After the Event Insurance and Funding Solutions in International Arbitration

advertisement

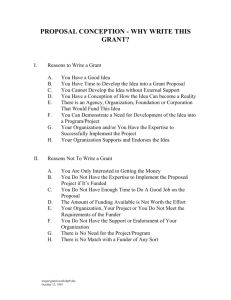

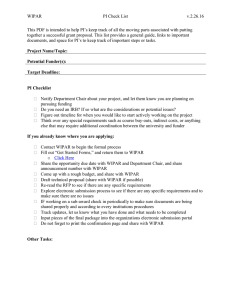

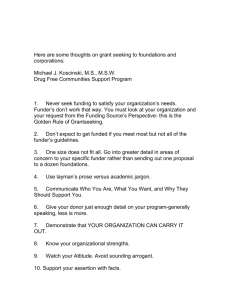

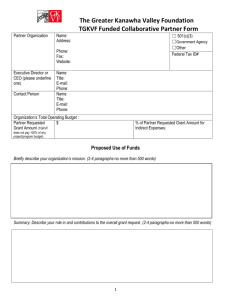

International Arbitration Webinar, 5 April 2011 After the Event Insurance and Funding Solutions in International Arbitration Peter Morton, K&L Gates LLP James Blick, The Judge Limited Neil Purslow, Therium Capital Management Limited Copyright © 2011 by K&L Gates LLP. All rights reserved. International Arbitration Webinar K & L Gates 5th April 2011 James Blick What is “ATE Insurance” • Insurance taken out “After the Event” giving rise to dispute • Typical policy coverage – Lawyers’ fees (subject to risk alignment) – Expenses, incl. expert fees, Tribunal Fees – Opponent’s costs (where applicable) • “Skin in the game” • ATE is not… – Interim funding for legal costs – Enforcement risk cover ATE Insurance Premiums • Deferred until conclusion • Contingent upon success / “self insured” • Discounts for settlement • Different structures • Cost increases with insurer’s financial risk • Geared to encourage settlement • Recoverability of the premium? • Section 29, Access to Justice Act 1999 • (Notice of Funding) • How much?... Considerations for insurers • Prospects of success • Estimates of potential value • Costs budget • Enforcement • Jurisdiction / Applicable law • Appeal procedure / Risk of Annulment Points to consider • Defining “success” – Applicant v Respondent – Non‐monetary objectives – Mixed outcomes / “partial success” • ‘Shop around’ – Maximise chances of securing terms – Adverse selection – Competitive pricing Case Study BIT Arbitration under UNCITRAL rules – – – – – – – – Dutch company claiming against EU member state Seat of Arbitration = London; Language = English US Law firm (with London office) acting on contingency fee basis Contingency fee arrangement excludes expenses, i.e. Tribunal fees and damages experts (to be funded by Applicant) ATE insurance covering expenses only Policy limit of indemnity £1.5m Premium of £675k ‐ deferred and only payable in the event of “success” “Success” = ‘recovery of monies after outcome of all appeals’ Outcome = loss – Insurer indemnifies expenses up to policy limit of indemnity – No premium payable Case Study #2 LCIA Arbitration – – – – – – – English supplier claiming £25m from German manufacturer English Law firm acting on a private fee paying basis ATE insurance covering expenses and opponent’s costs Policy limit of indemnity for expenses £500k Policy limit of indemnity for opponent’ costs £2m Premium of £1,125k ‐ deferred and only payable in the event of “success” Premium discounted by 75%, 50% and 25% depending on stage of settlement Outcome: ‐ Early settlement at £7m incl. costs ‐ Costs incurred = £550k; Stage 1 Premium = £281,250 (25% of total premium) ‐ Net recovery = £6,168,750 K&L GATES INTERNATIONAL ARBITRATION WEBINAR. Neil Purslow Therium Capital Management Limited April 2011 Therium Capital Management Limited 78 Duke Street London W1K 6JQ neil.purslow@therium.com T 020 7491 0600 INTRODUCTION TO THIRD PARTY LITIGATION FUNDING. y Third party funder agrees to fund legal costs in return for a percentage of the damages and/or a multiple of the funding. y Funding is not a loan; funder‘s investment is lost if case is lost. y Funding arrangement does not impact existing banking arrangements (note: floating charges). y Pays for all or a proportion of legal costs, or just disbursements. y Lawyers can be on fully paid basis or partial nowin no fee agreement. y “After-the-Event” (ATE) insurance commonly used to cover the other side’s costs in losing cases; third party funding and ATE provided in parallel. 10 BENEFITS OF THIRD PARTY FUNDING • Frees up cash flow / budgets. • Reduces risk on uncertain outcome. • Additional set of eyes on claim and costs. • Levels playing field against better-resourced defendant (note it is a strategic decision whether to disclose existence of funding). 11 FUNDING ARRANGEMENTS. y Strictly, contractual relationship between client and funder direct, not with law firm. y Nature of relationship is a partnership between funder and client; funder’s interests are most closely aligned with those of the client. y On UK model, client retains control of the case and decides when to settle within parameters of legal advice. y Funder and client agree budgets and project plan for arbitration up front. 12 WHAT DO FUNDERS REQUIRE? Merits y Key pleadings / case summaries / correspondence, any legal opinions, core documents. Quantum y Any views on quantum, expert reports. Procedural history and way forward y Any directions, history of offers. Key issues and risks y Annulment? y Appeals? y Procedural challenges? Costs y Budget and project plan. Recovery y 13 Ability of defendant to meet any award. THE FUNDING PROCESS. 14 ISSUES TO CONSIDER. Economics of the case as a whole y y y y Global view on cost / benefit on the case as a whole Effect of early settlement – funding released (and paid for) in tranches? Adequacy of budgets for the ‘long haul’? Ways of mitigating funding cost: – VAT? Use of conditional fees? Choice of funder y y y y y 15 Consequences of termination of the funding agreement Professional funder v hedge fund External or internal diligence? Other fees charged? Capital adequacy – does the funder run an over-commitment strategy? Is the funding risk transfer or a loan? Contact information for any questions: James Blick The Judge Limited Email: James.Blick@theJudge.co.uk Tel: 0845 257 60 58 Peter Morton K&L Gates LLP Email: peter.morton@klgates.com Tel: 020 7360 8199 Neil Purslow Therium Capital Management Limited Email: neil.purslow@therium.com Tel: 020 7941 0600