DAILY BUSINESS REVIEW K&L Gates Team Backs $310 Million Pharma Deal |

advertisement

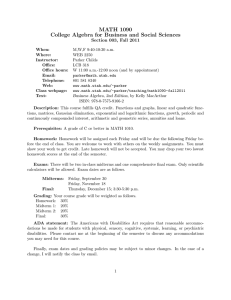

| | february 17, 2016 DAILY BUSINESS REVIEW DEALMAKERS K&L Gates Team Backs $310 Million Pharma Deal by Mary Hladky Special to the Review Shortly after their client NeoGenomics Inc. acquired Clarient Inc. in a deal valued at $310 million, K&L Gates attorneys Clay­ ton Parker and Matthew Ogurick received an unexpected accolade. NeoGenomics sent an email to K&L Gates chairman Peter Kalis, congratulating the Miami corporate and securities partners and the rest of their legal team on a job es­ pecially well done. “It is very satisfying to have an apprecia­ tion of that,” Parker said. The Dec. 30 closing culminated nearly a year of negotiations between NeoGenomics, a cancer genetics diagnostic testing compa­ ny, and Clarient, a unit of General Electric Healthcare Life Sciences. The talks were launched when Neo­ Genomics chairman and CEO Douglas VanOort called GE chairman and CEO Jef­ frey Immelt on Nov. 6, 2014, according to NeoGenomics’ proxy statement. Offers and counteroffers flew back and forth with changing amounts of cash and stock in play until the two companies signed a purchase agreement last Oct. 20. In the final push to get the deal done by the end of the year, “people were working in excess of 20 hours a day on Christmas week,” Parker said. The purchase price included $80 million in cash, $110 million in preferred stock and 15 million shares of NeoGenomics common stock. NeoGenomics financed $65 million of the cash portion with a $55 million term loan from AllianceBernstein and with $10 million of a $25 million credit facility from Wells Fargo. K&L Gates has represented Fort Myersbased NeoGenomics as outside general coun­ sel since 2005. In all, 28 attorneys in 10 of the firm’s offices played a role in the transaction. “Our vision is to become America’s pre­ mier cancer testing laboratory, and this ac­ quisition is a major step forward in achiev­ ing that vision,” VanOort said when the companies reached an agreement. The companies have complimentary product offerings. Clarient, based in Califor­ nia and Texas, is a provider of cancer diag­ nostic testing. The acquisition of Clarient will allow Ne­ oGenomics to acceler­ ate its growth, broaden its offering of diagnostic tests to hospitals and physicians across the country, expand its geo­ graphic reach, and le­ verage its laboratories and infrastructure to lower operating costs, the company said. The lengthy nego­ harvey bilt tiations centered on Clayton Parker, left, described Matthew Ogurick, center, as the “real quarterback the cash and stock ele­ ments of the purchase of the transaction from a legal standpoint,” and also credited Miami corporate partner David Baghdassarian. price. “There were very active negotiations as to the terms of the cial officer George Cardoza — for their “incred­ deal, purchase price, indemnities, represen­ ible effort” to complete the transaction. “Our drive was to get it closed. Then it tations and warranties,” Parker said. “That became GE’s drive to get it closed as well. was really, really challenging.” Many balls were in the air at the same We had unanimity of focus that helped us time, including significant due diligence overcome the challenges we faced,” Parker and getting antitrust and state health care said. GE Healthcare Life Sciences is GE’s $4 regulatory approvals as well as shareholder billion molecular medicine business that fo­ approval and financing. One factor that drew scrutiny from GE cuses on drug discovery and development was the size of NeoGenomics, which report­ as well as molecular tools for diagnostics ed $87 million in 2014 revenue compared and therapy selection. Now that the deal has closed, GE Healthcare owns 32 percent with Clarient’s revenue of $127 million. Significant amounts were at stake if the of NeoGenomics and a GE Healthcare offi­ transaction failed to close. Termination fees cial will join the NeoGenomics board. “The acquisition is about a lot of things,” ranged from $3 million to $15 million, de­ pending on the reason the deal hit a road­ Jones told the online news organization block. “That was a lot of pressure,” Parker GenomeWeb in October. “But getting more scale to be better able to compete in our in­ said. Geography added a challenge as lawyers dustry is one of the primary aims of this.” NeoGenomics expects to more than dou­ traveled to meetings and drafting sessions around the country. “Time zones were an ble its revenue to about $240 million and interesting added issue,” Ogurick said. “I cut costs by as much as $6 million this year. The company also expects the acquisi­ would be in California with a conference tion will speed its growth in the market for call starting at 5 a.m.” Parker described Ogurick as the “real pharmaceutical clinical trials and research. quarterback of the transaction from a legal In addition, NeoGenomics and GE Health­ standpoint” and also credited Miami corpo­ care have agreed to collaborate on a new rate partner David Baghdassarian and the bioinformatics initiative that will explore K&L Gates attorneys in other offices who the potential for new products that combine genomic and imaging data. were part of the team. With a goal of leading the cancer testing He also recognized NeoGenomics execu­ tives — including VanOort, executive vice presi­ industry, Parker said: “I believe they have dent for finance Steven Jones and chief finan­ the management to execute that plan.” Reprinted with permission from the 2/17/16 edition of the DAILY BUSINESS REVIEW © 2016 ALM Media Properties, LLC. All rights reserved. Further duplication without permission is prohibited. Contact: 877-257-3382 reprints@alm.com or visit www.almreprints.com. # 100-02-16-09