Asian Journal of Business Management 2(3): 48-56, 2010 ISSN: 2041-8752

advertisement

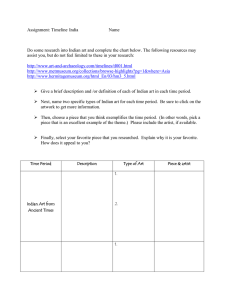

Asian Journal of Business Management 2(3): 48-56, 2010 ISSN: 2041-8752 © M axwell Scientific Organization, 2010 Submitted Date: February 26, 2010 Accepted Date: March 18, 2010 Published Date: September 30, 2010 Factors Influencing Purchase of ‘NANO’ the Innovative Car from India-An Empirical Study R.D. Bikash, S.K. Pravat and Sreekumar Rourkela Institute of Management Studies, Gopabandhu Nagar, Chhend Rourkela-7690 15, O rissa, India Abstract: This study attempts to find the factors, which are important for choosing the revolutionary car ‘Nano’ launched by one of the leading Indian automobile industry called ‘Tata Motors’. The year 2009 has been significant for Indian automobile industry as numbers of new models were launched for the domestic market and also registered a significant growth in exports. The report published by Cyg nus research ranked Indian autom obile sector to be nu mbe r one o n the basis of sales gro wth and P rofit After Tax (PAT) growth during Octob er- Dece mber 09 over O ctober- December 08 ov er other 14 m anufacturing sectors. The p aper considers 22 factors, wh ich may be impo rtant in the customer d ecision -mak ing pro cess. T wo appro ache s viz. G rey Relational Analysis and RIDIT analysis is used to rank the factors. Key w ords: Autom obile, grey relational analysis, nano, RID IT INTRODUCTION India has become a fast-growing auto market over the past decade. G rowth has been driven by rap id econom ic grow th and increasing wealth-double-digit average wage gains over the past decade and more than a three-fold surge in equity markets. The growth in Indian economy encounters the growth in industrial production. According to the Society of Indian Automobile Manufacturers (SIAM ), the Indian automo bile industry has maintained a steady growth of 20% till May 2005. The industry curren tly contributes about 5% of the G DP and it is targeted to grow fivefold by 2016 and accoun t for a geographically diversification. The development in automobile sector overhauls the perception of potential car buyers, with their increased disposable income, enormous information search, and availability of lucrative financial options. People today are more pragmatic before acqu iring the autom obile. For most people, purchasing a car is one of the most important and expensive investmen t, next to purchase of a house; for the automotive manufacturers, first-time car buyers give them the opportunity to create positive brand image which definitely could be reflected on in next com ing years because consumers could make repeat car purchasing. The small car market changed ve ry rapid ly due to the fierce competition and advanced technology; therefore, it requires the automotive manufacturers and car dealers to understand the consumers’ preference on time and take fast actions to reflect market changes quickly. So, it would be very interesting to know consumers’ preference in today’s fast-changing small car mark et. In this co ntext this study is carried ou t to understand how the customers’ buying process is, what the critical elements of making their purchasing decision for the innovative ca r “Na no”. Review of Indian automobile industry: The last few years have witne ssed revolu tionary changes in the management systems and manufacturing innovations of the world automotive industry. A proprietary study conducted by McK insey and the Associated Chambers of Commerce and Industry of India (summ arized in PTI, April 18, 2005 ; New swee k International N ovem ber 28, 2005, and the Financial Times, December 1, 2005) estimates that by 2015 glob al auto production is likely to reach $1.9 trillion dollars, of which around $700 billion dollars will be pro duced in low cost countries. The United Nations Development Program (UNDP) report hailed India as a powerful force in the global automo bile industry, and recognized that it has the streng th to sustain leadership and growth in the face of the global trading order. The growth in Indian economy encounters the grow th in industrial production. According to the Society of Indian Automobile Manufacturers (SIAM), the Indian automobile industry has maintained a steady growth of Corresponding Author: Sreekumar, Rourkela Institute of Management Studies, Gopabandhu Nagar, Chhend Rourkela-769015, Orissa, India 48 Asian J. Bus. Manage., 2(3): 48-56, 2010 20% till May 2005. The industry currently contributes about 5% of the GDP and it is targ eted to grow fivefold by 2016 and account for a geographically diversification. The growth curve of India Auto Inc . has been on an upswing for the past few years. In addition to matching comp etitor’s new products and upgraded machinery, technology is over 10% of India’s GD P. Automotive Mission Plan (AMP) expects the industry to reach a turnover of $150-200 billion in the next ten years from the current $45 billion levels. Over the last five years the production of four wheelers in India has increased from 9.3 lakh units in 2002-03 to 23 lakh units in 2007-08 reporting a CAGR of 20%. The Indian car manufactures are today serving a wide variety of transportation solutions across, different load levels. T here is a drastic growth in sales and distribution setup, which enables the automobile company to ensure playing a vital role. Moreover the com pany’s pro ximity to their raw material and com ponent suppliers help them in reducing procuremen t costs. Autom obile man ufacturers have clearly committed themselves to supply the market with ever safer and more environment friendly products and are continuously inve sting huge R& D resourc es in further product improvements and in developing radically new propulsion systems. The following section discusses the development of Indian automotive industry. company. The period prior to the entry of Maruti Udyog Ltd was ch aracterized by small num ber of auto m ajors like Hindustan Motors, Premier Automobiles, Telco, Bajaj, and Mahindra and Mahindra. However, cum ulatively political and social forces gave way to a curious partnership between the Govt. of India and Suzuki Motors of Japan in the early 1980s (D’Costa, 1995b). The government owned appro ximately 80% of the equity. For the first time India became an investor in a car project and in a successful monopoly (D’Costa, 1995b). This was marked as the beginning of the sec ond phase of the auto industry. The auto industry in the co untry really showed a spurt in growth during this period. This period witnessed the emergence of a new gene ration of auto manu facturers who were required to meet the stringent quality standard of Maruti’s collaborator Suzuki of Japan. The good performance of Maruti resulted in an upswing for the domestic autom obile industry. This Joint V enture (JV) resulted in a significant addition to the country’s car production volume, which helped satisfy the unmet consumer demand. The JV served another important function: by brin ging in cars at a low cost that were based on mod ern (an d fuel-efficient) au tomo bile tech nolog y, it galvanized the existing Indian firms to start upgrading their own technology, thereby initiating a modernization of the Indian passenger car industry. The other major Indian manufacturers also all moved to upgrade their own offerings, catalyzed partly by Maruti’s entry into the Indian car market: H M entered into collaboration w ith Isuzu of Japan for the manufacture of gasoline and diesel engines and powe r-train assemblies, and w ith Va uxhall of the United Kingdom for design and tooling technology, which in turn led to prod uction of a new model called Contessa (a derivative of the Vauxhall Victor). Premier Auto Limited (PA L) entered into a tech nical agreement with Nissan of Japan for their A-12 engine and matching transmission, which was placed in a Fiat 124 body. PAL also entered with a consultancy agreement with AVL of Austria to improve its existing gasoline engine, and through an acquisition , an arrangemen t with F NM of Italy for diesel engines (leading to a diesel car being offered in 1989) (Mohanty et al., 1994). Standard Motors began offering a luxury car, the R over 2000, in collaboration with A ustin Rov er of the U.K . (Venka tramani, 1990). In the year 1991, when India moved away from an inward looking industrialization strategy to a more ‘open’ economy (Narayanan, 2001), a newly elected Indian government took over and faced with a balan ce-ofpaymen ts crisis initiated a series of econom ic liberalization measures designed to open the Indian economy to foreign investment and trade. The Emergence of the Indian auto industries: The auto industry traced in India can be classified into three distinct phases namely: Period prior to the entry of Maruti Udhyog Ltd, period after the entry of M aruti U dhyog Ltd and Period post Liberalization (Kathuria, 1990). The Indian auto industry has come a long way since 1940 s. Since its independence in 1947, India has pursued, initially, a strong anti-imperialist automobile economic policy by pro moting self-reliance (D’C osta, 1995a). This policy established a basic industrial foundation and a technical-education infrastructure to sustain future growth. This fell behind the global technology frontier due to increasingly autarkic and sometimes dysfunctional policies (Bhagwati, 1993). India was characterized by a slow -grow ing, high-cost economy with shoddy and scarce products. Subsequently, since the 1980s, various economic and industrial sectors were gradually and selectively deregulated, privatized, and internationalized (D’C osta, 2006). The evolu tion of this econ omic nationalism has been devised to prom ote domestic business and increasingly to sustain their glo bal competitiveness. The key breakthrough occurred in the year1982. The Government of India created Maruti Udyog Limited, a public sector 49 Asian J. Bus. Manage., 2(3): 48-56, 2010 governm ents play a key ro le in sha ping th e grow th of the auto industry in emerging econ omies (A msden and Kang 1995). There for the Government of India revisited its Industrial Policy and allowed for capacity expansion as well as entry of foreign capital and firms. In this situation the Indian autom obile industry need s to restructure itself to retain co mpe titiveness. The new autom obile policy announced in 1993 included removal of licensing restrictions on production, automatic approval of foreign investment up to 51% in Indian firms opening the doors for foreign firms to e nter the Indian mark et (subject to government approval, up to 100% foreign equity participation was also allowed) (Sagar and Chandra, 2004). The government followe d up its liberalization measures with significant reductions in the import duty on automobile compone nts. These measures have spurred the growth of the Indian economy in general, and the automo tive industry in particular. Since 1993, the automotive industry has been experiencing growth rates of above 25%. Prior to the delice nsing of this sector in 1993, customers could purchase just three models: one made either by Hindustan Motors, Maruti-Suzuki or Premier Automobiles. By 1996, a total of eighteen autom obile companies from the US, Europe, and East Asia had began operations in India (Mukherjee and Sastry 1996). The entry of foreign automobile manufactures ranging from Mercedez, Ford and Genera l Motors to Daewoo following the government liberalizing the foreign investment limits saw the beginning of the third phase of the evolution of the industry. The auto industry witnessed huge capacity expansions and mod ernization initiative s in t h e post libe ralization period . T ech nological collaborations and equity partnerships with w orld leaders in auto components became a com mon affair. Th is increasing success in turn gav e India confid ence to accelerate liberalization . In 2001 the Government of India (GOI) lifted virtually all restrictions on direct foreign investment in the auto industry. Indian passenger car production, barely over 200,000 units in 1 993-94, do ubled to just over a halfmillion units in 2000-01. In the next four years, the production nearly doubled again, topping one million vehicles in 2004-05, and hitting 1.3 million vehicles in 2005-06 including utility vehicles and MPV s (Eco nom ic Times April 29, 2006). Annual sales have seen an increase by over a multiple of 5, from around 320,000 units in 1996 to 1.7 million in 2008, thanks to a combination of rising per capita incomes, relatively easier availability of finance and young demographics (SIAM, 2008). This sector as a whole has emerged as a significant engine of growth for the Indian economy. India is on every car manufacturer’s map. The Automotive Mission Plan 2006-2016 has set an ambitious turnover target of $145 billion for the industry from a modest $38 billion today (Narayanan and Vashisht, 2008). So the Indian automo bile industry is playing a pivotal role on the Indian Economy and also redefining the lifestyle of Indian consumers. In this context the Indian Automobile sector is also increasingly adopting an outward looking approach and exploring new markets and territories. Understanding Small car ma rket: The Indian autom obile industry has seen rapid change over the last decade in terms of both product characteristics as well as manufacturing processes. The focus has tilted away from volumes to a lower cost model as espoused by the emerging markets. This eventually led to a transformation of the Indian market towards “small” and “mini” cars. Maruti Udyog Limited (MUL) dom inated sales in “mini” segment (less than 340 cm length, generally less than 800 cc engine disp lacemen t) (Sagar and C handra, 2004). In the year 1996, MUL had approximately 80% of the country’s car market share. The reason can be attributed to the fact that many of the earlier entrants into the Indian car market did not target these segments. Furthermo re, M UL was able to offer its vehicles at a very com petitive price since it had relatively high indigenization levels, an established vendor base, and a depreciated plant (ICRA , 2003a). But it has lost significant ground with the entry of Hyundai Motor India Limited (HMIL) with its line-up of small cars. These compact or small sized cars are techn ologically advanced and offer greater number of features (ICR A, 2003b). The launch of Tata Motors’ Indica in the year 2003-04, another small car, drastically reduced Maruti’s domestic sales to just over 51%. Hyundai and T ata account for approximately 19 and 16% respectively during this period. Thus Indian car market is heav ily skewed towards mini and compact vehicles, this segment alone account for about 80% of the car sales in the country Table 1. Today, the small car segment is a sunrise sector, as new car registrations have grow n from 625,000 in 200 1 to over 1.3 million in 2006. The sub-1500 cc or 'mini and compact car' segments account for over 66% of new sales (KPMG, 2007). Rising incomes level of middle class, heterogeneous consumer preference, better financing for vehicles are the reasons driving this growth. The Annual K PM G International rep ort suggests that it is the small car 50 Asian J. Bus. Manage., 2(3): 48-56, 2010 Table 1: Passenger vehicle sales and exports, 2003-04 Passenger vehicles Domestic sales Ex por ts Passen ger C ars 696,207 125,327 Mini 167,565 10,479 Comp act 369,537 84,077 Mid-size 139,304 30,739 Executive 14,337 0 Premium 5,368 32 Lux ury 96 0 Utility vehicles 144,981 3,067 Multi purpose vehicles 59,564 922 Total 900,752 129,316 S ou rc e: S oc ie ty of In dia n A uto mo bile M an ufa ctu re rs (S IA M ) Table 2: A uto affordability forecast Segment Pric e (U SD '00 0') S eg m en t A 1 an d A2 6.2 5-1 2.5 (M ini an d co mp act) S eg m en t A 3 an d A4 12 .5-3 0.0 (Mid Size and Executive) Segment A5 and A6 Ov er 3 0.0 (Premier and Luxury) Sou rce: KP M G In ternationa l (2007 ) Rs 1.5 lakh car. Nissan Renault CEO Carlos Ghosn commented, "We w ill be part of this competition and we are investigating at the level of the alliance, how we can make a $3,000 car”. Tata Moto rs h as already unveiled th e w orld's cheapest passenger car "Nano" for around US$2,500. Tata Nano gives a fuel efficiency of 23.6km pl (under stand ard test condition), the highest among all petrol-run cars in the country. Nan o is 3.1 m (10.23 feet) long, 1.5 m wide and 1.6 m high and can accommodate four to five people. Nano with its two cylinder 623 cc, 33 horsepower rear mounted Multi-Point Fuel Injection (MPFI) petrol engine can touch the top speed of 105 Km. Nano surpasses Indian regulatory requirements and Euro IV emission norms and guarantee less polluting than most of the bikes on Indian roads. W ith the launch of Tata Nano, the stage is set for around a dozen n ew small and comp act cars to be launched in India in the next tw o yea rs. It is in this context this study is carried out to understand the Indian consumers mind towards the smallest car Nano. 2 00 5 (% ) 2 00 9 (% ) 35.06 48.46 8.9 14.53 2.43 4.5 segment that will continue to dominate the passenger car mark et, with almost 50 per cent of househo lds being ab le to afford a sma ll car by 2009 (Table 2). The Indian car industry is overflowing with small cars and automobile manufacturer in India are investing accordingly. According to Mr. P Balendran, Vice President (Corporate Affairs), “Gen eral Mo tors India, the grow th is happening on ly in the small ca r segm ent. People buying small cars are very cost conscious. General M otors is planning to launch its second small car in India in the 800-900 cc seg men ts. The com pact car will be unv eiled in 2010”. Acco rding to Hiroshi Nakagawa, India head of Toy ota Kirloskar M otors, “Small cars play a very important role and cover as much as 75 per cent of car volumes in India and currently does not include in Toyota Kirloskar’s portfolio. Toyota had announced Rs 1,400 crore investment to launch a 'strategic small car' for the Indian market by 2010. The entry car will be enhanced with below 1200-cc in petrol and below 1500cc in diesel”. The Xenitis group Chairman, Santanu Ghosh said the company will be launching an affordable four wheeler car that is priced lower than INR 1 lakh w hich is approxim ately equivalent to U S$ 2000. Another auto major, Peugeot Motor Company from France, is also planning to enter the small car market in India by 2011. It is com ing to India with a spacious five-seater car, which is designed especially to cater the whopping small car consum ers of India. Hyundai is also gearing up to launch a small car for 3,500 dollar (over Rs 1.45 lakh) by 2011. Nissan Ren ault is expected to team up with Indian man ufactu rer M ahind ra and Mahind ra to promote a sub- Factors influencing car purchase: A study by Lang motors (2007) found a list of 20 factors to be the most important factors that influence purchase of car. They are as follow s 1 - Reliability / D epen dability, 2 - Exterior Styling, 3 - Price / Cost to Buy, 4 - Interior Comfort, 5 Value for the Money, 6 - Fun to Drive, 7 - Reputation of the Manufacturer, 8 - Quality of Workmanship, 9 - Engine Performance, 10 - Road-holding / Handling, 11 - Fuel Economy, 12 - Storage and Cargo Capacity, 13 - Ride Quality on Highway, 14 - Durability / Long Lasting, 15 Safety Features, 16 - Future Trade -In / Resale, 17 Length of W arranty , 18 - Rebate / Incentive, 19 Discount / Value Package, 20 - Environme ntally Friendly Vehicle. Similarly a study by Power and associates (2005) listed the following nine to be the most important reasons for car purchase - 1 Styling, 2 Reliability, 3 Costs too much, 4 Poor quality, 5 R esale v alue, 6 Too small, 7 Lacked performance, 8 Didn't offer incentives, 9 Poor gas mileage. A study published in Anonymous (2008a) UK found for as many as 71% of customer price was the most important factor, followed by fuel economy, running costs, fuel type and Vehicle Excise Duty (VED ) costs. Similarly an article published in Anonymous (2008b) quoted After Price; Reliability is the number one factor for buyers. Car buyers’ rate reliability over fuel efficiency as their primary decision makes. Fuel efficiency and safety rank second and third in importance Performance not a top priority for most car buyers. Th is study intends to prioritize the important factors with reference to Nano from Indian consumers’ point of view. 51 Asian J. Bus. Manage., 2(3): 48-56, 2010 Fleiss et al. (1979) have reported that ridit analysis begins with the identification of a population to serve as a standard or reference group. V irtually the only assumption mad e in ridit analysis is that the discrete categories represent interv als of an underlying , but unobservable, continuous distribution. Given the distribution of any other group over the same categories, the mean ridit for that group may be calculated. The resulting mean valu e is interpretable as a probability. In summ ary, ridit analysis provides a simple alternative or adjunct to rank order statistical analysis, and may be viewed as adding an intuitively appealing, descriptive element to it. The detailed algorithm of RID IT analysis is provided in Appendix A. MATERIALS AND METHODS This study tries to explore the potential reasons behind the inten tion to book a T AT A N ano. W e have used two relatively new techniques i.e., RIDIT and Grey Relational Analysis (G RA ) in the paper. The pu rpose is to quantify the order of relative importance of the antecedent reasons for selection of a TATA Nano. The review of literature revealed the factors that affect the choice of car purchase. The 22 indicators identified are as follows style / Look, interior design, space inside, accessories, pow er, safety features, performance, environment friendly, Featu res of the car fulfils requirements, attractive colors, comfortable, price, high fuel efficiency, financing option, running cost, resale value, warranty, value for money, Comp anies reputation, brand name, status / prestige, overall possession satisfaction. The country of origin is another important factor but we have not used it, as all the respondents were Indians. It was assumed that the respondents are a ware abo ut the origin. A nd the re is a question about TATA’s reputation. Using the abovementioned indicators a scale was developed to cap ture potential consume rs’ view s. The same was administered in two major cities of O rissa, a fast grow ing state in Eastern part of India. Th e study was carried ou t during summer 2009. A total of 130 responses were collected from the field and final 108 responses were used for final analy sis after data filteration . Overview of the GRA: A system having incom plete information is called Grey system. The Grey relation is the relation with incomplete information (Chih-Hung Tsai, 2003). The Grey relational an alysis is a highly effective method for determining how a discrete data sequence is related to other data sequence. Data for the grey relational analysis must meet the following requirements: non-dimension, scaling, and polarization. Grey relational analysis is a method to analyze the relational grade for discrete sequences. The grey relational analysis is unlike the traditional statistics analy sis handling the relation between variables. Some of the draw back s of the later are: (i) it must have plenty of data; (ii) data distribution must be typical; (iii) a few factors are allowed and can be expressed functionally. But the Grey relational analysis requires less data and can analyze many factors that can overcome the disadvantages of statistics method (Chih-Hung Tsai, 2003). Grey Relational Analysis (GRA ) is used in order to build a ranking and suggest a best choice on a set of alternatives. Through the GRA , a Gra de R elation Grade (G RG ) is obtained to eva luate the multiple performance characteristics (Kuang, 2008). The detailed algorithm on GRA is provided in Appendix B. Overview of the RIDIT: The ridit analy sis is an acronym (‘Relative to an Identified Distribution’) plus the productive suffix ‘-it’ denotes a transformation” (Bross, 1981). We m ay quote the inv entor o f this ana lysis to understand its meaning and relevance: - “In 1950s studies of crash-injuries in highway accidents, the response variable used a graded scale (e.g., none, minor, moderate, severe, fatal). The common practice in analysis of contingency table data then (and sometimes now) was to avoid emp ty cells by collapsing to a dichotom ous scale (e.g., nonfatal, fatal). In an effort to avoid losing inform ation in this way, ridit analysis is used, which involves a simple empirical cumulative probability transformation of the entire scale. Tab le 3: D emo grap hic p rofile o f the s amp le Age 20-30 No . of res pon den ts 4 0(3 7.0 3% ) Occupation Business No . of res pon den ts 4 4(4 0.7 % ) Family size 3 No . of res pon den ts 2 6(2 4.0 7% ) Annual Income < 3 Lacs No . of res pon den ts 1 4(1 2.9 6% ) RESULTS AND DISCUSSION The sample for the study consisted of 108 respo ndents drawn from two major cities of Orissa a fast 30-40 2 8(2 5.9 2% ) Ce ntral G ovt. 1 6(1 4.8 1% ) 4 5 4(5 0% ) 3-5 lacs 4 5(4 1.6 6% ) 40-50 3 2(2 9.6 2% ) Professional 8 (7 .4 % ) 5 1 6(1 4.8 1% ) 5-7 lacs 2 8(2 5.9 2% ) 52 50-60 4 (3 .7 % ) Pvt. Company 3 0(2 7.7 % ) 6 1 2(1 1.1 1% ) 7-9 lacs 1 5(1 3.8 9% ) 60-70 4 (3 .7 % ) State Government 1 0(9 .2 5% ) 7 0 > 9 lacs 6 (5 .5 5% ) Asian J. Bus. Manage., 2(3): 48-56, 2010 Table 4: RIDIT values and GRA grades S. no. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 RID IT Scaled items values It's “pric e” is a fford able 0.397 I rely o n N ano as it is a “ Tata Pro duc t” 0.444 I love the name "Nano" 0.448 It is available in “attractive colors” 0.684 I love it's “style / look” 0.618 It has a “high fuel efficiency” 0.669 I am satisfied with the “financing option” 0.755 I like its “interior design” 0.518 Overall it is a “comfortable” car 0.501 The “space inside” Nano surprised me 0.383 Ov erall I w ill be v ery h app y to 0.447 possess a Nano Overall it is “value for money” 0.227 Features of this car fulfils my 0.419 requ irem ents It is an “environment friendly” car 0.436 I believe it's “running cost” will be low 0.553 The “w arranty” o ffered is satisfa ctory 0.680 I liked its “po wer” 0.560 It will add to my “status / prestige 0.464 It has proper “safety features” 0.246 I feel it will have a good “resale value” 0.313 There are adequate “accessories” 0.627 ava ilable Test drive “performan ce” was o f 0.452 high standards The findings have been sorted as warranted by the respective analysis (Ch ien-Ho, 2007), so as to co mpare the rankin gs of the scale items for their degree of impo rtance or agreeme nt. It is observed that there is positive correlation between the two methods used for prioritizing the factors. It is interesting to observe from the Table 5 that 16 out of 22 ranks as assigned by two techniques are matching. The Table 5 shows that the top most reason for selecting to book a TA TA Nano based on the finding s is its price. It is followed closely by the fact that it is a T AT A product. The third importan t reason is the name N ano seem s to have caught the imagination of the consumer. The least important reason for selection of the car being, “it’s test drive perform ance ”. This can b e taken it is also another indica tion for the correctness of the findings for none of the customers had the opportunity of test-driving the vehicle. The respondents had only got to view the vehicle in the show room. Rest of the items constitute three clusters i.e. cluster one (consisting of items 10, 1, 13, 14, 2, 11, 3, 22, 18 can be referred to as first hand overall perception of the vehicle); cluster two (consisting of items 9, 8, 15, 17 can be referred to as perception of performance promised) and cluster three (consisting of items 5, 21, 6, 16, 4 can be referred to as perception about real performance of the TATA Nano post purchase). These three fall the same order betw een the top three reasons and the least important reason for selecting TATA N ano. Based on the ranking we may infer that next to the top three reasons for selecting the car is cluster o ne i.e. the first hand overa ll perce ption about the vehicle. GRA grades 0.760 0.717 0.729 0.546 0.588 0.550 0.496 0.665 0.679 0.765 0.720 0.920 0.745 0.731 0.641 0.552 0.631 0.706 0.909 0.843 0.589 0.717 developing state in Eastern part of India. The demographic profile of the sample is shown in Table 3. Using the algorithms furnished in the App endix A -B respectively the RIDIT values and the GRA grades were calculated for each of the scale items and is shown in Table 4 along with 22 parameters used. Table 5: RIDIT and GRA comparative ranking Sr No. Scaled items RIDIT values 1 It's “pric e” is a fford able 0.227 2 I rely o n N ano as it is a “ Tata pro duc t” 0.246 3 I love the name "Nano" 0.313 4 It is available in “attractive colors” 0.383 5 I love it's “style / look” 0.397 6 It has a “high fuel efficiency” 0.419 7 I am satisfied with the “financing option” 0.436 8 I like its “interior design” 0.444 9 Overall it is a “comfortable” car 0.447 10 The “space inside” Nano surprised me 0.448 11 Overall I will be very happy to possess a Nano 0.452 12 Overall it is “value for money” 0.464 13 Fea tures of th is car f ulfils m y req uirem ents 0.501 14 It is an “environment friendly” car 0.518 15 I believe it's “running cost” will be low 0.553 16 The “w arranty” o ffered is satisfa ctory 0.560 17 I liked its “po wer” 0.618 18 It will add to my “status / prestige 0.627 19 It has proper “safety features” 0.669 20 I feel it will have a good “resale value” 0.680 21 Th ere are ade qua te “ac cess ories ” av ailab le 0.684 22 Test drive “performance” was of high standards 0.755 Spearman Rank Order Correlations between RIDIT rank and GRA rank is 0.596838 53 RIDIT rank GRA grades 12 0.920 19 0.909 20 0.843 10 0.765 1 0.760 13 0.745 14 0.731 2 0.729 11 0.720 3 0.717 22 0.717 18 0.706 9 0.679 8 0.665 15 0.641 17 0.631 5 0.589 21 0.588 6 0.552 16 0.550 4 0.546 7 0.496 which is significant at p<05000 GRA rank 12 19 20 10 1 13 14 3 11 2 22 18 9 8 15 17 21 5 16 6 4 7 Asian J. Bus. Manage., 2(3): 48-56, 2010 CONCLUSION As per Cygnus R esearch (2009) report among the manufacturing industries, automobiles witnessed highest grow th followed by steel. Automobiles led to strong demand due to signs of revival in economy and increasing trend in hiring especially in IT sector and cheaper bank credit. In this context Tata Motors strategy of producing of people’s car for India is rightly timed. The project is the realization of dream of Ratan Tata Chairm an of T ata groups to provide car to common men of India. The study carried out intends to have an insight into prospective consum ers mind for the ca r Nano . A total of 22 factors have been identified through literature review and these factors are prioritized with reference to the small car Nano. The finding of the study shows that price of the car is most important factor for selecting Nano followed by the name TATA which stan d quite tall in the country. The colour variant, style, fuel efficiency and financing option offered by the company are other important factors which attract the customers towards the car. Pow er, safety feature, prestige involv ed, resale value of the car etc. are some of the features which ranks low in the priority of the consumers. 2) Co mp ute ridits and mean ridits for compa rison data sets. Note that a comparison data set is comprised of the frequencies of responses for each category of a Likert scale item. Since there are m Likert scale items in this illustration, there will be m comparison data sets. C Comp ute ridit value rij for each category of scale items. Bij is the frequency of category j for the ith scale item, and Bi is a short form for the summation of frequencies for scale item i across all categories, i.e. C Co mp ute m ean ridit Di for each Likert scale item. C Co mp ute confid ence in terval for Di. Wh en the size of the reference data set is very large relative to that of any comparison data set, the 95% confidence interval of any Di is: C Test the following hypothesis using Kruskal-Wallis statistics W . A p p en d ix A : Algorithm for RIDIT Analysis (Ch ien-Ho, 200 7): Suppo se that there are m items and n ordered categories listed from the most favoured to the least favoured in the scale, and then R IDIT analysis go es as follows. 1) C C C Co mp ute rid its for th e refe renc e da ta set. Select a pop ulation to serve as a referenc e data se t. For a Lik ert scale survey, the reference data set can be the total responses of the survey, if the population cannot be easily identified. Co mp ute frequency fj for each category of responses, where j =1, ..., n Co mp ute mid-point accumulated frequency Fj for each category of responses. W follows a P2 distribution wi th ( m -1) deg ree of free dom . If H 0 cannot be accepted, examine the relationships among confidence interv als of D. The general rules for interpreting the values of D are s ho w n b el ow . C B Co mp ute ridit value Rj for each category of responses in the refere nce data set. B N is the to tal nu mb er of r esp ons es fro m th e Lik ert sca le survey of intere st. By definition, the expected v alue of R for the reference data set is always 0.5. B 54 A scale item with its Di valu e statistic ally dev iate from 0.5 implies a significant difference in the response patterns between the reference data set and the comparison data set for the particular scale item. If the confidence interval of a Di con tains 0 .5, then it is accepted that the Di value is not significantly deviate from 0.5. A l ow valu e of Di is preferred over a high value o f Di because a low value o f Di indicates a low probability of being in a negative propensity. The response patterns of scale items with overlapped confidence interv als of D are co nsid ered , amo ng th e resp ond ents , to be statistically indifferen t from ea ch oth er. Asian J. Bus. Manage., 2(3): 48-56, 2010 A p p en d ix B : A proce dure fo r the grey relational an alysis, wh ich is app ropriate for Lik ert scale data analysis, consists of the following steps (ChienHo , 2007 ). C REFERENCE Amsden, A.H. and J. Kang, 1995. Learning to be lea n in an emerging economy: The case of South Korea. IMVP Sponsors M eeting, Toronto. Anony mous, 2008a. Retrieved from: http://www. telegra ph.co .uk/m otoring /3510 631 /Co s t- is -m ainfactor-in-chosing-a-car-says, (Accessed date: 2 Octob er, 2009). Anonymous, 2008b. Retrieved from: http://www. b u y i n g a d v i ce . c o m / t o p -f a c t o rs - s u rv e y . h t m l , (Accessed date: 13 October, 2009). Bhagw ati, J., 1993. India in Transition: Freeing the Economy. Clarendon Press, Oxford. Bross, I.D.J., 1981. Citation Classic, Number 24 This W eek’s Citation Classic, 15 June. Chien-Ho, W., 2007. On the application of grey relational analy sis and RIDIT ana lysis to likert scale surveys. Int. Math. Forum, 2(14): 675-687. Chih-Hung, T., C. C hing-Liang, and C. Lieh, 2003. Applying grey relational analysis to the vendor evaluation mod el. Int. J. Comp ut. Internet M anag e., 11(3): 45-53. D’Costa, A.P., 1995a. The long march to capitalism: ind ia's resistance to and rein tegration with the w orld economy. Cont. S. Asia, 4(3): 257-287. D’Costa, A.P., 1995b. Restructuring of the Indian autom obile industry: The state and Japanese capital. W orld Dev., 23, (3), 485-502. D’Costa, A.P., 2006 . Foreign co mpa nies an d eco nom ic nationalism in the develo ping w orld after World W ar II. Paper presented at the XIV Congress of the International Economic History Association, Session #94, University of Helsinki, Helsinki, 21-25 August. Fleiss, J.L., N.W . Chilton and W . Sylva n, 197 9. Rid it analysis in dental clinical studies. J. Dent. Res., 58(11): 2080-2084. ICRA, 2003a The Ind ian A utom otive Industry. ICRA: New Delhi, Sep tember. ICRA, 2003b. ICRA Information and Grading Services, The Indian Passeng er Car Indu stry November 2003. ICR A: N ew Delhi. Kathuria, S., 1990. The indian automotive industry: Recent changes and impact of government policy. New D elhi, A Study Prepared for the World Bank. KPMG, 2007. Retr ie ve d f ro m : h tt p: // w w w. in.kpmg.com/TL_Files/Pictures/automotive-study. pdf, (Accessed da te: 23 Septem ber, 2009). Kuang Y.H., S. Shu-Ling, J. Chuen-Jiuan and J. De-Jyun, 2008. A new grey relation analysis applied to the assert allocation of stock po rtfolio. Int. J. Comput. Cogn., 6(3): 6-12. Generate reference data series x0. x0 = (d01, d02, ..., d0m) C where, m is the n umb er of re sponde nts. In general, the x0 reference data series consists of m values representing the most favoured respo nses. Ge nera te co mp ariso n da ta serie s xi. xi = (di1, di2, ..., dim) C wh ere , i = 1 , ..., k. k is the n um ber o f scale items . So th ere w ill be k comparison data series and each comparison data series contains m values. Com pute the difference data series )i. C Find the global maximum value )max and minimum value )min in the difference data series. C Trans form each data point in each difference data series to grey relational coe fficien t. Let (i(j) represents the grey relational coefficient of the jth data point in the ith difference data series, then C C where, )i(j) is the jth value in )i dif fere nc e d ata s erie s. H is a value between 0 an d 1. T he c oeff icien t H is used to compensate the effect of )max should )max be a n ex trem e va lue in the data series. In general the value of H can be set to 0.5. Co mp ute grey relational grade for each difference data series. Let 'i represent the gre y relational grade for the ith scale item and assume that data points in the series are of the same weights, then The magnitude o f 'i reflects the overall degree of standardized deviance of the ith o riginal data s eries from the re feren ce d ata series. In general, a scale item with a high value of ' indicates that the responden ts, as a whole, have a high degree of favoured consensus on the particular item. Sort ' values into either descending or ascending order to fac ilitate the manag erial interpretation of the results. 55 Asian J. Bus. Manage., 2(3): 48-56, 2010 Lang, D., 2007. Retrieved from: http://www. greenne xxus.com/view project .aspx?projectID=410, (Accessed date: Se ptembe r 23, 2009). Mohanty, A.K ., P.K. S ahu and S .C. Pati, 1994. Technology Transfer in Indian A utom obile Industry. Ashish P ublishing, N ew Delhi. Mukh erjee, A. an d T. Sastry, 1996. Entry strategie s in emerging economies: The case of the Indian autom obile industry. IMV P W orking Paper 0118a, MIT: Cambridge. Narayanan, K., 2001, Liberalisation and the Differential Conduct and Performance of Firms: A Study of the Indian Automobile Sector. Discussion Paper Series A No. 414. Retrieved from: http://hermes-ir.lib.hitu.ac.jp/rs/bitstream/10086/13838 /1/DP414.pdf. Narayanan, B. and P. Vashisht, 2008. Determinants of competitiveness of the Indian auto industry. ICRIER W orking Paper No. 201, January. Power J.D. and A ssociates, 2005. Retrieved from: http://4wheeldrive. about. com/b/20 05/05/24/factorswhich-influence-a-car-purchase.htm, (Accessed date: 28 Sep tember 20 09). Sagar, A.D. and P. Chandra, 2004. Technological change in the Indian passenger ca r industry, energy technology innovation p olicy discussion paper. Discussion Paper 200 4-05. Energy Technology Innovation Policy research group, Belfer Center for Science and International Affairs, Harvard Kennedy School. SIA M , 2008. Society of Indian Automobile Man ufacturers. Industry Statistics. Venkatrama ni, R., 1990 Japan Enters Indian Industry: The M aruti-Suzuki Joint Venture. Sangam Boo ks, London. 56