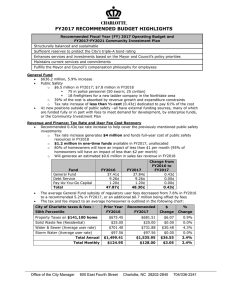

FY2016 & FY2017 PRELIMINARY STRATEGIC OPERATING PLAN

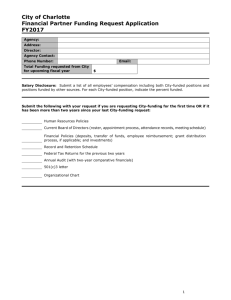

advertisement