Business Cycle Effects on Metal and Oil Prices:

advertisement

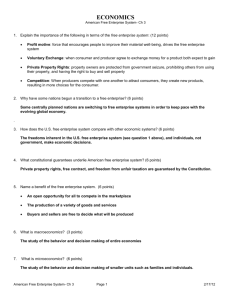

Business Cycle Effects on Metal and Oil Prices: Understanding the Price Retreat of 2008-9 by John T. Cuddington* and Daniel Jerrett** 12/02/2011 Abstract This paper studies the effect of macroeconomic business cycles on six metals traded on the London Metal Exchange and oil prices. Reduced-form equations for real metal prices that depend separately on the trend and cyclical components of global real GDP oil prices (as a proxy for energy inputs in metals production) are derived. The estimated trend and cyclical income responses suggest that our LME metals (with two exceptions) and oil prices are much more responsive to cyclical than trend movements in economic activity, as theory would suggest. Through counterfactual simulations, the following types of questions can be addressed: (i) how much lower would metal and oil prices have been in the early years of the 21st century in the absence of the booming global economy? and (ii) “How much higher would metal prices have been in 2008-2009 in the absence of the sharp slowdown in the global economy? Key Words: metal price fluctuations and cycles, oil prices, business cycle analysis, trend-cycle decomposition, Christiano-Fitzgerald band-pass filter. JEL Codes: Q31 (Nonrenewable Resources and Conservation – Supply and Demand), E32 (Macro: Prices, Fluctuations and Cycles), C53 (Forecasting Models and Simulation Methods), C32 (Time Series Models), L70 (Industry Studies: Primary Products and Construction – General) *William J. Coulter Professor of Mineral Economics, Colorado School of Mines, Golden, CO 80401 **Fixed Income Analyst, Putnam Investments, Boston MA 02109 1 I. Introduction Mineral economists have long held that metal demand is highly responsive to changes in the level of economic activity. Given low short-run price elasticities of both supply and demand, this causes metal prices to be strongly pro-cyclical. That is, metal prices move up quite dramatically during macroeconomic expansions, and fall sharply during contractions. See Radetzki (2006, 2008) and Tilton (1992). The worldwide economic slowdown, with outright recessions in major industrial nations, is one possible explanation of the unprecedented metals price retreat in the second half of 2008 and early 2009, following an equally unprecedented six to seven year run up in real prices. Other possible contributing factors are (i) increased investment activity in commodities, as an emerging asset class, with hedge funds retrenching sharply with the onset of the recession and (ii) overshooting behavior of metals prices in response to sharp changes in monetary policy (as first described in Frankel, 1986). Although the view that metal prices are strongly pro-cyclical is widely held, and is supported by the detailed “case study” investigations like Radetzki (2006), our search of the literature found few formal econometric studies addressing the topic.1 Perhaps the link between metal prices and business cycles is too self-evident to be a topic worthy of formal testing. There are several papers that characterize metal price cycles using a dating procedure like that used by the NBER when dating U.S. business cycles.2 Noteworthy examples include Davutyan and 1 In spite of its title, Fama and French’s (1988) paper “Business Cycles and the Behavior of Metal Prices” has very little discussion of business cycles. Their analysis focuses on the impact of metal market tightness and its effect on the interest-adjusted basis. They presume that markets are tight near the end of business cycle expansions, but there is no analysis of this claim. 2 The NBER Business Cycles Dating Committee uses a judgmental approaches that relies on an analysis of various leading, coincident, and lagging indicators using monthly frequency data in their efforts to determine the official turning points in the U.S. economy by month (not quarter) when they occur. See http://www.nber.org/cycles/dec2008.html for details. 2 Roberts (1994), Labys et al (1999), Labys et al (2000), and Cashin and McDermott (2002). Some of these authors employ the mechanical algorithm developed by Bry and Boschan (1971) for the NBER’s early research to identify local peaks and troughs in general economic activity. Although these papers provide interesting analyses of peaks and troughs in metal prices, they do not ask whether the metal-price cycles that they identify match up with the timing of macroeconomic fluctuations. Only the paper by Labys, Achouch and Terraza (1999) examines the correlation between metals prices and macroeconomic variables such as industrial production, interest rates, and stock prices. The objective of this paper is to study the link between macroeconomic business cycles and metals prices. Using a simple structural model, we derive reduced-form equations for real metals prices that depend separately on the trend and cyclical components of global real GDP, as well as other determinants of mineral supply and demand. Estimation of this equation allows us to address the question: how sensitive are metals prices to cyclical versus trend movements in economic activity? The reduced-form equation is then used to simulate the path of real metal prices in a counterfactual scenario where the business-cycle component of real GDP is set equal to zero. Comparing this scenario to the historical price series enables us to answer the related questions: (i) how much lower would metal and oil prices have been in the early years of the 21st century in the absence of the booming global economy? and (ii) “How much higher would metal prices have been in 2008-2009 in the absence of the sharp slowdown in the global economy? 3 II. A Simple Structural Model of Metal Markets The importance of studying business-cycle movements in metals is well summarized by John Tilton (1992), who has a detailed conceptual discussion of how the business cycle affects metals demand: The demand for many mineral commodities is particularly responsive to income changes caused by business cycle fluctuations. Metals and other materials, in particular, are consumed primarily in the capital equipment, construction, transportation, and consumer durable sectors of the economy, which use them to produce automobiles, refrigerators, homes and office buildings, new machinery, and other such items. These sectors boom when the economy is doing well, and suffer severely when it falters. Since small fluctuations in the business cycle cause major changes in their output and in turn the demand for materials, the income elasticity is normally greater than one when the business cycle is responsible for changes in income. When income changes are the result of secular growth trends, the traditional and still very common presumption is that mineral demand grows or declines in direct proportion with income. The income elasticity of demand in such situation is thus one. (p.51) In addition to the income elasticity of metal demand being larger in the presence of business-cycle shocks, mineral economists generally believe that the metals supply curves are quite price inelastic in the short run due to capacity constraints. (See, e.g., Tilton 1992 and Radetzki 2008). A steep supply curve along with large demand curve movements due to business-cycle shocks will result in large price movements in the short run. Our empirical analysis below is, to our knowledge, the first to implement Tilton’s (1992, p.51) idea that “The effect of income on metals demand can be separated into two parts: a cyclical component caused by short-term fluctuations in the business cycle, and a secular component caused by long-term growth trends.” Consider a simple structural model of a metal market where the quantity of metal demanded at time t ( qmt ) depends separately on the trend and cyclical components of real 4 economic activity such as global real GDP ( ytT , ytC ) , global population ( popt ) in addition to the real metal price ( pmt ) : qmt = β10 − β11 pmt + β12 ytT + β13 ytC + β14 popt + ε Dt (1) qmt = β10 − β11 pmt + β12 ( ytT + ytC ) + γ ytC + β14 popt + ε Dt (1’) or equivalently: Tilton’s discussion above implies that γ ≡ β13 − β12 > 0 . The inverse metal supply function is assumed to depend on energy input costs ( pet ) , and a time trend (trend) to capture the net effects of technological change and ongoing resource depletion: pmt = β 20 + β 21qmt + β 22 pet + β 23t trend + ε St (2) Our primary focus is on metal price behavior and we do not have access to quantity data on metal supply, demand or stocks (inventories). Therefore, the following reduced-form price equation is estimated: pmt = β 0 + β1 ytC + β 2 ytT + β3 pet + β 4 popt + β 5trend + β 6 pmt −1 + β 7 pmt − 2 + ε t (3) The structural model implies the following signs on the reduced-form coefficients: β1 , β 2 , β3 > 0 . The Tilton conjecture that the cyclical income elasticity of mineral demand exceeds the trend income elasticity implies the following testable hypothesis: β1 > β 2 > 0 in equation (3). In the estimated reduced-form equations reported below, one or two lags of the real metal price were included to eliminate serial correlation in the residuals and allow for expected dynamic effects on both the supply and demand sides of the metals markets. 5 III. Data and Estimation Reduced-form real metal price equations were estimated for the following six metals traded on the LME using annual data from 1950 through 2009: aluminum, copper, nickel, lead, tin and zinc. An analogous equation was also estimated for real oil prices (but with oil prices, of course, eliminated as a regressor on the right-hand side). Measures of global real GDP and global population were obtained from Maddison (2009) for the period 1950-2008 and extended through 2009 by the authors by using growth rates from IMF data3. The real price of oil4 is used as a proxy for the price of energy inputs; it was provided by Alan Heap of CitiGroup. All metal and oil prices are in U.S. dollars and were deflated by the U.S. consumer price index to obtain real prices. All variables, except trend, appear in natural log form in the regressions below. The Christiano-Fitzgerald asymmetric (2003) band pass filter with a window of 2-8 years is used to extract the business cycle component of real GDP and real oil prices. The ‘trend’ in these series is then defined as the actual series minus the business cycle component. The trend therefore includes possible longer-term cycles such as ‘super cycles’ (with periods of 20-70 years) studied by Cuddington-Jerrett (2008) and Jerrett-Cuddington (2008).5 See CuddingtonJerrett (2008) for a detailed discussion of band-pass filters. The estimated reduced-form real price equations for the six LME metals and crude oil are reported in Table 1.6 The adjusted R2 statistics are uniformly high (.72-.95) and the Ljung-Box 3 http://www.imf.org/external/ns/cs.aspx?id=28 The oil price series is Arabian Light posted at Ras Tanura from 1945 to 1985 and the Brent spot price thereafter. 5 The time span of our dataset is too short to permit the extraction of the super cycle component from the trend. 6 The equations are estimated OLS equation by equation. We also experimented with SUR estimation, which is identical to OLS when the same regressors appear in all equations. In our application, only the lagged dependent variable varies across equations. The results are very similar. 4 6 Q(5) statistics7 indicate that two lags of the dependent variable is sufficient to render the residuals white noise. Note that the estimated coefficients on both the cyclical and trend Table 1: OLS Regression Results for Reduced-Form Real Mineral Price Equations Dep. Var. Real Price of: Aluminum Copper C 38.98 82.09 [1.91]⁰ [2.76]** Log(GDPcyclical) 4.11 [1.71]⁰ Log(GDPtrend) Log(Oil Price) Log(Pop) Time Trend 1.67 [3.96]** 0.09 [2.03]* ‐2.82 [‐2.55]* ‐0.03 [‐1.82]⁰ 0.52 [3.23]** ‐0.30 [‐1.79]⁰ 0.87 48.82** Dep. Var.(‐1) Dep. Vary.(‐2) 5.77 [3.39]** Crude Oil 47.18 [2.02]* Nickel 107.94 [2.99]** 2.46 [0.79] 11.59 [2.88]** 2.39 3.65 1.64 [3.83]** [4.90]** [2.20]* 0.01 0.07 [0.21] [1.71]⁰ ‐5.39 ‐7.55 ‐3.34 [‐3.13]** [‐3.81]** [‐2.08]* 0.00 ‐0.01 [‐0.13] [‐0.32] 0.85 0.67 0.87 [7.75]** [6.84]** [8.30]** ‐0.29 ‐0.37 ‐0.03 [‐2.91]** [‐2.66]* [‐0.21] 0.87 0.72 0.88 48.01** 18.63** 60.72** Lead 70.21 [2.10]* Tin ‐19.97 [‐0.74] Zinc 7.50 [0.21] 5.93 [1.75]⁰ 7.32 [2.98]** 0.38 [0.15] 1.48 [3.12]** 2.61 [5.69]** 0.18 [3.11]** ‐0.81 [‐0.63] ‐0.09 [‐3.49]** 0.63 [6.09]** ‐0.12 [‐0.90] 0.95 134.95** 1.50 [3.00]** 0.11 [2.06]* ‐1.30 [‐0.68] ‐0.04 [‐1.96]⁰ 0.76 [8.10]** ‐0.41 [‐2.91]** 0.74 20.03** 0.03 [0.49] ‐4.21 [‐2.34]* 0.01 [0.51] 0.72 [6.30]** ‐0.18 [‐1.16] 0.82 32.40** R‐squared F‐statistic Ljung‐Box Q(5) 3.78 1.21 6.91 3.79 3.15 2.30 2.14 Student t statistics in parentheses. ** indicates significant at the 99% level, * at the 95% level and ⁰ at the 90% level. 7 The null hypothesis is no serial correlation of order 1-5. 7 components of global real GDP are positive, as theory would predict, and for the most part the t statistics (in parentheses) indicate they are statistically different from zero. The two exceptions are nickel and zinc, where the coefficients on cyclical GDP are statistically insignificant and, in fact, smaller in magnitude than the coefficient on trend GDP (contrary to the Tilton hypothesis). Table 2 reports t tests for the null hypothesis that the coefficient to cyclical GDP minus the coefficient on trend GDP is less than or equal zero; the (one-sided) alternative is that the difference is positive, as predicted by the Tilton hypothesis. That is, H 0 : β1 − β 2 ≤ 0; H A : β1 − β 2 > 0. Table 2: Estimated Difference between Cyclical and Trend GDP Response on Real Prices; Hypothesis Test H 0 : β1 − β 2 ≤ 0; H A : β1 − β 2 > 0. Aluminum Copper Nickel Crude Oil Lead Tin Zinc β1‐β2 2.44 3.38 ‐1.18 9.66 4.45 4.71 ‐1.12 t stat for H0: β1‐β2 ≤0 [1.00] [1.78]* [‐0.36] [2.62]** [1.41]⁰ [1.81]* [‐0.43] The differential response of real prices to cyclical rather than trend GDP movements is positive in all cases except nickel and zinc. Four of the remaining five minerals have positive responses that are statistically significant (at the 10% level, at least), as the Tilton hypothesis predicts.8 All in all, we conclude that our estimated reduced-form price equations provide some, empirical support for the proposition that cyclical fluctuations in global GDP should have a more pronounced effect on real mineral prices than trend movements in GDP. We are surprised by the 8 We experimented with the use of stepwise regression to narrow down the set of regressors in the hopes of improving the precision of our estimates. This however, made little difference in the simulation analysis that follows. These stepwise regression results are available on request. 8 absence of cyclical income effects for nickel and zinc, given that both metals are used in stainless steel production, a cyclical industry. (Nickel is a direct input, while zinc is a galvanizing agent.) Perhaps the use of a global measure of real economic activity in our analysis is too crude; greater country or regional disaggregation may be needed. When we added the cyclical and trend components of U.S. GDP to the specification in place of or in addition to global GDP, however, the results were less satisfactory than those reported. IV. Model Simulations The seven mineral price equations (six metals plus crude oil) are now combined in a simulation model to produce dynamic multi-step ahead forecasts of the mineral prices from 1952 through 2009, conditional on the historical paths of world GDP and population. Note that the forecasts for oil prices feed into the six metal equations. Thus, the cyclical component of GDP affects real metal prices both directly and via its effect on oil/energy input costs. The dynamic forecast results in Panels 1 and 2 of Figure 1 show that, for the most part, the actual data over the 1952-2009 period lie within the two standard forecast error band. This is quite remarkable for a 58-year multi-step ahead forecast – albeit in-sample and conditional on world GDP and population. With the exceptions of tin and oil, the model under-forecasted mineral prices during the boom of the middle years of the first decade of the 21st century. That is, actual prices were higher than what would have been expected given the underlying ‘fundamentals’ in our model. An open question that whether this reflects the omission of additional fundamentals in our model, or whether it reflects ‘animal spirits,” i.e. speculative factors. 9 Figure 1 Multi-Step Ahead Forecasts with 2 Std Error Band vs. Actuals: Panel 1 Copper Aluminum 6.0 6.4 5.6 6.0 5.2 5.6 4.8 5.2 4.4 4.8 4.0 1950 1960 1970 1980 1990 4.4 1950 2000 1960 Nickel 5.5 2.5 5.0 2.0 4.5 1.5 4.0 1.0 3.5 1960 1970 1980 1990 3.0 1950 2000 10 1980 1990 2000 Lead 3.0 0.5 1950 1970 1960 1970 1980 1990 2000 Multi-Step Ahead Forecasts with 2 Std Error Band vs. Actuals: Panel 2 Zinc Tin 5.6 8.5 8.0 5.2 7.5 4.8 7.0 6.5 4.4 6.0 4.0 5.5 5.0 1950 1960 1970 1980 1990 2000 3.6 1950 1960 1970 1980 1990 2000 Oil 6 5 4 3 2 1 1950 1960 1970 1980 1990 2000 Next, we consider a counterfactual scenario where the cyclical component of real global GDP is set equal to zero over the entire forecast sample 1952-2009. The resulting dynamic multistep ahead forecasts for the seven minerals are then compared to the baseline forecasts above. By examining the difference between the two scenarios, which is due solely to the cyclical component of GDP and the auto-correlation built into the estimated coefficients on the lagged dependent variables in each equation, we can address the question: In the absence of any given business-cycle expansion/contraction where would metals prices have been? The forecasted time paths of the seven minerals with and without the cyclical component of global GDP are shown in 11 the upper portion of each graph in Figure 2. The lower panel (with the scaling on the left axis) shows the difference between the two scenarios – that is, the business cycle components of the mineral prices. Figure 2 Model Simulations With and Without Global GDP Cyclical Component: Panel 1 Aluminum Global GDP - Cyclical Component .03 5.6 .02 5.2 .01 .2 4.8 .1 4.4 .00 -.01 .0 -.02 -.1 -.03 50 55 60 65 70 75 80 85 90 95 00 50 05 55 60 65 Copper 70 75 80 85 90 95 00 05 Nickel 6.0 2.4 5.6 2.0 .12 .2 5.2 .1 .08 1.6 .04 4.8 .00 1.2 .0 -.04 -.1 -.08 50 55 60 65 70 75 80 85 90 95 00 05 50 55 60 65 70 75 80 85 90 95 Forecast with Business Cycle Component Forecast Without Business Cycle Component Business Cycle Component of Mineral Price 12 00 05 Model Simulations With and Without Global GDP Cyclical Component: Panel 2 Tin Lead 8.0 5.2 7.5 4.8 7.0 .2 .1 4.4 .3 6.5 4.0 .2 6.0 .1 5.5 3.6 .0 .0 -.1 -.2 -.1 50 55 60 65 70 75 80 85 90 95 00 50 05 55 60 65 70 75 80 85 90 95 00 05 Oil Zinc 5.0 5.0 4.5 4.8 4.0 .08 4.6 .3 3.5 4.4 .2 3.0 .1 2.5 .04 4.2 .0 .00 -.1 -.2 -.04 50 55 60 65 70 75 80 85 90 95 00 05 50 55 60 65 70 75 80 85 90 95 00 05 Figure 2: Model Simulations With and Without Global GDP Cyclical Component for Six LME Metals and Crude Oil: The top lines in each graph provide model forecasts of mineral prices with and without the business cycle component of global GDP. “Without” means that the business-cycle component of global GDP is set to zero. The bottom line is the difference between the top lines at any point in time and is percentage deviation of the mineral price from its trend. The business cycle components for each mineral in Figure 2 are collected in Figure 3 along with the cyclical component of global GDP. Note the strong positive correlation among the minerals’ cyclical components. Their amplitudes are much larger than the cyclical component of 13 global GDP, reflecting the large estimated coefficients of the yc in the mineral price equations in Table 1. There is also a strong positive correlation between the various mineral cycles and the macroeconomic business cycle, supporting the common view that mineral prices have strong comovements and are strongly pro-cyclical. This figure shows us how much higher (lower) each mineral price was during various business cycle booms and busts. For the interested reader, the numerical values underlying the Figure are shown in Appendix A. Table 3 below contains an excerpt with the 1973-1974 and 2007-2008 boom episodes, which stand out in Figure 3. Figure 3 Dynamic Effects of Cyclical Component of World GDP on Real Metal and Oil Prices Percentage Deviations from Trend (in decimals) .28 World GDP Cyclical Component Copper Tin .24 .20 Crude Oil Nickel Zinc Aluminum Lead .16 .12 .08 .04 .00 -.04 -.08 -.12 -.16 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 82 84 86 88 90 92 94 96 98 00 02 04 06 08 As Table 3 shows, the cyclical component of global GDP was 2.1 percent in 1973; i.e. global real GDP was 2.1 percent above its long-run trend. The global expansion resulted in crude oil 14 prices being 14.3 and 19.2 percent above the level they would have been at in the absence of the business cycle expansion in 1973 and 1974, respectively. Copper prices, say, were 9.1 and 12.9 percent higher over the same two years. The effects on the other metals were also large, with the exception of nickel and zinc. During the global cyclical upswing in 2007-2008, before the abrupt slowdown in 2009, crude oil prices surged to 27.6 percent above trend. The metals, too, experienced double digit increases relative to trend, then moved into negative territory with the global slowdown. Again zinc is an exception. Table 3: Cyclical Components During the 1973-1975 and 2007-2009 Episodes GlobalGDP obs Cyclical Crude Oil ... Alum. Copper Nickel Lead Tin Zinc ... ... ... ... ... ... ... ... 1973 0.021 0.143 0.089 0.091 0.052 0.098 0.132 0.013 1974 0.006 0.192 0.100 0.129 0.073 0.122 0.173 0.043 1975 ‐0.016 ‐0.023 ‐0.044 ‐0.011 ‐0.012 ‐0.026 ‐0.029 0.018 ... ... ... ... ... ... ... ... 2007 0.014 0.068 0.064 0.051 0.035 0.057 0.072 0.000 2008 0.019 0.276 0.145 0.172 0.100 0.172 0.244 0.049 2009 ‐0.024 ‐0.039 ‐0.045 ‐0.007 ‐0.007 ‐0.029 ‐0.036 0.024 ... 15 V. Conclusion Metal and oil prices are notoriously volatile. It is commonly observed that they have strong co-movement at business cycle frequency. Our empirical work provides formal econometric support for these claims. We find that (with some puzzling exceptions involving nickel and zinc) that the real prices of LME metals and crude oil are much more responsive to cyclical than to trend movements in global real GDP. The business cycle upswing in the early part of the 21st century and the subsequent global slowdown explain a significant portion, but certainly not all of the sharp price movements that captivated the financial markets during this period. The results of our counter-factual simulation help to explain the cause of mineral price movements during two separate commodity boom periods. During 1973-74, the cyclical components of crude oil and copper help elevate prices above the long-term trend by 14-19 percent and 9-12 percent, respectively. Similar price movements were experienced in the most recent boom with oil and copper prices rising 27% and 17% above long-term trends by early 2008. For those of us who believe that a long-term super cycle for nonrenewable resource prices is in progress, the results in this paper on business cycle movements suggest that it would be premature to exclaim “So Long Super Cycle?!” after witnessing the metals price retreat in 2008-9. It is quite possible that business cycle movements in minerals prices could obscure long-term super cycle behavior for a period of time. Indeed, that is what we believe happened during late 2008 and early 2009. Interestingly, metal and oil prices have rebounded sharply since their troughs in 2008-9, which is consistent with our interpretation of events. 16 References Baxter, M. and R. G. King (1999). "Measuring Business Cycles: Approximate Band-Pass Filters for Economic Time Series." Review of Economics and Statistics 81(4): 575-593. Boschan and Bry (1971). Cyclical Analysis of Time Series: Selected Procedures and Computer Programs. NBER technical working paper 20. Burns, A. and W. Mitchell (1946). Measuring Business Cycles, NBER Studies in Business Cycles Cashin, P. and J. McDermott (2002). "The Long-Run Behavior of Commodity Prices: Small Trends and Big Variability." IMF Staff Papers 49: 1-26. Christiano, L. and T. Fitzgerald (2003). "The Band Pass Filter." International Economic Review 44(2): 435-465. Comin, D. and M. Gertler (2006). "Medium-Term Business Cycles." American Economic Review 96(3): 523-551. Cuddington, J. and D. Jerrett (2008). "Super Cycles in Real Metals Prices?" IMF Staff Papers 55(4): 541-565. Cuddington, J.T. and H. Liang (2001) "Will the Emergence of the Euro Affect World Commodity Prices?" in Charles Wyplosz (ed.) The Impact of EMU on Europe and the Developing Countries. Oxford University Press. Davutyan, N. and M. C. Roberts (1994). "Cyclicality in Metal Prices." Resources Policy 20(1): 49-57. Fama, E.J. and K.R. French (1988). “Business Cycles and the Behavior of Metals Prices.” The Journal of Finance 43(5): 1075-1093. Frankel, J. (1986). "Expectations and Commodity Price Dynamics: The Overshooting Model." American Journal of Agricultural Economics 68(2): 344-348. Hodrick, R. J. and E. C. Prescott (1997). "Postwar U.S. Business Cycles: An Empirical Investigation." Journal of Money, Credit and Banking 29(1): 1-16. Humphreys, D. (2009). "Comment: Unraveling the Causes of the Mineral Price Boom." Resources Policy 34(3): 103-104. Humphreys, D. (2010). "The Great Metals Boom: A Retrospective." Resources Policy 35(1): 103-104. 17 Koopmans, T. C. (1947). "Measurement Without Theory." Review of Economic Statistics 29(3): 161-172. Labys, W. C., A. Achouch, and M. Terraza. (1999). "Metal Prices and the Business Cycle." Resources Policy 25(4): 229-238. Labys, W. C., E. Kouassi, and M. Terraza.. (2000). "Short-Term Cycles In Primary Commodity Prices." The Developing Economies 330-342. Maddison, A. (2009). "Statistics on World Population, GDP and Per Capita GDP, 1-2006 AD" Retrieved September 15, 2009, from http://www.ggdc.net/maddison/. Roberts, M. C. (2009). "Duration and Characteristics of Metal Price Cycles." Resources Policy 34(3): 87-102. Radetzki, M. (2008). A Handbook of Primary Commodities in the Global Economy: Cambridge University Press. Radetzki, M., R. Eggert, Roderick. G. Lagos, M. Lima, and John E. Tilton. (2008) "The Boom in Mineral Markets: How Long Might It Last?" Resources Policy 33(3) 125-128. Radetzki, M. (2006). "The Anatomy of Three Commodity Booms." Resources Policy 31(1), 5664. Romer, C. D. (1999). "Changes in Business Cycles: Evidence and Explanations." The Journal of Economic Perspectives 13(2): 23-44. Stock, J. and M. Watson (1998). Business Cycle Fluctuations in U.S. Macroeconomic Time Series. NBER Working Paper No. 6528. Tilton, J. E. (1992). "Economics of the Metals Industries." SME Mining Engineering Handbook. H. L. Hartman. Littleton 2nd Edition Vol 1: 51-55. 18 Appendix A: Cyclical Effects Shown in Figure 3 obs Global GDP Cyclical Crude Oil Alum. Copper Nickel Lead Tin Zinc 1950 ‐0.00 NA NA NA NA NA NA NA 1951 0.01 NA NA NA NA NA NA NA 1952 0.00 0.04 0.02 0.02 0.01 0.02 0.03 0.01 1953 0.00 0.06 0.03 0.03 0.02 0.03 0.05 0.01 1954 ‐0.01 ‐0.10 ‐0.06 ‐0.06 ‐0.03 ‐0.06 ‐0.09 ‐0.01 1955 0.00 ‐0.07 ‐0.04 ‐0.05 ‐0.03 ‐0.04 ‐0.06 ‐0.02 1956 0.00 ‐0.01 0.02 0.00 0.00 0.01 0.00 ‐0.01 1957 0.00 0.02 0.03 0.03 0.02 0.03 0.03 0.00 1958 ‐0.00 ‐0.04 ‐0.01 ‐0.01 ‐0.00 ‐0.01 ‐0.02 0.00 1959 0.00 ‐0.03 ‐0.02 ‐0.01 ‐0.01 ‐0.01 ‐0.02 ‐0.00 1960 0.01 0.09 0.04 0.05 0.02 0.05 0.08 0.01 1961 ‐0.00 0.05 0.02 0.03 0.02 0.03 0.04 0.01 1962 ‐0.00 ‐0.01 ‐0.02 ‐0.01 ‐0.01 ‐0.02 ‐0.02 0.00 1963 ‐0.01 ‐0.15 ‐0.08 ‐0.09 ‐0.05 ‐0.10 ‐0.14 ‐0.02 1964 0.01 ‐0.06 ‐0.02 ‐0.04 ‐0.02 ‐0.03 ‐0.05 ‐0.02 1965 0.01 0.02 0.04 0.03 0.02 0.03 0.04 ‐0.00 1966 0.01 0.12 0.07 0.09 0.05 0.08 0.11 0.02 1967 ‐0.01 0.03 0.00 0.03 0.01 0.02 0.03 0.02 1968 ‐0.00 ‐0.01 ‐0.04 ‐0.02 ‐0.02 ‐0.02 ‐0.02 0.00 1969 ‐0.00 ‐0.02 ‐0.02 ‐0.03 ‐0.02 ‐0.02 ‐0.03 ‐0.01 1970 ‐0.00 ‐0.02 ‐0.01 ‐0.02 ‐0.01 ‐0.02 ‐0.02 ‐0.01 1971 ‐0.01 ‐0.09 ‐0.03 ‐0.05 ‐0.02 ‐0.05 ‐0.07 ‐0.02 1972 ‐0.00 ‐0.12 ‐0.04 ‐0.05 ‐0.03 ‐0.06 ‐0.09 ‐0.02 19 1973 0.02 0.14 0.09 0.09 0.05 0.10 0.13 0.01 1974 0.01 0.19 0.10 0.13 0.07 0.12 0.17 0.04 1975 ‐0.02 ‐0.02 ‐0.04 ‐0.01 ‐0.01 ‐0.03 ‐0.03 0.02 1976 ‐0.01 ‐0.09 ‐0.09 ‐0.08 ‐0.06 ‐0.08 ‐0.10 ‐0.02 1977 ‐0.00 ‐0.12 ‐0.06 ‐0.09 ‐0.05 ‐0.08 ‐0.11 ‐0.03 1978 0.00 ‐0.05 0.01 ‐0.02 ‐0.00 ‐0.01 ‐0.03 ‐0.02 1979 0.01 0.06 0.07 0.06 0.04 0.06 0.07 0.01 1980 0.00 0.09 0.05 0.07 0.04 0.07 0.09 0.03 1981 0.00 0.08 0.02 0.05 0.02 0.04 0.06 0.03 1982 ‐0.01 ‐0.05 ‐0.05 ‐0.04 ‐0.03 ‐0.04 ‐0.05 ‐0.00 1983 ‐0.01 ‐0.12 ‐0.07 ‐0.09 ‐0.05 ‐0.08 ‐0.11 ‐0.03 1984 0.01 ‐0.01 0.01 ‐0.02 ‐0.00 ‐0.00 ‐0.01 ‐0.02 1985 0.01 0.05 0.05 0.04 0.03 0.04 0.06 0.01 1986 ‐0.00 0.03 0.02 0.03 0.02 0.03 0.03 0.01 1987 ‐0.00 ‐0.03 ‐0.03 ‐0.01 ‐0.01 ‐0.02 ‐0.03 0.00 1988 0.00 ‐0.02 ‐0.02 ‐0.02 ‐0.02 ‐0.01 ‐0.02 ‐0.00 1989 0.00 0.02 0.01 0.01 0.00 0.01 0.01 ‐0.00 1990 0.00 0.03 0.02 0.02 0.01 0.02 0.03 0.00 1991 ‐0.00 ‐0.01 ‐0.01 ‐0.00 0.00 ‐0.01 ‐0.01 0.00 1992 ‐0.00 ‐0.01 ‐0.01 ‐0.01 ‐0.01 ‐0.01 ‐0.02 ‐0.00 1993 ‐0.00 ‐0.05 ‐0.02 ‐0.03 ‐0.02 ‐0.03 ‐0.04 ‐0.01 1994 0.00 ‐0.03 ‐0.01 ‐0.01 ‐0.01 ‐0.01 ‐0.02 ‐0.01 1995 0.01 0.04 0.03 0.03 0.02 0.03 0.04 0.00 1996 0.00 0.05 0.03 0.04 0.02 0.03 0.05 0.01 1997 0.00 0.08 0.02 0.04 0.02 0.04 0.06 0.02 1998 ‐0.01 ‐0.07 ‐0.05 ‐0.05 ‐0.03 ‐0.05 ‐0.07 ‐0.00 1999 ‐0.01 ‐0.14 ‐0.07 ‐0.09 ‐0.05 ‐0.09 ‐0.13 ‐0.03 20 2000 0.01 0.01 0.03 0.00 0.00 0.01 0.02 ‐0.01 2001 0.01 0.09 0.07 0.07 0.05 0.07 0.09 0.01 2002 ‐0.00 0.07 0.03 0.05 0.03 0.05 0.06 0.02 2003 ‐0.00 0.02 ‐0.02 0.01 ‐0.00 0.00 0.01 0.01 2004 ‐0.00 ‐0.03 ‐0.04 ‐0.03 ‐0.02 ‐0.03 ‐0.04 ‐0.00 2005 ‐0.01 ‐0.12 ‐0.06 ‐0.08 ‐0.04 ‐0.07 ‐0.10 ‐0.02 2006 ‐0.00 ‐0.11 ‐0.03 ‐0.06 ‐0.03 ‐0.06 ‐0.09 ‐0.03 2007 0.01 0.07 0.06 0.05 0.04 0.06 0.07 0.00 2008 0.02 0.28 0.15 0.17 0.10 0.17 0.24 0.05 2009 ‐0.02 ‐0.04 ‐0.05 ‐0.01 ‐0.01 ‐0.03 ‐0.04 0.02 21