NBER WORKING PAPER SERIES THEORY AND EMPIRICAL APPLICATIONS

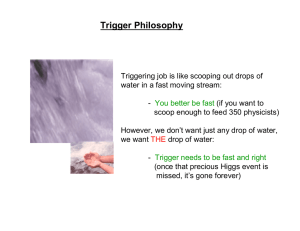

advertisement