Proceedings of 3rd Asia-Pacific Business Research Conference

advertisement

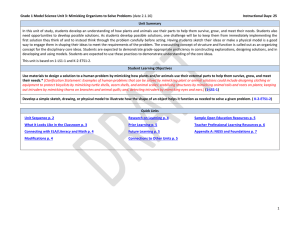

Proceedings of 3rd Asia-Pacific Business Research Conference 25 - 26 February 2013, Kuala Lumpur, Malaysia, ISBN: 978-1-922069-19-1 A Research on Size and Book-to-Market Ratio Effects based on Good Deal Bound in Korea Equity Market (KOSPI) HankyungLee1, Sehyeon Park2 and Bong Joon Kim3 Previous researches of Size and book-to-market(BM) ratio effects have usually been evaluated by parametric Capital Asset Pricing Model(CAPM)s. These parametric CAPMs are inevitably subject to ‘bad model’ problem, as is mentioned in Fama (1998). So, we suggest nonparametric CAPMs without bad model problem. Specifically, nonparametric stochastic discount factors (SDFs) are directly estimated from market price of reference assets. This paper evaluates Size and BM ratio effects in incomplete market through nonparametric CAPMs. Specific methods are as follows: First, we obtain admissible SDFs set under incomplete market using Euler equation of Lucas (1978). These nonparametric method does not suffer from the ‘bad model’ problem. Second, we introduce good deal constraint of Cochrane and Saa-Requejo (2000) into Euler equation. This makes the set of admissible SDFs tighter. Third, using admissible SDFs, we estimate the range of risk-adjusted expected return about Size, BM ratio, and Fama and French 16 (FF16, 1993) mimicking portfolios. We call it as good deal bounds. We select 91-day certificate of deposit and 16 KOSPI sub-indices for industry Group except for finance industry as reference assets. We obtain weekly data from January 2001 to December 2007. The number of observations is 364. Mimicking portfolios have the same sample period. Our results are as follows. The first is that smaller Size and higher BM ratio mimicking portfolios are related with higher returns. These are the same results as previous research. The second is that because the range of good deal bounds reflects different risk preferences of representatives under incomplete markets, the wide range of good deal bounds implies that performance of mimicking portfolios can be different according to heterogeneous risk preference of representatives under incomplete market. Specifically, we found that small size and high BM ratio mimicking portfolios had the range wider than any other mimicking portfolio. Key words: Size Effects, BM Ratio Effects, Stochastic Discount Factor, Euler Equation, No Arbitrage Constraints, Good Deal Constraints JEL Codes: C14, G11 1 Ph.D student, Graduate School of Business Administration, Gyeongsang National University, Korea nlfu2@hanmail.net 2 Ph.D student, Graduate School of Business Administration, Gyeongsang National University, Korea robbin82@hanmail.net 3 Professor, the Departement of Business Administration, Gyeongsang National University, Korea 055- 772-1527. bongjunkim1@gnu.ac.kr