Proceedings of 21st International Business Research Conference

advertisement

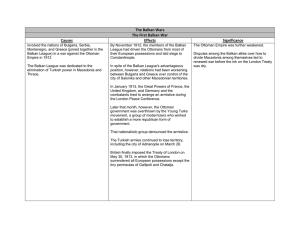

Proceedings of 21st International Business Research Conference 10 - 11 June, 2013, Ryerson University, Toronto, Canada, ISBN: 978-1-922069-25-2 Business Cycles and EU Integration for the Balkan Region John Ebio*, Scott W. Hegerty*, Steven Kania*, Raidas Korsakas*, Nicholas Malone*, Batkhuu Narankhuu*, and Michael Wenz*,+ The global financial crisis has exposed problems with coordination of monetary policy around the globe and especially throughout the Euro currency area. This paper examines the correlations in business cycles through the Balkan region to examine whether adopting the Euro is an appropriate strategy. Results show that business cycles in certain Balkan nations are in general not contemporaneously correlated with each other or with comparison countries such as Germany, Poland and the United States. Results do show that Croatian business cycles are correlated with Russian business cycles, but overall, integration of the Balkan economies into the Euro zone is not consistent with the theory of Optimal Currency Areas. JEL Codes: E32, F42 1. Introduction Over the past decade, the European Union has expanded to include the former communist countries of Central and Southeast Europe. While the first ―new‖ members of this now-27-member body included more advanced economies such as Poland, Estonia, and Slovenia, attention is now turning toward the Balkan nations and the former Yugoslavia. On July 1, 2013, Croatia is set to join the European Union, while Serbia is still negotiating its accession. The Balkan nations are located in Southeastern Europe and are generally considered to include the Balkan Peninsula and the nations of the Former Yugoslavia (and exclude Greece). We focus our study on the nations of Croatia, Serbia, Bulgaria and Romania in hopes of identifying their suitability for joining the Euro common currency area. Croatia, formerly a part of Yugoslavia with historic ties to Austria, is a nation with a highly developed infrastructure and many waterfront resort areas that have made it a major tourist destination in Eastern Europe. Another former Yugoslav territory included in this study is Serbia, whose abundance of mineral resources and relative political stabilization have led to its steady economic growth over the past decade. Bulgaria was included due to how similar its economy is to the other subject nations, which is largely driven by its exports of energy and timber, as well as geographic proximity. The final nation included is Romania, whose sustained economic growth can be attributed to its vast natural resources and strong agriculture and manufacturing industries. These latter two countries joined the EU in 2007, though they have not adopted the Euro. __________________________________________________________________ *Department of Economics, Northeastern Illinois University, Chicago, IL 60625. + Corresponding Author. E-mail: m-wenz@neiu.edu 1 Proceedings of 21st International Business Research Conference 10 - 11 June, 2013, Ryerson University, Toronto, Canada, ISBN: 978-1-922069-25-2 The countries of the former Soviet bloc have economies that differ greatly from those of Germany and Western Europe, and this is even truer for countries that have been unable to join the EU until now. Economic theory suggests that countries in a common currency area should have economies that behave similarly, however. We examine time series correlations in GDP between the four Balkan nations identified above and five comparison countries, including some within and some outside the Euro area. The findings in this paper indicate that the Balkan nations have business cycles that are not well synchronized with other key comparison countries in the European Union. These nations should proceed with great care as they consider and move toward adoption of the Euro as a common currency. 2. Literature Review According to the Optimal Currency Area (OCA) theory of Mundell (1961), policymakers will be unable to solve different regions’ problems using a single set of policy tools if these economies do not move in a similar fashion. Mundell’s OCA theory states that whenever a region such as the European Union shares a common currency, the ability of each participant country to cope with international or interregional pressures on their prices and output through monetary policy is diminished. The Central Bank set up by the treaties of the union must address the needs of each member country within its policies; this leaves the union and its member countries with limited potential responses to economic turmoil. If member countries are not within the same business cycle, policy developed to benefit one will have negative effects on the others. Suppose countries A and B share a common currency. When country B is afflicted by a negative supply shock it will push a policy to relieve that economic stress. If country A was intertwined with country B to the point they also experienced the negative effects of the supply shock, country A would agree to the new policy. If country A is unaffected by country B's supply shock they would not support the use of expansionary monetary policy to fight the downturn and try to avoid the inflation those policies would cause. Avoiding this conundrum is important for countries with a common currency and this is why identification of member countries correlations with each other is important. We thus endeavor to measure how similar these economies are. Most recent analyses of these interconnections have focused on the West (e.g., Backus et al., 1992; Imbs, 2004; Inagaki, 2006; and Furceri and Karras, 2008). Even those studies that have focused on transition economies (such as Hegerty, 2010) have focused on the more integrated countries to the north. Questions regarding the Balkans have gone unanswered, in part because the former Yugoslavian countries do not have a history long enough to perform reliable time series analysis. As sufficient data becomes available, it is now possible to expand this research into a study of Balkan countries to examine how compatible they really are with the Euro area. As noted by Hegerty (2010), early studies on business-cycle integration include Horvath and Rátfai (2004), Babetskii (2005), Benczúr and Rátfai (2005), Fidrmuc and Korhonen (2006), Artis et al. (2008), and Darvas and Szapáry (2008). These 2 Proceedings of 21st International Business Research Conference 10 - 11 June, 2013, Ryerson University, Toronto, Canada, ISBN: 978-1-922069-25-2 studies not only examine time periods that end well before the recent crisis, they also focus on various facets of integration rather than the relative strength of particular regional interconnections. Some focus specifically on modeling a country’s businesscycle dynamics without estimating regional connections. An example is Šergo et al. (2012)’s study of the case of Croatia and the resulting stylized facts. These authors considered many economic parts, such as vacancy rates, tourism patterns, price and productivity indices, trade flows, wages, exchange rates, and the money supply. By calculating the strength of the correlation between variables of the economic components or between economic components and the reference variables (such as output), this study found that the strong co-movements were between the growth of vacancy rates and tourist arrivals, and the growth of vacancy rate and exports. While that study focused on internal Croatian metrics, the methodology may help indicate whether the economy of a country is compatible for economic integration into a currency area such as the European Union. In one of the few multi-country analyses, Hegerty (2010) studied Poland, Hungary, the Czech Republic, Estonia, Latvia, and Lithuania, and deconstructed each economy into output (Y), consumption (C), government spending (G), investment (I), exports (X), and imports (M). Using these components, the strength of cross correlations were calculated between the Eastern European nations themselves, with the European Union, and with global cycles. This paper found that the Baltics were more closely linked to global cycles, and to each other, than with the European Union. This sort of extensive volatility analysis helps identify whether a country’s economy would be a good fit for a system where there is only one monetary policy for all participating members. This has important implications for the Euro, particularly since Estonia has since joined the common currency. We extend the literature here to conduct a similar analysis for four countries in the Balkan region. 3. Methodology Using data from the International Financial Statistics of the International Monetary Fund, we measure real GDP as well as its components (C, I, G, X, and M) by dividing nominal values by the Consumer Price Index or GDP deflator. Our data are quarterly, generally beginning in the mid 1990s and ending in 2012. The available countries for this analysis are Croatia, Bulgaria, and Romania for all GDP components and Serbia for GDP only. Quarterly data are not readily available for some countries of the former Yugoslavia (such as Macedonia) and are therefore not included. We also look for connections among real output and consumption series for five partner countries, listed below. It is typical to view each of these time series as having three components, a seasonal component, a cyclical component, and a trend. We first deseasonalize our real variables to eliminate within-year seasonal fluctuations using the Census-X12 procedure. We then decompose each series into its trend and cyclical component using the Hodrick-Prescott filter (lambda = 1600). The H-P filter uses the data to estimate and separate out the trend component of the series. Applying the filter allows us to isolate the cyclical fluctuations in the various time series. These cyclical fluctuations, presented in Figure 1, are the focus of our study. 3 Proceedings of 21st International Business Research Conference 10 - 11 June, 2013, Ryerson University, Toronto, Canada, ISBN: 978-1-922069-25-2 Figure 1: Business Cycles of Balkan and Partner Countries Bulgaria Croatia Romania Serbia Germany Turkey Poland Russia U.S. Next, we use these cycles to estimate cross-correlation functions between various country pairs as follows: X t X Y t kY t k (1) 2 2 X t X Y t kY 4 Proceedings of 21st International Business Research Conference 10 - 11 June, 2013, Ryerson University, Toronto, Canada, ISBN: 978-1-922069-25-2 Here, X and Y represent two comparison countries, t represents the time period in country X, and k represents the lead or lag in country Y, where k = 0 for the contemporaneous observation. These are measured over a span of four lead quarters and four lag quarters. As estimated here, the correlation at ―+2‖ quarters measures the relationship between the Balkan country’s current variable and the partner country’s variable two quarters previous (the Balkan country ―lags‖ its partner). At ―-2,‖ the Balkan country leads, with its variable tied to its partner’s future value. In our study, we investigate synchronization—whether the highest correlation occurs contemporaneously so that business cycles move together. We aim to answer two key questions in our analysis. First, are Balkan business cycles more closely integrated with the core of the Eurozone than with other potential partner countries? According to OCA theory, these cycles must move in a similar fashion between countries over time for the economies to be considered compatible and amenable for economic integration. We use Germany to represent the ―core‖ country in the Eurozone, expecting that, if the Balkans are to share a monetary policy with the Eurozone, these contemporaneous correlations must be highest with Germany. For comparison, we also include neighboring countries Turkey, Poland, and Russia; to capture global effects, we also include the United States. In our second question, we address the well-known ―Consumption Correlations Puzzle.‖ According to economic theory, increased integration creates the opportunity for risk sharing among economies as many of the trade barriers begin to disappear, factors of production become more mobile, and economic interdependence increases, thus allowing the economies to maintain their level of consumption regardless of output shocks. As a result, consumption correlations should be higher between countries than are output correlations. But, as Obstfeld and Rogoff (2000) point out, the theory has not been proven empirically by noting that consumption levels in actuality are even less correlated than those of output, which suggests that the risk sharing should be quite minimal. We compare these two components to see if the ―puzzle‖ persists in the Balkans. 4. Results Figure 1 shows our generated GDP cycles for each of the four Balkan and five partner countries. We see similar patterns—particularly the ―boom‖ right before the 2008 crash—for many of them. But many other movements, such as around Bulgaria’s 1997 hyperinflation and the 1999 war in Serbia—are particular to the country in question. It is therefore up to empirical testing to uncover any common patterns. Our cross-correlation functions for each Balkan country’s GDP, compared with each of the five partners’ GDP, are provided in Table 1. If business cycles are well synchronized, two things should come out in this table. First, the highest correlations within each country-pair should occur contemporaneously; that is, the highest value in each row should appear at lag 0. The highest value in each row appears in bold in Table 1. Second, the correlations should be high in absolute value and highest for the best potential currency partners. We indicate in the table whether the correlations between the Balkan countries and their potential pairs are statistically 5 Proceedings of 21st International Business Research Conference 10 - 11 June, 2013, Ryerson University, Toronto, Canada, ISBN: 978-1-922069-25-2 significant. In general, the standard error of a correlation coefficient is calculated as Table 1: Output Cross-Correlations Bulgaria and -4 -3 -2 -1 Germany 0.037 0.069 0.166 0.2180* 0.3115*** 0.316*** 0.3168*** 0.271** 0.189 Poland 0.018 0.031 0.012 -0.020 -0.0554 0.042 0.132 0.205* 0.256** Russia 0.125 0.133 0.111 0.122 0.082 0.101 0.130 0.148 0.153 Turkey -0.179 -0.132 -0.091 -0.057 0.118 0.138 0.167 0.166 0.148 U.S. Croatia and 0.010 -4 0.035 -3 0.084 -2 0.137 -1 0.214* 0 0.2688** 0.3190*** 0.350*** 0.357*** 1 2 3 4 Germany -0.194 -0.012 0.2299* 0.4760*** 0.6320*** 0.6715*** 0.6206*** 0.4870*** 0.365*** Poland -0.138 -0.179 -0.163 Russia -0.167 0.055 0.359*** 0.6029*** 0.769*** 0.740*** 0.603*** 0.4300*** 0.2140* Turkey -0.409*** -0.265** -0.031 0.240* U.S. -0.355*** -0.205 0.005 0.2558** 0.407*** 0.536*** 0.564*** 0.5389*** 0.5075*** -2 -1 0 Romania and -4 -3 -0.122 0 1 -0.0147 0.142 2 0.231* 3 4 0.388*** 0.472*** 0.4240*** 0.5286*** 0.468*** 0.3796*** 0.269** 1 2 3 4 Germany -0.528*** -0.391*** -0.149 0.138 0.4015*** 0.552*** 0.623*** 0.624*** 0.568*** Poland -0.145 -0.153 -0.112 0.005 Russia -0.346*** -0.147 0.104 0.370*** 0.5965*** 0.641*** 0.570*** 0.4950*** 0.3926*** Turkey -0.460*** -0.4860*** -0.342*** -0.136 0.155 0.355*** 0.465*** 0.4926*** 0.458*** U.S. -0.516*** -0.421*** -0.2235* 0.012 Serbia and -4 Germany -0.150 0.066 0.2305* 0.386*** 0.5306*** 0.221* 0.4219*** 0.5046*** 0.541*** 0.5405*** -2 -1 0 1 2 -0.305** -0.208* -0.115 0.029 0.172 0.205 0.2220* 0.2417* 0.2236* Poland 0.094 -0.004 -0.103 -0.187 0.2699** -0.2606** -0.2777** -0.254* Russia -0.2897** -0.193 -0.041 0.079 0.182 Turkey -0.067 -0.083 -0.071 0-0.0199 0.084 U.S. -0.2739** -0.2969** -0.2998** -0.2207* -0.1867 -0.088 -3 -0.124 0.237* 3 4 -0.184 0.262** 0.2779** 0.280** 0.085 0.105 0.075 -0.014 0.088 0.117 Bold = highest correlation for a particular country pair ***, **, * = significant at 1, 5, and 10 percent, respectively 1 2 ; we then use the corresponding t-values to assign asterisks based on the T 1 traditional significance levels. Contemporaneous correlations are weak. In examining the business cycle synchronizations between the Balkan nations and Germany, the highest correlations appear with a lag. Bulgaria’s highest correlation coefficient (0.3168) lags Germany’s business cycle by two quarters. Romania (0.624) and Serbia (0.2417) lag Germany by three quarters at their highest correlations. Given the influence Germany has with regards to monetary policy in the Euro zone, this does not bode well for currency integration. Comparatively speaking, only Bulgaria has the highest contemporaneous correlation with Germany, compared to the other four comparison countries. Serbia, Romania, and Croatia have stronger correlations with Russia than with Germany. This pattern 6 Proceedings of 21st International Business Research Conference 10 - 11 June, 2013, Ryerson University, Toronto, Canada, ISBN: 978-1-922069-25-2 holds true for one-period leads and lags as well. The one possible exception to the loose linkages is Croatia. Its business cycle is more synchronized with Germany than that of the other Balkan countries, with a relatively high correlation coefficient of 0.6715 at a lag of only one quarter and a correlation coefficient of 0.6320 at zero lag. Croatia, however, shows an even stronger, contemporaneous correlation with Russia (0.769). The link between Croatia and Russia is the only example of 20 possible country-pairs that shows the sort of contemporaneous business cycle synchronization that we are searching for over the sample period, with relatively high correlation coefficients and the highest correlation value occurring at zero lag. The link between Croatia and Russia is explored in more detail in Table 2, which shows all Croatian GDP components’ cross-correlations with Russian GDP. Croatian consumption (correlation coefficient=0.6760), exports (0.8180), and imports (0.8308) have high coefficients at zero lags, while Investment lags Russian GDP by only one quarter. While these statistical tests provide evidence for Russian and Croatian linkages, it is less clear what is driving the connection. Russia is not among the top few countries for tourism and trade with Croatia, so this correlation may be spurious, but this is a worthy subject for future research. Possible connections include Croatia’s dependence on Russian energy imports, for example. 7 Proceedings of 21st International Business Research Conference 10 - 11 June, 2013, Ryerson University, Toronto, Canada, ISBN: 978-1-922069-25-2 Table 2: Cross-Correlations of Croatian GDP Components with Various Partners’ GDP Germany -4 -3 -2 -1 0 1 2 3 4 -0.029 0.2148* 0.4291*** 0.5409*** 0.5959*** 0.5621*** 0.4568*** 0.3398*** C -0.2301* I -0.4443*** -0.2898** -0.096 0.096 0.2847** 0.3841*** 0.4415*** 0.4888*** 0.4724*** G 0.099 0.063 0.056 0.038 0.044 0.112 X -0.015 0.159 0.3647*** 0.6116*** 0.7430*** 0.7516*** 0.6239*** 0.375*** M Russia -0.2809** -4 -0.049 -3 0.253** -2 C -0.206 0.070 0.3418*** 0.5487*** 0.6760*** 0.6417*** 0.5325*** 0.357*** I -0.2708** -0.123 0.132 0.302** 0.4308*** 0.499*** 0.4749*** 0.454*** 0.407*** G 0.184 0.189 0.114 0.071 0.047 0.105 0.094 X 0.150 0.315** 0.486*** 0.6885*** 0.818*** M Turkey -0.088 -4 0.162 -3 0.4589*** 0.7106*** 0.8308*** 0.7405*** 0.5350*** 0.3015** -2 -1 0 1 2 3 C -0.4157*** -0.238* 0.2100* 0.309** 0.341*** I -0.284** -0.2727** -0.124 0.064 0.2459* 0.3805*** 0.4339*** 0.479*** G -0.044 0.013 0.063 0.069 0.091 0.193 X -0.142 -0.043 0.137 0.337*** 0.5429*** 0.652*** M U.S. -0.234* -4 -0.148 -3 0.054 -2 0.3319*** 0.534*** -1 0 0.6417*** 0.6089*** 0.469*** 1 2 3 C -0.4608*** -0.307** -0.107 0.113 0.2469** 0.362*** 0.402*** 0.4018*** 0.3836*** I -0.264** -0.205 -0.053 0.110 0.221* 0.322** 0.388*** 0.4155*** 0.404*** G 0.184 0.251** 0.267** 0.264** 0.2808** 0.303** 0.296** 0.2840** 0.239* X -0.105 0.058 0.2777** 0.453*** 0.6230*** 0.6998*** 0.646*** 0.513*** 0.3356*** M -0.245* -0.114 0.116 0.347*** 0.538*** -0.003 0.535*** -1 0.7036*** 0.724*** 0 1 0.068 0.111 0.634*** 2 0.136 0.484*** 3 0.085 0.7098*** 0.4878*** 0.191 0.617*** 0.2527** 0.285** 0.175 0.101 0.110 0.3198** 4 0.126 -0.110 0.064 4 0.077 0.4968*** 0.3286*** 0.369*** 0.6239*** 0.4710*** 0.2800** 0.3410*** 4 0.5780*** 0.4930*** 0.377*** Table 3 shows that our analysis does not solve the ―Consumption Correlations Puzzle.‖ Output correlations, although limited, are still stronger than consumption correlations. For example, Croatia and Romania have an output correlation of 0.5830 but a consumption correlation of 0.3369. Romanian and Serbian outputs do share a contemporaneous output correlation (albeit small) of 0.2485. Expected pairs—Romania and Bulgaria (0.079), or Croatia and Serbia (0.3317)—do not show strong linkages in consumption or output. This runs counter to Hegerty (2010), who found that the Baltics had more interconnections as a region than with outside partners. The Balkans do not follow suit. 8 Proceedings of 21st International Business Research Conference 10 - 11 June, 2013, Ryerson University, Toronto, Canada, ISBN: 978-1-922069-25-2 Table 3: Output and Consumption Cross-Correlations, Country Pairs 1 2 3 0.2660** 0.196 0.171 0.104 0.067 0.021 Bulgaria and Romania 0.3070** 0.274** 0.2446* 0.2828** 0.079 0.055 0.115 -0.059 -0.072 Output -4 -3 Bulgaria and Croatia 0.2140* 0.067 Bulgaria and Serbia -0.101 -0.156 -2 -1 0.173 -0.205 -0.145 0 0-0.1221 -0.092 4 -0.100 -0.086 -0.064 Croatia and Romania 0.4550*** 0.533*** 0.6038*** 0.6189*** 0.5830*** 0.4225*** 0.196 0.111 -0.075 0.4676*** 0.343*** 0.344*** 0.3525*** 0.3317*** 0.2158* 0.049 -0.123 -0.184 Croatia and Serbia Romania and Serbia -0.025 Consumption -4 0.047 0.120 0.193 0.2485** 0.2190* 0.180 0.125 0.075 -3 -2 -1 0 1 2 3 0.090 0.138 0.140 0.138 0.052 -0.022 -0.051 0.173 0.2438* 0.2377* 0.103 -0.076 Bulgaria and Croatia 0.3385*** 0.205 Bulgaria and Romania 0.238* 0.321** 0.3118** 0.297** Croatia and Romania 0.259** 0.3050** 0.3597*** 0.377*** 0.3369*** 0.2728** 0.143 4 0.025 -0.058 5. Conclusion Clearly, our findings have implications for the future of the Euro. Should these countries one day join the common currency, a single monetary policy will prove ineffective in solving a set of dissimilar economic problems. The eurozone’s current problems—as is evidenced by Greece and Cyprus—may play out in similar fashion with the Balkan countries that display very little synchronization with German business cycles. The only correlations pointing to a potentially beneficial currency union were those between Croatia and Russia. While the results here suggest that these two economies are well synchronized, it is not clear from our analysis what is driving the linkages, and while we believe this merits further study, we do not rule out spurious correlations. Additionally, our analysis supports the existence of a consumption correlations puzzle, with output correlations appearing stronger than consumption correlations between the three Balkan countries for which we had sufficient data to perform the analysis. In sum, the results of this study suggest that any sort of integration by the Balkan nations into the Eurozone should be approached with great caution. References: Artis, M. J., Fidrmuc, J. and Scharler, J. 2008. ―The Transmission of Business Cycles: Implications for EMU Enlargement,‖ Economics of Transition 16(3), 559-582. Backus, D.K., Kehoe, P.J. and Kydland, F.E. 1992. ―International Real Business Cycles,‖ Journal of Political Economy 100: 745-775 Backus, D.K., Kehoe, P.J. and Kydland, F.E. 1994. ―Dynamics of the Trade Balance and the Terms of Trade: the J-Curve?,‖ American Economic Review 84, 84-103. Darvas, Z.and Szapáry, G. 2008. ―Business Cycle Synchronization in the Enlarged EU,‖ Open Economies Review, 19(1), 1-19. Fidrmuc, J. and Korhonen, I 2006. ―Meta-Analysis of the Business Cycle Correlation Between the Euro Area and the CEECs,‖ Journal of Comparative Economics 34(3), 518-537. 9 Proceedings of 21st International Business Research Conference 10 - 11 June, 2013, Ryerson University, Toronto, Canada, ISBN: 978-1-922069-25-2 Furceri, D. and Karras, G. 2008. ―Business-cycle synchronization in the EMU,‖ Applied Economics 40, 1491–1501 Hegerty, S.W. 2010. ―Central European Business Cycles: Might Global (and Local) Linkages Dominate Regional Ones?‖ Eastern European Economics 48(2), 5673. Horvath, J., and Ratfai, A. 2004. ―Supply and Demand Shocks in Accession Countries to the Economic and Monetary Union,‖ Journal of Comparative Economics 32(2), 202-211. Inagaki, K. 2006. ―Output Correlation and EMU: Evidence from European Countries,” Journal of Economic Integration (21)3, 458-473. Imbs, J. 2004. ―Trade, Finance, Specialization and Synchronization,‖ Review of Economics and Statistics 86(3): 723–734. Mundell, R. A. 1961. ―A Theory of Optimum Currency Areas,‖ American Economic Review 51, 657-665. Obstfeld, M. and Rogoff, K. 2000. ―The Six Major Puzzles in International Macroeconomics: Is There a Common Cause?‖ NBER Working Paper 7777. Šergo, Z., Poropat, A. and Gržinić, J. 2012. ―Business cycle Synchronization in Croatia,‖ South East European Journal of Economics and Business 1; 29-43 10