Proceedings of 10th Global Business and Social Science Research Conference

advertisement

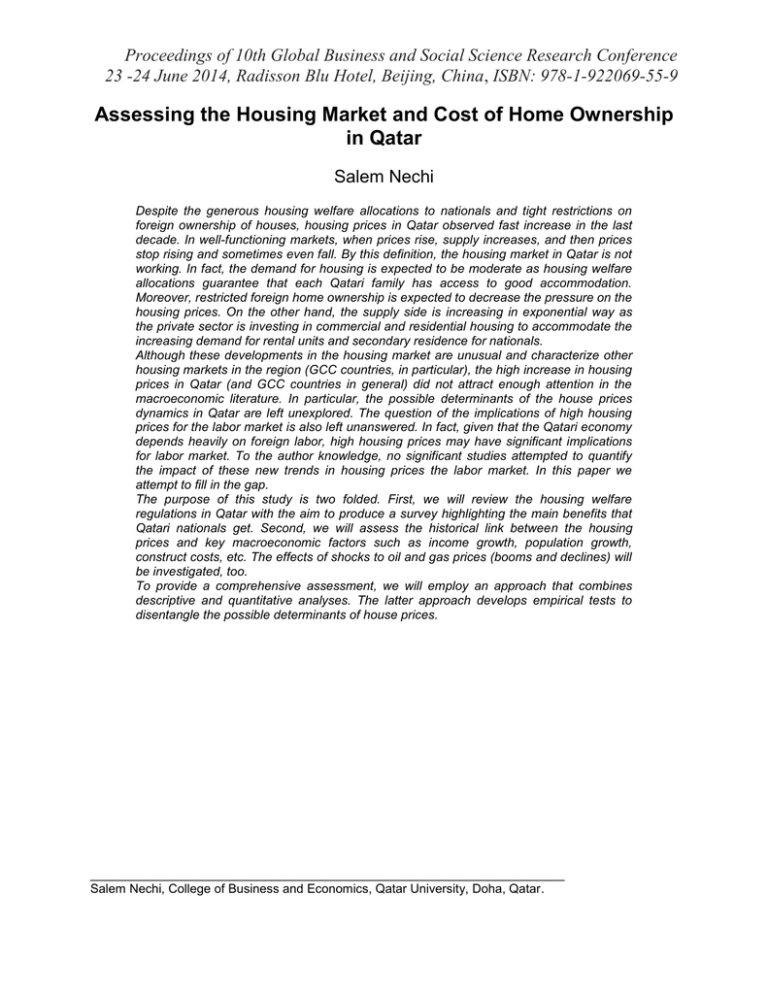

Proceedings of 10th Global Business and Social Science Research Conference 23 -24 June 2014, Radisson Blu Hotel, Beijing, China, ISBN: 978-1-922069-55-9 Assessing the Housing Market and Cost of Home Ownership in Qatar Salem Nechi Despite the generous housing welfare allocations to nationals and tight restrictions on foreign ownership of houses, housing prices in Qatar observed fast increase in the last decade. In well-functioning markets, when prices rise, supply increases, and then prices stop rising and sometimes even fall. By this definition, the housing market in Qatar is not working. In fact, the demand for housing is expected to be moderate as housing welfare allocations guarantee that each Qatari family has access to good accommodation. Moreover, restricted foreign home ownership is expected to decrease the pressure on the housing prices. On the other hand, the supply side is increasing in exponential way as the private sector is investing in commercial and residential housing to accommodate the increasing demand for rental units and secondary residence for nationals. Although these developments in the housing market are unusual and characterize other housing markets in the region (GCC countries, in particular), the high increase in housing prices in Qatar (and GCC countries in general) did not attract enough attention in the macroeconomic literature. In particular, the possible determinants of the house prices dynamics in Qatar are left unexplored. The question of the implications of high housing prices for the labor market is also left unanswered. In fact, given that the Qatari economy depends heavily on foreign labor, high housing prices may have significant implications for labor market. To the author knowledge, no significant studies attempted to quantify the impact of these new trends in housing prices the labor market. In this paper we attempt to fill in the gap. The purpose of this study is two folded. First, we will review the housing welfare regulations in Qatar with the aim to produce a survey highlighting the main benefits that Qatari nationals get. Second, we will assess the historical link between the housing prices and key macroeconomic factors such as income growth, population growth, construct costs, etc. The effects of shocks to oil and gas prices (booms and declines) will be investigated, too. To provide a comprehensive assessment, we will employ an approach that combines descriptive and quantitative analyses. The latter approach develops empirical tests to disentangle the possible determinants of house prices. ____________________________________________________________________ Salem Nechi, College of Business and Economics, Qatar University, Doha, Qatar.