Proceedings of World Business and Economics Research Conference

advertisement

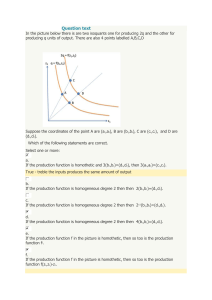

Proceedings of World Business and Economics Research Conference 24 - 25 February, 2014, Rendezvous Hotel, Auckland, New Zealand, ISBN: 978-1-922069-45-0 Production and Cost Duality: A New Look Theodore J. Osborne* The derivation of the long run cost function and the connections between the characteristics of the production function and the characteristics of this cost function are relatively complex. Due to this complexity, duality analysis, which includes the mathematical derivation of the cost function from the production function as well as the role of returns to scale in those functions, is usually reserved for presentation in advanced undergraduate and graduate microeconomic theory courses. It is unfortunate that this analysis is not normally presented in second year courses since it significantly enhances understanding of all further applications of microeconomic theory. A set of simpler tools specifically for teaching this analysis, which are easy to present and understand, are clearly needed. This paper presents just such a set of tools. The two main elements of this approach are the “scale product curve” and a method, developed in this paper, for deriving a cost function from a production function without calculus. The scale product curve, which plots output against scale, shows the long run characteristics of the production function much as the total product curve does for short run characteristics (Cole (1973), Eaton and Eaton (1991)). It is used in this paper in order to more fully and clearly examine the connections between returns to scale and the characteristics of costs. These two elements are then applied to three production functions—two Cobb-Douglas forms (with constant and increasing returns to scale) and a relatively simple CES. These three are then combined into one function using their scale product curves. We refer to this new production function as the Merged CES production function (or MCES). The long run cost function associated with the MCES is then found by factoring the production function (no calculus or algebra required!). The scale product, average and marginal products of scale and long run average and marginal costs curves of this production function are derived and then the relationship between these curves explored—i.e. an example of duality analysis. In their explanation of the connection between returns to scale, the production function and costs, virtually all textbook authors assume that the production function is homothetic which gives the impression that special cases are general principles. Since the MCES is not homothetic, the conclusions drawn from the duality analysis presented in this paper are much more general. * Department of Economics, King’s University College at Western University, 266 Epworth Ave., London, Ontario, N6A 2M3. (519-433-3491 ext. 4346), email: tosborne@uwo.ca,