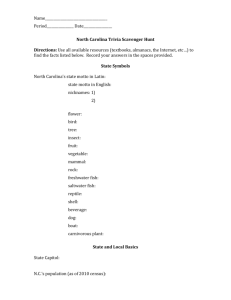

N C ’

advertisement