The Ever-evolving Case for a Carbon Tax Shi-Ling Hsu

advertisement

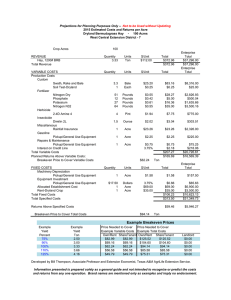

The Ever-evolving Case for a Carbon Tax Shi-Ling Hsu Univ. of British Columbia Faculty of Law Florida State University College of Law The Role of Forests in Carbon Mitigation and Energy Independence 1.1 tons per acre per year x $30/ton = $33 per acre per year Washington has 22 m acres of forest Maximum earning potential: $726 m per year Value of raw logs: 8 m3/acr/yr x $60/m3/acr/yr = $480 per acre per year China’s HCFC plants •manufacture of HCFC-22 •capture of HFC-23 •1 ton HCFC Æ 175-350 tons CO2 ($5k-7k/ton) •Value of offsets: avg $115m over 2 years per HCFC plant Joseph Stiglitz on Climate Change: "There is a way out, and that is through a common (global) environmental tax on emissions…." Economists' Voice, July 2006 Gregory Mankiw on Climate Change: Here are three votes for a carbon tax: Tierney, Nordhaus, and Mankiw…. What do we all have in common? None of us is planning to run for elected office. Gregory Mankiw's Blog, May, 2006 1. federalism 2. innovation in small chunks 3. government is bad at picking winners "America can lead the world in developing clean, hydrogen-powered automobiles. A simple chemical reaction between hydrogen and oxygen generates energy, which can be used to power a car, producing only water, not exhaust fumes. With a new national commitment, our scientists and engineers will overcome obstacles to taking these cars from laboratory to showroom, so that the first car driven by a child born today could be powered by hydrogen and pollution-free.” George W. Bush, January 28, 2003. 1. federalism 2. innovation in small chunks 3. government is bad at picking winners 4. international harmonization 5. sticky capital “If something can’t go on forever, it won’t.” There is no way around the reality that a carbon tax is needed. Herbert Stein, economist 1916-1999