Fall 2012 Retreat Alumni and Students Thursday Afternoon Nov.29 2012

advertisement

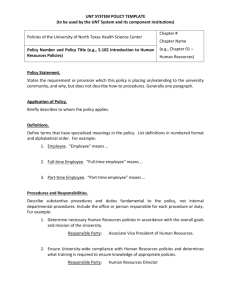

1 UNT Real Estate News October 2012 Fall 2012 Retreat Alumni and Students Thursday Afternoon Nov.29 2012 Testimonies 12:30-2:00PM BLB245 Followed by Alumni Meeting and Mixer Off Campus (TBA) REAL ESTATE & PROPERTY MANAGEMENT PROGRAM Department of Finance, Insurance, Real Estate and Law Fall 2012 and Spring 2013 Newsletter A co-production of the UNT Real Estate Program and the UNT Real Estate Alumni Association October 2012 2012/ 2013 UNT Real Estate Program Faculty Dr. Kimberly Geideman and Dr. Enya He invite all stu- dents, regardless of major, to meet with them to discuss a phenomenal opportunity to earn required/ elective credit and see an amazing part of the world at the same time! They will be traveling with a group of students to Hong Kong, Shanghai and Beijing, China for about 16 days in the summer of 2013 to teach and learn about real estate and risk management from an international perspective. Dr. Geideman will be teaching Real Estate Principles (REAL 2100) and Real Estate Finance (REAL 4000) and Dr. He Intro to Risk Management and Insurance (RMIN 2500) and Corporate Risk Management (RMIN 4600). They will be joined by Michael Sexton, Senior Lecturer in Management, who will be teaching International Management (MGMT 4660) and Business Policy (BUSI 4940). The deadline for applications is quickly approaching, so don't delay! Contact Dr. Geideman for details at 565-3620 or geideman@unt.edu Dr. Geideman has been busy writing and publishing. She and co-author Nick Evangelopoulos (ITDS) had a paper accepted for publication in the Journal of Real Estate Literature (JREL). Their work was so wellreceived that it won a national manuscript prize from the American Real Estate Society. Announced in Spetember 2012, the award includes prize money and puts UNT in the national spotlight. In addition, the editor of JREL has formally invited them to write another piece for the technology section of the journal. Even more awards came Dr. Geideman’s way earlier this year. She received the 2012 Professional Development Institute Fellowship Award and was also chosen by the FIREL faculty to receive the 2012 Faculty Award for Outstanding Teaching. Dr. Mike Braswell continues to work with students and the Texas Apartment Association in regards to professional students on campus mixers (2 per year), state and national meeting and trade shows for our students, and wonderful scholarships. The demand for our own students for property management graduates is far greater than graduating students! Four (4) of our students were interviewed, photographed and quote in the fall color National Apartment Association Magazine UNITS in July 2012! The article entitled “University of North Texas Students Ready for Success” with the national spotlight on our UNT program. The following students were quoted and noted! 1. Sherry Reynolds 2. Chelsey Hayes (Now with Radio Shack) 3. Durenda Mathis 4. Stephen Barkis (Now President of the UNT Real Estate Club) Property Management is recession proof and there are lots of exciting jobs! Not sure how to get more students to apply! Dr. John Baen has been busy teaching very large classes to pump up our numbers of real estate majors and minors. His drop-out rate continues to be less than 1%. UNT is now accountable to the State of Texas on completion rates for state funding. Various administrators have asked how we retain our students. I guess our mission is to both educate and motivate students. We also teach real world skills that absolutely will save or make them money in their lives from personal housing to investments and/or careers. Baen also continues to give many industry speeches 2 UNT Real Estate News and academic papers nationally and in the DFW region. Often this leads to more scholarships and student employment. He recently presented an overview of the U.S. Oil and Gas industry from the standpoint of land use, leases, damage payments, royalty etc. to 5top executives of Petro China. Last month both he and former MBA student Calvin Wong were honored to be asked by the U.S. State Dept. to present to international foreign journalist a similar presentation at the Ft. Worth Petroleum Club. Private land rights and mineral rights are a mystery to the rest of the world! Adequate compensation to land owners is serious or farmer terrorism will occur in China, Africa, Canada and South America. Dr. Randy Guttery has left the UNT Real Estate Program and moved on to UTD in Richardson. Widely known by our alumni, having been at UNT for 20 years, he will be missed and we wish him good luck in his new post. UNT is currently under budgeting hiring freeze with no known finding on when a replacement professor can be hired. (A funded Real Estate Chair would accelerate the prospects? And quality of replacement faculty?) Undergraduate Enrollment up! As the Texas and national real estate markets have improved, so have the overall numbers of students taking classes! The public and particularly young students are generally indicators of and reflections of the market. We currently have 334 undergraduates in classes now. Over the past two (2) years, total numbers were considerably down, however the Fall 2012 is more compared to Fall 2011 and generally up an “average” of 13.7%! Real Estate valuation dropped 15% and Real Estate law 5%. October 2012 The Residential Property Management Program had another great year. A mixer with the Texas Apartment Association Education Foundation Board (TAAEF) was held at the Career Center in both the fall and spring. Students also went to San Antonio to attend the annual Texas Apartment Association Education Conference as well as the Apartment Association of Greater Dallas (AAGD) trade show. TAAEF continued to provide scholarships for students in the amount of $16,000 a year. The TAAEF/Larry Niemann Scholarship provides $5,000 each semester and the Apartment Association of Tarrant County (AATC) Jonetta Vise Scholarship $3,000 each semester. These scholarships have provided $66,000 dollars to students New Licensing Laws have changed the demand for some classes. The Texas Legislature reduced the total number of hours to get a license and designated different required classes. UNT required equivalent classes include: 1. Principles I 2. Agency (includes Principles II) 3. Law of Contracts 4. Real Estate Finance (now required!) 5. Contract Forms 2 credit hours (New class not currently offered at UNT) Previously another real estate class was required and another business related class. While the vast majority of our students enter real estate fields not requiring a salesperson license, we are currently considering offering a Contract Forms class in a variety of ways but will require changes in the degree plan which takes time to get approved. In the meantime, we suggest former students and current students to take the Contract Forms Class at an area community UNT Real Estate Club Meeting at Business Leadership Building on September 27, 2012. Former students gave Business Testimonies to current students. This year, the date is Nov. 29, 2012 @ 12:30 Room 245 BLB followed by a business and social gathering of UNT Real Estate Professional and Friends of the program 3 UNT Real Estate News college or proprietary real estate school (Kaplan for example) for $95 if they want to become licensed. We are sad to report that the UNT M.S. in Real Estate was discontinued due to minimum graduation and class size requirements. A “Real Estate Concentration” option for an MBA may allow advanced students to win in the future. The MBA does require an additional 6 credit hours to complete. General Business MBA programs have flourished at all the DFW area universities due to weekend programs, online programs and “cafeteria styled” programs, and many less rigorous non accredited programs. Over the years we have had 100’s of Masters Students graduate who have done very well in their careers in US, China, Malaysia, etc. The UNT Real Estate Alumni Association (www.realestatealumniunt.com) is FREE and open to anyone and everyone who: 1. Is in any Real Estate related business. 2. Ever went to UNT (regardless of major)! 3. Has a need of any interns, employees, or research needs. 4. Is bored with life and needs excitement, thrills and a social network and business. We have many members who need to update their business affiliation and email addresses. Sign up at www.realestatealumniunt.com now! There have been over 30,000 former students at UNT that have taken Real Estate classes! There are 10,000+ UNT former students who NEVER took a Real Estate class and are in the Biz! We need more members! It is free! UNT Real Estate Jobs! Internship! and Opportunities! for Students, Graduates and Alumni Employers are sending lots of requests for applicants. We try to post them, show them to students and actually call those alumni that let us know they are LOOKING. The problem is while the Real Estate Program attempts to assist all companies and all current and former students, we just can’t be a full time placement agency. Many firms contact us after having posted their jobs with the Career Center through the UNT Eagle Network Job Posting Service. From these calls and postings, we find many employers want REAL ESTATE MAJORS but are not fully aware we even have a program. Alumni generally do not have access to the postings and understandably so, UNT and the companies do not want these positions to be readily available on “Monster Jobs.com” or for public reading. We are the ONLY undergraduate REAL ESTATE DEGREE PROGRAM in TEXAS! We now tell firms that want our students to create: 1) A 1 page Letterhead Flyer with all information possible 2) Indicate if a real estate license is required 3) Clearly indicate range of pay or if commission only. 4) Sponsor a company named real estate scholarship to October 2012 get more attention 5) Guest speak in classes on a meaningful topic at the appropriate level. 6) Join the Career Fair Days 7) Join the UNT Real Estate Alumni Club It all boils down to the fact demand for entry or 3-5 year experienced real estate educated college graduate is greater than the supply! The following companies that are looking for full-time hiring are as follows: 1) WINGSPAN, a mortgage servicing company out of Frisco. A startup company that has grown to nearly 1700 employees in 4 years. In order to have access to our students their Campus Recruiting Director has offered to send a corporate executive to speak in class and are the first ever Official Sponsor of the UNT Real Estate Club. (They will be sponsoring a meal for the huge club.) Good deal! Contact Carol Nielsen, Campus Recruiting Director at Carol.Nielsen@Wingspanadvisors.com 2) Dental Space Advisors commercial real estate and advisory firm in Dallas. (brokerage, leasing, developers, reports and proformas). Katie Parker, kparker@dentalspaceadvisors.com 3) Trinity CPM, property management firm, on-site property management for multifamily projects, Denton, TX 4) Globe Medical Realty Advisors Brokerage, Leasing, Packages, Proforma, and Knowledge of commercial real estate. Grapevine, TX drutson@globemedllc.com 5) Finely Morrow Commercial Real Estate Association (Hourly+Bonus) commercial real estate activities and generating prospects, cold calling etc. 6) Swearingen Realty Group LLC, Dallas, new broker in training position. Market research, proformas, presentations, financial analysis, rates of returns, leasing and sale negotiations. Salaried for 6-12 months for 40+hours/week. Contact Alan Thomas: athomas@swearingen.com 7) INTEGRA Realty Resources, Ft. Worth and Dallas. Seeking commercial appraiser trainee who will work with one of the top national firms in the US. Must enjoy complex valuation projects, research and excellent writing skills. Many former UNT real estate Graduates work there. Contact Dan Wright MAI, Director: dwright@irr.com UNT Real Estate Internships (Example of firms seeking and types of jobs) (Send them resume and cover letter!) 1) Verdad Real Estate owned by Jason Keen, UNT Alumnus, commercial developer and build-to-suit deals. Debt/equity packages, Proformas, demographics, site selections, research etc. @ $10/hour. Seeks sharp advanced students having had real estate investments and real estate finance. 2) Legacy Alliance Holdings, Addison, TX. Commercial/ 4 UNT Real Estate News 3) 4) 5) 6) 7) 8) 9) 10) 11) Investment firm owned and operated by 3 UNT Real Estate Alumni who buy and sell larger deals, seeking sharp student to assist with analysis and building proformas. Contact Brad De Young 214-731-3133 Verus Capital Partners: Owns and operates 8 commercial properties in Denton. Owned by UNT Real Estate Alumni and wants intern to “Bird Dog” deals, conduct research, analyze deals, work the numbers. Former BAEN student seeking someone who can run “Rates” and their financial models. 1 or 2 positions for 20 hours per week. Contact Bryan Korba @ bkorba@v-re.com Roosevelt Management Company: Mr. Ryan Cooper will interview you. He is a former UNT Real Estate Major and is seeking TOP students that will assist in buying portfolios of non performing loans. Many of our students have worked there as interns. You must love numbers and hard work for great pay. rcooper@roosevelt.com Finley Morrow Commercial Real Estate , Hourly+ bonus for cold calling, property research, talking to prospects, create presentation and proformas. Weinchert Realtors, Flower Mound, TX, general duties and assist brokers, contact Ken Herrell, kenherrell@weichert.com Wingspan– Mortgage Associate Program, 8 full-time positions for January/May 2013 in Frisco, TX. Resolve borrower complaints and research borrower accounts. Expected to increase the number of summer internship opportunities. Scott Brown Properties, Denton Texas owned by a former student Mr. Scott Brown, there are many UNT alumni from the real estate program that work there managing rent houses, investments, finding deals, etc. Hard work, fast paced environment. Contact: Jennifer@scottbrownproperties.net Toll Brothers-Luxury Home Builders– Model Home Sales Assistant, Flower Mound and possibly other locations. Weekends and evening you show homes enthusiastically and with fabulous, outgoing people skills. 4 days per week. Wonderful opportunity and potential. Contact Chris Sahualla, Sales Manager: csahualla@tollbrothersinc.com Crest Commercial Real Estate, LBJ/Dallas. Performance based pay. Have hired our students in the past! Contact Sally Stixrood 214-696-6677 x 308 Mages Group a dynamic national real estate brokerage, development, and construction company is seeking a college student (junior or senior) for a parttime job with potential college credit available next year. Candidates should be majoring in real estate, finance, marketing or related discipline with a minimum of 3.00 GPA. Pay is $14-$16 per hour. Please contact Rich Uzelac for consideration at 214-5384823 or send resume and cover letter to hr@magesgroup.com UNT Real Estate Scholarships and Grants We have had many loyal former students and friends of UNT share their success by giving back to help our real October 2012 estate students. Some give a one time gift, others annually. A departmental committee grants the money based on the donors wishes. Two (2) types of gifts are made: 1) Designated/Named Scholarship named after themselves or their company. 2) An unrestricted gift to the program that is used for financial needs of the program. Some of the recently initiated scholarships are as follows: The Edward Okpa Real Estate Scholarship: Mr. Okpa is a Real Estate Alumnus who has committed to a five (5) year gift of $5,000. An accomplished Dallas real estate developer, he also ran a very competitive race for Mayor of the City of Dallas. Celeste Pilgrim always is appreciated for her annual gift giving to the program. Her loyal gift of $250 per year is so muchly appreciated. Celeste has been an apartment manager, investor and apartment locator service owner and has so graciously contributed thousands of dollars over a very long period of time. We have many other scholarships but funds are low. (Your Name Here or Company Name Here) would you please create a named scholarship that will really help students in their high cost enrollment? Stephen Barkis receiving the Jonetta Vise Scholarship Award and Sherry Reynolds receiving the Larry Niemann Scholarship Award Free: UNT Real Estate Alumni Association Join Now! www.realestatealumniunt.com The UNT Real Estate Alumni Association builds awareness and support of the UNT Real Estate Program by providing information about current events and news, networking opportunities to students and alumni, and building a stronger network of UNT Real Estate Alumni. The primary functions of the UNT Real Estate Alumni Association are to: Provide Networking Opportunities: Real Estate is about relationships. The Alumni Association provides many opportunities to meet other UNT real estate graduates through several different events throughout the year. Promote the UNT Real Estate Program: The UNT Real Estate program is one of the top rated real estate programs in the United States! The Alumni Association is working to build the recognition of the UNT Re- 5 UNT Real Estate News al Estate program throughout the business community to promote the credibility of your education. Support the UNT Real Estate Program: The continued strength of the UNT Real Estate program and Alumni Association will require support from all to retain and build upon this presence. Financial support is always helpful, but the physical support of becoming involved and working to build on these goals will guarantee the continued success of the UNT real estate program, strengthen the activities of the Alumni Association, and supplement your ability to build on your career through your education at the University of North Texas. JOIN TODAY! The UNT Real Estate Alumni Association is free to all who attended the University of North Texas and to Friends of UNT Alumni that are working in the real estate industry. Please visit the UNT Real Estate Alumni Association website at: www.realestatealumniunt.com/ The website contains great information about upcoming alumni events and recaps of past events as well as information on job postings and contacts for UNT Alumni who have registered to be a member. If you have not yet registered on the website, please do so by clicking on the “Register” button on the left side of the page. This will insure that you are kept up to date with the latest activities. October 2012 2. Their homes 3. Their retirement investments 4. Disposable income disappearing with rising prices and flat pay 5. Other investments U.S. Dollar: Buying power here, overseas—Oil Prices! Real Estate and a small business—the best after tax cash flow and inflation protector! 1. Homes interest rates 2. Land 3. Income properties 4. Exotic Real Estate (Oil, Gas, Royalties, Billboards, Cell Phone Tower) 5. Small business that Cash Flows! Taxes: Federal income taxes and estate taxes will never be lower—will sky rocket. (Real estate and small business write-offs are the only protection!) The New Jobs Bill 1. $4,000 tax credit for hiring 6-month unemployed, … is not going to work 2. Say $35,000 salary, needs to generate $15,000 profit to have value to the company doing the hiring and to justify the tax credit! 3. U.S. is 70% consumer driven economy— consumers have stopped spending. a. No EZ credit or credit cards b. No disposable income c. Flat income, rising costs, utilities, insurance, etc. 4. We manufacture very little to sell overseas a. U.S. labor cost b. 15 in 16 cars sold in China are 1st time buyers. Now, 55% of all cars selling in the world are Chinese. c. various wars and conflicts are winding down and war related exports and jobs will diminish 5. Technology is stolen in 3 months, so is not a jobs builder in U.S. over long term Homes as Investments 2013-2018 Baen as Bane in The Dark Knight Rises Crystal Balling the 2013—2018 Markets Thank God you live in Texas!!! By Professor John Baen General Overview: Historically: A double dip or one canyon “Recession”? Politically: Doesn’t matter who is the President today… Government cannot solve our debts or economy… but can hurt. People: People are concerned about the following: 1. Their jobs 1. Smaller/more affordable homes ($150K or lower 1/3 of market) will greatly appreciate due to affordability, availability of loans (Government socialized loans– FNMA), cost to build, and cost to develop lots. 2. Large homes (>$500k) will stagnate and will likely fall in value. (except in special small markets) a. New jumbo loan rules and rates: 20+% down and 28%/36% qualifying ratios (October 2011) Maximum FNMA loans $417,000) b. Interest rate 5±% (future) c. Low liquidity d. Tax deductible interest may disappear or be bracketed. e. Credit scores increase from 675 to 750+ f. Loan standards and down payments to increase! 3. Homes, like the historic NEW CAR craze, will become less impressive to impress others. Renting house no longer a stigma. 4. Perfect home in Texas: $130,000 with 3 bedrooms, 2.5 baths, 2 car garage, (Newly “Weds”, Nearly 6 UNT Real Estate News “Deads”, and raising kids) - lifetime home. 5. We will stay put and move less vs. historic 1 in 7 homes selling, annually. 6. DFW had 60,000 homes in foreclosure in 2011. That trend will soften, but bigger houses, larger loans, will increase—equating to HIGHER total loan loss while fewer absolute number of homes are foreclosed on. 7. Urban infilling will occur in wealthy zip codes. 8. Pockets of good markets exist with lots of new homes SELLING! Prosper, Frisco, etc. ($380K– 450K). 9. MLS/home sales data does not report: a. Short sales/ prices b. Bank sales c. Builder sales d. leads to incomplete data and market snapshot 10. Bottom of market/ doggy houses (less than $50K) will make fortunes for those with guts (rental and/or owner-financed resales). 11. DANGER! Large Home Tax deductions may be “taken away” in the new Federal Budget Environment. a. Property Taxes b. Mortgage Interest deduction c. Tax-free gains on Personal Homes may be TAXED! d. Smaller homes will be hurt much less Rural Land Investments 2013-2018 1. Land has maintained its value, although volume of sales is down. 2. Record low debt on Land today per acre, appears as few foreclosures are found in the data. 3. Rising commodities prices (Grub) and lower interest rate and investment yields make Land looks good! 35% agricultural yields and inflation hedge with development potential as Texas population booms. 4. Oil and Gas and other hidden income have made land owners look smart. a) Barnett Shale royalties b) Wind royalties c) Water sales d) Pipeline income e) Hunting leases (stable) f) Higher grass leases and farm leases g) Power line payments 5. Record cattle prices and herd sales combined with record drought/fires will cause a real problem and spike in cattle prices in near future (farmers buying back and consumers eating beef). 6. Financing for Land will be tough! Farmer Mac and U.S. may bow out while FDIC restricts loans. a) Liquidity will be low b) Holding periods will be longer c) Down payments 35%+ 7. The Rich will keep their lands (Perot, Hunts, Basses, Ted Turner, etc.) 8. Land, as always, will be a place to store wealth and for retaining wealth for estates and very long-term holding periods. Apartments and Multi-Family 2013-2018 1. The boom and success of apartments in 2011 were October 2012 2. 3. 4. 5. due to : a) Foreclosed home occupants b) Marital stress and divorces c) Lack of financing due to home buyer credit scores, higher down payments, etc. d) “New Americans” and migration of people from other states seeking work and medium term housing e) Lower total cost of renting vs. home purchase (for 2-3 years) Rents will continue up until home financing improves and/or availability of financing eases (perhaps never?). When house ownership costs = new apartment rents, occupancy will fall. Renting vs. owning home is no longer a stigma in U.S. (Lifestyle/ status change). Renting is considered very smart by much of society today! (Boom to Landlords) Short-term apartment leases vs. 30-yr mortgage? All cities need some affordable zoning for retirees and youth! Retail and Retail Sales Taxes 2013-2018 1. 7 of 9 major malls in DFW have just come out of bankruptcy 2. Major “Anchor Tenants” are not doing well: Borders & Blockbuster 3. Walmart’s gross sales per store have dropped by 4% for nine (9) quarters. They are boosting sales by: a) Opening new stores (gross sales ↑) b) New lay-away plans, payment plans for Christmas 2011 c) Dropping prices and having SPECIALS d) Mining their data e) Internet sales explosion f) NAFTA Walmart cards/debit cards g) Laying off excess employees of 600,000 workforce (SAM’s laid off 11,200 in 2011) 4. Increasing investor’s “CAP-Rates” with failing market values (-20—40%) result in falling property taxes to communities/schools. 5. Vacant space and boxes are serious problem— alternative uses? 6. 7-11 sales are flat, however, big push for new stores in growing areas to boost national sales level through growth/ new locations (Quicktrips and Racetracs are winning). 7. Pad site users/ new buildings growing that are in demand NOW: Whataburger, RaceTrac, 7-11 looking in Argyle NOW 8. Sales Taxes will only grow in the suburbs (except for inflation in prices) but should reach 30% of total city in income “Normal Towns.” 9. Internet sales will increasingly “steal” from Bricks and Sticks Real Estate. Industrial/ Warehouse Investments 2013-2018 1. Growth will be at Alliance and Frisco due to locational advantages and lack of traffic (for now). 2. DFW Airport (18,000 acres) has plans to offer many sites to attract ground rents and new cash flows (may compete with private land sales in MidCities and Grapevine!) 3. Target is building major distribution facility in Denton 7 UNT Real Estate News 4. 5. 6. 7. 8. 9. near the I-35 split. (Following Walmart’s lead in Sanger?) Huge Project on about 50 acres of Giant Frozen Foods Freezer! J.C. Penny’s 3-D 10-story warehouse is working for them: a) Few workers b) Automated systems c) High efficiency Burlington Northern/Buffett Investments (North Ft. Worth) are of regional and national importance. (Rail distribution) We will likely manufacture less in DFW: a) Airplanes (defense cuts) b) Helicopter c) Military hardware U.S. labor costs can NOT compete with anything overseas including Call Centers (old warehouse space). Small projects are not wanted by most nearby towns! Small warehouse projects will boom if small towns will allow them. Service centers for small businesses would work on I-35W, US 380 and Highway 114! a) Plumbers b) Air conditioning companies, etc. Federal, State, and Local Taxes and Estate Taxes 20132018 1. After-tax income is more important than Gross Income/year. 2. We have the lowest taxes today than you will have for the rest of your LIFE! 3. Real Estate Investments will be the main engine of smart people’s tax-sheltered and retirement income (depreciation, etc.). 4. In 1978-1979, the U.S. had a 70% tax rate for income over $125,000. Get ready! Higher taxes are on the way. 5. Estate taxes are likely to be 55% of anything over $1$1.25 million, including your: a) Home b) Business Value c) All assets including Life Insurance 6. Prepare an Estate Plan NOW! I paid a lot of money to do this recently. Get a GOOD attorney that knows YOU and not a cookie cutter lawyer. 7. Property taxes are not your friend. AG taxes may be attacked and go away, which would cause AG land values to crash. 8. The new Texas mortgage. A paid for home and investment real estate: 4% of value each year (3% local taxes + 1% insurance)! Better than a state Income Tax! Specific Investment Recommendation (Public and Private Investments) 1. The U.S. Dollar will fall 2. The Euro will fail 3. We will either have: a) Hyper-inflation/devaluation of U.S. Dollar: Debt cancellation Fresh capital Skyrocketing hard assets values October 2012 “Increasing” home values Debt holders slaughtered China, Japan, foreign T-bill holders Mortgage holders Treasury investments Municipal bond holders Peace and New Economy b) A depression where U.S. $1 is King and the dollar buying power worth 10x! Cash will be King Asset values crash Civil unrest and rioting Political upheaval Civil financial war and New Economy Game over, start over! 4. Protect yourself and pray for peace a) Hard Assets– the 7 G’s: Gold Guns Good Cash Flowing Business! Grub (Commodities) Ground (Real Estate) Gas/Oil God 5. Action Plan: a) Be Highly Leveraged Assets: with nonrecourse debt or Real Estate with cash flow (the default option). GO LONG on cheap debt now! b) Have zero debt on Real Assets: cash flow will drop, but purchasing power will remain (all prices fall). UNT Real Estate Club Meeting Fall 2011 8 UNT Real Estate News October 2012 UNT Real Estate Program News To ta l Stude nts Principles of Real Estate (REAL 2100) Real Estate Agency (REAL 3100) Real Estate Finance (REAL 4000) Property Management 2009 2010 2011 2012 202 190 157 176 (+13%) 15 29 19 24 (+26%) 48 29 18 21 (+17%) 37 18 18 20 (+11%) 64 66 33 43 (+30%) 31 17 13 11 (-15%) 1 1 0 0 - 71 72 40 38 (-5%) 298 333 (REAL 4200) Real Estate Investments (REAL 4300) Real Estate Valuation (REAL 4400) Real Estate Internship (REAL 4800) Real Estate Law & Contracts (BLAW 4770) Total Students *from previous Fall TAA conference Spring 2011 CCIM's Annual Sporting Clays Event Fall 2011 UNT Real Estate Club Retreat Fall 2012 FIREL Department Scholarship Banquet 2012 Real Estate Club General Election 2012 9 UNT Real Estate News October 2012 UNIVERSITY OF NORTH TEXAS REAL ESTATE CLUB FALL 2012/SPRING 2013 **All Dates to be Confirmed** 1. September 26th, 2012 Wednesday Career Fair College of Business Career Fair at UNT Coliseum 3:00-7:00pm – Be there or be square! 2. September 27th, 2012 Thursday 10:15-11:00AM PIZZA & SIGN UP MEETING BLB 170 Field Trip Sign Up Meet the Real Estate Faculty Elections Activities – Join for $5 a year NOW! Meet the Faculty Meet the Club Scholarship Application Deadlines (Feb 2013) Announcements Information Retreat Planning 3. October 4th, 2012 Thursday 12:30-6:30PM CCIM Sporting Clays Outing and Hosting! 40 club members needed. We generally don’t shoot, but host the Big Dogs of Real Estate and keep scores followed by dinner and prizes. Or you can shoot for a $150 donation! More info later. Dallas Gun Club/ Near SE Corner of New 121/35E Lunch, Beverages and Dinner! Two (2) $500 scholarship to most lottery ticket sold by UNT students Wear UNT Green T-Shirts! Meet Potential Employers Win 1 of 2 $500 Scholarships! 4. October 4th, 2012 Thursday 5:00-7:00PM Texas Apartment Association Sponsored Mixer and Food/ Beverages! Atrium of BLB 1st floor A great opportunity to meet and greet our UNT Real Estate Program sponsors and supporters. Jobs, opportunities, and fun! Professional Dress please Executives on Campus! From Frisco Texas H.Q. Mr. Jason Dickard, Executive VP Carol Nielsen, Director of Campus Recruiting Growth to nearly 1700 employees in 4 years 5. October 16th, 2012 Tuesday 10:15-AM Sharp! WINGSPAN Portfolio Advisors — a Mortgage Servicing Company! BLB 170 What they do and how they do it! Will be seeking Dec. and May grads and a few interns Informative, fun and educational meet 6. November 15th, 2012 Thursday North Texas CCIM Park Cities Club Luncheon Limited to 20 students. Advanced students priority first. Near Loop 12 and N. Dal. Tollroad/ SE Quad Professional Dress Spread out and sit with Deal Makers! 7. November 29th, 2012 Thursday 12:30-2PM Executive on Campus Presentation and Mixer BLB 245 Lunch Alumni Mentors Job Testimonials Followed by Alumni Mixer off campus! TBA Spring 2013 Potential Club Meetings: Dates TBA Paul Myvic Director of Real Estate, Sally Beauty and Team for Site Locator, Presentation, GIS, Career Positions etc. Mike Staffer—1st Priority Inspections (Homes/Res) 817-467-7328. You won’t believe what you see! Fabulous Presentation of problems in houses Texas Apartment Association: Mixer & Fieldtrip to Construction. 10 UNT Real Estate News October 2012 Give Back! Real Estate Professorship! In order to enhance the Real Estate program’s level of excellence dramatically and make it the destination for high quality, real estate career-track students, the FIREL Department has long wanted to fully fund an endowed chair in commercial real estate. This effort is well under way. We want to build on the current success and invite you to join us in fully funding an endowed chair. $100,000 has already been pledged and accepted by the UNT Administration. The CCIM, SIOR®, ULI, MAI®, TAA, REALTOR®, and Baen Endowed Chair in Commercial Real Estate will ensure commercial real estate is always taught at UNT; create a new faculty line that will hire a full-time real estate professor who, by virtue of being named to the Endowed Chair, will be a renowned scholar; expand the pool of quality, recruitable students for the real estate industry; and extend the legacy of excellence in professorship established in part by the founding faculty. The goal of $1.M will yield $40,000 annually to be used toward research expenses, travel expenses, and salary supplements. The Chair is named to honor those leading organizations in the commercial real estate industry that have strong ties to the real estate program. These leading organizations and trade groups are Certified Commercial Investment Member Institute, Society of Industrial & Office Realtors®, Urban Land Institute, Appraisal Institute®, Texas Apartment Association, and Realtor®. The real estate program develops highly trained commercial real estate professionals who are then hired by these organizations. The success of the university and these organizations is linked through the students graduating from the real estate program. We want to complete this project by the end of the year in order to hire a new faculty member in 2013. Show the real estate program you support us and the Endowed Chair. Your past financial support has been a tangible demonstration of how much you value your education, the real estate faculty, and the importance of a strong real estate educational program at UNT. A generous contribution at this time will allow us to get much closer to the goal of funding the endowment for the chair this year. You can also ask your employer to financially support the Endowed Chair through a corporate matching program or an outright gift. You can make your gift online by using our secure online giving form which can be found at https://development.unt.edu/ givenow/givenow.php; use Appeal Code ECCOMREAL. Or you can send you check, made payable to UNT Foundation, to the Office of Development, PO Box 311250, Denton, TX 76203-1250. Thank you for your time and for supporting UNT. UNT Endowed Professorship in Commercial Real Estate Investment Yes! I am interested in investing in the future of the Real Estate Program at UNT. Please contact me with more information on this proposed endowed professorship. Name:_________________________________ E-mail: __________________________ Address:_________________________________________________________________ City: ________________________ State: __________ Zip:_______________________ Phone1#:___________________________ Phone2#: ____________________________ Mail this form to John Baen 1155 Union Circle #310410, Denton, TX 76203 OR FAX to 940.565.4234 11 UNT Real Estate News October 2012 Autumn 2012 Real Estate Retreat On UNT Campus! Thursday, November 29th, 2012, 12:30-5:00 P.M. 27th Annual Event For UNT friends, guests, former students, real estate students, and real estate professionals. KIDS WELCOME. Hosted by Friends of the UNT Real Estate Club as a non-university event. Why? Lunch hosted by UNT Real Estate Alumni and Real Estate Club Mixer, Testimonies and meet current students 12:30-2:00PM Association and Advisory Meeting 2:00-3:00 PM, followed by off campus location gathering. TBA Head Hunters and HR People Welcome Deals, contacts, internships, renew acquaintances To get to know more real estate people! Meet current and former students Make friends for your future! Yes! I would like to sponsor a named Real Estate scholarship. One time gift of $_______ OR Amount per year: $250 $500 $1,000 $25,000 (Make checks payable to UNT Real Estate Scholarships #75697 or for program support UNT Real Estate Unrestricted Gift Fund #67583) Name ________________________________________E-mail___________________________________________ Address __________________________________________________City _________________________________ State ___________________ Zip___________________ Phone___________________ Fax __________________ Mail to: UNT Real Estate Program 1155 Union Circle #310410 Denton, TX 76203 12 UNT Real Estate News October 2012 RSVP to Retreat Thursday, November 29th, 2012, 12:30-2:00 P.M. 27th Annual Event RSVP online at http://www.cob.unt.edu/rsvp ______ YES, we plan on coming to the Real Estate Retreat! NAME: ____________________________ with _________ guests. My phone number is ___________________. My firm is __________________________________. My cell phone number is ________________. My email address is ___________________________. RSVP by November 26th. (If possible. If not, just come!) phone (940) 565-3050, fax (940) 565-4234, e-mail: firel@unt.edu ______ NO, we wish we could attend! Attached please accept our contribution of $________ to support the UNT Real Estate Program. Mail contributions to John Baen, PH.D., UNT Real Estate Program, FIREL Department, 1155 Union Circle #310410, Denton, TX 76203-0410. Please make checks for program support payable to UNT Real Estate Unrestricted Gift Fund #67583 or for scholarships to UNT Real Estate Scholarships Fund #75697. Where: The New Business Leadership Building (BLB 245 12:30-2:00PM) Food: A light lunch will be served. RSVP: With the staff at (940) 565-3050, via email firel@unt.edu or via fax (940) 565-4234 by Monday, November 26th, 2012 Cost: Free! Donations to the UNT Real Estate Program are appreciated. Alumni who do not attend are encouraged to send $20 to $100 to support the UNT Real Estate Program. Please make your TAX DEDUCTIBLE check payable to UNT Real Estate Unrestricted Gift Fund #67583 or for scholarship support to UNT Real Estate Scholarships #75697 and send to the following address: Dr. John Baen FIREL Department 1155 Union Circle #310410 Denton, TX 76203-0410 University of North Texas FIREL Department 1155 Union Circle #310410 Denton, Texas 76203 Nonprofit Organization U.S. Postage P A I D Denton, Texas 76201 Permit 455 13 UNT Real Estate News October 2012