2010 NEGLECTED DISEASE RESEARCH AND DEVELOPMENT: POLICY CURES

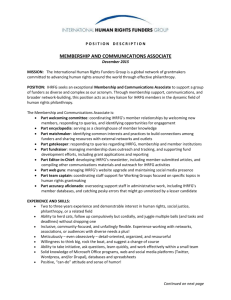

advertisement