Deconstructing Nepotism

advertisement

Deconstructing Nepotism

Sheheryar Banuri, Catherine Eckel, & Rick K. Wilson1

April 2016

Abstract

Nepotism arises when favoritism toward one’s group affects personnel and contract decisions. It

is widely regarded to be welfare reducing, yet it persists. In this paper we address the motives

for engaging in nepotism. Using naturally-occurring groups, we present a laboratory experiment

to test the strength of two motives for engaging in nepotism: beliefs regarding worker

performance within and outside one’s group, and the desire to reward members of one’s group in

the form of favoritism. Nepotism is introduced by allowing subjects to select their partners in a

trust game. The design varies two factors in a 2x2 design: the efficiency of group members and

the ability to select partners. We find beliefs about group member productivity to be the

predominant motive. These beliefs bear out: ingroup members trust each other more, and

reciprocate at higher levels, even when they are less productive. Selecting ingroup partners is

profitable. These results help explain why nepotism persists.

Keywords: Nepotism, Group Identity, Discrimination, Trust, Reciprocity

JEL Classification Codes: C92, D73, M51

1

Banuri: Development Economics Research Group, World Bank, 1818 H St NW, MC 3-356, Washington, DC,

20433 (e-mail: sbanuri@gmail.com); Eckel: Department of Economics, Texas A&M University, 4228 TAMU,

College Station, TX, 77845 (e-mail: ceckel@econmail.tamu.edu); Wilson: Department of Political Science, Rice

University, MS 24, Houston, TX, 77251 (e-mail: rkw@rice.edu). The authors have no relevant or material financial

interests that relate to the research described in this paper. The findings, interpretations, and conclusions expressed

in this paper are entirely those of the authors and do not necessarily represent the views of the World Bank, its

Executive Directors, or the countries they represent. We are indebted to Klaus Abbink, Rachel Croson, Sherry Xin

Li, Angela de Oliveira, Ngoc Phan and participants of the EITM summer school at Washington University-St.

Louis, NSF Conference on Politics Experiments at the University of Virginia, the NYU Experimental Political

Science Conference, and the Economic Science Association meetings in Tucson, AZ. Funding was provided by the

National Science Foundation (NSF SES-0921884). Any errors remain our own.

0 “Better to dance with the devil you know than the angel you don’t.” – English proverb

INTRODUCTION

Consider a manager who is in a position to hire one of two possible candidates with

identical levels of skill. One candidate has social ties to the manager, while the other candidate

is randomly selected from the general population. Which candidate will the manager select for

the position? Will his answer be the same if the candidate with social ties has a lower level of

skill? If the manager chooses the candidate with social ties, this can be considered nepotism,2 an

act that is widely regarded as inefficient and discriminatory, and yet is pervasive. There is little

agreement about why people engage in nepotism, and whether it is profitable for them. In this

paper, we address both these questions using naturally occurring groups and a novel

experimental design.

From the perspective of traditional economic theory, nepotism can only reduce profit,

since restricting employment to a favored group yields a less qualified candidate, on average,

than an open, full search (Becker 1971). Current empirical research also supports the notion that

nepotism is damaging for firm profitability (Bennedsen et al. 2007, Perez-Gonzalez 2006). Yet,

despite its impact on performance and efficiency, nepotism persists.

We define nepotism as the choice of a partner from one’s own primary group (kin,

friendship, or identity group) in a setting involving trust. Two motives have been offered for

engaging in nepotism: one is based on the claim that nepotism is rewarded - members of the

same group work harder, thereby reciprocating the trust placed in them (McConaugby, et al.,

2001, Kets de Vries 1993, Davis et al. 1997). The second motive (more common in the

literature) is the desire to confer benefits on group members (Vanhanen 1999, Brewer 1999,

Chen and Li, 2009, Brandts and Sola 2010, Belot and van de Ven 2011). While both motives are

plausible, it has been difficult to determine the relative contribution of each in determining

nepotism. This is due, in part, to the inherent difficulty of observing motives underlying

nepotism in the field.

2

Note that we define nepotism in a broader framework than simply kin-based relationships. Nepotism is defined as

“discrimination in favor” of a group member relative to the population (Fershtman et al. 2005, Becker 1971). This is

divergent from traditional biological definitions of nepotism, which stress kin-based relationships.

1 We employ a laboratory experiment to investigate the motives for engaging in nepotism.

Using the familiar trust game (Berg et al. 1995) as our starting point, we introduce two types of

responders: an ingroup member and a non-ingroup member.3 In one treatment responders can

choose which partner they prefer, and in another they are randomly assigned. Each treatment is

further divided into a condition where ingroup members are less efficient than others, and

another where ingroup members are equally efficient. This design allows us to identify motives

for engaging in nepotism and its impact on subsequent trust and reciprocity.

Motives are difficult to uncover in observational studies. Nepotism, for example, is often

either illegal or socially undesirable, and therefore observing it is problematic. Our design

allows us to eliminate social desirability, since all interaction is anonymous, and to manipulate

the efficiency of ingroup members, which is not easily observable in the field. There may be

other factors that contribute to nepotism than those we consider in our experiments (such as labor

market conditions, and reputations within the group). However, by restricting our attention to

key aspects of nepotism, we are able to focus on mechanisms through which it operates.

We address three central questions. First, why do individuals engage in nepotism, when

ingroup members are less efficient? Is it a strategic choice based on expectations of reciprocity

(beliefs), or is it out of concern for the wellbeing of the group (favoritism)? Second, what is the

impact of nepotism on trust and reciprocity? And finally, is engaging in nepotism profitable?

We find that individuals engage in nepotism because of their beliefs about the reciprocity

of ingroup members. We also find that ingroup members trust each other more, and that

nepotism has a positive impact on reciprocity among group members, leading to the primary

reason for the persistence of nepotism: it is profitable. We find that having an ingroup member

as a partner carries an earnings premium. Thus, we find evidence for nepotism as a social

dilemma: it is individually beneficial to engage in nepotism, but may be welfare reducing due to

negative externalities on meritocracy.

3

As opposed to a majority of the literature in this area, we use naturally occurring group to study nepotism: Rice

university’s residential college system, where students are randomly assigned to one of eleven different residential

colleges at the beginning of their freshman year. These residential colleges are the basis of our ingroups.

2 RELATED RESEARCH

A primary theme of research on nepotism is that it leads to inefficient outcomes. These

studies are diverse and include a wide variety of settings. For example, Brick et al. (2005) find

that excess compensation of boards of directors, which they interpret as evidence of cronyism,

predicts future firm underperformance. In a study of the emergence of liberal democracy in

Africa following the demise of colonialism, Englebert (2000) makes a similar argument, noting

that in countries where colonial institutions conflict with historical (formal or informal)

institutions, reversion to ethnicity-based resource allocation decisions is more likely, again

yielding inefficient outcomes. Nepotism also is a widespread phenomenon within professional

groups. To name two examples, Lentz and Laband (1989) show that children of doctors are 14

percent more likely to be admitted to medical school than are comparable other candidates,4 and

Singell and Thornton (1997) find that many dairy farmers in Utah regularly make hiring

decisions based on family and group ties, and that these farms underperform when compared

with farmers that do not.

So why does nepotism persist if it is welfare-reducing? There are two dominant

explanations: (1) beliefs, and (2) favoritism. Previous literature supports both beliefs about

trustworthiness (e.g., Ashraf et al 2006; Barr 2003; Buchan et al. 2008) and favoritism (Falk and

Zehnder 2007) as determinants of the level of trust in the investment game.5 The argument for

beliefs as a motive is based on the assumption that nepotism may be profitable because of the

superior performance of group members. This assumption may stem from the belief that group

members are in fact more capable, on average. Alternatively, higher productivity can arise from

enhanced monitoring due to social ties: Social ties can substitute for incomplete contracts or

weak legal institutions.6 Fearon and Laitin (1996) point out three factors that enhance trust and

cooperation within groups: greater information regarding other members of the group, individual

reputations that are sustainable and credible, and the availability of sanctions from within the

group when defection is observed. All of these factors may serve to enhance productivity and

4

Their research cannot rule out the effects of legacy and donations on college acceptance, and note that

intergenerational human capital transfers may also be a reason for larger acceptance rates.

5

Cox (2004) presents a “triadic” design that carefully explores the relationship between altruism and trust. He

argues that the amount sent in the trust game incorporates both altruism and trust. Thus in our context, trust would

be greater for fellow group members if there is greater altruism toward group members.

6

For example, McConaugby et al. (2001) argue that family-controlled firms are more likely to hire fellow group

members as a solution to the agency problem, and that reduced monitoring costs can yield higher firm valuations.

3 reciprocity. Even if fellow group members are less capable, they may be more likely to engage in

reciprocal behavior, effectively working harder than their more-qualified counterparts. Strong

group identity yields high motivation for reciprocity, and results in a greater preference for

nepotism.

The second dominant explanation for nepotism is that individuals with a strong sense of

group identity are more likely to select in-group members because of favoritism. This can be

either taste-based discrimination (Becker, 1971) or because of strong ties to a social identity

(Akerlof and Kranton, 2000).7 Nepotism is employed to benefit fellow group members, or

because of the higher value placed on interactions within the group. Tajfel and Turner’s (1979)

social identity theory suggests that individuals derive utility from group membership and actively

work towards maintaining ties within the group, culminating in favoritism.8 Behavior favoring

fellow group members is commonplace in these studies (for reviews, see Brewer and Brown,

1998; Messick and Mackie, 1989).9

Nepotism has implications for trust and reciprocity among group members: Slonim and

Garbarino (2008) show that merely providing subjects with the ability to select their partners

(based on gender and age) in the trust game increases trust. Brandts and Sola (2010) find higher

reciprocity among friends in a lab experimental study using the trust game, justifying the

selection of friends as partners, even when their efficiency is, by design, lower. Fiedler et al.

(2011) find a similar result among a sample of second life players (but not among a standard lab

sample of college undergraduates): reciprocity is higher among ingroup members. Fershtman, et

al., (2005) also find nepotism using a unique pool of subjects in Israel and Belgium. Orthodox

Jews trust other Orthodox Jews more than the general population and Belgian subjects are less

trusting of identifiable out-groups (Flemish vs. Walloon). Despite their breadth, these studies do

7

Psychologists have studied the effects of ingroup bias, understood as discriminating in favor of the primary group

of the individual relative to an out-group (Brewer, 1999). Once individuals establish their identities as part of a

particular group, pro-social behavior towards their group members increases based on this linkage. Thus, the

stronger an individual identifies with their group (relative to an outgroup), the greater the instance of pro-social

behavior. See Chen and Li (2009) and Goette et al. (2006) for recent examples.

8

Much of the research in this area utilizes lab experiments, and employs the minimal group paradigm (Billig and

Tajfel 1973), a relatively weak procedure for manipulating group identity in the lab. The procedure creates an

ingroup as well as a complementary outgroup.

9

In contrast, several studies find ingroup denigration. Lewis and Sherman (2003) document two such situations.

They show that individuals are more likely to hire out-group members when both applicants are unqualified (for

qualified candidates, the favoritism result holds), or when a marginally qualified ingroup member might confirm a

negative stereotype about the ingroup.

4 not distinguish between the two motives for nepotistic behavior, because they do not collect

information on expected reciprocity or strength of friendship.

Two studies support the idea that motives for nepotism lie with favoritism. In a field

experiment with children aged 6-8 and 10-12, Belot and van de Ven (2011) demonstrate that

younger children are more likely to select friends as group members regardless of performance.

But for older children performance becomes important. This study also finds that favoritism

improves performance, as group members who are selected exert more effort, consistent with

(accurate) beliefs about the productivity of fellow group members. In a field experiment in a

fruit-picking firm, Bandiera, et al., (2009) provide evidence that managers favor workers who are

socially close to them when it is costless to do so, but when it is costly, favoritism is eliminated.

These studies demonstrate the prevalence of the favoritism motive and suggest that beliefs about

higher performance can also play an important role.

While these studies are informative, they do not assess the relative strengths of beliefs

and favoritism as motives for selecting ingroup members under conditions where ingroup

members are less or equally efficient. Our experiment allows us to make this distinction. We

use laboratory experiments to examine which behavioral factors influence nepotism, and the

impact of nepotism on trust and reciprocity.

EXPERIMENTAL DESIGN

We modify the standard trust game (Berg et al. 1995) by introducing groups and

differences in partner efficiency. Our treatment of groups is somewhat different from prior

studies in that we do not have a true outgroup. We allow the proposer, the first mover in the trust

game, to choose either an ingroup or a non-ingroup member as responder (second mover). A

non-ingroup member is an individual that is “not in” the ingroup. Thus, by design, the

“outgroup” has no identity: it is a random individual from the population, reflecting common

situations where nepotism plays a role. This is an important distinction, since favoritism towards

one’s group is not the same as out-group dislike (Brewer 1999).10 Previous studies of ingroup

favoritism typically include an identifiable outgroup, confounding ingroup favoritism with

10

Brewer (1999) argues that ingroup favoritism and outgroup discrimination are separable phenomena, and thus it

may be unclear whether behavioral variation is driven by a preference for the ingroup or dislike towards the

outgroup. We have no identifiable outgroup, meaning that subjects cannot discriminate against outgroup members.

5 outgroup dislike. By structuring the game in this way, we are able attribute any preferential

treatment shown the ingroup members as favoritism, rather than outgroup dislike. We increase

the external validity of our study by using naturally-occurring groups, as explained below.

The experiment includes two factors with four treatments, in a 2x2 design. The first

factor is nepotism, labeled as “Random match” and “Nepotism” treatments. The difference

between the two is that the latter allows proposers to choose their partners, while the former does

not.11 The other factor varies the efficiency of ingroup members: “Equal efficiency” or “Low

ingroup efficiency.” In the Equal efficiency treatments, the standard trust game multiplier of

three applies to both ingroup members and others. In the Low ingroup efficiency treatments, a

lower multiplier of 2.5 is applied to ingroup members, while transfers to others retain the original

multiplier of three. Each treatment combination is conducted with an independent sample in a

between-subjects design.

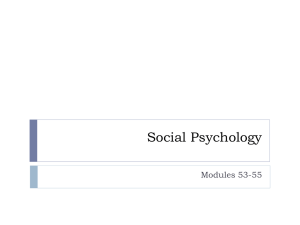

Figure 1: Experiment timeline

Figure 1 shows a timeline of events in each session. The experiment begins with a pregame survey (collecting demographic information) followed by three games (Trust, Dictator,

Risk, presented in random order by session) and then a post-game survey (collecting game

specific information).

Nepotism game

Proposers and responders in the trust game are endowed with 20 tokens (with each token

equal to $0.50). In the Nepotism treatments, proposers make three decisions in the trust game;

(1) choose between ingroup and other, (2) choose how many tokens to send to responder, and (3)

11

In the Random match treatment, during the post-game survey we ask the subjects if they could choose, which

group would they choose their responder from, giving us survey based information on partner preferences, which

has no bearing on outcome of the game, and is not incentive compatible.

6 estimate the number of tokens sent back by the responder. All three decisions are incentivized.12

We use the strategy method, meaning that each subject makes a trust decision and a return

estimate for both possible counterparts: the ingroup and the other.13 Responders make two

decisions: (1) estimate how much they will receive, and (2) choose how much to send back for

all possible amounts received (using the strategy method). Both these decisions are incentivized.

We use complete information, meaning that both proposers and responders are aware that

proposers choose partners.14

In the Random match treatment, the setup is identical to above except for decision (1).

Proposers do not choose a responder group, but instead are informed that there is a 50% chance

they will be matched with either group. Both proposers and responders are aware that actual

matching is random. In the post-game survey for this treatment, proposers are asked which

group they prefer to be matched with if they could choose; however, their response has no

bearing on the matching protocol.

In the Low ingroup efficiency treatments, proposers are informed that pairing with an

ingroup member yields a lower multiplier (of 2.5, compared to a multiplier of 3 for a pairing

with the non-ingroup counterpart). In the Equal efficiency treatment the multiplier is 3, and is

the same for ingroup members and others. Both proposers and responders are informed of this.

Preference controls

To measure subject’s key preferences – favoritism and risk aversion – we conduct additional

games. Favoritism is measured by a variation on the standard dictator game. Proposers are

endowed with 20 tokens (each worth $.50 USD) and are asked how much they want to send to an

ingroup responder, and how much they want to send to a non-ingroup responder. They make this

decision simultaneously (on a single screen, with the order randomized). In the Nepotism

12

Belief estimates are rewarded using a binary scoring rule. Subjects receive a 2-token ($1) bonus if they estimate

correctly.

13

As explained in the next section, subjects are informed that there is a chance their first choice responder will not

be available, and are thus asked to take both ingroup and other decisions simultaneously. The matching protocol

(described below) ensures that there is some chance they will be matched with their second choice of responder.

This provides us with appropriate counterfactual data for each subject.

14

The trust game is played once, all participants have fixed positions, and the pairings are anonymous. The game is

computerized using z-tree (Fischbacher, 2007).

7 treatment, proposers select the group (ingroup or other) to which they send tokens.15 The

protocol in the Random match treatment is identical, but the choice of responder group is

removed.

We implement a simple measure of risk aversion as in Eckel and Grossman (2008),

wherein subjects are asked to select one of six possible gambles. Appendix A displays a

screenshot of the gambles viewed by the subjects. Gambles one through five increase in both

expected value and variance. Gamble six increases in variance, but holds the expected value the

same as in gamble five. Each gamble has a 50% chance of paying out a low amount or a high

amount.

In addition, as an additional control variable, we measure the strength of group identity

using a 7-point Likert-scale survey question (“How strongly do you identify with members of

[primary group]?”) and use survey measures of generalized trust and perceptions of generalized

fairness (from the World Values Survey).

EXPERIMENTAL PROCEDURES

We conducted the experiment at Rice University, making use of their Residential College

system. Upon entrance to the university as freshmen, undergraduates are randomly assigned to

one of eleven Residential Colleges. Colleges have their own dining halls, dorms, and faculty

advisors, which cultivates a strong group identity. Furthermore, a week-long orientation period

for freshman and regular competitions among colleges further establish strong group

affiliations.16 These residential colleges serve as the primary group affiliation for undergraduates

on campus.

Subjects were recruited during lunch and dinner hours at the dining hall for each

particular college. The experiments explicitly make reference to the primary college under

15

Again, both decisions are incentive compatible as the matching protocol allows for a chance that the proposer will

not be matched with the responder they selected.

16

We utilize Rice University’s residential college system as the basis for our groups. This is useful as (1) we can

implement the partner choice mechanism with an in-group but no identifiable out-group, and (2) we can conceal the

identity of the partner so as to mitigate post-game play. Furthermore, random assignment assures that potentially

confounding factors are not correlated with treatments, and the possibility of selection bias in group assignment is

avoided. However, one threat to randomization is the possibility of legacy admissions; i.e., undergraduates

requesting to be assigned to a particular college based on previous affiliation. The number of legacy admissions is

relatively small at Rice, and given the relatively small sample of subjects, the probability of legacy students

participating in the study is low. For more information on the residential college system, please see:

http://students.rice.edu/students/Colleges.asp

8 observation in order to establish a basis for engaging in nepotism. All partners are anonymous,

and no identifiable characteristics (other than group membership) are revealed.

Table 1: Study Design

Nepotism

Equal multiplier

N = 78

Low ingroup multiplier

N = 78

Random match

N = 68

N = 72

Table 1 contains the overall design of the study. Sessions were conducted at the

Behavioral Research Lab at Rice University in April and October 2009, and October 2010. A

total of 296 subjects participated in the study. There were a total of 17 sessions, with an average

of 16 subjects in each session. In all cases, the ingroups were labeled in accordance with the

name of the residential college.

As detailed above, the experiment consisted of an initial short entry survey (collecting

demographic information), and the three games (Dictator, Nepotism, and Risk described above),

followed by a post-game survey. Each game started with instructions, two examples, and a short

quiz to test understanding, followed by the game itself.

The overall experiment has a number of games, and well as two types of groups (ingroup

and other), which brings up concerns about order effects. To minimize these concerns, we

randomized a number of things in the experiment. First, we randomized the order of the games:

subjects had an equal chance of starting with the dictator, nepotism, or risk game. Second, we

randomized the order of the groups: each subject made ingroup decisions on the left side of the

screen or the right side (with the other decisions on the adjacent side).17 Third, we randomly

selected one game (dictator, nepotism, or risk) for payment at the end of the session, so as to

induce independence in decisions across games.

Upon arriving at the lab, subjects signed in and were asked to confirm their residential

college name and then promptly seated at a terminal. Instructions referred to ingroup subjects by

the name of their college (for example, “individuals in Baker College”) and others were referred

to as “individuals not in Baker College but from the Rice University population” (emphasis

17

Ingroup and other decisions were made on the same screen to avoid biasing the subjects.

9 added).18 No feedback was provided on earnings between tasks during the experiment. At the

end of the session, the experimenter entered the lab area and asked for a volunteer. The

volunteer rolled a die to determine the game that would be paid for in the session. If the risk

game was selected for payment, subjects were directed to the payment area and rolled a six-sided

die. A roll of 1 through 3 gave them the low amount listed for their chosen gamble, and the roll

of 4 through 6 gave them a payout of the high amount.

Subjects were assigned to one of two roles at the beginning of the session: proposer or a

responder. Subjects kept this role through the entire session. In all sessions, all proposers

belonged to the ingroup, while approximately half of the responders belonged to the ingroup.

The remaining responders belonged to residential colleges other than the ingroup’s. All

participants were aware of this.

Appendix A contains screenshots of the proposer and responder decision screen,

respectively (figures A.2 and A.3). In the Nepotism treatment, proposers had the option to select

the group that their counterpart would be drawn from for each task. In the Random match

treatments, subjects were not given this option, but were told that there would be “approximately

a 50% chance” that they would be matched with a responder from either group (i.e., their own

group or not).

Subjects were paired using a matching algorithm that is a variation on one developed by

Castillo and Petrie (2010) for eliciting preferences for partners in a public goods game. For the

Nepotism treatments, one proposer was selected at random. His preferred group choice was

noted, and then a responder was randomly selected from his preferred group. Next, a second

proposer was randomly selected and given his first choice of group from the remaining candidate

responders. This process continued until each proposer was matched with a responder in the

session. In the event that the pool of responders from any particular group was exhausted, but

still had been requested by a proposer, then the proposer was matched with a responder from the

alternate group. In the Random match treatments, each proposer was matched with a responder

at random. The matching algorithm was triggered once all subjects had completed all tasks and

the surveys. Each proposer was matched with a single responder.

18

Note that the “others” belonged to Rice University, which constitutes another in-group for the subjects, but one

that is not as salient as their own college.

10 RESULTS

In this section we first examine the main treatment effects. We then focus on the motives

for nepotism: favoritism or beliefs. Next, we discuss the impact of nepotism on trust and

reciprocity. Finally, we address the question of whether nepotism is a profitable strategy.

Figure 2 presents preferences for nepotism in all treatments. Note that in both the

Random match and Nepotism treatments, over 80 percent of proposers prefer/choose ingroup

members as their partner when the ingroup member is as efficient as the general population.19

Nepotism, however, is rarely costless, and we find that when it is costly, it is less utilized.

Across both the Random match and Nepotism treatments, when ingroup members are less

efficient than the general population, 44 percent of the proposers choose ingroup members as

their partner, significantly lower than when ingroup members are as efficient (from 85 percent to

44 percent, two-sample z-test of proportions, z=5.19, p<0.01).20 Note, however, that even when

ingroup members are less efficient, a large proportion of subjects still choose them as partners.

19

Please note that in the random match treatment, subjects cannot directly choose their partner, but indicate their

preference in the exit survey. The figure reports this metric for the random match treatment.

20

There are no significant differences between the Random match and Nepotism treatments both when ingroup

member efficiency is identical to or lower than the general population.

11 Figure 2: Percentage of subjects choosing/preferring ingroup members (95% confidence interval)

Motives for nepotism

We now test for the determinants of nepotism. Our primary variables of interest are (1)

favoritism towards ingroup members21 and (2) beliefs regarding the performance of the trustee.22

We also control for risk preferences, measured using the Eckel-Grossman risk elicitation method

(2008).23 Finally, we add controls for gender, group identity,24 and the survey-based attitudinal

measures of trust and fairness.25

21

We measure favoritism by constructing a measure using the dictator game, defined as the amount donated to an

ingroup member less the amount donated to a member of the general population. If the difference in dictator game

giving favors the ingroup member then this variable is positive. Stronger altruism toward group members is likely to

play a role in partner selection. Thus, this variable measures the extent to which the subject is altruistic towards his

ingroup relative to his altruism towards the general population, using the following formula: 𝐹𝑎𝑣𝑜𝑟𝑖𝑡𝑖𝑠𝑚! =

𝐴𝑚𝑜𝑢𝑛𝑡 𝑑𝑜𝑛𝑎𝑡𝑒𝑑 𝑡𝑜 𝑖𝑛𝑔𝑟𝑜𝑢𝑝 − 𝐴𝑚𝑜𝑢𝑛𝑡 𝑑𝑜𝑛𝑎𝑡𝑒𝑑 𝑡𝑜 𝑜𝑡ℎ𝑒𝑟 .

22

We measure beliefs in the following way: after subjects make their partner choice (depending on treatment) and

trust decisions, we inform them the total available to their ingroup and other responders. We then ask them how

much of that total they expect back from each responder. The elicitation is incentive compatible in that subjects are

paid a bonus for guessing correctly, and zero otherwise. The difference in beliefs about the performance of ingroup

members and others is our measure, using the following formula:

𝐸𝑥𝑝𝑒𝑐𝑡𝑒𝑑 𝑟𝑒𝑡𝑢𝑟𝑛 𝑓𝑟𝑜𝑚 𝑖𝑛𝑔𝑟𝑜𝑢𝑝

𝐸𝑥𝑝𝑒𝑐𝑡𝑒𝑑 𝑟𝑒𝑡𝑢𝑟𝑛 𝑓𝑟𝑜𝑚 𝑜𝑡ℎ𝑒𝑟

𝐵𝑒𝑙𝑖𝑒𝑓! =

−

𝑇𝑜𝑡𝑎𝑙 𝑎𝑣𝑎𝑖𝑙𝑎𝑏𝑙𝑒 𝑡𝑜 𝑖𝑛𝑔𝑟𝑜𝑢𝑝

𝑇𝑜𝑡𝑎𝑙 𝑎𝑣𝑎𝑖𝑙𝑎𝑏𝑙𝑒 𝑡𝑜 𝑜𝑡ℎ𝑒𝑟

23

Ben-Ner and Putterman (2001) argue that trust is necessarily a risky decision due to lack of information between

partners (see also Eckel and Wilson 2004, who find little relationship between risk attitudes and trust, and Schechter

2007 who does find a positive relationship between risk-tolerance and trust). The decision to trust is inherently risky

due to the possibility of betrayal (see Bohnet and Zeckhauser 2004). Trust decisions involve uncertainty regarding

12 Our dependent variable is a dummy variable equaling 1 if the subject chose an ingroup

member as partner in the trust game. Therefore, we use a probit model to estimate the

probability of the subject choosing an ingroup member as partner. Furthermore, we restrict our

analysis to the Nepotism treatment, where partner choice is incentive compatible.26 The results

are provided in table 2 (marginal effects are reported).27

Table 2: Probability of selecting ingroup members as partner (marginal effects)

Dependent variable: Partner choice (1 = Chose ingroup member)

Treatment

(1 = Low ingroup efficiency)

Beliefs

(Ingroup less other)

Favoritism

(Ingroup less other)

Risk Preferences

(6 = Risk seeking)

Gender (D)

(1 = Female)

Group Identity

(7 = Strong ingroup identity)

Generalized Trust

(7 = More trusting)

Generalized Fairness

(7 = Others are fair)

I

II

III

IV

V

-0.339***

-0.422***

-0.355***

-0.410***

-0.397***

(0.11)

(0.10)

(0.10)

(0.11)

(0.11)

0.069*

2.471**

(1.09)

0.072

2.580**

(1.10)

0.064

2.881**

(1.11)

0.067

(0.04)

(0.04)

(0.04)

(0.05)

-0.116***

-0.094**

(0.04)

(0.04)

2.655**

(1.11)

0.153

(0.10)

0.011

(0.04)

-0.017

(0.04)

0.013

(0.04)

behavior of the counterpart; this uncertainty is diminished in interactions between individuals with a common social

identity. Individuals choosing between in-group partners and “others” have a shared history with in-group members,

allowing better calibration of reciprocity beliefs. Conversely, the perceived distribution of reciprocity levels in the

general population is more dispersed, which in turn makes the choice of an individual from the general population a

riskier prospect.

24

This was measured using a 7 point Likert-scale response to the question “To what extent do you identify with

other members of {Insert group name}?” taken from Levin and Sidanius (1999). This provides us with an additional

measure of favoritism towards the ingroup.

25

Trust is measured by a 7 point Likert scale response to the question “Generally speaking, would you say that most

people can be trusted, or that you need to be very careful in dealing with people?” taken from the 2005 version of

the World Values Survey, accessible at http://www.wvsevsdb.com/wvs/WVSAnalize.jsp. Fairness is measured by a

7 point Likert scale response to the question “Do you think that most people would try to take advantage of you if

they got a chance, or would they try to be fair?” taken from the 2005 version of the World Values Survey, accessible

at http://www.wvsevsdb.com/wvs/WVSAnalize.jsp.

26

We conduct the same analysis with the Random Choice treatment data in appendix B (table B.2).

27

Model coefficients are provided in table B.1 in appendix B for the interested reader.

13 Constant

0.733

0.723

0.773

0.803

0.815

Pseudo R-squared

Chi-squared

P-value

Log Likelihood

0.263

26.4

0.000

-37.09

0.225

22.6

0.000

-39.01

0.307

30.9

0.000

-34.86

0.416

41.9

0.000

-29.38

0.438

44.0

0.000

-28.30

78

78

78

78

78

Observations

Note: * p<0.1, **p<0.05, *** p<0.01. Probit specification, standard errors in parentheses. Table reports marginal

effects. Dependent variable takes on a value of 1 if subject selected ingroup member as partner in the trust game.

Data is from the Nepotism treatment. The “Beliefs” variable measures the difference in beliefs about reciprocity

between ingroup members and others. Thus, positive values mean subjects expect more back from their ingroup,

while negative values mean subjects expect less back from their ingroup (relative to others). The “Favoritism”

variable measures the difference in dictator giving to ingroup members and others. Thus, positive values are

subjects giving more to ingroup relative to others, while negative values are subjects giving more to others.

Models 1, 2, and 3 estimate partner choice with a dummy variable for the treatment

(equaling 1 if the ingroup respondent is less efficient, and 0 otherwise) and beliefs and/or

favoritism variables. Model 4 adds risk preferences, while model 5 adds gender and social

preference controls. We first note that the coefficient on the treatment dummy is significant and

negative, replicating what we observed in figure 2: when ingroup members are less efficient,

subjects are significantly less likely (approximately 40 percentage points less likely) to choose

ingroup members as partners (p<0.01). We also find that subjects with higher beliefs regarding

ingroup member performance (relative to others) are significantly more likely to select them

(p<0.05), and this effect does not vary by treatment (p=0.70 for the interaction term). In fact, for

every 1% increase beliefs about ingroup member performance, subjects are approximately 2.7%

more likely to select ingroup members as partners. Thus, we find that beliefs regarding partner

performance matter for nepotism.

Second, we test the relationship between favoritism towards the group and nepotism. We

find little evidence in favor of the favoritism channel. The coefficient is weakly significant in

model 2 (p<0.10), and does not remain so once we add additional controls. Similarly, group

identity is also not significant in our data. The effect of favoritism also does not vary by

treatment (p=0.53). This suggests that subjects engage in nepotism primarily due to beliefs.

Table B.2 in the appendix conducts the same analysis for the Random match treatment, where

the choice between ingroup member and other was not incentive compatible (subjects were

simply asked for their preference in the post-game survey, prior to decisions being revealed).

We find similar effects for the treatment (Low ingroup efficiency) and for beliefs regarding

14 performance. In this table, however, we also find that favoritism towards ingroup members also

predicts partner choice. This implies that favoritism may not play as much of a role when real

stakes are attached to the partner choice decision.

Finally, we note that the coefficient on risk preference is significant and negatively

related to the choice of an ingroup member as partner (p<0.05). Risk-seeking subjects are less

likely to choose ingroup members as partners in the trust game. The negative coefficient is also

significant when ingroup members are less efficient (p<0.05). This implies that risk-averse

subjects are more likely to engage in nepotism.

Overall, we find that nepotism is a strategic decision, motivated mainly by beliefs about

ingroup member performance. We do find some suggestive evidence in favor of favoritism, but

only when there are no payoff implications. We also find some evidence of risk-aversion

informing the choice to engage in nepotism. People engage in nepotism mainly because they

expect better (more profitable) outcomes for themselves.

Impact of nepotism on trust

In this section we analyze the amount sent by proposers in the trust game across all four

treatments.28 This allows us to estimate the impact of nepotism on trust. Therefore, our major

variable of interest is the Nepotism treatment dummy. Since we use the strategy method, each

subject takes a decision for ingroup members as responders, and for others as responders. We

estimate tobit models for the amount sent to the responder in the trust game, pooling all decisions

and clustering by individual. In addition to the treatment dummies, we add in controls for

whether the target responder is an ingroup member (dummy), whether the target responder is

chosen as partner (dummy), risk preferences, gender, trust and fairness perceptions, as well as

group identity. Table 3 displays the results.

28

Recall that in the Random Match treatment, subjects indicate a preference for participating in the trust game with

a member of their own group, or a randomly selected individual. This preference has no bearing on who they are

ultimately matched with. In the Nepotism treatment, counterparts are matched in accordance to the subject’s group

choice. In both treatments, subjects are asked to make both decisions (one for an ingroup responder and another for

the other responder).

15 Model 1 introduces the two treatment dummies (for the Nepotism treatment, and the

Equal efficiency treatment), while model 2 adds an interaction term. Model 3 adds control

dummies for whether the decision is for an ingroup responder, and whether the decision is for a

responder that is chosen as partner. Finally, model 4 adds the gender, risk and social preference

controls.

Table 3: Trust - Tokens sent by proposer

Dependent variable: Trust

Nepotism Treatment

(1 = Nepotism)

Equal Efficiency Treatment

(1 = Equal ingroup efficiency)

Nepotism X Equal Efficiency

Ingroup

(1 = Sent to ingroup)

Chosen as Partner

(1 = Responder chosen as partner)

Risk Preferences

(6 = Risk seeking)

Gender (D)

(1 = Female)

I

II

III

IV

1.346

(1.56)

3.267**

3.202

(1.97)

5.279**

3.204

(1.97)

5.280**

4.144**

(1.96)

5.891***

(1.56)

(2.39)

(2.39)

(2.25)

-3.802

-3.797

-4.752

(3.13)

(3.12)

(2.90)

1.484***

(0.42)

1.342***

1.474***

(0.41)

1.315***

(0.42)

(0.41)

1.153**

(0.47)

-4.701***

(1.25)

16 Group Identity

(7 = Strong ingroup identity)

Generalized Trust

(7 = More trusting)

Generalized Fairness

-0.260

(0.58)

0.823

(0.60)

0.492

(7 = Others are fair)

Constant

(0.58)

7.094***

6.128***

4.710***

-1.997

(1.26)

(1.38)

(1.41)

(4.45)

0.006

0.055

-836.80

0.007

0.062

-835.40

0.010

0.001

-833.40

0.036

0.000

-811.40

Observations

296

296

296

296

Left censored observations

38

38

38

38

Right censored observations

59

59

59

59

Pseudo R-squared

P-value

Log Likelihood

Note: * p<0.1, **p<0.05, *** p<0.01. Tobit specification, standard errors in parentheses. Dependent variable is the

number of tokens sent in the trust game. Data in models I and II is from the equal efficiency treatment, while data in

models III and IV is from the low ingroup efficiency treatment. Variables are censored at 0 (lower limit) and 20

(upper limit).

Both the Nepotism and Equal efficiency treatments have a positive coefficient in the

models. In particular, raising the efficiency of the ingroup member has a positive impact on trust

overall, significantly increasing trust, on average, by between 3 and 6 tokens ($1.50-$3.00;

p<0.05). Second, the Nepotism treatment has a positive coefficient, but it is not significant

(p=0.39). When we add the interaction term and controls, however, we find that the Nepotism

treatment in the Low ingroup efficiency treatment is significant (p<0.05), increasing trust by 4

tokens ($2.00). In the Nepotism and Equal efficiency treatment, trust is lower and marginally

significant (p=0.103). Thus, Nepotism may have some positive impact on trust, but it is not

always the case, particularly when ingroup members are as efficient as others.29 We do find,

however, that subjects trust their ingroup more overall: subjects send 1.5 additional tokens

($0.75) to their ingroup (p<0.01). In addition, subjects send 1.3 additional tokens ($0.65) to their

chosen/preferred partner (p<0.01). We also find that trust is a risky decision in this context, with

more risk-tolerant subjects trusting more (p<0.05), and that women send significantly less than

29

This result is similar to the findings of Slonim and Garbarino (2008), who find that partner choice induces higher

levels of trust. In their framework additional information regarding partner gender and age were available to

subjects, whereas in our study, the only information available is that of ingroup status and efficiency.

17 men ($2.35 less; p<0.01), which is consistent with Buchan et al. (2008), and many studies in the

survey by Croson and Gneezy (2009). 30

Overall, we find little evidence for Nepotism having a positive impact on trust. We do

find that the equal efficiency treatments have a positive and significant impact on trust overall,

even with non-ingroup members.31 Importantly, however, we find that subjects consistently send

more to their ingroup (about 1.5 tokens on average), and send more to the respondents that

choose as their partners, across all treatments.

Impact of nepotism on reciprocity

We now turn to responder trustworthiness/reciprocity in this section. We utilize the

strategy method in measuring the reciprocity levels; i.e., responders make a decision for every

possible amount sent by the proposer, making a total of 11 decisions. In addition, responders can

return the amount that they received, as well as their own initial endowment.

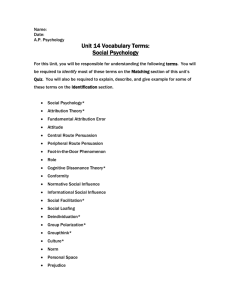

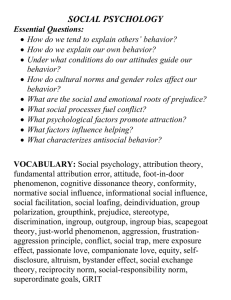

Figures 3 and 4 display reciprocity decisions (tokens returned) of ingroup members

(figure 3) and others (figure 4). The figures compare differences in reciprocity in the Random

Match and Nepotism for the Low ingroup efficiency treatments (figures 3a and 4a) and the Equal

efficiency treatments (figures 3b and 4b). In each graph the dotted line indicates that the

responder just returns the amount sent, and the dashed line indicates that the amount returned

equalizes the gains from the amount sent. Returns have the usual feature in that they are linear

and upward-sloping in trust. From the graphs it is plain to see that average returns in the

Nepotism treatment are nearly always higher than average returns in the Random match

treatments, both for ingroup members and for others. However, the difference in treatments in

particularly pronounced in the Low ingroup efficiency treatment, and particularly from ingroup

members. In fact, in just one case do the returns approach an equal split: among group members

in the Low treatment when nepotism is available. For the Equal efficiency treatment, subjects

appear to be unaffected by the Nepotism treatment.

30

Note that we have not explicitly controlled for expectations in the regressions, since expectations are elicited

subsequent to the trust decision and so are likely to be endogenous.

31

While we would expect that raising ingroup member efficiency has a positive impact on trust among ingroup

members, the increase in trust with others comes as a surprise. This may be due to the fact that trust decisions were

made simultaneously, and hence increased trust in the ingroup had a positive spillover effect on trust overall. Our

data does not allow us to test this motivation, however.

18 Ingroup Reciprocity -­‐ Low ingroup efficiency Ingroup Reciprocity -­‐ Equal efficiency 35 35 Random match NepoDsm Same amount returned Equal split 25 20 30 Amount Returned Amount Returned 30 15 10 5 Random match NepoDsm Same amount returned Equal split 25 20 15 10 5 0 0 0 2 4 6 8 10 12 14 16 18 20 0 2 4 6 Amount Sent 8 10 12 14 16 18 20 Amount Sent Figure 3a-b: Average returns by ingroup members by treatment Other Reciprocity -­‐ Low ingroup efficiency Other Reciprocity -­‐ Equal efficiency 35 35 30 Random match NepoDsm Same amount returned Equal split 25 20 Amount Returned Amount Returned 30 15 10 5 Random match NepoDsm Same amount returned Equal split 25 20 15 10 5 0 0 0 2 4 6 8 10 12 14 16 18 20 0 Amount Sent 2 4 6 8 10 12 14 16 18 20 Amount Sent Figure 4a-b: Average returns by others by treatment

We formally test the effect of the treatments on reciprocity separately for ingroup

members, and for others, using a linear regression with individual clusters (tobit regressions with

left censoring at zero give us similar results). The dependent variable is the amount returned by

responders. Our main independent variables are: the amount sent by the proposer, the treatment

dummies and their interaction. As above, we also control for gender, group identity (for others,

this question refers to how strongly they identify with the ingroup), generalized trust, and

fairness preferences. Models 1 and 2 are for ingroup responders, while models 3 and 4 are for

others. Models 1 and 3 use just the treatment dummies and the amount sent by the proposer,

while models 2 and 4 add controls. Table 4 provides the estimation results.

19 Table 4: Reciprocity: Tokens returned by responders to Ingroup and Others

Dependent variable: Reciprocity

Ingroup

Ingroup

Tokens Sent by Proposer

Nepotism Treatment

(1 = Nepotism)

Equal Efficiency Treatment

(1 = Equal ingroup efficiency)

II

III

IV

0.923***

0.923***

0.912***

0.912***

(0.09)

(0.09)

(0.09)

(0.09)

3.521*

(1.95)

1.439

7.058***

(2.42)

5.884**

1.707

(1.90)

0.221

4.084*

(2.24)

3.131

(1.94)

(2.55)

(1.95)

(2.16)

Gender (D)

(1 = Female)

Group Identity

(7 = Strong ingroup identity)

Generalized Trust

(7 = More trusting)

Generalized Fairness

R-squared

P-value

Observations

Others

I

Nepotism X Equal Efficiency

(7 = Others are fair)

Constant

Others

-7.671**

-4.176

(3.72)

(3.51)

-0.464

(1.80)

-0.288

(0.75)

1.218*

(0.62)

1.999***

-0.210

(1.81)

0.962*

(0.54)

1.269*

(0.64)

1.378**

(0.49)

(0.61)

-1.263

-14.10***

-0.334

-14.10***

(1.22)

(4.74)

(1.39)

(2.68)

0.313

0.000

0.417

0.000

0.235

0.000

0.365

0.000

693

693

935

935

Note: * p<0.1, **p<0.05, *** p<0.01. Linear regression with individual clusters, standard errors in parentheses.

Dependent variable is the number of tokens returned in the trust game. Data in models I and II is for ingroup

subjects while data in models III and IV is other subjects.

The regressions confirm the observations from the figures. First, we find that reciprocity

is increasing in trust: subjects return one token ($0.50) for every two tokens sent by proposers

($1.00). Furthermore, the Nepotism treatment has a positive and significant impact on

reciprocity among group members overall (p<0.10), but a smaller effect on ingroup reciprocity

when ingroup members are equally efficient as others. The Equal efficiency treatment has a

positive impact on reciprocity among group members but is not significant (p=0.46). We do

find, however, that reciprocity increases in the Random match-Equal efficiency treatment

(p<0.05), but is significantly lower in the Nepotism-Equal efficiency treatment (p<0.05). Thus,

the effect of Equal efficiency on ingroup member reciprocity varies depending on the existence

of Nepotism.

20 For others’ reciprocity, we observe a similar pattern as for the ingroup, except that the

coefficients are smaller and not as significant. We do observe a positive effect of Nepotism on

reciprocity, but only in the Low ingroup efficiency treatment (p<0.10). The independent effect of

the Equal efficiency treatment is not significant (p=0.15) and neither is the treatment interaction

(p=0.24). Finally, we also observe a significant relationship between trust and fairness with

reciprocity, meaning that more trusting subjects and those with higher perceptions of fairness are

also more reciprocal, regardless of ingroup status.

Importantly, we find that the presence of nepotism has a significant and positive impact

on reciprocity among the ingroup. This same pattern holds for others, but the effect is

considerably smaller, and not significant. Ingroup members in the nepotism treatment send back

3.5 extra tokens ($1.75) on average, while others return half that amount ($0.85). This indicates

that ingroup members reward nepotism. Knowing that they have lower productivity, ingroup

members are willing to reward generously those who choose them.

Impact of nepotism on earnings

In the analysis above, we found that nepotism is motivated by beliefs about performance

of the ingroup. We find that subjects send more to their ingroup, and that nepotism has a

positive impact on reciprocity, with a larger effect on the ingroup. We now ask whether

nepotism is profitable for ingroup members.

Since we use the strategy method, proposers make two decisions, one for each group of

responders. We can thus calculate earnings based on the mean level of reciprocity for each

amount sent (again, because of the strategy method, we collect responder reciprocity decisions

for each level of trust). Using this method, we can estimate what each proposer would earn by

being partnered with their ingroup or with the other for each treatment. We take the difference in

earnings between being paired with an ingroup member and with a non-ingroup member. Figure

7 displays the results by treatment (independent of the choice of partner), with positive amounts

indicating higher earnings from ingroup relative to others.

In all treatments except one, partnering with the ingroup is more profitable. Both

Nepotism treatments yield significantly higher earnings when pairing with the ingroup (Equal

efficiency: 1.70 tokens-$0.85; p<0.01; Low ingroup efficiency: 1.25 tokens-$0.63; p<0.01). In

the Random match treatment when the ingroup is equally efficient, ingroup members still benefit

21 from being paired with the ingroup, though the increase in earnings is modest (0.44 tokens $0.22; p<0.10). However, in the Random match treatment with lower ingroup member

efficiency, subjects are better off partnering with others, earning 1.92 tokens ($0.96) less when

being paired with ingroup members (p<0.01). Thus, we can clearly see that Nepotism has a

positive impact on proposer earnings, even when the efficiency of the ingroup members is low.

Figure 7: Relative earnings: Earnings with an ingroup less earnings with others (95% confidence

interval)

Figure 7 reports earnings for all proposers, including those that chose their ingroup

members and those that chose other responders as partners. In the next figures (8a and 8b) we

split the sample by Nepotists (those that chose or preferred an ingroup members as partner) and

Non-nepotists (those that chose or preferred a non-ingroup member as partner). We find that

earnings from pairing with group members is higher for both non-nepotists and nepotists alike.

Thus, the positive impact of nepotism on ingroup earnings is true for both sets of responders

(though this difference is not significant in the Equal efficiency treatment for non-nepotists).

Furthermore, when nepotism is available, ingroup member efficiency has no significant impact

22 on the earnings of nepotists (fig. 8a), indicating that nepotists are completely compensated for

the lowered ingroup member efficiency.32

Figure 8a-b: Relative earnings: Nepotists and non-nepotists by treatment (95% confidence

interval)

Overall, we find that nepotism is profitable for ingroup members, even when ingroup

members are less efficient than others. This is mainly due to higher levels of trust among

ingroup members, and higher levels of reciprocity when nepotism is possible. We find that both

nepotists and non-nepotists benefit from partnering with ingroup members when the choice is

available to them. Finally, we also find strong evidence of positive efficiency impacts: when

ingroup members are more efficient, ingroup members are better off partnering with ingroup

members.

CONCLUSIONS AND POLICY IMPLICATIONS

In this paper we present the results of a study designed to examine the factors that

motivate nepotistic behavior, and the impacts of such behavior on trust, reciprocity, and profits.

The study uses a variation on a well-studied experimental game: the trust game. We find that

individuals engage in nepotism due to beliefs about ingroup members. Furthermore, the

efficiency of ingroup members is a relevant factor: subjects are less likely to partner with

32

For nepotists, the premium for selecting a less efficient ingroup partner is large, and larger than for non-nepotists.

This is because nepotists have higher relative trust in ingroup members as compared with others, and that trust is

reciprocated.

23 ingroup members when they are less efficient. In addition, more risk-tolerant individuals are

more likely to partner with people outside their group.

We find that there is greater trust towards ingroup members. We also find that nepotism

has a positive impact on reciprocity: first movers are rewarded when they select fellow ingroup

members as partners.

Taken together, these results demonstrate why nepotism exists and

persists, even in the presence of costs. Becker (1971) argued that engaging in discrimination (of

any variety) would reduce profits since a more efficient worker would be available with a wider

search. However, this reasoning does not take into account that individual behavior also varies

under the two conditions. We find that nepotism compensates for decreased efficiency through

increased trust among ingroup members, and increased reciprocity by trusted ingroup

responders. We find that when nepotism is available, partnering with group members is always

profitable. Hence, we find evidence for nepotism as a social dilemma: it persists because it is

individually profitable, but still may be welfare reducing overall.

Our results are similar to those found by Brandts and Sola (2010), Fiedler et al. (2011),

and Belot and van de Ven (2011), which show that reciprocity increases with reduced social

distance. Fershtman et al. (2005) also shows that trust is higher among group members, but has

no real impact on reciprocity. We build on these studies by identifying the motives for engaging

in nepotism, and find nepotistic behavior to be rational: subjects engage in nepotism because

they believe in greater productivity by fellow group members. Nepotism is a profitable strategy.

We also find that nepotism has limited impact on trust, but greater impact on reciprocity,

yielding higher returns.

Our stylized representation of nepotism differs from the “real world” form of nepotism in

two ways. First, the analysis we present is static, i.e. the trust game is played a single time and

ends. Nepotism may have a significant long term component with impacts on inequality and

meritocracy that we do not address here. In addition, these repeated interactions may provide

further incentives for individuals to engage in inefficient behavior. Further research is needed to

estimate the long run impact of engaging in such behavior. Second, this paper is divorced from

any externalities resulting from the employment of low-quality workers, the effect of which is

(as yet) unknown.

Our results have interesting implications for policy. First, we show clear incentives for

group polarization. Partnering with ingroup members pays off, even when ingroup members are

24 relatively inefficient. Organizations that do not allow nepotism may not be availing themselves

of productivity enhancements. So, should we eliminate anti-nepotism rules? The answer lies in

the purpose of the rule itself. If the purpose is to reduce discrimination for its own sake, then

maintaining the rule is desirable. However, if the purpose is to maximize profits, then the

relationships between employers and workers need closer examination.

25 REFERENCES

Akerlof, George, and Rachel Kranton. 2000. “Economics and Identity.” Quarterly Journal of

Economics, 115(3): 715-753.

Ashraf, Nava, Iris Bohnet, and Nikita Piankov. 2006. “Decomposing Trust and Trustworthiness.”

Experimental Economics, 9(3): 193-208.

Bandiera, Oriana, Iwan Barankay, and Imran Rasul. 2009. “Social Connections and Incentives in

the Workplace: Evidence from Personnel Data.” Econometrica, 77(4): 1047-1094.

Barr, Abigail. 2003. “Trust and Trustworthiness: Experimental Evidence from Zimbabwean

Villages.” The Economic Journal, 113(489): 614-630.

Becker, Gary. 1971. The Economics of Discrimination. Chicago, IL: University of Chicago

Press.

Ben-Ner, Avner. and Louis Putterman. 2001. “Trusting and Trustworthiness.” Boston University

Rule Review, 81(2): 523-551.

Bennedsen, Morten, Kasper M. Nielsen, Francisco Perez-Gonzalez, and Daniel Wolfenzon .

2007. “Inside the Family Firm: the Role of Families in Succession Decisions and

Performance.” Quarterly Journal of Economics, 122(2): 647-691.

Belot, Michele, and Jeroen van de Ven. 2011. “Friendships and Favoritism at School: Evidence

from the Field.” Economic Journal, 121(557): 1228-1251.

Berg, Joyce, John Dickhaut, and Kevin McCabe. 1995. “Trust, Reciprocity, and Social History.”

Games and Economic Behavior, 10(1): 122-142.

Billig, Michael, and Henri Tajfel. 1973. “Social Categorization and Similarity in Intergroup

Behavior.” European Journal of Social Psychology, 3(1): 27-52.

Bohnet, Iris, and Richard Zeckhauser. "Trust, risk and betrayal." Journal of Economic Behavior

& Organization 55.4 (2004): 467-484.

Brandts, Jordi, and Carlos Solà. 2010. “Personal Relations and their Effect on Behavior in an

Organizational Setting: An Experimental Study.” Journal of Economic Behavior and

Organization, 73(2): 246-253.

Brewer, Marilynn B. 1999. “The Psychology of Prejudice: Ingroup Love or Outgroup Hate?”

Journal of Social Issues, 55(3): 429-444.

Brewer, Marilynn B. and Rupert J. Brown. 1998. “Intergroup Relations.” In Daniel T. Gilbert,

Susan T. Fiske, and Gardner Lindzey (Eds.), The Handbook of Social Psychology, 2(4),

Boston, MA: McGraw-Hill.

Brick, Ivan E., Oded Palmon, and John K. Wald. 2005. “CEO Compensation, Director

Compensation, and Firm Performance: Evidence of Cronyism.” Journal of Corporate

Finance, 12(3): 403-423.

Buchan, Nancy R., Rachel T.A. Croson, and Sara Solnick. 2008. “Trust and Gender: An

Examination of Behavior, Biases and Beliefs in the Investment Game.” Journal of

Economic Behavior and Organization, 64(3-4): 466-476.

Castillo, Marco, and Ragan Petrie. 2010. “Discrimination in the Lab: Does Information Trump

Appearance?” Games and Economic Behavior, 68(1): 50-59.

Chen, Yan, and Sherry X. Li. 2009. “Group Identity and Social Preferences.” American

Economic Review, 99(1): 431-457.

Cox, James C. 2004. “How to Identify Trust and Reciprocity.” Games and Economic Behavior,

46: 260-281.

26 Croson, Rachel T.A., and Uri Gneezy. 2009. “Gender Differences in Preferences.” Journal of

Economic Literature, 47(2): 448-474.

Davis, James H., F. David Schoorman, and Lex Donaldson. 1997. “Toward a Stewardship

Theory of Management.” The Academy of Management Review, 22(1): 20-47.

Eckel, Catherine C., and Philip J. Grossman. 2008. “Forecasting Risk Attitudes: An

Experimental Study Using Actual and Forecast Gamble Choices.” Journal of Economic

Behavior and Organization, 68 (1): 1-17.

Eckel, Catherine C., and Rick K. Wilson. "Is trust a risky decision?" Journal of Economic

Behavior & Organization 55, no. 4 (2004): 447-465.

Englebert, Pierre. 2000. “Pre-Colonial Institutions, Post-Colonial States, and Economic

Development in Tropical Africa.” Political Research Quarterly, 53(1): 7-36.

Falk, Armin, and Christian Zehnder. 2007. “Discrimination and In-Group Favoritism in a

Citywide Trust Experiment.” IZA Working Paper DP 2765.

Fearon, James D., and David D. Laitin. 1996. “Explaining Interethnic Cooperation.” American

Political Science Review, 90(4): 715-735.

Fershtman, Chaim, Uri Gneezy, and Frank Verboven. 2005. “Discrimination and Nepotism: the

Efficiency of the Anonymity Rule.” Journal of Legal Studies, 34(2): 371-394.

Fiedler, Marina, Ernan Haruvy, and Sherry X. Li. 2011. “Social Distance in a Virtual World

Experiment.” Games and Economic Behavior, 72(2): 400-426.

Fischbacher, Urs. 2007. “z-Tree: Zurich Toolbox for Ready-Made Economic Experiments.”

Experimental Economics, 10(2): 171-178.

Goette, Lorenz, David Huffman, and Stephan Meier. 2006. “The Impact of Group Membership

on Cooperation and Norm Enforcement: Evidence Using Random Assignment to Real

Social Groups.” American Economic Review, 96(2): 212-216.

Kets de Vries, Manfred F.R. 1993. “The Dynamics of Family Controlled Firms: The Good and

Bad News.” Organizational Dynamics, 21(3): 59-71.

Lentz, Bernard F. and David N. Laband. 1989. “Why So Many Children of Doctors Become

Doctors: Nepotism vs. Human Capital Transfers.” Journal of Human Resources, 24(3):

392-413.

Levin, S., & Sidanius, J. (1999). “Social dominance and social identity in the United States and

Israel: Ingroup favouritism or outgroup derogation?” Political Psychology, 20, 99 – 126.

Lewis, Amy C., and Steven J. Sherman. 2003. “Hiring You Makes Me Look Bad: Social-Identity

Based Reversals of the Ingroup Favoritism Effect.” Organizational Behavior and Human

Decision Processes, 90(2): 262-276.

McConaugby, Daniel L., Charles H. Matthews, and Anne S. Fialko. 2001. “Founding family

Controlled Firms: Performance, Risk, and Value.” Journal of Small Business

Management, 39(1): 31-49.

Messick, David M., and Diane M. Mackie. 1989. “Intergroup Relations.” Annual Review of

Psychology, 40(1): 45-81.

Perez-Gonzalez, Francisco. 2006. “Inherited Control and Firm Performance.” American

Economic Review, 96(5): 1559-1588.

Schechter, L. (2007). Traditional trust measurement and the risk confound: An experiment in

rural Paraguay. Journal of Economic Behavior & Organization, 62(2), 272-292.

Singell, Larry D., and James Thornton. 1997. “Nepotism, Discrimination, and the Persistence of

Utility-Maximizing, Owner-Operated Firms.” Southern Economic Journal, 63(4): 904919.

27 Slonim, Robert, and Ellen Garbarino. 2008. “Increases in Trust and Altruism from Partner

Selection: Experimental Evidence.” Experimental Economics, 11(2): 134-153.

Tajfel, Henri, and John Turner. 1979. “An Integrative Theory of Intergroup Conflict.” In William

G. Austin and Stephen Worchel (Eds.), The Social Psychology of Intergroup Relations,

Monterey, CA: Brooks-Cole.

Vanhanen, Tatu. 1999. “Domestic Ethnic Conflict and Ethnic Nepotism: A Comparative

Analysis.” Journal of Peace Research, 36(1): 55-73.

28 Appendix A: Game Screenshots

Figure A.1: Eckel-Grossman risk measure screenshot

29 Figure A.2: Nepotism game proposer decision screenshot

30 Figure A.3: Nepotism game responder decision screenshot

31 Appendix B: Additional Regressions

Table B.1: Probability of selecting ingroup members as partner (coefficients)

Dependent variable: Partner choice (1 = Chose ingroup member)

Treatment

(1 = Low ingroup efficiency)

Beliefs

(Ingroup less other)

Favoritism

I

II

III

IV

V

-1.063***

-1.319***

-1.209***

-1.522***

-1.521***

(0.35)

(0.34)

(0.37)

(0.45)

(0.47)

0.206

8.195**

(3.92)

0.240

9.301**

(4.22)

0.231

10.80**

(4.50)

0.252

(0.13)

(0.16)

(0.17)

(0.20)

-0.419***

-0.354**

(0.14)

(0.15)

8.080**

(3.68)

(Ingroup less other)

Risk Preferences

(6 = Risk seeking)

Gender (D)

(1 = Female)

Group Identity

(7 = Strong ingroup identity)

Generalized Trust

(7 = More trusting)

Generalized Fairness

0.613

(0.46)

0.042

(0.13)

-0.063

(0.16)

0.050

(7 = Others are fair)

Constant

(0.15)

Pseudo R-squared

Chi-squared

P-value

Log Likelihood

Observations

0.914***

1.092***

0.924***

2.701***

2.041*

(0.28)

(0.27)

(0.29)

(0.73)

(1.23)

0.263

26.4

0.000

0.225

22.6

0.000

0.307

30.9

0.000

0.416

41.9

0.000

0.438

44.0

0.000

-37.09

-39.01

-34.86

-29.38

-28.30

78

78

78

78

78

Note: * p<0.1, **p<0.05, *** p<0.01. Probit specification, standard errors in parentheses. Table reports

coefficients. Dependent variable takes on a value of 1 if subject selected ingroup member as partner in the trust

game. Data is from the Nepotism treatment. The “Beliefs” variable measures the difference in beliefs about

reciprocity between ingroup members and others. Thus, positive values mean subjects expect more back from their

ingroup, while negative values mean subjects expect less back from their ingroup (relative to others). The

“Favoritism” variable measures the difference in dictator giving to ingroup members and others. Thus, positive

values are subjects giving more to ingroup relative to others, while negative values are subjects giving more to

others.

32 Table B.2: Probability of preferring ingroup members as partner (Random match treatments)

Dependent variable: Partner choice (1 = Chose ingroup member)

Treatment

(1 = Low ingroup efficiency)

Beliefs

(Ingroup less other)

Favoritism

I

II

III

IV

V

-1.298***

-1.448***

-1.636***

-1.640***

-1.838***

(0.36)

(0.37)

(0.41)

(0.41)

(0.46)

0.242***

9.537**

(4.44)

0.213**

9.474**

(4.50)

0.214**

10.38**

(4.72)

0.234**

(0.09)

(0.09)

(0.09)

(0.10)

0.009

0.056

(0.11)

(0.13)

11.19**

(4.46)

(Ingroup less other)

Risk Preferences

(6 = Risk seeking)

Gender (D)

(1 = Female)

Group Identity

(7 = Strong ingroup identity)

Generalized Trust

(7 = More trusting)

Generalized Fairness

0.311

(0.44)

0.120

(0.16)

-0.088

(0.14)

-0.175

(7 = Others are fair)

Constant

(0.16)

Pseudo R-squared

Chi-squared

P-value

Log Likelihood

Observations

0.809***

0.884***

0.798***

0.767

0.967

(0.27)

(0.26)

(0.27)

(0.47)

(1.16)

0.271

25.0

0.000

-33.68

0.223

20.6

0.000

-35.86

0.335

30.9

0.000

-30.71

0.335

30.9

0.000

-30.71

0.373

34.4

0.000

-28.96

70

70

70

70

70

Note: * p<0.1, **p<0.05, *** p<0.01. Probit specification, standard errors in parentheses. Table reports

coefficients. Dependent variable takes on a value of 1 if subject selected ingroup member as partner in the trust

game. Data is from the Random match treatment. The “Beliefs” variable measures the difference in beliefs about

reciprocity between ingroup members and others. Thus, positive values mean subjects expect more back from their

ingroup, while negative values mean subjects expect less back from their ingroup (relative to others). The

“Favoritism” variable measures the difference in dictator giving to ingroup members and others. Thus, positive

values are subjects giving more to ingroup relative to others, while negative values are subjects giving more to

others.

33