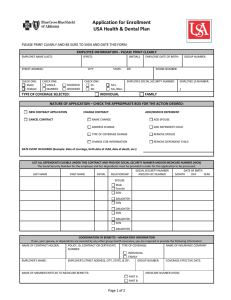

CHEIBA T M

advertisement