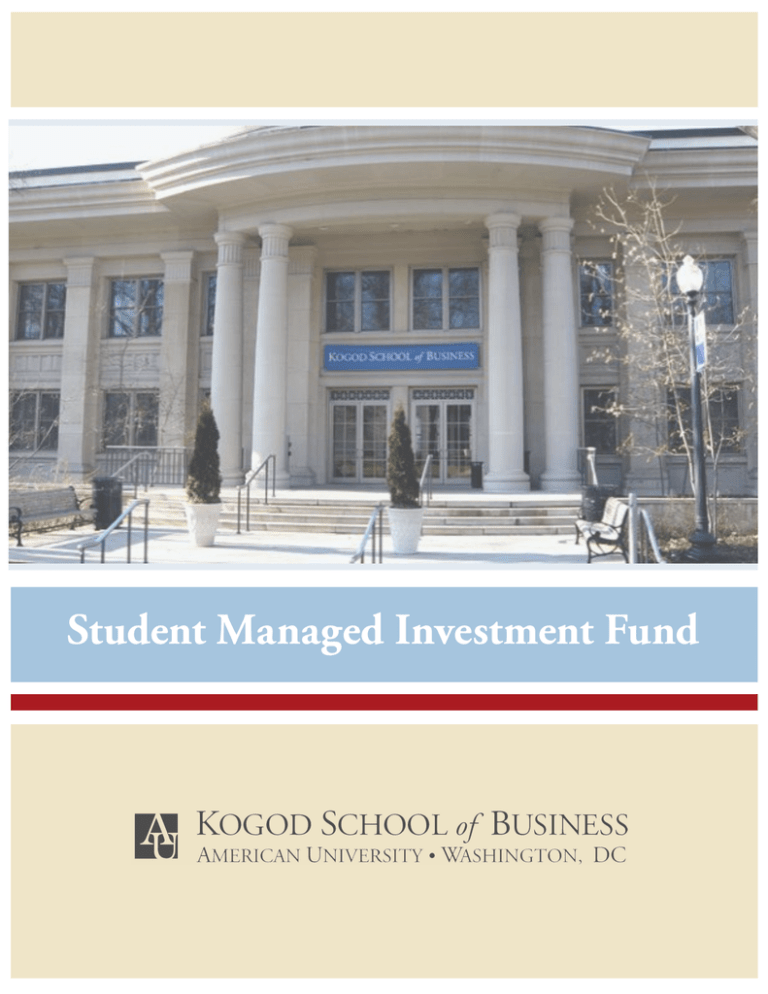

Student Managed Investment Fund

advertisement

Student Managed Investment Fund Table of Contents • Disclaimer • Fund Basics • SMIF: Adding Educational Value • Portfolio Management • Building an Enduring Fund • Appendix Disclaimer This report is published for educational and investment purposes only by students enrolled in American University’s Student Managed Investment Fund. This report does not contain investment recommendations. American University and its affiliates do not accept any liability for any direct, indirect or consequential damages or losses arising from any use of this report or its contents. The information in this report was obtained from sources believed to be accurate, but we do not guarantee that it is accurate or complete. The opinions herein are those of the American University Student Managed Investment Fund and are generated for educational purposes only. Fund Basics Thank You to Our Donors We would like to thank the following alumni, parents, faculty and friends who provided initial funding, supplementing that from legacy student organizations and the Kogod operating budget: Anonymous (2) Dean J. Factor KSB/BSBA ’87 and Shannon Factor Richard P. Golaszewski KSB/ BSBA ’07 Dorothy Matza and Robert Matza Oyebola Oyedijo KSB/MBA ’00 David C. Wajsgras KSB/MBA ’89 and Teena M. Wajsgras Mission Statement The Student Managed Investment Fund is built on American University’s core commitments of fostering research, interactive teaching, and practical application of knowledge. The Fund seeks to provide students of the Kogod School of Business with real-world investment experience that enhances and adds value to their overall education. In addition to its educational value, this experiential learning class is meant to better prepare students for the high expectations and rigor of the working world. Fund Overview • The Kogod SMIF is an upper-level finance class open to highly capable graduate and undergraduate students. • Approximately 20 students take the class each semester filling roles that range from buy-side analysts to fund management positions. • Graduates and undergraduates work together to manage an equity portfolio sharing their knowledge and experience. • Funding is provided by generous donors and initial seed monies allocated from predecessor student organizations, and the Kogod operating budget. • See Appendix for a breakdown of a typical class session. Recent Pitches Checks and Balances • SMIF structures are designed to provide safeguards so that no one individual is responsible for making or monitoring investment decisions. • All investment decisions are reviewed by an advisory board of American University finance faculty. • Company news and updates are monitored in coverage groups. Executive board members provide a second layer of coverage for all holdings. Investment Policy Statement • The fund invests in US-traded equities. • The fund style is a blend of value and growth. • Investments are made with a 3 to 5 year time horizon. • Eligible firms must have a minimum market capitalization of $500 million. • Eligible firms must have a minimum share price of $5. • No single position is allowed to compose more than 5% of the overall portfolio (excluding the cash position). SMIF: Adding Educational Value Complementing a Kogod Education • Conceptually, the fund acts as a bridge between theory and practice. • Each member graduates with experience as a buy-side analyst and potentially experience in management. • Each student writes a minimum of 1 report per semester and presents the investment opportunity to the class. • Additional deliverables include industry reports, a macroeconomic outlook, and a semester-end fund report. • Faculty play a limited role allowing students to gain valuable lessons from mistakes as well as successes. • The fund is completely student-run giving students the opportunity to gain practical management experience. Adding Value: Professional Guests • Visits from practitioners offer windows into careers in the financial services industry. • Guests help illustrate the application of different approaches to investing. - Active vs. passive management - Manager selection vs. security selection • Recent guests include: - Dennis Gogarty, CFP – President Raffa Wealth Management - Bill Mann, CFA – Portfolio Manager Motley Fool Funds, SIS ‘92 - Ira Jersey – Director US Interest Rate Strategy Credit Suisse, SPA/SOC ‘93 - Eric J. Green, CFA – Senior Managing Partner & Director of Research Penn Capital, KSB ‘92 Adding Value: Collaboration • The collaborative environment facilitates sharing of knowledge and experience. • Graduate students bring work experience from many different industries. - Ex. logistics, energy exploration and production, banking, etc. • Not all members are business majors bringing perspectives from other schools. - Includes students from the School of International Service and the College of Arts and Sciences. Portfolio Management A Top Down Approach Level of Analysis Macro Economic Industry Specific Firm Specific Coverage Responsibilities Fund Economist Coverage Groups Individual Analysts and Coverage Groups Near-Term Economic Outlook For the past eight months, SMIF has held a cautiously optimistic economic outlook. Reasons for optimism: - Manufacturing expansion - Improvement in consumer confidence and spending - Labor market improvement - Economic growth - Increased risk taking across asset classes Economic Risks • Short-Term Concerns - Severity of the European recession - Currency fluctuations and their impact on localized profits - Volatility of food and energy - Stabilization in the housing market - Domestic and international political turbulence • Long-Term Concerns - Inflation resulting from ongoing monetary expansion in developed markets - Integrity of the financial system Food and Energy Volatility Price fluctuations in energy and food pressure consumers in the short run, which affects consumer spending, business investment, and employment. Inflation Recent monetary expansion through the Federal Reserve’s “Quantitative Easing” creates concerns about rising future inflation. Inflation poses a significant threat to margins, earnings, and ultimately the value produced from many equities in our portfolio. European Recession A prolonged recession in Europe continues to be a central risk. Intervention by the International Monetary Fund and European Central Bank has reduced short-term pressure on the Eurozone, but significant structural changes have not yet been made. 2011 Q4 EU GDP Change (Annualized) Moderate Bullishness Sustained corporate earnings growth maintains attractive asset levels. S&P earnings are at an all-time high, yet the index is 11.74% off of its 2007 peak P/E valuation is lower year over year, indicating valuations have not kept up with earnings growth Consumer Spending Consumer spending rebounded quickly after the recession. Credit remained scarce until the second half of 2010, but has since expanded. This has helped to increase consumer spending. Companies within the consumer discretionary and staples industries are driven by changes in personal consumption. Manufacturing Improvement Manufacturing expansion continued through early 2012, but the pace has slowed. As a leading indicator of economic progress, this trend shows an ongoing, stable recovery in the U.S. Unemployment U.S. labor markets are slowly improving. Recent data suggest more rapid declines in unemployment. Increased employment supports growth in consumer spending and sentiment, ultimately enhancing asset prices. Industry Weightings Operationally, the fund is currently benchmarked against the S&P 500 with adjustments made to each industry weighting based on a 3-5 year outlook. The fund currently favors cyclical industries - Our outlook anticipates a cyclical upswing in the next 3 to 5 years - Each weighting is specific to the outlook for each individual industry - Outlooks were developed through group industry reports Target Weights 25.00% 20.00% 15.00% 10.00% 5.00% 0.00% Consumer Discretionary Consumer Staples Energy Financials Healthcare S&P 500 Materials Industrials Recommended Weights Technology Utilities Telecom Industry Weighting Rational Consumer Discretionary 13.50% 13.00% 12.50% 12.00% 11.50% 11.00% 10.50% 10.00% 9.50% Overweight The US economy is heavily driven by consumer spending. As the economic cycle turns upward we expect higher than average discretionary goods spending. S&P Weight Ideal Weight Consumer Staples 12.50% Overweight Though less favorable than consumer discretionary, there is less downside for staple products. Slower growth in commodity prices and improving consumer confidence will help the American consumer and correspondingly, this sector. 12.00% 11.50% 11.00% 10.50% 10.00% S&P Weight Ideal Weight Healthcare Underweight 12.00% In spite of demographic trends, high levels of uncertainty concerning future Medicare/ Medicaid payments make this sector look relatively less attractive than some of the cyclical sectors. 10.00% 8.00% 6.00% 4.00% 2.00% 0.00% S&P Weight Ideal Weight Materials Underweight 3.50% This industry is becoming increasingly reliant on imports from developing countries. With growth slowing in Asia, we remain concerned about a supply-demand imbalance. 3.00% 2.50% S&P Weight Ideal Weight Industry Weighting Rational Utilities Underweight 3.50% We see utilities threatened by historically low natural gas prices and high stock valuations. Also, as a result of the industry’s stable nature, it will not benefit from a cyclical upswing as much as other industries. 3.00% 2.50% S&P Weight Ideal Weight Telecom Underweight 3.50% With a cautiously optimistic outlook, we believe that better opportunities exist in other industries. 3.00% 2.50% 2.00% 1.50% 1.00% 0.50% 0.00% S&P Weight Ideal Weight SMIF Recommended Weights h as C om ec Te l es iti til U y og ol hn Te c ls ria st du In ls ia er at M re ca lth ea H ls ia nc er gy En s le ap St na Fi er m ry na io cr et is D su on C er m su on C Actual Portfolio Weights 25.00% 20.00% 15.00% 10.00% 5.00% 0.00% Necessary Actions • Sell down - Consumer discretionary - Consumer staples - Industrials - Materials • Invest more heavily in - Technology - Healthcare - Financials - Energy • Reduce Cash Position Portfolio Performance • Return Since Inception: 4.83% • Return Year to Date: 6.49% • Sharpe Ratio: 0.003 • Beta: 1.00 • Dividend Yield: 1.96% Portfolio Performance Portfolio: Top and Bottom Winners Losers Boston Beer Inc. (SAM) 44.58% Polypore International Inc. (PPO) -24.03% W W Granger Inc. (GWW) 41.58% Goldman Sachs Group Inc. (GS) -23.07% Continental Resources Inc. (CLR) 31.62% Petroleo Brasileiro SA Petrobras (PBR) -18.53% Portfolio Risk 0.20 Comparative Sharpe Ratios 0.15 0.10 0.05 0.00 AAPL -0.05 -0.10 -0.15 JPM GE SMIF Russell 2000 MSCI Emerging Markets S&P 500 DAX Index Dow Jones MSCI ALL FTSE 100 Industrial Country Average World Index Nikkei 6 01 6 15 01 /2 16 2/ /2 16 1/ 5 01 15 S&P 500 INDEX 20 6/ /1 12 /2 16 11 / 5 01 20 6/ /1 10 5 01 /2 16 9/ 5 01 /2 16 8/ 5 01 /2 16 7/ 5 STUDENT MANAGED INVESTMENT FUND 01 /2 16 6/ 5 5 01 /2 16 5/ /2 16 4/ 01 5 5 01 /2 16 3/ /2 16 2/ 14 01 /2 16 1/ 20 6/ /1 12 Relative Returns 20% 15% 10% 5% 0% -5% -10% -15% Building an Enduring Fund Implementing Lessons Learned • There is educational value in both successes and failures. • Introspection reveals areas for improvement. • The following case studies illustrate a sampling of lessons learned and resulting changes to the fund. Downside Sell Discipline • Research in Motion (RIMM) • Failure to sell our stake in RIMM identified a problem with downside sell discipline. • Key misjudgment: Over-estimated the strength of RIMM’s corporate customer base relative to its competitors. Resulting Changes: Coverage was restructured to be conducted in teams based on industry. Enables members to make the most use of overlapping information, such as understanding the strengths of competitors. Bought Sold Delving into Industry Nuances Continental Resources (CLR) The rapid growth of CLR demonstrated the importance of understanding the nuances in each industry. - CLR is isolated from the recent collapse in natural gas prices unlike the oil majors. - CLR benefits from political risk premiums included in oil prices, but is not exposed to political dangers concentrated in the Middle East and Africa. Resulting Changes: Opted to look beyond industry weightings. A section was included in our industry reports where analysts were asked to identify specific areas within each industry that offer the best potential. Bought Structural Resiliency • Organizational structures in SMIF are constantly evolving. • A principal goal for SMIF has been to develop resilient structures that insulate the fund from student turnover. • Coverage teams divided by industry spread knowledge so that continuing members can share it with incoming students. • Advisory board ensures consistency in operational rules. Looking Forward • The basic equity fund, as it is now structured, is an excellent tool for teaching broad investing and management skills. • Equity funds are common in universities. • The long-term goal for the SMIF is to expand in a way that plays to American University’s strengths. Future Opportunities Long-term Vision Includes: • Fixed Income Fund – Few universities have fixed income funds. Creating one would provide students with an opportunity to practice managing fixed income investments. • International Equity Fund – American University is known for its international relations program. Emphasizing international finance would play into this acknowledged area of University expertise. • Constrained Optimization Fund - A unique opportunity to teach sustainable and socially responsible investing. In addition to being part of American University’s core values, sustainability and social responsibility are areas of increasing interest in finance. Appendix Holdings (as of 3/17/2012) Fund History: Timeline • Initial Funding Sources: - Alumni Donations - One-time allocation from the Kogod Operating budget - Funds from predecessor finance clubs • The fund’s first trades were made in the Fall of 2010. • Academic year 2010/2011 saw the development of formal organizational structures within the fund. • Cash Position was fully invested by the Fall of 2011. • The Fall of 2011 also saw an increased effort to avoid style drift as holdings were heavily weighted towards large capitalization equities. • Spring of 2012 - implementation of a top-down approach and increased emphasis on collaboration. Quick Facts • 27 securities • Avg. Market Cap: $45B • 20 dividend paying securities • Portfolio Beta: 1.00 • Buys this semester: 5 • Sells this semester: 4 • Cash position: 8.27% • Winners: 17 • Losers: 10 • Total Return Since Inception: 4.83% Typical Class Session • Reports are circulated several days before each class, so that analysts can study the proposed action. • Each class begins with coverage of the fund’s holdings. Members share and discuss relevant news and financial information. • This is followed by two to three stock pitch presentations where members suggest new securities to purchase or current holdings to sell. • A question and answer session follows each presentation. Members then vote on the suggested course of action. • The class also regularly hosts industry practitioners as guest speakers. Student Leadership: Spring 2012 John Stefos, Fund Manager John is a senior with a major in international studies and minors in finance and Arabic language. John is originally from Lancaster, Massachusetts, but moved to Washington, DC to study international politics. During his first two years at American University, he developed a passion for finance while learning about the root causes of the 2008/2009 financial crisis. Following graduation, John will be joining Raytheon Company's corporate Finance Leadership Development Program. Seth Borko, Portfolio Manager Seth is a senior at the Kogod School of Business specializing in finance. Seth became interested in investing after taking Investment Analysis, a class with Professor Phil English. He now maintains his own portfolio in addition to his role with the SMIF. As portfolio manager, Seth aims to refine the fund's stock selection routine to create a top down process. This summer Seth will be joining J.P. Morgan in their Private Banking division. Ashley Rose Stumbaugh, Investor Relations Officer Ashley Rose is a Kogod senior, specializing in finance with a minor in economics. She is originally from Hamilton, New Jersey and transferred to AU during her junior year. The two years she spent in DC were full of AU activities: Washington Initiative, Honors Alumni Program, 1955 Club, Professional Women's Association among others. Upon graduation, she looks forward to joining J.P. Morgan's Corporate Development Team as a financial analyst. Mike Hirschberg, Economist Mike is a second-year MBA student from Chicago, IL, concentrating in Finance. He currently works at Greenberg Advisors, LLC, an investment bank focused on M&A advisory and raising capital. Prior to going back for his Ashley Rose Stumbaugh, Investor Relations Officer Ashley Rose is a Kogod senior, specializing in finance with a minor in economics. She is originally from Hamilton, New Jersey and transferred to AU during her junior year. The two years she spent in DC were full of AU activities: Washington Initiative, Honors Alumni Program, 1955 Club, Professional Women's Association among others. Upon graduation, she looks forward to joining J.P. Morgan's Corporate Development Team as a financial analyst. Mike Hirschberg, Economist Mike is a second-year MBA student from Chicago, IL, concentrating in Finance. He currently works at Greenberg Advisors, LLC, an investment bank focused on M&A advisory and raising capital. Prior to going back for his MBA, he worked in Logistics. He holds a BS from Indiana University. After graduation, he will join WCF Advisors in Minneapolis, MN, as an Investment Banking Associate. Kristen Owen, Accountant Kristen is currently obtaining her MBA from American University's Kogod School of Business with a concentration in Finance. Originally, from Cleveland, Ohio, Kristen graduated with honors from Kent State University with a Business Administration degree and was recognized as a Golden Key International Scholar. With interest in International Finance, Kristen has studied abroad in London, England and Sao Paulo, Brazil. Before beginning her MBA, she had previous experience in banking and personal finance. Bryan Schapperle, Operations Manager Bryan is a junior in the Kogod School of Business majoring in Finance. Bryan first became interested in investing after joining the Kogod Finance Group during his freshman year. An avid sailor, he also holds the position of Treasurer for American University's Club Sailing Team.