Transportation & Planning Committee Monday, March 18, 2013 1:30 – 3:00 p.m.

advertisement

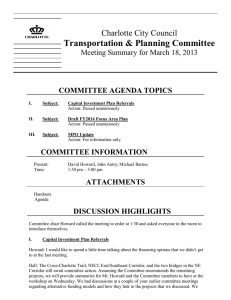

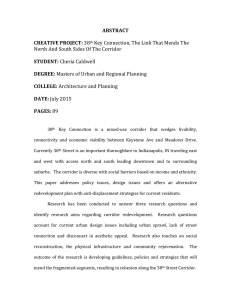

Transportation & Planning Committee Monday, March 18, 2013 1:30 – 3:00 p.m. Charlotte-Mecklenburg Government Center Room 280 Committee Members: Staff Resource: David Howard, Chair Michael Barnes, Vice Chair John Autry Warren Cooksey Patsy Kinsey Ruffin Hall, Assistant City Manager AGENDA I. Capital Investment Plan Referrals – 45 minutes Staff Resource: Ruffin Hall Consider a recommendation on CIP Projects referred to the Committee in preparation for the March 20 Council Budget Workshop. Action: Committee Recommendation Attachment: 1. Q&A from the February 11 Committee meeting.doc II. Draft FY2014 Focus Area Plan – 30 minutes Staff Resources: Debra Campbell, Planning Danny Pleasant, Transportation The Committee will review and finalize the Focus Area Plan Action: Committee Recommendation Attachment: 2. Draft-FY2014 Strategic Focus Area Plan.doc III. MPO Update – 15 minutes Staff Resource: Bob Cook, Planning Staff will provide the Committee with the latest updates. Action: For information only Next Scheduled Meeting: Thursday, March 28, 2013 – 12:00 p.m. Future Topics-Blue Line Extension Station Area Plans, Parking and Housing Issues Near Colleges and Universities, Park Woodlawn Area Plan Distribution: Mayor & City Council Transportation Cabinet Robert Cook Julie Burch, Interim City Manager Debra Campbell Leadership Team Danny Pleasant Questions and Answers February 11, 2013 Transportation & Planning Committee Meeting Question 5 (Howard and Cooksey): What are the options for using alternative financing tools such as TIFs, TIGs, STIFs, MSDs, and SADs to fund the Cross-Charlotte Trail, the East/Southeast Corridor, the two bridges in the Northeast Corridor, and NECI? Below are descriptions and staff assessments of each of the alternative financing tools that could be considered for funding the Cross-Charlotte Trail, the East/Southeast Corridor, the two bridges in the Northeast Corridor, and NECI. Staff assessments are based on the authorized use and purpose of these financing tools, as well as on the financial and practical viability of each tool in conjunction with the specific project areas. Tax Increment Financing (TIF) – Tax Increment Financing is a debt-financing tool authorized by a constitutional amendment approved by North Carolina voters in 2004. In a true TIF, a district is legally established, funds are borrowed and used for public improvements in the district, and incremental taxes (i.e., property taxes collected from the district above the amount collected in the area prior to establishment of the district) are pledged as security for the debt. In a TIF, a municipality pledges incremental taxes from an area with multiple property owners, all of whom are impacted somehow by the project financed by the TIF. The City could then issues bonds, typically 20 to 30 years in length of term, backed by the incremental taxes created by the multiple properties. The bonds could be issued before the project occurs and be used to pay for the project up front. TIF Assessment: Transportation infrastructure development is an eligible public use of funds generated by the TIF powers articulated in Chapter 159 of the State General Statutes. NECI, the Northeast Corridor Bridges, the East/Southeast Corridor streetscape and road improvements would likely qualify for TIF financing. The Cross Charlotte Trail may also qualify for a TIF Assessment but staff will need to conduct further research to confirm whether this type of facility is eligible under the current statute. Some considerations for using TIFs for these projects include: • Charlotte has never done a true TIF since interest rates are typically higher than more traditional financing devices (e.g., COPs, GO Bonds, special obligation bonds) due to the speculative nature of incremental taxes. • Because a TIF is subject to oversight from the Local Government Commission (LGC), the State of North Carolina has developed specific rules and limits on a TIF. The most notable is that no more than 5% of a municipality’s land mass can be subject to a TIF. If the 5% land area threshold is neared, the City would be unable to use TIF for other projects until the existing TIF expires. Additionally, the City would be required by the LGC to create a development plan for the TIF district that outlines the planned development and expected incremental valuation growth to repay the debt on the infrastructure investments. • The City would be required to guarantee the bonds from other sources if the project does not generate enough incremental tax revenue to cover bond payments over the life of the bond. Unlike the TIG structure, the City carries the risk for the debt with a TIF. • Implementing a true TIF is a timely process that could take 12 to 24 months to complete. The statutorily defined process includes creating a project development financing plan, establishing the base valuation of the proposed district, providing written public notice to all property owners in the defined district, holding a public hearing, and obtaining approval from the LGC and Secretary of Commerce. Tax Increment Grant (TIG) – is a local funding option Charlotte has used to capture incremental taxes as part of an economic development agreement with a developer or business. Typically the grant is paid over a series of years to either reimburse the developer for constructing public improvements (such as streets) as part of their project, or for creating jobs and increasing the tax base. In this model, the developer or business takes the risk of not being fully reimbursed or compensated if it is not successful in generating sufficient incremental taxes. Examples include reimbursing the developer for the cost of raising and improving Eighth Street as part of the Levine First Ward project, the Ballantyne Road improvements infrastructure reimbursement agreement, and grants made to businesses through the Business Investment Program. TIG Assessment: The City has used TIGs, but only in the context of a reimbursement agreement with a developer or business making a significant private capital investment. The proceeds from the incremental taxes are paid over a series of years to reimburse a developer for their initial investment. Some considerations for using TIGs for these projects include: • A TIG would be a viable financing tool for the transportation CIP projects if a known private developer was willing to front the capital costs and provide additional development whose incremental property tax revenue could be used to reimburse the developer for a portion of the upfront capital costs. • Staff is currently unaware of any developer interest to fund construction of the Cross Charlotte Trail, the East/Southeast Corridor, the two Northeast Corridor Bridges, or NECI. Synthetic Tax Increment Financing (STIF) – Synthetic Tax Increment Financing is a local policy device that mimics a TIF but takes advantage of the lower interest rates of more traditional financing devices. A STIF works similar to a TIF in that the projected incremental taxes are identified as the source of debt service, but are not pledged as security for the debt. An example of a STIF is the cultural arts facilities project where the City financed the acquisition of the four facilities (i.e., Bechtler, Mint, Gantt, and Knight) with COPs, but developed a financing model that uses incremental taxes from the Duke Energy Center tower (guaranteed by Wachovia/ Wells-Fargo) along with funds made available from the vehicle rental tax to service the debt. STIF Assessment: The City has also used STIFs, but as with the TIG, they have so far only been used in the context of a public private partnership with a developer or business making a significant private capital investment to provide sufficient incremental new property taxes to finance the infrastructure cost. However, because STIFs are a City policy device rather than a statutorily regulated financing tool, the City does have more flexibility to initiate a STIF mechanism to fund City infrastructure projects without private investment participation. To be successful, a City-defined STIF district would need to generate significant-enough growth in incremental tax revenues to support the cost of the City’s capital investments. Some considerations for using STIFs for these projects include: • Portions of the Cross-Charlotte Trail, particularly around the potential development nodes, may see sufficient future growth in incremental taxes to support some of the costs of this project. Other predominantly residential portions of the Trail may not be appropriate for a STIF mechanism, and likely would not generate sufficient incremental tax revenue growth. • There are also potentially significant development opportunities for the properties around the NECI project corridor and the two Northeast Corridor bridges that could ultimately generate sufficient incremental tax revenues to support the cost of constructing these projects. • Incremental taxes from some of the properties around the South Bridge are already dedicated to the City’s IKEA Boulevard infrastructure reimbursement agreement and would not be available for use as tax increment boundaries for any additional project. See Attachment 2 showing the IKEA Blvd tax increment boundaries. • The proceeds from incremental taxes generated by subsequent economic development occurring around the City’s capital investment would not be realized for some time, until after the projects are complete. As a result, initial revenue from the STIF areas would not be sufficient to support the cost of constructing the capital projects nor the initial debt service payments. The City would need to identify another funding source for the initial investment. • One potential hybrid use of a STIF approach could be for the designation of STIF districts around the areas of the proposed capital investments with the incremental property tax revenue “banked” to fund other, future capital investments. • Due to the speculative nature of potential incremental tax growth resulting from the City’s capital investments, debt service on the funds borrowed to pay for these projects would be more costly than traditional financing tools. Municipal Service District (MSD) – As established in NC §160A-536, MSDs may be established by City Council for the purposes of providing one or more of the statutorily authorized services, facilities, or functions in addition to or to a greater extent than provided in the rest of the city: Statutory purposes of an MSD (may provide one or more services/facilities/functions) beach erosion control and flood and hurricane protection works sewage collection and disposal systems downtown revitalization projects drainage projects urban area revitalization projects off-street parking facilities transit-oriented development projects watershed improvement projects Successfully designed MSDs have easily identifiable geographies to generate revenues to finance, provide, enhance, and maintain the economic vitality and quality of life in the central business district or other commercial areas. MSD revenues are generated through an ad valorem property tax paid by the property owners (residential and commercial) in the designated districts and must be spent on programs and services that enhance the quality of the districts. MSD Assessment: Municipal Service Districts can be a viable option for generating revenue to support the cost of City investments in economic and transit-oriented development projects. The City currently has five active MSDs that are successfully supporting and promoting economic development and urban revitalization in Center City, South End, and University City. State statutes define very specific purposes for establishing an MSD, and the proposed CIP projects have varying degrees of eligibility and appropriateness for their use. Some considerations for using MSDs for these projects include: • The City has local authority to create and define the boundaries of an MSD and to set the appropriate ad valorem tax rate through City Council approval. • The statutorily defined process for establishing and implementing an MSD, including notifying affected property owners, obtaining community input, and holding a public hearing, would likely require 12 – 18 months to complete. Once a district is established though, the City could begin collecting MSD tax revenues immediately. • Unlike with tax increment financing tools, MSD revenues can be used to support the cost of the City’s capital investments without the need for upfront private investments. • Based on the defined statutory purposes of an MSD, it is unclear whether the entire Cross-Charlotte Trail would qualify as an urban area revitalization or transitoriented development. Staff would need to conduct a legal assessment to verify the eligibility of funding of the Trail through an MSD. • The East/Southeast Corridor road improvements likely qualify as urban area revitalization and transit-oriented development projects under the MSD statutes, but may not be the best candidates for MSDs due to their proximity to predominantly residential communities, which would bear the brunt of the additional tax assessment. • The two Northeast Corridor Bridges and the NECI project corridor would be ideal candidates for an MSD. However, both bridges and a portion of NECI are already within the existing University City MSD. Properties within this MSD already have a dedicated property tax of 2.79 cents which generates approximately $640,000 annually and is used to fund the operations of University City Partners, Inc. See Attachment 3 showing the current boundaries of the University City MSD. • Increasing the current University City MSD tax rate to support the cost of the NECI and bridge projects would require a higher tax rate on the property owners within the district. For example, in order to pay for the $14.5 million South Bridge from IBM Drive to Ikea Blvd, the tax rate for the University City MSD would need to increase from 2.79 cents to 9.13 cents. This additional 6.34 cent tax rate would cost property owners $63.40 in additional annual taxes for every $100,000 in property value. A property valued at $200,000 would pay $126.80 in additional property tax each year to support the South Bridge project. • A new or expanded MSD boundary could also be established along the remaining NECI project corridor that lies outside the existing University City MSD. Special Assessment Districts (SADs) – Similar to MSDs, Special Assessment Districts pay for public improvements that benefit the property affected by the improvement. The City levies a special assessment related to the benefit received by the property owner. There are two types of Special Assessments – Traditional and New. The information below provides further detail on Traditional Special Assessments, New Special Assessments, and the difference between New Special Assessments and MSDs Traditional Special Assessments - As established in NC § 160A-216, these Special Assessments may be approved by City Council for the purposes of providing one or more of the statutorily authorized services or functions in addition to or to a greater extent than provided in the rest of the city. The City must pay for the full costs of the public improvement upfront, and then may recoup costs through the assessment once the project is complete. Statutory purposes of Traditional Special Assessments (may provide one or more services/functions) beach erosion control and flood and hurricane protection works water systems curbs and gutters; streets sewage collection and disposal systems Sidewalks storm sewer and drainage systems New Special Assessments - During the 2008 and 2009 legislative sessions, the General Assembly granted a new level of assessment authority – entitled “special assessments for critical infrastructure needs.” This new assessment authority is effective August 3, 2008 until July 1, 2013. Statutory purposes of New Special Assessments, effective until July 1, 2013 (applies to capital costs) Auditoriums, coliseums, arenas, stadiums, art galleries, museums Public transportation facilities, including equipment, buses, railways, ferries, and garages Housing projects for low to moderate income Sanitary sewer systems On- and off-street parking and parking facilities Streets and sidewalks Other differences between the new special assessment method and traditional special assessment method include: • Requires a petition signed by at least a majority of property owners to be assessed who represent at least 66% of the assessed value • Authorizes borrowing money to front the costs of projects for which assessments may be imposed according to one or more of the following methods: revenue bonds, project development financing debt instruments, general obligation bonds • Allows special assessment before the projects being financed are complete • Does not expressly limit the bases upon which the assessment may be made Instead, leaving the bases of the assessments within the discretion of the governing board, subject to the requirement that the assessments bear some relationship to the amount of benefit that accrues to the assessed property. • Authorizes governing board to allow assessments to be paid in up to 30 annual installments, with interest Key Differences between New Special Assessments and MSDs • Special Assessment projects are typically more focused and specialized in nature; for example, a Special Assessment may fund a sidewalk, while an MSD may fund an urban area revitalization • For a Special Assessment, both private and non-profit entities pay the established assessment rate (with the exception of property owned by the federal government); conversely, for an MSD, non-profit entities such as Presbyterian Healthcare, Johnson & Wales University, and Johnson C. Smith University, would be exempt from paying property taxes • The process for a Special Assessment begins with a petition signed by at least a majority of property owners to be assessed who represent at least 66% of the assessed value; whereas, the MSD process is initiated by a proposal or report from City Council. SAD Assessment: Special Assessment Districts could also be a viable option for generating revenue to support the cost of some transportation capital investments. An advantage of using a SAD is that, unlike MSDs, tax assessments within the district would be applied to all property owners. SADs do not exempt non-profit entities from the tax assessment as MSDs do. With the possible exception of the Cross-Charlotte Trail and the two Northeast Corridor Bridges, Staff believes Special Assessment Districts could be used to support the funding of the proposed transportation-related projects. Some considerations for using a New SAD for these projects include: • The NECI project, which is essentially transportation improvements around the BLE transit station areas including streets, curb and gutter and other road improvements would likely qualify for both a Traditional and a New SAD, but boundaries for a potential SAD district along the NECI corridor would overlap the existing University City MSD, potentially adding to the existing tax burden on property owners in those areas. • Within the East/Southeast Corridor, the Monroe Road Streetscape, Idlewild Road/Monroe Road Intersection, and the Sidewalk and Bikeway Improvement projects would likely qualify for both a Traditional and a New SAD. However, the New SAD regulations limit the district boundaries to property owners which show a unique benefit from the public improvement. With these East/Southeast Corridor projects spread throughout the Corridor, creating a defensible SAD boundary around all of the projects that generates the necessary revenue to pay for them while adhering to the unique benefits requirement would be difficult. • It is unclear whether the Cross-Charlotte Trail or the two Northeast Corridor Bridges would meet the statutorily defined purposes of Traditional or New Special Assessment Districts. Both types of assessment districts allow the use for street and sidewalk projects, and much of the Cross-Charlotte Trail will be comprised of urban trail components such as paved walking trails, which may fall within the allowed uses. However, neither assessment district mentions bridges as an approved purpose for establishing a SAD, but the “public transportation facilities” allowed under a New SAD could be interpreted to include bridges. Staff would need to conduct a legal assessment to verify the eligibility of funding of the CrossCharlotte Trail and the two bridges through a SAD. • A significant impediment to the use of a New SAD for any of the CIP projects is that the statutory authorization for creating a New SAD expires July 1, 2013. Extension of the New SAD authorization would require State legislative approval. City Council’s approved 2013 State Legislative Agenda includes a proposal to extend the sunset date of the Special Assessments for Critical Infrastructure Needs Act from July 1, 2013 to July 1, 2018. • Another consideration for use of New Special Assessment Districts is that any assessment must be approved by a majority of the property owners who also represent at least 66% of the proposed district’s assessed value. ´ Attachment 2 IKEA Tax Increment Grant Project Area 500 Feet IB M Dr M 1 6 10 04 7 4 Cla rk B 6 2 12 04 7 2 04 74 6 3 14 04722140 10 2 Brookside L n Ra S ity Bv bC T b I-85 o W 04722127 Cit S I85 y B vx I-85 Ra N Hy NB N I-8 5H y 04 7 4 6 10 6 University Pointe Bv y Cit 85x SB S I v Ra B nS Try o 10 3 14 1 N I8 5 R a SB BvxS 04 72 2 14 2 rS t y C it 85x a NB I N vR B 04 72 2 Bv University City Ty ne City t 04722133 04 74 6 3 72 04 8 10 Ri St et so cfa Ma ne rla Bv Neighborhood & Business Services, February 15, 2013 n Dr Dr v e e rsity Park Dr v 2 72 04 lloug h Un i v Ex ec ut i IK B EA cc u W R ver ocky Rd v Attachment 3 Map of MSD for University City DRAFT - FY2014 Strategic Focus Area Plan “Charlotte will be the premier city in the country for integrating land use and transportation choices.” Safe, convenient, efficient, and sustainable transportation choices are critical to a viable community. The City of Charlotte takes a proactive approach to land use and transportation planning. This can be seen in the Centers, Corridors and Wedges Growth Framework, the Transportation Action Plan and the 2030 Transit Corridor System Plan that provide the context for the Transportation Focus Area Plan. The City’s strategy focuses on integrating land use and transportation choices for motorists, transit users, bicyclists and pedestrians. A combination of sound land use planning and continued transportation investment will be necessary to accommodate Charlotte’s growth, enhance quality of life and support the City’s efforts to attract and retain businesses and jobs. Focus Area Initiative Measure Reduce annual hours of congestion per traveler, as measured by Texas Transportation Institute, for the Charlotte Urban Area compared to top 25 cities Reduce Vehicle Miles Travelled (VMT) per capita Enhance multimodal mobility, environmental quality and long-term sustainability Decrease commute times Accelerate implementation of 2030 Transit Corridor System Plan as conditions allow: 1. LYNX BLE FY 2012 Actual FY 2013 Mid-Year Status .8% increase Charlotte: 0.7% Top 25: .7% Top 25: - 3.4% NA NA 40.8% NA FY2014 Target Any increase will be less than 5-year average of top 25 cities Reduce VMT per capita from prior year Increase the percent of Charlotte commuters with a commute time of less than 20 minutes. DEIS Complete FFGA Approved 1. Begin construction by 6/30/14 2. Streetcar Starter Project PE Complete Construction underway 2. Complete construction by June 30, 2015 3. Transit Ridership 3% Goal 6.4% Actual 0% Goal 0.3% YTD Oct 2012 3. Increase by 2% 4. Red Line Advanced Work Plan NA 4. Participate in NCDOT/NS Corp “O” Line Capacity Study Transportation | 1 Focus Area Initiative Measure Improve Charlotte’s walkability and bicyclefriendliness Promote transportation choices, land use objectives, and transportation investments that improve safety, promote sustainability and livability Communicate land use and transportation objectives as outlined in the Transportation Action Plan (TAP) Seek financial resources, external grants, and funding partnerships necessary to implement transportation programs and services Decrease vehicle accidents per mile traveled by monitoring crashes annually and identifying, analyzing and investigating hazardous locations and concentrating on patterns of correctable crashes Improve City Pavement Condition Survey Rating Increase % of transportation bond road projects completed or forecast to be completed on schedule Complete and present TAP Annual Report to the City Council The City will work with MUMPO to initiate the 2040 Long Range Transportation Plan to help advance economic development and regional land use goals. Collaborate with regional partners on CONNECT, to plan for future growth and development. Work with legislative partners and stakeholders to consider new revenue sources to fund transportation improvements. Develop CIP funding strategy for transportation improvements FY 2012 Actual NA (New) FY 2013 Mid-Year Status NA (New) NA (New) NA (New) NA (New) NA (New) NA (New) 18.8 sidewalk 11.1 bikeways NA (New) 13.4 sidewalk 2.5 bikeways -23.5% NA (Reported at end of year) 88 85.4 Achieve Survey Rating of 90 79% 73% 90% or better Met Met Complete by January 2014 FY2014 Target Increase Charlotte’s walk score relative to peer cities. Increase Charlotte’s walk score in mixed-use activity centers and transit station areas. Complete a scan of City policies and practices impacting walkability and recommend needed improvements by June 2014. Implement 15 or more pedestrian safety and/or crossing projects by June 2014. Implement 10 miles of new sidewalk and 10 miles of new bikeways annually. Decrease vehicle accidents per mile traveled below prior year Complete project ranking by August 2013 N/A N/A MPO approval of 2040 LRTP by March 2014 Collaborate with CONNECT Partners to engage the public in developing a consensus growth scenario by June 2014. N/A (New) N/A (New) Continue to evaluate the legislative environment regarding new revenue sources and lend support to acceptable solutions. N/A (New) N/A (New) Develop project list for CIP bond funding. Transportation | 2