UNOBSERVABLE MECHANISMS (VERY PRELIMINARY VERSION)

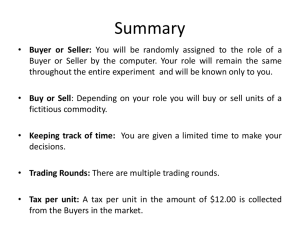

advertisement

UNOBSERVABLE MECHANISMS

(VERY PRELIMINARY VERSION)

MICHAEL PETERS

Abstract. In this paper a group of sellers sell to a group of buyers using a

double auction. Sellers’ ask prices in the auction are chosen by computer programs that condition the ask price on communications with buyers before the

auction. The paper shows that perfect Bayesian equilibria for this competing

mechanism game exist in which prices are inefficiently high independent of the

number of traders in the market provided it is common knowledge that at least

two buyers can observe each seller’s mechanism. We show that a seller whose

mechanism is observed by less that two buyers will price competitively in every PBE when the market is large. Finally we show that the set of outcomes

supportable as perfect Bayesian equilibrium grows as mechanisms are made

more observable.

1. Introduction

Digital markets represent a kind of classic example of competing mechanism

games. Sellers sell through websites that output price offers that depend on messages received from clients. The messages aren’t type or value reports, or really

anything that looks like a type report, or a bid in a competing auction. The messages are streams of urls that buyers visited before requesting quotes, or cookies

that are passed from external websites. Even the time at which a buyer requests a

price quote can convey information that the seller’s program uses to choose a price

quote.

Nonetheless, the programs sellers use are mechanisms in any standard sense of

the term. As there are many sellers doing the same thing in a lot of digital markets,

they are competing mechanisms. Games in which sellers compete against each

other using mechanisms can have a lot of equilibrium outcomes. The reason is that

sellers’ mechanisms can incorporate messages that allow buyers to reveal market

information which can be used to trigger punishments when some seller deviates

from a collusive outcome.1 Indeed, what the theory shows is that there must always

be a message space defining a single competing mechanism game, such that if sellers

write mechanisms that condition their price offers on messages they receive from

this message space, then any incentive compatible and individually rational outcome

in the sense of Myerson’s textbook (Myerson 1997) can be supported as a perfect

Bayesian equilibrium outcome..

The point of this paper is to illustrate how this result depends on an observability assumption. We show that in a simple trading environment, perfect Bayesian

equilibrium with prices that are inefficiently high can be supported independent of

the number of buyers and sellers provided it is common knowledge that at least

October 1, 2014.

1

For a survey see (Peters 2013).

1

2

MICHAEL PETERS

two buyers can observe each seller’s mechanism. In contrast, if only a single buyer

can observe each seller’s mechanism, then perfect Bayesian equilibrium will be approximately efficient, provided the number of buyers and sellers is large enough.

Furthermore, if we say that a seller’s mechanism is effectively observable when it

is common knowledge that two or more buyers observe it, then we can show that

the set of supportable equilibrium outcomes expands as the number of effectively

observable mechanisms increases.

When a mechanism is observable by some trader, the trader both understands

and believes the commitments built into the mechanism. When a mechanism is

unobservable, traders will typically understand that a commitment is being made,

but be unsure of what the commitment is. For example, when a buyer purchases

a plane ticket, the buyer knows that sellers monitor their online search behavior,

but doesn’t know exactly how this information is used to create the price quote

that they see. Of course, some buyers do know this commitment - for example, the

computer engineers who created the pricing software, and they buy plane tickets

the same way other buyers do. Generally, the plethora of equilibrium outcomes

that arise in competing mechanism games occur when it is common knowledge that

at least 3 buyers observe each seller’s mechanism.2

The fact that buyers don’t observe mechanisms doesn’t mean that mechanism

can’t be used to make effective commitments. If buyers behave in the usual Bayesian

rational way, they will correctly anticipate how their messages are being used. If

there is enough observability, mechanisms can work in the usual way even if buyers

don’t understand them. For example, if buyers know that enough other buyers

can observe commitments, and anticipate that the behavior of these buyers will be

effected in an appropriate way, this will often be enough for the other buyers to

believe the commitments as well.

To address this issue formally, we introduce two concepts. The first is a commitment message, and the second, the default game. A commitment message is a

message sent during a competing mechanism game that binds the actions of the

mechanism designer in a way that is understood by any market participant who

sees the message. For example, a simple take it or leave it price offer binds a seller

to trade with the first buyer who accepts the price offer. Any buyer who sees such

a message believes the commitment will be enforced, and understands that anyone

else who sees the message will share this belief. Similarly, accepting a price offer is

a commitment message for a buyer.

The default game defines a set of commitments that are observable to all market

participants. Indeed, our view of the default game is that it is a normal form

game in which the actions available to each player are commitment messages. Each

profile of commitment messages is associated with an outcome defined by primitives

of the relationship. For example, in an ticket pricing game, each buyer can ask any

seller he or she likes for a price quote, then accept it, or simply choose to sample

another seller. A price quote is a commitment message that says that if the buyer

who receives it accepts it, trade must occur at that price. Similarly, since the

2

The reason for the number three in this statement is that communication protocols can be

devised that allow the informed buyers to convey their information to other market participants.

This protocol relies on agreement in messages, which only makes sense when there are at least

three players trying to send the same message.

UNOBSERVABLE MECHANISMS

(VERY PRELIMINARY VERSION)

3

buyer responds, the acceptance set could be viewed as a commitment message that

commits a buyer to trade at any acceptable price.

The rules of the default game are the bits of the competing mechanism game

that are readily observable to an outsider. However, it might be that there are other

commitment messages the seller could make. For example, in a digital market, a

seller might design a program that makes the price quote depend on what the seller

sees of the buyer’s browsing history.3 A commitment message verifiably conveys

the details of this program to one of the buyers. Generally, we assume that there

is at least one buyer who knows what this program is, but there may be others.

The question is how additional commitment messages affect the possible outcomes

of the game.

In principal, the notion of observability could be applied to a single mechanism

designer problem. For example, suppose that a single seller is trying to sell a

homogeneous unit of output to one of a set of n different buyers. As above, the

seller chooses one of the buyers and makes that buyer a take it or leave it offer. Each

buyer selects an acceptance set. This defines the default game. However, the seller

may also communicate with they buyers before he makes the offer. Suppose this

communication simply involves each buyer sending the seller a real number, similar

to a bid. The seller writes a program that chooses a buyer and sets a price offer

that is conditional on these messages. The seller might have the option of sending

a commitment message to one or more of the buyers revealing this program. In

the simple environment where the seller’s value is common knowledge, it isn’t hard

to see that if only a single buyer observes this commitment message, the only

outcome supportable as a perfect Bayesian equilibrium is one in which the seller

simply chooses a buyer at random and makes him or her at take it or leave it offer.

This follows from the fact that unobservability means that whatever the seller’s

computer program does with the messages it receives must be sequentially rational.

In particular, once the seller has chosen a buyer, the mechanism that is offered

must maximize the seller’s expected payoff for the single buyer seller problem - it is

well known that the mechanism that does that (even with observable mechanisms)

is the take it or leave it offer. Of course, if the buyers could all observe the seller’s

commitment message, then they would be a continuation equilibrium in which each

bidders message would be a bid, and the seller would make a take it or leave it offer

to the buyer who submitted the highest bid, at a price equal to the second highest

bid.

To see what happens without the observability assumption, we are going to focus

on a market in which the default game is a double auction. The reason for this

default game instead of one in which sellers choose buyers and make them offers

is that it simplifies the analysis of buyer search. To mimic the search process, we

imagine that each buyer can choose to visit each of the sellers’ websites before the

double auction begins but after buyers, if any, observe the sellers’ mechanisms.

Sellers can monitor these visits, and condition their bids in the double auction on

what they observe. Observability of the mechanism means that buyers learn how

sellers’ bids in the double auction depend on buyers browsing history. As mentioned

above, we show that the set of outcomes supportable as perfect Bayesian equilibrium

grows as the number of traders who (effectively) observe these mechanisms grows.

3

Of course, this program might make the quote independent of the history.

4

MICHAEL PETERS

The implications of observability are similar to the implications of lack of commitment. When mechanisms are not observed, they will have to implement sequentially rational actions in response to most messages, and buyers will know this

(hence the take it or leave it offer outcome in the single mechanism designer example described above). The difference here is that sellers actually can commit some buyers simply might not know what sellers have committed to. This allows

us to study games in which some buyers actually do observe these commitments.

In principle, this is richer since we could study situations in which observability is

not common knowledge.

Our approach is much closer to the discussion of unobservable incentive schemes

studied by (Katz 1991) or (Katz 2006). In his model players hire agents to play

games for them, and give those agents incentive contracts that the other player

can’t observe. What this paper considers is similar except that the players offering

incentive contracts, offer them to many agents who can also communicate with the

other players.

1.1. Environment. We stick with a very well known environment. There are n

sellers and n buyers in a market. Each seller has a single unit of a homogeneous

good to sell. Each buyer wants to acquire exactly one unit. The sellers’ goods are

all perfect substitutes. We’ll refer to both buyers and sellers with a single index i.

The value of a buyer or seller with value vi who trades at price p is (vi − p) for the

buyer and (p − vi ) for the seller.

The basic interaction between a buyer and seller - i.e., the default game - involves a price offer. To keep the matching process as simple as possible for this

environment, we’ll assume that the posted price is a reserve price or equivalently

an ask price in a double auction.4 Buyers will submit bids to the double auction.

The double auction will allocate the n goods to the traders who with the n highest

bids or asks (transferring the good to buyers in the case of ties) and set the trading

price to the n + 1st highest bid or ask.

In the terminology of the more general model described in this paper, the seller’s

ask prices are commitment messages that bind a seller to trade with some buyer

whenever the n + 1st highest bid or ask submitted to the auction is at least as large

as the ask price the seller submitted at a price equal to the n + 1st highest bid or

ask. Similarly, the buyer’s bid is a commitment message that commits the buyer to

buy whenever his bid is at or above the n + 1st highest bid or ask, paying a price

equal to the n + 1st highest bid or ask.

The double auction constitutes the default game. Every profile of messages

in that game implies a profile of action (trades and transfers). The issue here

is whether sellers can successfully make commitments such that their ask prices

depend on messages communicated before the double auction begins. ©

ª

An outcome function for this environment is a collection of mappings qji (v) i,j

©

ª

and pij (v) i,j where qji (v) is interpreted as the probability with which buyer i

trades

© i

ªwith seller j. The monetary transfer from buyer i to seller j is given by

pj (v) .

4See (Peters and Severinov 2006) to see how an online auction market may have equilibrium

that look exactly like equilibrium in double auctions.

UNOBSERVABLE MECHANISMS

(VERY PRELIMINARY VERSION)

5

Let s (i) be an indicator function that takes the value 1 if i is a seller,

P and takes

value 0 otherwise. An outcome function is feasible if 0 ≤ qji ≤ 1 and j qji (v) ≤ 1

for all v, and i.

Whatever mechanisms sellers use, the equilibrium outcome function satisfies two

well known requirements. The first is incentive compatibility:

X

n

³

´o

¡

¢

s(i)

s(i)

qji (vi , v−i ) (−1)

vi − pij (vi , v−i )

≥ E qji (vi′ , v−i ) (−1)

vi − pij (vi′ , v−i )

E

j6=i

for all i, vi and vi′ . The second is individual rationality,

X

¡

¢

s(i)

qji (vi , v−i ) (−1)

vi − pij (vi , v−i )

≥ 0.

E

j6=i

The theory of competing mechanisms says that by augmenting the message space

in this process and allowing sellers to make commitments based on messages in this

augmented message space, any outcome function that satisfies the two conditions

above can be supported as a perfect Bayesian equilibrium in this new game. 5

A competing mechanism game is a directed graph in which the nodes represent

the opportunity for different players to send messages, while the edges represent the

messages themselves. Each node is a decision node for a particular player, and the

decision nodes of each player are partitioned into information sets. Each terminal

node in this graph is associated with a profile of bids and asks. This means that

once the terminal node is attained, each buyer and seller is committed to make

the corresponding bid or ask associated with that terminal node. Of course, the

mapping from terminal nodes to bids (or asks) for a particular player must be

measurable with respect to that player’s information.

At any node, the continuation history associated with the node is a sequence of

pairs in which the first element of the pair is a message from some space M, while

the second element is the identity of the player who sent the message. The first

element in this continuation history much contain the identity of the player who

owns the decision node.

Since competing mechanism games are about messages and the effect they might

have on actions, we assume that the set of continuation histories associated with

every pair of nodes in a particular information set are the same. Of course the

mapping from continuation histories into profiles of bids and asks might be different

at different nodes within the same information set for player i if some other player

has made commitments that i has not yet observed.

A node for player i is called a commitment node if there are two continuation

histories associated with that node that differ only with respect to the first message

sent by player i, which induce different bids (or asks) by player i in the associated

terminal node. The corresponding message is called a commitment message. A

commitment message by player i is observable by player j if each message induces

a node that lies in a different information set for player j.

We are interested in trying to characterize the set of outcome functions that

are supportable as weak perfect Bayesian equilibrium of the competing mechanism

game under different observability assumptions.

5See (Peters 2010).

6

MICHAEL PETERS

1.2. A Very Stylized Environment. We can illustrate the argument with an

example in which both the environment and the communication needed are very

simple.

Our competing mechanism game begins with each seller designing a computer

program that will convert messages he receives during the interaction into an ask

price for the double auction. We’ll treat the program itself as a commitment message. Then, there is a period before the double auction occurs in which buyers simply choose whether or not to visit each sellers’ website. The seller simply records

whether or not each buyer visits. Sellers’ programs assign an ask price to each subset of buyers who choose to visit. Since different programs can assign different ask

prices to the same collection of visitors, the programs are commitment messages in

the sense described above. The issue is which buyers can distinguish the different

programs.

Since the objective is to make the communication process clear, we’ll also make

the environment as simple as possible. Suppose the number of buyers is n and

that there are n sellers as well. Suppose, in addition, that it is common belief that

sellers’ values are all equal to zero, and that each buyers’ value is either low, vl > 0

or high, vh > vl with the high value being drawn with a fixed probability π ∈ (0, 1)

independently for each buyer.

There are sure gains to trade in this environment between each buyer and seller.

Any outcome in which all but one of the sellers sell is ex post efficient.

Perhaps surprisingly, there is ’collusive’ equilibrium for this game if at least two

buyers can observe each seller’s program. This collusive equilibrium supports an

outcome in which all sellers ask vh and buyers trade if and only if their value is vh .

To describe this equilibrium, recall there are n buyers. After the buyers observe

whatever information there is about sellers’ mechanisms, each chooses whether or

not to visit each of the sellers’ websites. After these visits occur, buyers submit

their bids in the double auction, while sellers’ asks are submitted by their programs.

Let mij be equal to 1 if and only if buyer i chooses to visit seller j’s website before

submitting his bid.

Each seller’s program records who visits and who doesn’t, so that it has n messages consisting of a sequence of 0’s and 1’s that it uses to decide what ask price

to set. Let K (j) be the set of buyers who are able to observe what program j is

using to set price. The important assumption in all this is that for every j, K (j) is

common knowledge among the sellers and that each buyer in K (j) knows whether

or not there is another buyer in K (j). Buyers outside of K (j) either don’t know

or don’t understand seller j’s mechanism despite the fact that they do understand

that j is choosing an ask price that can depend on the message they send.

n

The computer program used by each seller is a function from {0, 1} → Aj

where Aj is the set of feasible bids in the auction. Call the following special pricing

program a reciprocal pricing program:

aj (m1,j , . . . mnj ) =

(1.1)

(

vh

0

|i ∈ K (j ′ ) : mij = 1| < 2∀j ′ 6= j

otherwise.

We explain the notation. The symbol |·|means cardinality. So the cardinality

computed in the term before the less than sign is the number of buyers from the

UNOBSERVABLE MECHANISMS

(VERY PRELIMINARY VERSION)

7

set K (j ′ ) who know the mechanism seller j ′ is using who also choose to visit seller

j ′ s website.

The idea behind the reciprocal pricing program is that seller j is going to set a

high price as long as the buyers who he knows observe the mechanisms of each of

the other sellers stay away from his website (or that at least one of them does). If

there is a buyer who he knows doesn’t know any seller’s mechanism, then he ignores

what that buyer does.

Proposition 1. If there are at least two buyers in K (j) for each seller j, then there

is a weak perfect Bayesian equilibrium for this competing mechanism game in which

each seller uses a reciprocal pricing mechanism, all sellers ask vh with probability 1

on the equilibrium path, and buyers trade if and only if their values are vh .

Proof. The ask prices for sellers is determined by their computer programs, so it

is enough to show that there is no alternative program that will raise expected

profit. The strategy that buyers use is to stay away for every seller’s website if

each of the sellers whose mechanism they observe has chosen the reciprocal pricing

mechanism. If, on the other hand, the buyer observes that some seller j ′ chooses

a mechanism other than the reciprocal pricing mechanism, then i should visit the

website of every seller other than the website of j ′ . Once the buyer arrives at the

double auction, they bid their values.

On the equilibrium path, there is no reason to visit a website since a unilateral

visit is ignored in a reciprocal pricing mechanism, and each buyer expects the

whichever of the other buyers observed j’s mechanism is not going to bother to

visit. In that case, visiting a website has no effect on the ask prices that sellers use.

On the other hand, if a buyer sees a deviation by some seller, he expects that some

other buyer will see the deviation and visit all website. In this case, if he confirms

the messages sent by the other buyers, each of the sellers will end up cutting his

ask price to zero, so he has a strict incentive to visit the website as well.

As there are n sellers asking vh , the n + 1st highest bid or ask (which is the

trading price in the auction) will be vh unless all buyers have low values. However,

no trades occur in that case. The expected payoff to the seller is

¶

n µ

X

n

n−l l

.

vh π = v h

π l (1 − π)

l

n

l=0

A seller who deviates expects the other sellers to ask 0 in the double auction

because he expects two or more buyers to visit the other sellers’ websites. In that

case, the only way he can actually trade if he sets a price greater than zero is if

all buyers have high values. So the maximum profit attainable with a deviation is

vh π n (which he would almost attain by setting an ask price slightly below vh ). So

this deviation is unprofitable.

¤

A few comments. Notice that this is not a sequential equilibrium. Buyers don’t

visit websites because doing so has no effect on their payoff. If they expect trembles

by the other player, then it will always be in their interest to visit the website as

well, in case they can confirm the others visit and induce a price cut. This could

be made into a sequential equilibrium if it was slightly costly for buyers to visit

websites. Then they wouldn’t find it worthwhile to visit a website to trigger a price

cut unless they were quite sure the other buyer would also do that. In any case,

8

MICHAEL PETERS

the seller’s mechanism acts as a type of correlating device that allows the buyers

to coordinate their actions.

The equilibrium described here is obviously not the only equilibrium. There

is also an equilibrium in which sellers all bid vl and buyers never bother to visit

websites before bidding in the auction. The payoff to sellers in this equilibrium is

vl . In the case where vl > vh π this equilibrium makes all the sellers worse off than

they would have been if they didn’t use mechanisms at all.

This example does illustrate that the messages that buyers send do not have

to be complex to support outcomes with inefficiently high prices. Compare the

simple messages here with the recommendation mechanism in (Yamashita 2010),

the universal type reports in (Epstein and Peters 1999) or the mechanisms that

depend explicitly on other mechanisms in (Peters and Szentes 2012).

Notice that there is some similarity in this story to the dynamic pricing that

airlines use to price tickets - if the airline isn’t filling as many seats as it expected

at some point in time, it will discount. If the slow down is caused by a competitor’s

sale, then buyers may anticipate the price response and delay their purchases,

confident that the other buyers will confirm their behavior and ensure that the

price response follows. As in the meet the competition argument, the competitor

realizes that sales are pointless and doesn’t cut price.

What may not fit the airline pricing story so cleanly is the assumption that

enough buyers actually see what the airlines pricing mechanisms are doing.

1.3. Unobservable Commitments. In this section, we’ll relax the assumption

that there are multiple buyers who observe each sellers mechanism.

In this case, there is a seller whose mechanism is observed by only a single buyer.

The device used above to support the equilibrium no longer works, because if other

sellers respond to any message that buyer sends by cutting price, the buyer will

always send the message, no matter what mechanism he has observed the seller

using.

To state the next theorem, we need two new concepts. Recall that m is a profile

of n reports by buyers to all the sellers, and let i be any buyer. A mechanism

for seller j is said to be monotonic if whenever there is a profile m−ij of reports

for the other buyers such that for two distinct reports mij and m′ij for buyer i,

¢

¢

¡

¢

¡

¡

aj (mij , m−ij ) > aj m′ij , m−ij , then aj mij , m′−ij ≥ aj m′ij , m′−ij for every

profile m′−ij .

Second, we assume that one of the two messages that buyers can send is ’focal’

in the sense that if a buyer can’t affect his payoff by sending the non-focal message,

then he just won’t send it. This is somewhat captured by using the idea that the

message is simply whether or not the buyer visits the seller’s website as the message.

If there is even a slight cost to visiting a website, the buyer won’t bother to do it

unless there is a strict benefit. A strategy is called focal if a buyer only sends a

non-focal message when it actually changes his payoff.

Notice that the mechanisms described above that support the collusive equilibrium are monotonic.

Proposition 2. Suppose there is a seller such that K (j) < 2. Then for large

enough n, that seller’s program will set a price no higher than vl with probability 1

in every perfect Bayesian equilibrium of the competing mechanism game in which

UNOBSERVABLE MECHANISMS

(VERY PRELIMINARY VERSION)

9

buyers bid their true values in the double auction, sellers use monotonic mechanisms, and buyers use focal reporting strategies.

Proof. Each buyer sends a binary message to each seller. The profile of messages

viewed by each seller leads to a profile of ask prices. Since incentive compatibility

requires that the probability of trading for a high value buyer is at least as high as

it is for a low value buyer, and mechanisms are monotonic, either messages have

no effect whatsoever on a seller j ′ s ask price, or there is a profile of messages m−ij

that seller j receives with positive probability, and a profile of types for the buyers

other than i such that j ′ s ask price is strictly lower with message mij than it is

with message m′ij , and i trades if he sends message mij while he doesn’t if he sends

message m′ij . For this to be true, the trading price associated with mij must be

lower than the trading price associated with m′ij .

In that case, both buyer types must weakly prefer the message mij . If the low

type buyer is indifferent between the messages, the high type buyer must weakly

prefer mij . Since buyers will use the focal message when they are indifferent, the

buyers reporting strategy must be pure. That is, either both buyer types send the

same message, or the high type buyer sends mij while the low buyer type sends

m′ij .

Start with the case where all buyers send the same message on the equilibrium

path, since it is easier. Let j be the seller whose mechanism is observed by just

one buyer, let i be that buyer, and let j ′ be one of the other sellers. Suppose that

j’s mechanism offers an ask price above vl in response to the equilibrium profile of

messages. The deviation we want to consider is one where j replaces this ask price

with one (just slightly lower than) vl .

Given any profile of ask prices of the other bidders, let t be the number of

other sellers whose ask price is at or above the ask price offered by j in the initial

equilibrium. j’s price will be pivotal if the number of buyers with high values is

exactly n − t. If this event occurs, then the price at which j trades will fall when j

modifies his ask price to something below vl . This event occurs with probability

n!

t

π (n−t) (1 − π) ≤

(n − t)!t!

′

n!

t′

π (n−t ) (1 − π)

′

′

t

(n − t )!t !

which converges to zero as n goes to infinity. So j is unlikely to modify his trading

price by cutting his ask price.

The signaling case is more difficult because the ask prices used by sellers will

be correlated with the types of the buyers. Let v be a profile of buyer types and

a (v) be the profile of ask prices associated with the messages sent by those types

(from the pure strategy property of focal equilibrium we can identify the profile of

messages sent by each buyer to each seller in this event). Choose v such that j’s

ask is the n + 1st highest value in the vector (v, a (v)). Changing the value of one of

the buyers’ types will cause the nth highest value in the profile (v, a (v)) to change,

so j’s bid will no longer be pivotal. Then if we use the number of buyers with a

high value to be the number in this pivotal profile, we are back in the situation

described above, and the pivot probability shrinks to zero with n.

The final bit of the proof requires a demonstration that buyer i (who actually

sees j’s deviation) can’t unilaterally trigger a retaliation by the other sellers. This

max

′

10

MICHAEL PETERS

follows from a straightforward argument - he i could trigger a retaliation that

lowered the ask prices of the others unilaterally, then he would do so whether j

deviated or not.

¤

The fact that some sellers’ mechanisms are unobservable in the sense described

in Proposition 1 is not enough to ensure efficient outcomes. For example, suppose

that there is a single seller in the example above whose mechanism is observed by

only a single buyer, while the other sellers’ mechanisms are all observed by multiple

buyers. Suppose that each of the other sellers uses the reciprocal pricing mechanism

described in Proposition 1 and equation (1.1). Suppose seller j is the one whose

mechanism isn’t observed by multiple buyers. If j simply asks 0 independent of any

messages he receives in period 1. Then having the other sellers use the reciprocal

pricing mechanism can be supported in equilibrium. The logic for buyers is exactly

the same. For sellers who offer reciprocal pricing mechanisms, they should expect

that if they deviate, all the other sellers will set their ask prices at 0, so no profit

can be made. Since seller j sets ask price 0 independent of any messages, the profit

associated with the reciprocal pricing mechanism is

n−1

vh π

.

n

This is lower than what it would have been if j had also used a reciprocal pricing

mechanism, but still positive.

All that remains to be checked is whether j wants to deviate. If he keeps his

price at 0 he always trades at a price at least equal to vl . The only way he can

change the trading price is to raise his ask to vh , in which case his profits will be

n

the same as the others vh π n+1

. If this is smaller than vh , he won’t deviate and the

equilibrium is supported. If it is larger, then he will set ask price vh in equilibrium

instead. The other sellers will still use a reciprocal pricing program because they

prefer to take a chance at vh than to sell at vl for sure.

Nonetheless, an immediate corollary of Proposition 2 is the following:

Proposition 3. All buyers trade in any perfect Bayesian equilibrium in which

sellers use monotonic mechanisms, buyers use focal strategies, n is large enough,

and K (j) < 2 for each j.

A final observation provides some insight into observability. Fix some competing

mechanism game in which K (j) < 2 for some player and suppose some profile of

messages is supported as a perfect Bayesian equilibrium.

References

Epstein, L., and M. Peters (1999): “A Revelation Principle for Competing Mechanisms,”

Journal of Economic Theory, 88(1), 119–160.

Katz, M. (2006): “Observable Contracts as Commitments: Interdependent Contracts and Moral

Hazard,” Journal of Economics and Management Strategy, 15(3), 685–706.

Katz, M. L. (1991): “Game-Playing Agents: Unobservable Contracts as Precommitments,”

RAND Journal of Economics, 22(3), 307–328.

Myerson, R. (1997): Game Theory The Analysis of Conflict. Harvard University Press.

Peters, M. (2010): “Reciprocal Contracting,” Discussion paper, University of British Columbia.

(2013): “Survey on Competing Mechanisms 2 - The revelation principle,” Discussion

paper, Vancouver School of Economics, to appear in the Canadian Journal of Economics.

Peters, M., and S. Severinov (2006): “Internet Auctions with Many Traders,” Journal of

Economic Theory, pp. 220–245.

UNOBSERVABLE MECHANISMS

(VERY PRELIMINARY VERSION)

11

Peters, M., and B. Szentes (2012): “Definable and Contractible Contracts,” Econometrica,

80(1), 363–411.

Yamashita, T. (2010): “Mechanism Games with Multiple Principals and Three or More Agents,”

Econometrica, 78(2), 791–801.