7. CityLYNX Gold Line Phase 2

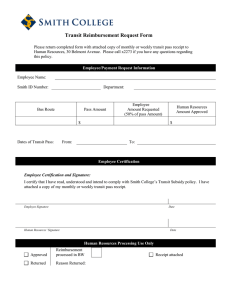

advertisement