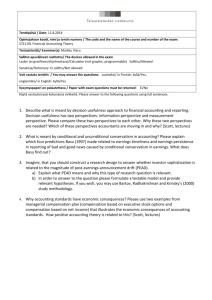

Proceedings of 24th International Business Research Conference

advertisement

Proceedings of 24th International Business Research Conference

12 - 13 December 2013, Planet Hollywood, Las Vegas, USA, ISBN: 978-1-922069-37-5

Credit Rating, Post-Earnings-Announcement-Drift, and Arbitrage

from Transient Institutions

Guanming He1

This study establishes a robust link between credit rating and post-earningsannouncement-drift (PEAD). I find strong evidence that PEAD is much stronger

for firms with lower credit ratings. This is consistent with the notion that investors

are apt to underreact to earnings news of low credit rating firms which are

characterized by high uncertainty of asset fundamentals in the long run. The

credit rating effect on PEAD is unexplained by traditional information uncertainty

proxies such as earnings volatility, cash flow volatility, accrual quality, firm age,

idiosyncratic volatility, and analyst forecast dispersion. Further, I investigate

whether transient institutions exploit the differential of PEAD among different

rated firms in their arbitrage trades. My results reveal that transient institutions

tend to focus their arbitrage on low credit rating firms which are featured as

abundant in arbitrage profits and that ex ante transaction cost impedes the

transient institutions from exploiting the PEAD in the low rated firms. This

evidence is taken to be suggestive of underreaction story rather than arbitrage

risk story to explain why PEAD anomaly concentrates in low credit rating firms.

Keywords: Credit rating, Post-earnings-announcement-drift, Transient institutions, Arbitrage

JEL Classifications: M41 G24 G14

1. Introduction

Existent literature documents that market anomalies concentrate in high credit risk stocks. For

instance, Avramov et al. (2009a) shows that the puzzling negative cross-sectional relation

between dispersion in analyst earnings forecasts and future stock returns is explained by credit

rating that measures a firm’s credit risk. Avramov et al. (2007) find that price momentum

prevails only among firms with low credit ratings and is nonexistent among firms with high

credit ratings. Collectively, these findings suggest that credit rating is an important predictor of

market anomalies and that low credit rating firms provide a crucial source of arbitrage profits

from trading on the anomalies. Given the strong implication of credit rating for market anomaly,

the first objective of this study is to explore the role of credit rating in post-earningsannouncement-drift (hereafter, PEAD) that is yet another most robust anomaly well

documented in the asset pricing literature.

PEAD refers to the tendency of stocks to continue to earn positive (negative) average

abnormal returns after positive (negative) earnings surprises. Beginning with the early work by

Ball and Brown (1968), the finance and accounting literature (e.g., Bernard and Thomas 1989,

1990; Ball and Bartov 1996) documents that investors tend to underreact to earnings

1

Guanming He , Corresponding author. University of Warwick, United Kingdom. Tel.: +44-7570184501.

Email: guanming.he@wbs.ac.uk.

1

Proceedings of 24th International Business Research Conference

12 - 13 December 2013, Planet Hollywood, Las Vegas, USA, ISBN: 978-1-922069-37-5

information at earnings announcements, followed by a continuous drift in the same direction as

earnings surprises. As such, firms that report high standardized unexpected earnings

(hereafter, SUE) subsequently outperform firms that report low SUE. This is known as PEAD

anomaly.

Extensive research (e.g., Odders-White and Ready 2006) documents the ability of credit

rating to capture uncertainty about the value of not only debt but also equity of a firm.

Theoretically, firm equity can be regarded as a call option on a firm with a strike price equal to

the face value of debt (e.g., Core and Schrand 1999). Default occurs when firm value falls

below the strike. Accordingly, default risk, which is embodied by credit rating, captures

uncertainty about a firm’s future earnings, growth rates and the cost of equity capital --- the

ingredients used in asset valuation (Merton 1974; Avramov et al. 2009a). Further, Standard &

Poor (2009) states that “Credit rating is meant to be forward-looking and their time horizon

extends as far as is analytically foreseeable2”, suggesting that credit rating is forward-looking

in discriminating risk and uncertainty of asset components of a firm in the long run. In view of

this, I posit that investors tend to delay their reaction to earnings news of low credit rating firms

until more additional relevant information become available and/or the precision of the

information increases following earnings announcements, resulting in stronger PEAD for low

rated firms.

I find strong evidence that PEAD is more salient for firms with lower credit ratings. In

particular, a univariate portfolio analysis reveals that a zero investment portfolio that longs the

highest SUE stocks and shorts the lowest SUE stocks yields larger payoffs (hereafter, PEAD

payoffs or earnings momentum payoffs) among lower credit rating group. This payoff

differential across credit rating groups cannot be explained by a battery of traditional

information uncertainty 3 proxies such as firm age, earnings volatility, accruals quality, cash

flow volatility, idiosyncratic volatility, and analyst forecast dispersion, as evidenced by the

results from the independent double sorts by credit rating and each of the information

uncertainty variables. Note that these variables primarily capture the earnings-preannouncement information uncertainty which could be largely resolved in a short run

(Shivakumar 2007). In contrast, credit rating captures the uncertainty that is forward-looking on

a long horizon. Presumably, investors should be concerned more about the forward-looking

uncertainty of asset fundamentals in a long run rather than in a short run when they use the

current earnings news to predict future earnings and price the firm equity. Hence, it is likely

that investors delay response to earnings news of firms featured by low credit rating rather

than by the high short-term information uncertainty. Consistent with this notion, my multivariate

regression analysis also reveals that the credit rating effect on PEAD is both independent of

and much stronger than the effect of those traditional information uncertainty proxies. In

particular, most information uncertainty variables lose their predictive power for PEAD whereas

the effect of credit rating remains highly significant. The results hold for PEAD associated with

2

Altman and Rijken (2004) quantify the impact of the long-term default horizon and show that, in contrast to one-year

default prediction models, credit rating agencies place less weight on short-term indicators of credit quality and focus on the

long term ones in assigning credit ratings to firms.

3

Following Zhang (2006), I define information uncertainty as ambiguity with respect to the implications of new information

for a firm’s value.

2

Proceedings of 24th International Business Research Conference

12 - 13 December 2013, Planet Hollywood, Las Vegas, USA, ISBN: 978-1-922069-37-5

either seasonal random walk-based earnings surprises (hereafters, RW-based PEAD) or

analyst forecast-based earnings surprises (hereafters, AF-based PEAD) over different drift

windows and are robust to controlling for an array of other PEAD determinants (e.g.,

transaction cost) documented in the literature. These results also persist after adjusting the

PEAD for systematic risks.

Firms with lower credit ratings tend to have higher idiosyncratic risk. If arbitrageurs are not

well informed or not able to well diversify their investment portfolios, the credit risk might

restrain rather than stimulate the arbitrages on PEAD. This alternatively explains why the

PEAD is concentrated in high credit risk firms. Thus, I next examine whether transient

institutions exploit the significance of earnings momentum payoffs among low credit rating

firms and engage in the arbitrages accordingly. I focus on the transient institutions’ arbitrages

for two reasons: First, transient institutions make the majority of all trades in the US stock

market (e.g., Ke and Ramalingegowda 2005). Second, transient institutions are characterized

by high turnover and high portfolio diversification with short trading horizons and fragmented

investments in a large number of companies. Prior research (e.g., Gompers and Metrick 2001;

Yan and Zhang 2009) shows that transient institutions are sophisticated and informed

investors who trade actively to exploit their information advantage. They aim at maximizing the

short-term profits and tend to arbitrage anomalies in the financial market place (e.g., Ke and

Ramalingegowda 2005). Further, given prior evidence that transient institutions arbitrage

PEAD anomaly, it is also important to further investigate how capable transient institutions are

to exploit the PEAD payoff differential among different firms to enlarge their arbitrage profits. In

this way, we could obtain further insights into the role of transient institutions in contributing to

capital market efficiency.

The drift returns remain significant after adjusting for systematic risk and transaction cost,

suggesting that the PEAD affords an arbitrage opportunity for arbitrageurs to obtain real profits

(e.g., Bernard and Thomas 1989; Ke and Ramalingegowda 2005; Chung and Hrazdil 2011).

To the extent that credit rating is a potent determinant of PEAD payoffs, transient institutions

who wish to pursue high arbitrage profits should be particularly sensitive to a firm’s credit rating

information. If transient institutions are sophisticated in collecting and processing information,

they would be able to identify the significance of PEAD payoffs among low rated firms. Given

the high PEAD payoffs, high idiosyncratic risk from low credit rating firms should not impede a

transient institution from exploiting the PEAD so long as the transient institution is capable of

diversifying away the idiosyncratic risk through the portfolio diversification or the possession of

private information about firms. In this scenario, I expect that transient institutions tend to trade

more aggressively to exploit PEAD in firms with lower credit ratings. Results confirm my

expectation, suggesting that the transient institutions are not only sophisticated in information

processing but also well capable of diversifying idiosyncratic risk from firms with low credit

ratings. However, PEAD yet existent and concentrated in low credit rating firms points to the

fact that the transient institutions still do not fully exploit the PEAD among the low rated firms.

My further analysis reveals that ex ante transaction cost4 hinders the transient institutions from

exploiting the PEAD in the low rated firms.

4

Ex ante transaction cost is defined as the transaction cost that traders expect to incur for trading stocks in the stock market.

3

Proceedings of 24th International Business Research Conference

12 - 13 December 2013, Planet Hollywood, Las Vegas, USA, ISBN: 978-1-922069-37-5

This study contributes to the existent literature in several aspects. First, this study

conducts the first exploration about the theoretical and empirical link between credit rating and

PEAD anomaly. I hypothesize that investors are apt to underreact to earnings news released

by low credit rating firms that are featured as having high future uncertainty of asset

fundamentals in the long run. My empirical results are consistent with the testable hypothesis,

that is, either seasonal-random-walk-based PEAD or analyst-based PEAD is more salient for

firms with lower credit ratings. This evidence lends support to the notion that investors’

underreaction to earnings news could be the outcome of investors’ rational behaviors. In this

way, this study complements the rationality explanation for financial anomalies in the literature

(e.g., Morris 1996; Lewellen and Shanken 2002; Dontoh et al. 2003; Francis et al. 2007), but is

contrasted with the irrationality story for the investors’ underreaction in some prior PEAD

studies (e.g., Bartov et al. 2000; Battalio and Mendenhall 2005).

Second, Avramov et al. (2007) find a strong and robust association between credit rating

and price momentum. However, prior studies (e.g., Chordia and Shivakumar 2006) also find

that price momentum is entirely subsumed and driven by earnings momentum (i.e., PEAD) and

hence merely a manifestation of the earnings momentum. Building on this strand of literature,

my study further establishes a strong predictable link between credit rating and earnings

momentum, and therein contributes to more understanding of the profitability of momentum

strategies. By showing that the credit rating effect on PEAD is unexplained by varied proxies

for information uncertainty and other drift-related variables, I corroborate that credit rating is a

potent predictor of PEAD anomaly.

Third, prior literature (e.g., Ke and Petroni 2004; Ke and Ramalingegowda 2005; Yan and

Zhang 2009) documents that transient institutions are sophisticated and trade actively to

exploit RW-based PEAD. However, there is no prior evidence on how these transient

institutions exploit the PEAD to enlarge arbitrage profits. This study sheds light on this issue

and finds that transient institutions tend to focus their arbitrage on PEAD among low rated

firms that are featured as abundant in arbitrage profits, and that this arbitrage strategy applies

not only to RW-based PEAD but also to AF-based PEAD.

Fourth, asset pricing literature (e.g., Francis et al. 2007; Arena et al. 2008; McLean 2010)

well documents that market anomalies concentrates among high idiosyncratic risk firms. There

are two explanations for this evidence. First, investors are prone to underreact to a larger

extent to firm-specific information featured by higher idiosyncratic risk. Second, idiosyncratic

risk represents limits of arbitrage for arbitrageurs, thereby allowing anomalies to persist and

remain conspicuous for stocks with high idiosyncratic risk. To the best of my knowledge, this

paper is the first to disentangle these two explanations. Specifically, by providing evidence that

credit risk represents a stimulus to rather than a limit of arbitrage for transient institutions, I rule

out the limit of arbitrage story (in terms of idiosyncratic risk) as an alternative explanation for

why stronger PEAD prevails among lower rated firms. Rather, I attribute the stronger PEAD

primarily to investors’ greater underreaction to earnings news released by lower rated firms5.

5

My first objective of exploring the role of credit ratings in PEAD is conceptually different from Avramov et al. (2013) in

that the objective of their paper is to empirically explore the potential implications of financial distress for asset pricing

anomalies. Furthermore, Avramov et al. do not tell why the anomalies are stronger for financial distress firms. They do not

4

Proceedings of 24th International Business Research Conference

12 - 13 December 2013, Planet Hollywood, Las Vegas, USA, ISBN: 978-1-922069-37-5

The remainder of the paper proceeds as follows. Section 2 conducts literature review and

develops the testable hypothesis. Section 3 describes the data collection and sample selection

procedures. Section 4 presents the research methodologies to test the hypothesis. Section 5

discusses the results and Section 6 concludes.

2. Literature Review and Hypothesis Development

2.1. Credit rating and Pead

The literature has explored varied explanations for PEAD, and specifically, for why market

participants are slow in reacting to the earnings information. Irrational explanations as to investors’

underreaction to earnings news (e.g., Bartov et al. 2000; Battalio and Mendenhall 2005) pinpoints the

investors’ unsophistication in their information processing and suggests that the trading by naive

individual investors drives the PEAD. However, one limitation of these studies is that the quality of the

proxies used to capture investor sophistication, such as trade size and institutional ownership, is

questionable (Richardson et al. 2010). Using actual daily signed trading made by individual investors,

Hirshleifer et al. (2008) present direct contrary evidence that PEAD is not caused by the trading

activities of individual investors.

Another main strand of explanations for PEAD pertains to investors’ reliance on private information

more than public information. For instance, Daniel et al. (1998) present a model in which investors

overweight the value of their private signals and underweight the information content of important public

information such as earnings announcements. Hong and Stein (1999) suggest that market participants

might require additional private information to convert the news at earnings announcements into a

judgment about future earnings. More recent studies such as Liang (2003), Vega (2006), and Francis et

al. (2007) also find that the PEAD of a given firm is related to the amount of private information

available about that firm. In this vein, individual investors not driving PEAD as evidenced by Hirshleifer

et al. (2008) is probably because the individuals have to resort to (and thereby react promptly to)

important public information such as earnings news given their lack of private information. Despite

these evidence and explanations for PEAD, few studies in the PEAD literature show under what

circumstances investors are prone to underreact to the earnings news. This study extends this strand of

literature by showing whether the investors’ delayed reactions are subject to a firm’s credit risk proxied

by credit rating.

Prior studies (e.g., Merton 1974; Avramov et al. 2009a) argue that credit rating captures the

uncertainty about a firm’s future earnings, growth rates and the cost of equity capital --- the ingredients

used for asset valuation. Consistent with this assertion, Avramov et al. (2009a) find that credit rating

even subsumes the information in analyst forecast dispersion in capturing the uncertainty about future

earnings and future stock returns. Further, credit rating aims to discriminate relatively long-term credit

risk and long-term uncertainty about a firm’s asset components in future. This is distinctive from firm

age, earnings volatility, accruals quality, cash flow volatility, return volatility, idiosyncratic volatility, and

analyst forecast dispersion, which capture a firm’s historical information uncertainty and/or information

uncertainty to be resolved on a short horizon. Compared to these traditional information uncertainty

variables, credit rating is a long-term indicator of future uncertainty about a firm’s fundamentals (e.g.,

consider information uncertainty that may alternatively explain the effect of financial distress on the anomalies. Nor do they

exclude limit of arbitrage (in terms of a firm’s idiosyncratic risk) story as an alternative explanation for why the anomalies

concentrate among the financial distress firms.

5

Proceedings of 24th International Business Research Conference

12 - 13 December 2013, Planet Hollywood, Las Vegas, USA, ISBN: 978-1-922069-37-5

future earnings) at the earnings announcements. Accordingly, current earnings released by lower credit

rating firms have weaker implications for future earnings in the long run.

Rational explanations for financial anomaly (e.g., Morris 1996; Lewellen and Shanken 2002;

Francis et al. 2007) focus on investors’ rational processing of incomplete and imprecise information. In

particular, investors place less weight on signal that is of lower precision or lower quality and therein

rationally defer investing in stocks until more relevant information becomes available and/or the

precision of information increases in future. In this regard, the extent of investors’ underreaction at

earnings announcements depends on the precision and quality of the earnings signal in terms of its

implication for future earnings. As a lower credit rating firm is characterized by its weaker implication of

current earnings about future earnings, it’s more difficult for investors to interpret its earnings news and

form expectations about its future earnings in a timely manner. As a consequence, investors’ delayed

trading on earnings news of lower rated firms becomes more prominent. Accordingly, I expect that the

PEAD is stronger among firms with lower credit ratings.

Chordia and Shivakumar (2006) find that a zero investment portfolio that is long on stocks with

high SUE and short on stocks with low SUE are significantly related to business cycle proxied by

growth in GDP, industrial production, consumption, labor income, inflation and T-bill returns. Moreover,

Avramov and Chordia (2006) show that an optimizing investor who appreciates the business cycle is

able to successfully load on the momentum strategy during different phases of the economy. Since

credit risk varies over business cycle (e.g., Nickell et al. 2000; Bangia et al. 2002; Amato and Furfine

2004), it is natural to ask whether the earnings momentum payoffs are related to credit rating of a firm.

In this study, I provide a new and unexplored dimension in understanding the profitability of PEAD

trading strategy. To the extent that more prominent PEAD is generated by high credit risk firms,

earnings momentum profitability should be higher for firms with lower credit ratings.

In a similar vein, Francis et al. (2007) examines the effect of information uncertainty on PEAD.

They focus on information uncertainty before the earnings announcements and define information

uncertainty as the degree to which historical accruals map into cash flows. In contrast, I focus on future

uncertainty of asset valuation in a long run, which is captured by a firm’s credit rating. Moreover,

Francis et al.’s measure of information uncertainty by the standard deviation of residuals in the Dechow

and Dichev (2002) model is subject to two limitations. First, their measure directly equates poor

accounting quality with high information uncertainty. However, a firm that consistently overestimates

accruals has poor accounting quality but does not necessarily have high information uncertainty as

captured by the high accruals volatility. Second, firms could use accruals to report losses in a timely

fashion. Ball and Shivakumar (2006) show that timely loss recognition role of accruals implies a

nonlinearity in the mapping of accruals into cash flows. A failure to account for the nonlinearity in

Francis et al. (2007)’s study could result in greater accrual volatility stemming from timely loss

recognition rather than high information uncertainty (Shivakumar 2007). Last but not the least, Francis

et al. (2007) do not exclude limit of arbitrage (in terms of a firm’s idiosyncratic risk) story as an

alternative explanation for why PEAD is more pronounced for firms with high information uncertainty.

My study does so by further showing (in Section 2.2, 4.2, and 5.2) that credit risk stimulates rather than

restrains the arbitrage from transient institutions who are well informed and capable of diversifying

idiosyncratic risk in the low rated firms.

2.2. Credit rating and transient institutions’ arbitrage on Pead

Institutions can be classified into transient, dedicated and quasi-indexing institutions based on their

investment horizon and portfolio turnover. Transient institutions possess short trading horizons and

fragmented investments in a large amount of firms, and hence are featured by high turnover, high

6

Proceedings of 24th International Business Research Conference

12 - 13 December 2013, Planet Hollywood, Las Vegas, USA, ISBN: 978-1-922069-37-5

investment portfolio diversification and high frequency of arbitrage activities. In contrast, dedicated

institutions have a long-term strategy of holding large stakes in a fewer firms, and thus exhibit low

turnover and low diversification. Quasi-indexing institutions have a passive long-term buy-and-hold

strategy in a broad set of firms, and hence exhibit low turnover and high diversification.

Most prior studies (e.g., Nofsinger and Sias 1999; Gompers and Metrick 2001; Ke and

Ramalingegowda 2005) that examined the effect of institutional trading on asset prices and returns

suggest that institutional investors are sophisticated and informed. Suppose that some institutional

investors have superior information and can regularly identify mispricing of stocks, these institutional

investors should trade frequently to exploit their informational advantage and skill (e.g., Wermers 2000).

In contrast, institutional investors in possession of limited information would trade more cautiously.

Therefore, transient institutions (i.e., those actively trade to maximize short-term profits) should be more

sophisticated and better informed than dedicated and quasi-indexing institutions (i.e., those that have

long-term investment horizon). Consistent with this proposition, Yan and Zhang (2009) find that

transient institutions’ trading predicts future stock returns and future earnings surprises whereas

dedicated or quasi-indexing institutional trading does not forecast returns and earnings news. Ke and

Petroni (2004) find that transient institutions can predict a break in a string of consecutive quarterly

earnings increases but dedicated and quasi-indexing institutions cannot. Ke and Ramalingegowda

(2005) provide evidence that transient institutions, but not dedicated and quasi-indexing institutions,

exploit the PEAD.

Provided that transient institutions are sophisticated in collecting and processing information, they

should be able to identify that the earnings momentum payoffs concentrate among low credit rating

firms. Though low credit ratings are associated with high idiosyncratic risk for a firm, one can well

manage unsystematic risk at a low cost by holding a diversified portfolio or possessing private

information about a firm (e.g., Markowitz 1959; Hughes et al. 2007). Given the high PEAD payoffs, the

high idiosyncratic risk from low credit rating firms should not hinder a transient institution from exploiting

their PEAD so long as the transient institution is capable of diversifying away the idiosyncratic risk. Or

rather, if a transient institution is capable of diversifying idiosyncratic risk, the marginal benefits with

respect to an increase in credit risk should surpass the marginal costs for the transient institution. In this

scenario, I expect that transient institutions who wish to maximize their short-term arbitrage profits

would trade more aggressively to exploit PEAD among firms with lower credit ratings. On the contrary, if

transient institutions are not sophisticated enough to identify the significance of PEAD payoffs among

low rated firms or they are not capable of diversifying the idiosyncratic risk, we would not observe that

transient institutions trade more intensively to exploit PEAD in low rated firms.

In addition, prior studies (e.g., Bhushan 1994; Ke and Ramalingegowda 2005) provide evidence

that high ex ante transaction cost decreases the arbitrage activities of institutional investors and thereby

exacerbates the magnitude of PEAD. To the extent that transient institutions trade more intensively to

exploit PEAD in firms that have low credit ratings, I would further explore whether the ex ante

transaction cost would mitigate the intensity of transient institutions’ arbitrage on PEAD for the low rated

firms.

Last, given a long-term focus by dedicated and quasi-indexing institutions, they serve more of a

monitoring role for a company (Chen et al. 2007), care more about long-term firm performance, and are

less likely to engage in arbitrages as transient institutions do. Therefore, there should be no mitigating

effect of dedicated or quasi-indexing institutions’ trading on the magnitude of PEAD. Rather, the

dedicated and quasi-indexing institutions act more as normal investors who tend to underreact to

earnings news released by a firm with high credit risk.

7

Proceedings of 24th International Business Research Conference

12 - 13 December 2013, Planet Hollywood, Las Vegas, USA, ISBN: 978-1-922069-37-5

3. Data

3.1. Data source

The empirical analyses are based on data gathered from four sources: I/B/E/S, CRSP, Compustat,

and CDA Spectrum. Stock returns are obtained from all NYSE, AMEX, and NASDAQ stocks listed in

the Center for Research in Security Prices (CRSP) database. Firm credit ratings are extracted from the

Standard and Poor’s Long-Term Domestic Issuer credit ratings reported by Compustat from the second

quarter of 1985. So my sample period starts from July, 1985. Since institutions’ trading classification

data are only available for the period before 2010, my sample period ends in December, 2009. Table 1

shows the full sample distribution of credit ratings at the firm-quarter level from 1985-2009. The majority

of observations in the rated firm population fall within the credit rating level from BB- to BBB+, with BBB

level observations accounting for the highest percentage (10.28%). I collect institutional ownership data

on the CDA Spectrum while the institutions’ trading classification (transient, dedicated and quasiindexing) is obtained from Brian Bushee. I focus on the effect of transient institutions’ trading on PEAD

since prior studies (e.g., Ke and Ramalingegowda 2005) provide evidence that transient institutions

exploit PEAD whereas dedicated or quasi-indexing institutions do not. I require that firms have

necessary data to construct variables of interest in all my empirical analyses.

3.2. Measurement of earnings surprises

While the majority of prior studies focus on the drift associated with seasonal random walk-based

earnings surprises, recent studies (e.g., Livnat and Mendenhall 2006; Doyle et al. 2006) document a

drift associated with analyst forecast-based earnings surprises that appear not only distinct from but

even larger than the drift associated with random walk-based earnings surprises. So I focus on PEAD

associated with both the seasonal random walk-based and the analyst forecast-based earnings

surprises, namely, RW-based and AF-based PEAD, respectively. Following Bernard and Thomas

(1989), I define the random walk-based earnings surprise as current quarter earnings less earnings four

quarters ago, standardized by the standard deviation of earnings changes in the prior ten quarters. I

standardize the earnings surprise by the standard deviation rather than stock price, market

capitalization, or sales because these variables may in themselves proxy for size or expected returns

which would bias the results towards capturing cross-sectional variance in the expected returns

associated with these variables (Chordia and Shivakumar 2006). To compute the seasonal random

walk-based earnings surprise, I require firms to have earnings before extraordinary items and

discontinued operations for the same quarter in the prior year and to have at least 14 quarters of the

prior quarterly earnings.

Following Livnat and Mendenhall (2006), I define analyst forecast-based earnings surprise as the

unsplit-adjusted I/B/E/S actual EPS minus the most recent I/B/E/S median consensus analyst forecast,

deflated by stock price at the end of the fiscal quarter. Accordingly, I require firms to have both analyst

forecasts and actual earnings for the fiscal quarter in the I/B/E/S database. I also require that the

analyst forecasts be within one quarter before earnings announcement date to ensure that stale

forecasts are excluded in my analyses.

8

Proceedings of 24th International Business Research Conference

12 - 13 December 2013, Planet Hollywood, Las Vegas, USA, ISBN: 978-1-922069-37-5

4. Research Methodology

4.1. Credit rating and Pead

4.1.1. Portfolio analysis

I rank firms into deciles based on SUE for each fiscal quarter 6 . The PEAD trading strategy

involves a hedge portfolio which takes the long (short) position in the decile portfolios of firms with the

most positive (negative) SUE. Firms enter the portfolios on the second trading day following each

earnings announcement, and the portfolios are held for 60 trading days thereafter. Since prior studies

(e.g., Bernard and Thomas 1990) show that a significant portion of PEAD concentrates in a three-day

window surrounding the announcements of the next three quarterly earnings, I also have the long (short)

position held until one trading day after the earnings announcement date for quarter t+1, quarter t+2

and quarter t+3 (i.e., [2, Et+1+1], [2, Et+2+1], and [2, Et+3+1] relative to the earnings announcement date

for quarter t), respectively. Accordingly, I require firms to have stock returns data from the CRSP daily

stock file during the corresponding drift windows.

Following prior research on earnings-related anomalies (e.g., Dechow et al. 2008;

Baladrishnan et al. 2009), I use size-adjusted buy-and-hold abnormal returns to measure a

firm’s drift returns7. The expected returns for firm i on trading day t are defined as the equallyweighted returns for all firms in firm i’s size-matched deciles on day t, where size is measured

as market capitalization at the beginning of the most recent calendar quarter. The return to the

most positive (negative) SUE decile portfolio is then calculated as an equally-weighted

average of drift return of the corresponding firms in that SUE decile portfolio. Accordingly,

payoffs from the PEAD trading strategy are based on the portfolio returns from the strategy

implemented at the earnings announcements and held over the corresponding drift windows.

To investigate whether PEAD anomaly differs across different credit rating firms, I

implement the PEAD strategies by conditioning on both credit rating and SUE. I consider 10

SUE portfolios and 3 credit rating (Rating) groups. Specifically, the Rating-SUE portfolios are

formed on a sequential basis, sorting first on Rating and then on SUE. For each quarter, the

high (low) credit rating group contains the A- to AAA rated (the SD to CCC+ rated) firms based

on their Standard & Poor’s ratings for that particular quarter. The middle credit rating group

incorporates firms that have ratings from B- to BBB+. It’s expected that the profitability from the

PEAD trading strategy of being long (short) the highest (lowest) SUE decile portfolio is the

highest among the low credit rating group.

Further, I implement the PEAD trading strategy over subsamples of different rated firms.

Particularly, I start with the entire sample of rated firms and then sequentially exclude firms

with lower credit ratings. This analysis reveals the subsample of rated firms that drive the

6

To be consistent with Collins and Hribar (2000), I also use the cut-off values that define the deciles of SUE for period t-1 to

sort the SUE for period t into deciles. The results are qualitatively the same.

7

Inferences are unchanged if I follow prior research (e.g., Ogneva and Subramanyam 2007; Baladrishnan et al. 2009) to

estimate the expected returns based on Carhart’s (1997) 4-factor model. Nor would my inferences change if I employ the

calendar-time portfolio approach (e.g., Fama 1998; Mitchell and Stafford 2000) to assess the magnitude and statistical

significance of the PEAD.

9

Proceedings of 24th International Business Research Conference

12 - 13 December 2013, Planet Hollywood, Las Vegas, USA, ISBN: 978-1-922069-37-5

earnings momentum payoffs. I report the average payoffs from the PEAD trading strategy in

each subsample which is expected to gradually decline as I progressively drop the worse-rated

firms.

4.1.2. Regression analysis

I specify the following pooled OLS regression model to test the credit rating effect on PEAD:

(1)

Drift 0 1DSUE 2 DSUE * Rating 3 Rating 4Controls 5Controls * DSUE

Drift is the size-adjusted buy-and-hold returns over the drift window and equals the compounded

raw returns minus the compounded equally-weighted returns of the same CRSP size decile and the

same CRSP exchange index (NYSE/AMEX/NASDAQ) that a firm belongs to8. Consistent with prior

studies, I rank RW-based and AF-based SUE into ten deciles indexed from 0 to 9 by quarters, and

divide the index by 9 to get DSUE which ranges from 0 to 1. As such, the coefficient on DSUE can be

readily interpreted as the excess returns one can earn over the drift window under a zero investment

portfolio strategy that takes a long position in the highest SUE decile (DSUE = 1) and a short position in

the lowest SUE decile (DSUE = 0). Given that PEAD persists for three quarters ahead following

earnings announcements, I focus on a drift over four different windows as I did in the portfolio analysis.

A positive coefficient on DSUE would suggest that investors do not fully incorporate the implications of

current earnings for future earnings at earnings announcement dates, thereby consistent with the

existence of PEAD documented in the prior research. Rating is coded 0 for firms that have ratings

ranging from SD/D to CCC+, 0.5 for firms with ratings from B- to BBB+, and 1 for firms with ratings from

A- to AAA 9 . I expect the coefficient on the interaction term between DSUE and Rating, 2, to be

negative and statistically significant to support the hypothesis that PEAD for lower rated firms is

stronger and that their earnings momentum payoffs are larger.

Since prior literature (e.g., Jiang et al. 2005; Zhang 2006) provides evidence that momentum

payoffs are higher in firms that have higher information uncertainty, PEAD should be stronger for firms

with higher information uncertainty. Hence, I control for a battery of information uncertainty proxies used

in the prior studies: Firm age (Firmage), return volatility (Returnvol), earnings volatility (Earningsvol),

cash flow volatility (Cashvol), accruals quality (AQ), idiosyncratic volatility (IdioVol), and analyst forecast

dispersion (Anadis) (Jiang et al. 2005; Zhang 2006; Francis 2007, among others)10. Stronger PEAD is

expected for firms with smaller age, higher return volatility, higher earnings volatility, higher cash flow

volatility, lower accruals quality, higher idiosyncratic volatility, or higher analyst forecast dispersion.

I also control for other factors that potentially affect the magnitude of PEAD. Following Mendenhall

(2004), I control for transaction cost, proxied by trading volume (Tradingvol) and share price (Price)11,

since PEAD is stronger when transaction cost is higher. I include firm size (Size) as prior studies (e.g.,

Foster et al. 1984) show that PEAD is more pronounced for smaller firms. Prior studies (e.g., Bartov et

8

I obtain almost identical results when I compute the PEAD in two alternative ways: (1) size-adjusted cumulative abnormal

returns over the drift window; (2) buy-and-hold abnormal returns over the drift window, where daily abnormal return is

calculated as the raw daily return minus the daily return on the quintile/decile portfolio of firms with approximately the same

size and book-to-market ratio as of the most recent fiscal quarter end.

9

The results are robust to using a dichotomized credit rating variable which is based on the classification of credit ratings into

investment grade and speculative grade categories.

10

Inferences on the impact of credit rating on PEAD remain unchanged if I include only one of these information uncertainty

proxies as the control in the regression analyses.

11

Use of bid-ask spread (Korajczyk and Sadka 2004; Hanna and Ready 2005) as an alternative measure of ex ante

transaction costs does not alter the inferences I drawn from the regression results.

10

Proceedings of 24th International Business Research Conference

12 - 13 December 2013, Planet Hollywood, Las Vegas, USA, ISBN: 978-1-922069-37-5

al. 2000) find that high institutional ownership mitigates PEAD, suggesting that firms whose investors

are more sophisticated are likely to suffer less from mispricing. Hence, I control for the percentage of

shares held by institutional investors (Insti) and expect it to be inversely related to PEAD. Following

Merndenhall (2002) and Zhang (2008), I further control for investor sophistication measured by analyst

following (Anacov). Since the probability that analysts uncover and publicize information about a firm’s

future earnings increases with the magnitude of analyst coverage, I expect that the analyst coverage

helps mitigate the PEAD as institutional holdings do. I control for the nature of earnings news

(Badnews) because negative earnings surprise is less persistent and hence it is more difficult to assess

its implication for future earnings (Hong et al. 2000). I include the fourth quarter earnings

announcement (4THQTR) since it provides more information to analysts and investors than does an

interim announcement and thus might be associated with lesser extent of PEAD (Cornell and

Landsman 1989). I also include an indicator variable for the post-Regulation Fair Disclosure period (FD)

to control for the effect of change in information environment due to the enforcement of Regulation FD.

All the control variables are defined in the appendix. Last, I include the industry-fixed effects in the

regression model. Standard errors are clustered two-way by firm and year-quarter to correct for both

cross-sectional and time-series correlation.

Following prior studies (e.g., Bartov 2000; Zhang 2008), I interact all the control variables with

DSUE. The interactions allow the slope of the SUE-return relation to vary with each control variable and

hence enable us to assess how these control variables affect the magnitude of the drift. Each

continuous control variable is ranked into deciles within each fiscal quarter and coded from 0 to 1. The

coding allows the coefficient on the interaction term to be interpreted as the additional spread in

abnormal returns, between the highest- and lowest-SUE decile portfolio, for firms with largest versus

smallest decile rank of the control variables (Mendenhall 2004). Also, the decile ranking of the control

variables address potential problem of outliers and nonlinearity in the earnings-returns relation (e.g.,

Bernard and Thomas 1990; Bartov et al. 2000).

4.2. Do transient institutions focus their arbitrage on PEAD in low rated firms?

To assess the effect of credit rating on transient institutions’ arbitrage intensity, I estimate the

following firm-fixed effect regression model of the quarterly changes in transient institutional ownership

for firm i in calendar quarter t´:

3

3

q 0

q 0

Transienti ,t´ 0 1 q DSUEi ,t q 2 Rating i ,t 3 q DSUEi ,t q * Rating i ,t

3

4 ExtTradi ,t 5 q DSUEi ,t q * ExtTrad i ,t 6 BM i ,t 7 Sizei ,t 8 PWi ,t

(2)

q 0

9 FDi ,t 10 RET 1i ,t 11 ( RET 2 3)i ,t 12 ( RET 4 6)i ,t

3

(13 q DSUEi ,t q * ExtTradi ,t * Rating i ,t ) i ,t

q 0

Transient is the change in transient institutional ownership as a percentage of the outstanding

shares. Institutional holdings are reported by CDA Spectrum Database only at the end of calendar

quarters. Thus, Transienti,t´ is measured for firm i over a calendar quarter from the end of calendar

quarter t´-1 to the end of calendar quarter t´, within which the earnings announcement date for fiscal

quarter t falls. SUEi,t is the standardized unexpected earnings surprise of firm i for fiscal quarter t.

DSUEi,t-q is the decile ranking of SUE of firm i for fiscal quarter t-q. PWi,t is the mean portfolio weight of

firm i in the portfolio of a transient institution for fiscal quarter t. PW measures the extent to which stock

investments of transient institutional investors are allocated to a given firm. I include PW because

transient institutions whose stock holdings are heavily weighted towards a given firm are more likely to

11

Proceedings of 24th International Business Research Conference

12 - 13 December 2013, Planet Hollywood, Las Vegas, USA, ISBN: 978-1-922069-37-5

sell shares in the subsequent quarter for portfolio diversifications. I control for firm size (Size) and bookto-market effect (BM) since they are systematically related to institutional ownership (Gompers and

Metrick 2001). I include RET1, RET2-3, and RET4-6 to control for the price momentum effect since

prior research (e.g., Griffin et al. 2003) finds that institutional investors tend to be momentum traders. If

transient institutions follow a momentum (contrarian) trading strategy, the coefficients on RET1, RET2-3,

and RET4-6 would be significantly positive (negative). I also include an indicator for the post-Regulation

Fair Disclosure period (FD) to control for the impact of Regulation FD on transient institutions’ trading

behaviors (Ke et al. 2008). All the control variables are defined in the appendix. Last, I include industry,

year, and quarter fixed effects in the regression model as there might be systematic variation in

institutional ownership across industries, over years, and over the four calendar quarters.

Prior studies (e.g., Bernard and Thomas 1990) document that a disproportionately large portion of

the abnormal returns from the zero-investment RW-based PEAD trading strategy, which are cumulated

from the day after earnings announcement for quarter t through the earnings announcement for quarter

t+3, are realized before the earnings announcement date for quarter t+1. Therefore, if transient

institutional investors exploit RW-based PEAD, they would well initial their arbitrage positions before

earnings announcement for quarter t+1. Accordingly, transient institutional ownership changes around

earnings announcement in quarter t´ should be positively related to the SUE for quarter t, and the

coefficient on DSUEt should be significantly positive. Meanwhile, since the direction of abnormal returns

associated with RW-based SUE reverses at earnings announcements for quarter t+4, transient

institutional investors should unwind their arbitrage positions no later than quarter t+3 and hence one or

more of the coefficients on lagged DSUEs (i.e., DSUEt-1 to t-3) should be negative. Consistent with Ke

and Ramalingegowda (2005), I do not expect all the coefficients on lagged DSUEs to be negative since

transient institutions could choose to liquidate their arbitrage positions in any one of the following three

quarters. Rather, I expect that the sum of the coefficients on lagged DSUEs is negative.

Prior literature (e.g., Livnat et al. 2006; Doyle et al. 2006) documents that the pattern of the AFbased drift is different from that of RW-based drift around the four subsequent quarterly earnings

announcements. As for AF-based PEAD, there exist positive autocorrelations of the abnormal returns

around the earnings announcements for quarter t, t+1, t+2, and t+3 but no reversal of abnormal returns

around the earnings announcement for quarter t+4. This suggests that analysts do not rely on a

seasonal random walk model to form earnings expectations and hence their earnings forecasts are free

from a bias from assuming that earnings follow a seasonal random walk pattern. Further, prior studies

(e.g., Livnat et al. 2006) show that AF-based drift concentrates around two subsequent quarterly

earnings announcements. In this respect, if transient institutions wish to exploit the AF-based PEAD,

they should well establish their arbitrage positions before the quarter t+2. Accordingly, I expect that

transient institutional ownership changes (Transienti,t´) are positively correlated with DSUEt or DSUEt-1

(i.e., the SUE for quarter t and quarter t+1, respectively), or both. Meanwhile, transient institutions might

find it optimal to unwind their arbitrage positions in quarter t+2 or quarter t+3 in order to shift their

capital to more profitable investments. Hence, transient institutional ownership changes (Transienti,t´)

would be negatively related to DSUEt-2 or DSUEt-3 (i.e., SUE for quarter t+2 and quarter t+3), or both.

To further support the rationale underlying the PEAD arbitrage strategy, I replicate two key

findings in the PEAD literature (results not tabulated): (1) the autocorrelation between DSUE in quarter

t+4 and DSUEs in quarter t+3 to t; and (2) the association between the market reactions to SUE in

quarter t+4 and DSUEs in quarter t+3 to t, with the coefficient estimates of DSUEt+3 to t denoting the

hedge returns around the subsequent four earnings announcements. A pooled cross-sectional and

time-series regression is used for the replication during the sample period of 1985-2009. Consistent

with Bernard and Thomas (1990, panel B of table 1) and Ball and Bartov (1996, table 1), I find positive

and declining first-, second-, and third-order autocorrelations and a negative fourth-order

autocorrelation for the RW-based DSUEs (i.e., {0.412, 0.276, 0.161, -0.109}). Also, consistent with

12

Proceedings of 24th International Business Research Conference

12 - 13 December 2013, Planet Hollywood, Las Vegas, USA, ISBN: 978-1-922069-37-5

Bernard and Thomas (1990, panel B of table 2) and Ball and Bartov (1996, table 2), I find positive and

significant RW-based hedge returns around the first two subsequent earnings announcements (0.007

and 0.004, respectively), an almost zero hedge return around the third subsequent earnings

announcement (-0.0005), and a significantly negative hedge return around the fourth earnings

announcement (-0.006). The autocorrelations for AF-based DSUEs are positive and declining through

four lags (i.e.,{0.342, 0.226, 0.166, 0.153}), which is very akin to that documented by Abarbanell and

Bernard (1992, panel B of table 1) and Livnat et al. (2006, table 7). The pattern of hedge returns for AFbased DSUEs over the subsequent four quarterly earnings announcements is {0.004, 0.002, -0.0002, 0.006}, with the first two and the fourth associations being significantly different from zero. The positive

hedge returns surrounding the first two subsequent earnings announcements are consistent with those

of Abarbanell and Bernard (1992, figure 1) and Livnat et al. (2006, table 7), while the negative hedge

return around the fourth subsequent earnings announcement is qualitatively similar to that observed in

Abarbanell and Bernard (1992, figure 1).

I first do a regression analysis on the main effect of DSUEs on transient institutions’ trading,

leaving out the moderating effect of the interaction terms in model (2). The results (not tabulated)

indicate that the coefficients on DSUE(t to t-3) are all highly significant in the predicted sign, demonstrating

that transient institutions trade actively to exploit RW-based and AF-based PEAD. In model (2), I allow

the regression coefficients on DSUEs to differ for high and low credit rating (Rating) firms. If transient

institutions trade more intensively to exploit PEAD among firms with lower credit ratings, I expect the

coefficients on Rating*DSUEs to be in the opposite sign to the coefficients on DSUEs and statistically

significant. In particular, in the case that transient institution investors exploit RW-based PEAD more

intensively for lower credit rating firms, the coefficient for Rating*DSUEt would be negative and

statistically significant, while one or more of the coefficients (or the sum of the coefficients) for

Rating*DSUE(t-1 to t-3) would be significantly positive. In the case that transient institutions exploit AFbased PEAD more aggressively for lower rated firms, one or the sum of the coefficients on

Rating*DSUEt and Rating*DSUE t-1 (on Rating*DSUEt-2 and Rating*DSUEt-3) would be significantly

negative (positive). Following Ke and Ramalingegowda (2005), I also control for ex ante transaction

cost (ExtTrad) and its interaction term with DSUEs. If transient institutions trade more intensively to

exploit PEAD among firms with lower ex ante transaction cost, the coefficients for ExtTrad*DSUEs

would also be in the opposite sign to the coefficients for DSUEs and statistically significant.

I further employ regression model (2) to test how credit rating and ex ante transaction cost jointly

affect transient institutions’ arbitrage intensity. The prior thesis of the test is to figure out whether ex

ante transaction cost impedes transient institutions from exploiting PEAD among low credit rating firms

only, leaving high credit rating firms out of account. To this end, based on the extant regression model

(2), I add up a three-way interaction among DSUE, Rating, and ExtTrad. With controls for both

DSUE*Rating* ExtTrad and DSUE*Rating, the coefficient on DSUE (on DSUE+DSUE*ExtTrad) denotes

the transient institutions’ arbitrage on PEAD for the low rated firms that have the low (high) ex ante

transaction cost. If ex ante transaction cost mitigates the intensity of the transient institutions’ arbitrage

on RW-based PEAD among the low credit rating firms, the coefficient on DSUEt*ExtTrad would be

significantly negative, while one or more of the coefficients (or the sum of the coefficients) on DSUEt1*ExtTrad, DSUEt-2* ExtTrad, and DSUEt-3*ExtTrad would be significantly positive. Similarly, if ex ante

transaction cost attenuates the extent of the transient institutions’ arbitrage on AF-based PEAD among

the low rated firms, at least one or the sum of the coefficients on DSUEt*ExtTrad and DSUEt-1*ExtTrad

(on DSUEt-2 *ExtTrad and DSUEt-3*ExtTrad) would be significantly negative (positive).

In addition, the three-way interaction term, DSUE*Rating*ExtTrad, tells how the impact of credit

rating on the transient institutions’ arbitrage differs between high and low ex ante transaction cost firms.

If the credit rating effect on the transient institutions’ arbitrage is stronger for firms with lower ex ante

transaction cost, DSUE*Rating*ExtTrad would be statistically significant in the opposite sign to DSUE*

13

Proceedings of 24th International Business Research Conference

12 - 13 December 2013, Planet Hollywood, Las Vegas, USA, ISBN: 978-1-922069-37-5

Rating.

Following prior studies (e.g., Bhushan 1994; Stoll 2000; Mendenhall 2004), I use the average of

daily dollar trading volume (i.e., the product of the CRSP daily closing price and the CRSP daily shares

traded, averaged over days from the beginning of the fiscal quarter to date -21 relative to the earnings

announcement date) as the proxy for the ex ante transaction cost of stocks trading12. High trading

volume corresponds to low ex ante transaction cost (e.g., Mendenhall 2004). I rank the trading volume

into deciles and convert it into [0, 1] with 0 (1) denoting the highest (lowest) trading volume. I then use

the converted score as the measure of ex ante transaction cost with 1 (0) representing the highest

(lowest) ex ante transaction cost.

Following Korajczyk and Sadka (2004) and Hanna and Ready (2005), I also employ bid-ask

spread, which is estimated using relative effective spreads or relative quoted spreads equally-weighted

over three months prior to the earnings announcements, as the proxy for ex ante transaction cost. My

results for model (2) are insensitive to this alternative specification. Though the effective bid-ask

spreads and the quoted spreads are direct estimates of transaction cost, the literature (e.g., Keim and

Madhavan 1998; Lesmond et al. 2004) emphasizes that the spreads underestimate the true transaction

cost for arbitrageurs due to the omission of relevant transaction cost such as opportunity cost and price

impact which can instead be captured by dollar trading volume (TradingVol). Another proxy for ex ante

transaction cost could be the limited dependent variable (LDV) measure, which is developed by

Lesmond et al. (1999) and based on the transaction cost implied by the investors’ trading behaviors.

This measure incorporates all costs that are reflected in the trading and assumes that all impediments

to efficient market reaction are due to transaction cost. However, there are other behavioral or

institutional factors that lead to an underreaction to market level news as well. Hence, the LDV measure

likely overestimates the ex ante transaction cost. Still, I also employ the LDV estimates of transaction

cost for the robustness check and obtain almost identical results.

5. Empirical Results

5.1. The impact of credit rating on PEAD

5.1.1. Results for portfolio analysis

Table 2 reports the results for payoffs from trading on PEAD in different credit rating groups. The

payoff to the PEAD trading strategy becomes larger as we move from the high to the low credit rating

group. Focusing on the RW-based PEAD over the window of [2, 61] relative to earnings announcement

dates, for example, the average payoff to the D10-D1 trading strategy for the high and medium credit

rating groups is 0.99% and 0.35%, respectively. In contrast, the payoff is much greater and

economically significant at 15.66% for the low credit rating group. The RW-based earnings momentum

payoffs over other drift window, [2, Et+1+1], [2, Et+2+1], and [2, Et+3+1], are also highest (lowest) for low

(high) credit rating group. So too are the payoffs from trading on the AF-based PEAD. These results

suggest that the profits of implementing the PEAD trading strategy stem primarily from firms with low

credit ratings.

12

I do not use the share price before earnings announcements (Price) as the proxy for a firm’s ex ante transaction cost

because RET1, RET2-3, and RET4-6, the control variable for the price momentum effects on transient institutions’ trading in

model (2), would mitigate the power of Price in capturing the ex ante transaction cost.

14

Proceedings of 24th International Business Research Conference

12 - 13 December 2013, Planet Hollywood, Las Vegas, USA, ISBN: 978-1-922069-37-5

The earnings momentum payoff differential across different credit rating groups might be

explained by information uncertainty proxies such as return volatility, accrual quality, cash flow volatility,

earnings volatility, firm age, idiosyncratic volatility, and analyst forecast dispersion. To address this

possibility, I assess the robustness of earnings momentum profitability across different credit rating

dimensions based on 3*3 portfolios which are sorted independently by credit rating and each of the

information uncertainty variables. The results (not tabulated for parsimony) indicate that earnings

momentum payoff still increases monotonically with the decrease in credit rating across all the groups

sorted by each of the information uncertainty variables. However, not all the credit rating groups exhibit

the pattern of a monotonic increase in PEAD payoffs with an increase in the magnitude of the

information uncertainty variables. Therefore, it is credit rating not those information uncertainty

variables that provides the divergent earnings momentum returns.

To ensure that the profits of implementing the PEAD trading strategy among low credit rating

firms does not merely compensate for exposure to systematic risk, I further use calendar-time portfolio

approach to risk-adjust the raw earnings momentum payoffs. The advantage of the calendar-time

portfolio approach is that the cross-sectional correlations of the abnormal returns are automatically

accounted for in the portfolio variance at each point in calendar time (Fama 1998; Mitchell and Stafford

2000). Sadka (2006) finds that the unexpected systematic variation of the variable component of

liquidity is priced within the context of PEAD portfolio returns. Hence, I incorporate the Sadka variable

liquidity factor, along with the Carhart’s four factors, in my portfolio regression. Consistent with prior

research (e.g., Mitchell and Stafford 2000; Francis et al. 2007), I use monthly returns to construct the

hedge portfolio returns which involves taking the long (short) position in the highest (lowest) SUE decile

portfolio. Firms enter the portfolio on the first day of the month following the earnings announcement,

and are held for nine months which normally covers three subsequent quarterly earnings

announcements13. Accordingly, the monthly return to the hedge portfolio is measured as the difference

between the equally-weighted average monthly return of the highest SUE decile portfolio and that of the

lowest SUE decile portfolio. The hedge portfolio monthly returns net of risk-free rate are then regressed

on the Sadka’s (2006) five factors (i.e., excess market returns, size, book-to-market, price momentum,

and variable liquidity factors) for each credit rating group, whereby alpha from the regression would

represent the average monthly earnings momentum payoffs that are adjusted for the systematic risk.

Table 3 reports the results for alphas from the Sadka-based calendar-time portfolio regressions for

each credit rating group. The alpha for the monthly RW-based earnings momentum payoffs amounts to

2.97%, 0.15%, and -0.25% (translated into an annualized return of 42.10%, 1.82%, and -2.92%) for the

low, medium, and high credit rating group, respectively, and are all statistically significant. The

annualized profits from implementing RW-based PEAD trading strategy are economically significant for

the low credit rating group but not for the high and medium credit rating group. The alpha for the

monthly AF-based earnings momentum payoffs is statistically and economically significant in positive

magnitude for the low credit rating group (t-stat.=1.82) but not for the high credit rating group (tstat.=1.21). Moving from low credit rating to high credit rating group, both the RW-based and the AFbased alphas decline in magnitude. Overall, these results suggest that higher earnings momentum

payoff for a lower credit rating firm does not represent compensation for systematic risk.

Table 4 reports the average payoffs from the PEAD trading strategy in each subsample as I

progressively drop the lower-rated firms. It also provides the percentage of the total number of firms

included in each subsample. Overall, we can observe a monotonic and significant decrease in the

average payoffs from the PEAD trading strategy as the lower rated firms are sequentially dropped out

13

Inferences are unchanged if I choose a three-month (six-month) portfolio holding period that normally covers one (two)

subsequent quarterly earnings announcements.

15

Proceedings of 24th International Business Research Conference

12 - 13 December 2013, Planet Hollywood, Las Vegas, USA, ISBN: 978-1-922069-37-5

of the full sample. For instance, the average payoff to the trading strategy for RW-based PEAD over the

window of [2, 61] totals 1.06% (t-stat.=2.07) for the full sample but drastically decreases to 0.35% (tstat.=0.66) when only firms with ratings from AAA to A- remain in the sample. Remarkably, the sample

that contains firms rated from AAA to BB- accounts for 79.24% but only has an average of 0.53%

payoff compared to the 1.06% payoff for the whole sample. These findings further demonstrate that

PEAD payoffs concentrate among firms with low credit ratings.

The univariate results needs to be interpreted with caution as they do not control for transaction

cost, firm size, and trading volume, etc., which also affect the magnitude of PEAD. Hence, I turn to the

multivariate analysis to account for these factors.

5.1.2. Results for regression analysis

Table 5 presents the regression results for the credit rating effect on PEAD. The coefficient on the

interaction term, DSUE*Rating, is negative and statistically significant, consistent with the hypothesis

that PEAD is more pronounced for firms with lower credit ratings. The sum of the coefficients on DSUE

and DSUE*Rating (i.e., 1+2) is positive and statistically significant, indicating that the drift still exists

among high credit rating firms though it is smaller in magnitude than the drift for firms with low credit

ratings. Further, the coefficients on the interaction of DSUE with all the information uncertainty proxies

(i.e., firm age, analyst forecast dispersion, earnings volatility, accruals quality, return volatility,

idiosyncratic volatility, and cash flow volatility) are not statistically significant at the conventional level in

their expected sign, whereas the coefficient on DSUE*Rating remains negative and significant. The

results qualitatively hold not only for RW-based PEAD but also for AF-based PEAD over the drift

window of [2, 61], [2, Et+1+1], [2, Et+2+1], and [2, Et+3+1], respectively. This suggests that the information

uncertainty purged out of credit rating effect does not distinguish among more and less profitable PEAD.

Hence, credit rating is a more primitive variable than those information uncertainty proxies in predicting

the PEAD. In addition, the coefficients on Rating for all the PEAD models are all positive and

statistically significant at the 1% level, which reconcile the prior evidence that stock returns are

negatively related to credit risk (Dichev 1998; Campbell et al. 2008; Avramov 2009b).

To assess the sensitivity of my findings to alternative risk adjustments, I also compute daily

expected returns based on Carhart’s (1997) 4-factor model to obtain the buy-and-hold abnormal returns

for the regression analyses. Along the lines of prior research (e.g., Ogneva and Subramanyam 2007;

Balakrishnan et al. 2010), I estimate the expected value of Carhart’s (1997) model using a 40-tradingday hold-out period which starts 55 trading days prior to the earnings announcement date. Following

Shumway and Warther (1999), if a firm is delisted due to poor performance during the return window,

the delisting return is assumed to be -35% if the firm is traded on NYSE/AMEX, and -55% if the firm is

traded on NASDAQ. My results are robust to this alternative risk adjustment on the drift returns.

5.2. Transient institutions’ trading behavior around earnings announcements

Column 1a of Table 6 shows the regression results for the impact of credit rating on the intensity of

transient institutions’ arbitrage on RW-based PEAD. As expected, DSUEt*Rating (DSUEt-1*Rating) has

a significantly negative (positive) coefficient which is in the opposite sign to the coefficients on DSUEt

(DSUEt-1). The overall coefficient for DSUEt-1*Rating+DSUEt-2*Rating+DSUEt-3*Rating is also in the

predicted positive sign and significant at the 1% level (F-stat.=11.81). These results evidence that

transient institutions trade less intensively to exploit RW-based PEAD for higher rated firms. The

coefficient on DSUEt*ExtTrad is significantly negative (t-stat.=-2.23), while the coefficients on DSUEt-1*

ExtTrad and DSUEt-2*ExtTrad are significantly positive (t-stat.=2.27 and 3.96, respectively). Hence,

16

Proceedings of 24th International Business Research Conference

12 - 13 December 2013, Planet Hollywood, Las Vegas, USA, ISBN: 978-1-922069-37-5

there is also evidence that transient institutions trade less aggressively to exploit RW-based PEAD

when ex ante transaction cost is higher.

Column 1b reports the joint effect of credit rating and ex ante transaction cost on transient

institutions’ trading for RW-based PEAD. Recall that with control for the three-way interaction term,

DSUEt to t-3 denotes the transient institutions’ ownership changes in response to SUE in quarter t to t-3

for low credit rating and low transaction cost firms only. As expected, the coefficient on DSUEt is

significantly positive, while DSUEt-1, DSUEt-2, and DSUEt-3 all have a significantly negative coefficient.

These results indicate that for firms with low credit ratings and low transaction cost, transient

institutional investors tend to take initial positions in earnings announcement quarter and then unwind

their positions in the subsequent three quarters, thereby substantiating that transient institutions

actively exploit RW-based PEAD among low transaction cost and low rated firms. Further, transient

institutions appear to exploit the PEAD less intensively among firms with lower ex ante transaction

costs, which is evidenced by the significantly negative (positive) coefficient on DSUEt*ExtTrad (DSUEt2*ExtTrad). DSUEt* Rating*ExtTrad has a significantly positive coefficient, while the sum of the

coefficients on DSUE(t-1 to t-3) *Rating*ExtTrad is significantly negative (F-stat.=-27.83). This indicates

that the credit rating effect on the transient institutions’ arbitrage on RW-based PEAD, as evidenced in

Column 1a, is less pronounced when ex ante transaction cost is higher.

Column 2a reports the results for the impact of credit rating on transient institutions’ arbitrages on

AF-based PEAD. The coefficients on DSUEt*Rating and DSUEt*Rating are significantly negative (t-stat.

=-5.15 and -2.24, respectively), while DSUEt-2*Rating and DSUEt-3 *Rating have a significantly positive

coefficient (t-stat.=2.48 and 2.10, respectively). Hence, transient institutions appear to exploit AF-based

PEAD far less aggressively in firms with higher credit ratings. There is also evidence to suggest that

high ex ante transaction cost mitigates the intensity of the transient institutions’ arbitrage on AF-based

PEAD. In particular, the coefficients for DSUEt*ExtTrad and DSUEt-1*ExtTrad are significantly negative

(t-stat.= -5.21 and -3.45, respectively), while DSUEt-2*ExtTrad and DSUEt-3*ExtTrad take on a

significantly positive coefficient (t-stat.=4.30 and 5.73, respectively).

Column 2b presents the results for the joint impact of credit rating and ex ante transaction cost on

transient institutions’ trading for AF-based PEAD. DSUEt and DSUEt-1 take on a significantly positive

coefficient (t-stat.=7.28 and 2.93, respectively), indicating that transient institutions initiate and enhance

their arbitrage positions in low transaction cost and low credit rating firms over quarter t and t+1. The

coefficients on DSUEt-2 and DSUEt-3 are significantly negative (t-stat.=-4.86 and -5.59, respectively),

indicating that transient institutions liquidate their arbitrage positions in low transaction cost and low

rated firms in quarter t+2 and t+3. Together, these results suggest that transient institutions tend to

exploit AF-based PEAD among firms with low credit ratings and low ex ante transaction cost. As

indicated by the significantly negative (positive) coefficient for DSUEt-1*ExtTrad (for DSUEt-2 to t3*ExtTrad), transient institutions appear to exploit the PEAD less aggressively among firms with lower

ex ante transaction costs. The sum of the coefficients for DSUEt*Rating*ExtTrad and DSUEt1*Rating*ExtTrad (for DSUEt-2 *Rating*ExtTrad and DSUEt-3*Rating*ExtTrad) is significantly (positive)

negative (F-stat.=3.16 (-7.71)), suggesting that the impact of credit rating on the transient institutions’

arbitrage on AF-based PEAD becomes less salient when ex ante transaction cost is higher.

Consistent with prior studies, transient institutional investors are price momentum traders as

evidenced by the significantly positive coefficients on RET1, RET2-3, and RET4-614. The magnitude of

14

The significantly positive coefficient on past returns (i.e., RET1, RET2-3, or RET4-6) alone is not sufficient to prove that

transient institutions exploit price momentum. This is because such a finding is also consistent with transient institutions

merely following a momentum trading strategy of buying (selling) shares that have high (low) past returns. Proof of the

17

Proceedings of 24th International Business Research Conference

12 - 13 December 2013, Planet Hollywood, Las Vegas, USA, ISBN: 978-1-922069-37-5

the coefficient for RET1 is not statistically larger than that of the coefficient for DSUEt, indicating that

the transient institutions’ price momentum trades in a quarter is not larger than the PEAD-driven trades.

Thus, different from Ke and Ramalingegowda (2005), I find no evidence that the price momentum effect

dominates the PEAD arbitrage effect in the transient institutions’ trading. This is not surprising because

price momentum is primarily subsumed by PEAD but not vice versa (Chordia and Shivakumar 2006).

FD has a negative and significant coefficient, suggesting that transient institutions’ trading becomes

less active in the post FD regulation period. This may be because transient institutions are not entitled

to access a firm’s private information any more after the enforcement of FD regulation. In addition, I rerun regression model (2) where the dependent variable is replaced with dedicated or quasi-indexing

institutions’ ownership changes. Consistent with Ke and Ramalingegowda (2005), I find no evidence

that dedicated or quasi-indexing institutions trade to exploit the PEAD.

Lastly, transient institutions can rely on their private information along with other sources of public

information in addition to the past SUEs to infer future earnings surprises for their current trading

decisions. As such, the changes in transient institutions’ ownership could incorporate the information

about future earnings. To account for this possibility, I include future earnings surprises, DSUEt+1,

DSUEt+2, and DSUEt+3, in the regression model (2). In results not tabulated, the coefficients on DSUEt+2

and DSUEt+3 are both significantly positive while DSUEt+1 has an insignificantly positive coefficient. This

indicates that the transient institutions’ trading decisions incorporate the information about future

earnings surprises for quarter t+2 and quarter t+3, which is consistent with transient institutional

investors being informed. More importantly, the coefficients on the current and lagged DSUEs (i.e.,

DSUEt to t-3) are all qualitatively the same as those reported in Table 6. Therefore, I refute the possibility

that transient institutions’ trading behaviors as evidenced in Table 6 is a result of their inference about

future earnings based on other channels of information other than past earnings reports.

In sum, the results indicate that the transient institutions tend to focus their arbitrage on PEAD

among low credit rating firms which are characterized as abundant in arbitrage profits. Hence, we can

infer that transient institutions are not only sophisticated in information processing but also capable of

exploiting PEAD for low credit rating firms in spite of their high idiosyncratic risk. An increase in PEADbased arbitrage profits realized by the transient institutions in turn accelerates the speed that stock

price reflects the implications of current earnings for future earnings, thereby contributing to high market

efficiency. However, PEAD yet existent and concentrated in low credit rating firms also implies that the

transient institutions still do not fully exploit the PEAD for low credit rating firms. My further analysis

reveals that ex ante transaction cost impedes transient institutions from exploiting the PEAD in the low

rated firms, which reconciles the prior evidence (e.g., Ng et al. 2008) that transaction cost explains the

existence and persistence of PEAD. This helps explain why the PEAD payoffs that concentrate in low

rated firms are not arbitraged away.

Though firms with lower credit ratings are subject to higher idiosyncratic risk, I find no evidence

that the high idiosyncratic risk impedes transient institutions from exploiting PEAD among the low rated