For Surveyors and Engineers y g Biggert-Waters

advertisement

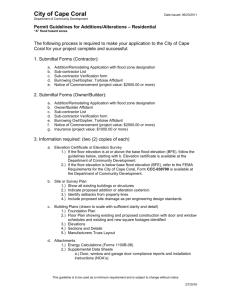

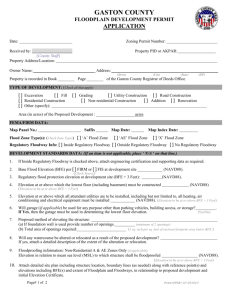

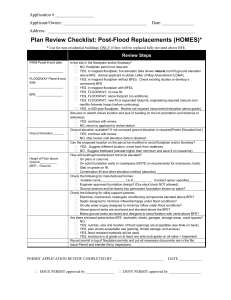

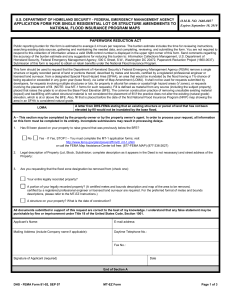

Biggert-Waters NFIP Reform Act of 2012 For Surveyors y and Engineers g December 3,, 2013 Bill Tingle PG, CFM Biggert-Waters National Flood Insurance Program Reform f Act off 2012 ( (BW-12) ) Signed into Law July 6, 2012 Extends financing & authority for the NFIP through September 30, 2017 Since 2008 Congress passed 18 stop stop-gap gap extensions Sited as BW 12 BW-12 Subsidized flood insurance policies being phased out (About 20% of all flood insurance policies) Rate increase 25% per year for 4 years to actuarial rates for…. Non Non-primary primary residences (living in the home < 80% of the time) 305,000 nationally & 4759 NC pre-FIRM subsidized policies begin phasing into full risk rates. rates Rates will increase on average over 150 percent Business i properties i and d Severe Repetitive i i Losses - Commercial - 90,000 nationally and 2143 NC - Severe Rep Loss - 11,000 nationally & 700 NC Began January 1, 1 2013 BW-12 Primary, residential buildings may keep cheaper …UNLESS…. Property is sold (or purchased) There is a lapse in insurance coverage Substantial damage or substantial improvement (30%) occurs Building is uninsured as of BW-12 enactment A mitigation grant is refused 650,000 nationally and 7,728 NC existing pre-FIRM policies convert to full-risk rates when sold to a new owner Subsidized rates will move DIRECTLY to full risk rate (no 25% increase/year over 4 years) Bega an Octo ober 1, 2013 subsidized (Pre-FIRM) rates forever… BW-12 Grandfathering To Be Phased Out: Throughout history of NFIP – rates based on FIRM in effect when house built. If BFE increased on new map, rates grandfathered to cheaper rates because house was built in compliance. BW-12 - For any property newly mapped into SFHA or subject to a revised map p WILL PAY ACTUARIAL RATES Anticipated to take effect October 1, 2014. Rates to increase 20% each year for 5 years until they reach full actuarial rates for the map in effect. ~ 515,000 grandfathered policies, premiums may increase 200% Biggert-Waters gg Flood Insurance Program Reform Act of 2012 Average of 10% increase after Oct. 1, 2013 V Zone – Post Post-FIRM FIRM 11%, Pre-FIRM Pre FIRM 17% AE Zone – Post-FIRM 6%, Pre-FIRM 16% Zone A – 8% X Zones – Standard 8%, PRP 1%, ext. 19% BW-12 DATE BW-12 IMPLEMENTATION STEP July 6, 2012 BW-12 becomes law; reauthorizes the NFIP for five years and requires FEMA to eliminate most discounts and subsidies January 1, 2013 2nd Homes, Commercial –Phase Out October 1, 2013 Single family Pre-FIRM – Direct Full Risk Rates No 25% increase each year. *sale/purchase of property, *Policy Lapse *substantial damage/improvement 30%. October 1, 2014 Grandfathering Phase Out BW 12 BW-12 Streamlines FMA, RFC and SRL program to allow mitigation of repetitive or severe repetitive loss structures; Creates a reserve fund Establishes the TMAC to advise FEMA administrator and SRP Modifies use of CDBG funds to include flood insurance outreach and community building code administration Biggert-Waters Flood Insurance P Program R Reform f A Actt off 2012 Greater civil penalties for lender non-compliance ($350 to $2,000) Lenders required to escrow and maintain control of claim payments Study the economic cost of vouchers for low-income Studyy of the capacity p y of the private p reinsurance market Insurance Cost Coverage: $250K Building/$100K contents Q QUESTIONS?? Example Rates for Various Floor Elevations 4’ Below BFE At BFE 3’ Above BFE AE (el 14’) BFE -9’ Premium ~$20,400/yr BFE -9’ Premium ~$20,400/yr ~$20 400/yr AE ((el 14’)) Premium Present: ~$3400 Pending: P di $51 $51,000/yr 000/ Pre-FIRM Pre2007 VE (el 16’) 16 ) Now: BFE -10 10’’ Biggert-Waters Biggert Waters Flood Insurance Program Reform Act of 2012 September 2013 U.S. Rep. Maxine Waters introduced the Homeowners Flood Insurance Affordability Act last month. Purpose is to delay implementation of BW12 until Affordability Study is completed. completed Determining Flood Insurance Rate - Zone AE Elevation Certificates and BW-12 Elevation Certificates will be required for all pre-FIRM buildings to be actuarially rated An extremely high premium will be enforced without an EC. Rates generally based on difference between lowest floor and d BFE Flood Insurance requirement may be removed if EC shows LAG at or above BFE ((LOMA, O , LOMR-F) O ) The Elevation Certificate Administrative tool of the NFIP Policy rating Support of map revisions and amendments Certify building elevations Community compliance Sections A - G Section A FEMA Non Engineered Opening R i Requirements t Must have a Minimum of Two Openings One sq/in per 1 sq/ft of enclosed area Bottom of opening within 1’ of adjacent grade Any louvers, screens, or other opening covers must not block or impede the automatic flow of Floodwaters into and out of the enclosed area. Openings must be permanently open Vent Options p Typical Air Vent Screened Wood Frame Louvered Air Vent Block Turned Sideways Return V t Vents Lowest Floor for Flood Insurance Rating With Proper Vents in Crawlspace $700 / year Lowest Floor + 2.0 Feet Opening (typical) BFE Lowest Floor for Flood Insurance Rating Without Proper Vents in Crawlspace $2 700 / year $2,700 Lowest L Floor - 1.0 1 0 Feet BFE Lowest Floor for Flood Insurance Rating With Proper Vents Lowest Floor + 2.0 Feet Opening (typical) BFE Lowest Floor for Flood Insurance Rating Without Proper Vents Lowest Floor - 1.0 1 0 Feet BFE Section - B Section C Lowest Adjacent Grade Elevation of g ground,, sidewalk,, patio, p , or deck support immediately next to building Lowest ground elevation touching structure or supporting i members b off structure Definition of Lowest Floor Lowest L t floor fl off llowestt enclosed l d area, including basement Unfinished or flood-resistant enclosures, used solely for parking of vehicles, building access, or storage in areas other than basements are not considered lowest floors PROVIDED that such enclosures are not built to render structure to be in violation of applicable non elevation design requirements of a non-elevation community’s ordinance Low Floor (LF) For Insurance Rating Diagram 1-A Slab on Grade Low Floor (LF) For Insurance Rating Diagram 1-B 1B Raised Slab Low Floor (LF) For Insurance Rating Diagram 1-B With Attached Garage Low Floor (LF) For Insurance Rating Diagram 9 S bG d C Sub-Grade Crawll Space S Low Floor (LF) For Insurance Rating Diagram g 2 Basement Low Floor (LF) For Insurance Rating Diagram 8 Crawl space, openings Low Floor (LF) For Insurance Rating Diagram 8 Crawl space, space No Openings Flood Insurance Rating Elevation Determination Difference, measured in feet, between the lowest floor elevation and the BFE for that zone. The elevation difference can be a number of feet above (+) or below (-) ( ) the BFE. BFE 0.1’ Can Make $$Thousands Difference in Annual Premium • Insurance agent must apply the rounding rule to the difference between the elevation of the lowest floor and the BFE. • Round to nearest whole number • If the difference is negative (floor below BFE), the final figure is rounded up from .5. 5 • If the difference is positive (floor above BFE), the final figure is rounded up from .5. • Always round to the higher elevation Q Questions? ti ?