Proceedings of Eurasia Business Research Conference

advertisement

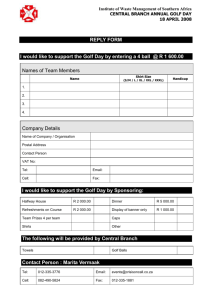

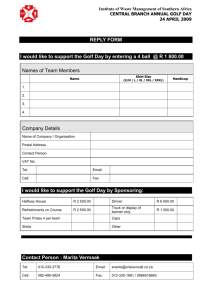

Proceedings of Eurasia Business Research Conference 4 - 6 June 2015, Nippon Hotel, Istanbul, Turkey, ISBN: 978-1-922069-77-1 Marketing Strategies of Golf Courses in the United States and Canada: A Comparative Exploratory Study Lise Heroux The golf industry in the United States generated $69 billion in goods and services, with a total economic impact of $177 billion. In Canada, the golf industry generated an estimated $14.3 billion. The successful marketing strategy of golf courses requires the identification of a target market and development of a marketing mix (product/service, place, price and promotion) that will best satisfy the needs of this target market. This research investigates whether there were differences in the marketing strategies implemented by golf courses in northern climates to meet the needs of visitors. Systematic observations of the 18 golf courses in the contiguous regions of southern Quebec and northeastern New York/northwestern Vermont using a detailed grid of variables were compiled for each establishment. More similarities than differences were found in these regions, although Quebec golf courses tended to have slightly better marketing strategies than New York/Vermont. JEL Codes: M3, O1, F00 1. Introduction Globally, golf is a $300 billion dollar industry, with the increasingly passionate markets of the Middle East and East Asia joining the traditional power centers of the US and Europe (Wilson, 2011). According to this author, the sport is played at 32,000 golf courses worldwide, by 55 million people, in more than 100 countries, and supports employment of 3.5 million people. The potential economic impact of golf courses on a region can be significant. This research focuses on the marketing strategies implemented by seasonal golf courses in the United States and Canada. 2. Literature Review In the United States, 26 million golfers helped the industry generate $69 billion in revenue in 2011 (Huteesing, 2013a). When the spillover effect on industries such as tourism is included, the golf economy expands to $177 billion dollars. According to Huteesing (2013b), this includes $2.1 billion spending on golf supplies, $1.6 billion of which went to golf apparel; $3.5 billion on golf equipment such as golf clubs, balls and bags; $30 billion on green fees to the countries‟ 15,751 golf courses, 1,000 stand-alone ranges, 1,366 miniature golf facilities, and 415 golf schools; tournament costs of $1.2 billion; endorsements of $320 million; $20.6 billion spending on golf tourism, and golf-related wage income of $55.6 billion. In Canada, the National Allied Golf Association (2014) reports that there are 5.7 million Canadian golfers, and that the golf industry accounts for about $19.7 billion in direct spending on: membership and green fees at 2,308 golf Dr. Lise Heroux, Department of Marketing and Entrepreneurship, State University of New York (SUNY) Plattsburgh, United States. Email: lise.heroux@plattsburgh.edu Proceedings of Eurasia Business Research Conference 4 - 6 June 2015, Nippon Hotel, Istanbul, Turkey, ISBN: 978-1-922069-77-1 courses ($5.0 billion); golf equipment ($3.2 billion); golf apparel ($0.86 billion); golf-related travel within Canada ($1.5 billion); Golf-related travel outside of Canada by Canadians ($4.6 billion); golf-related travel in Canada by foreign golfers ($1.2 billion); and spending on other golf-related goods and services such as instruction, publications, transportation to golf courses, etc. ($2.5 billion). In many tournaments, golfers pay fees to play in fund-raising tournaments, and the net proceeds are passed on to the charity. According to the National Golf Foundation, 143,000 events were attended by 12 million people and generated $3.9 billion for charity in 2011 in the United States (Huteesing, 2013b). There were 37,000 charitable events raising more than $533 million for charitable causes across Canada (National Allied Golf Association, 2014). An extensive study of Canadian golf consumer behavior by the National Allied Golf Association (2012) categorizes players as Avid Golfers (25+ rounds/year; 12% of golfers), Frequent Golfers (9-24 round/year; 14% of golfers), Occasional Golfers (3-8 rounds/year; 36% of golfers), and Infrequent Golfers (a couple of rounds/year; 38% of golfers.) The majority of rounds are played by less than 26% of golfers, and only 25% of golfers are engaged in the game, where engagement is defined by playing, following, supporting and endorsing the game. The majority (75%) are of the mind that they can “take or leave the game”. There is also limited interest in the game by the 73% of Canadians who are non-players, unless their spouse or child is involved in the game. Today, there are fewer golfers with a child/junior playing the game than in the past, which may impact golf engagement in the future. The number of people entering the game is equal to the number of people leaving the game annually. This is also the case in the United States (golfprofitbuilders.com, 2015). The largest influx into the game is 18-25 year olds: the largest outpouring of the game are 46-59 year olds; and the 26-35 year olds‟ enthusiasm for the game flattens. This study also indicates that golf has a focused appeal with well-educated, higher income males and attracts executives, professionals, sales/service, trades and retired people. This is also the case in the United States (National Golf Foundation, 2014). There is little ethnic diversity, although this is changing with Canadian demographics, and less engagement of women in the sport. Women do not perceive the same value in playing the game as men (Petrick and Backman, 2002). Those who play a lot of golf, compared to those who play less, tend to agree with the following motivations: having fun, being social, enjoying themselves, meeting/besting challenges, they are proud, they are inspired, they see leadership that is moving the game forward. Therefore, engagement in the game is emotional and self-expressive and not functional. It is about how the game makes you feel. This golfer consumer behavior profile also applies to golfers from other nationalities (Laird, 2011). The National Allied Golf Association (2012) finds that time and money constrain the playing of the game. In addition, the lack of engagement of the majority of the golf-playing population makes the golf industry vulnerable. As a result golf courses have been innovative in developing marketing strategies to respond to these market forces. Proceedings of Eurasia Business Research Conference 4 - 6 June 2015, Nippon Hotel, Istanbul, Turkey, ISBN: 978-1-922069-77-1 Implementing marketing strategies that move a portion of the unengaged golf players into the engaged status could make a significant impact in the golf industry since engaged golfers spend more money on golf-related products and activities. The National Allied Golf Association is implementing an integrated cooperative approach across the Canadian golf industry with message and actions focused on the “It‟s a game for life” theme (2012). They encourage innovative ways to show golfers that the game and everything related to the game is: fun, enjoyable, social, challenging but winnable, inspiring, prideful and lead edge. Some of the innovations are designed to overcome the time and money constraints. Since 18-hole golf courses take a half day to play, more golf courses are offering shorter courses that take less time to play, more 9-hole options (Newport, 2007; Gregory, 2013), simplified golf courses for beginners, or graded courses for different levels of play. The cost of golf can be lowered with more access to public golf courses that charge low membership fees, family membership fees to encourage more family members to join, and lower tee fees. Some private golf courses offer entry level membership fees that are more affordable, and family membership discounts. Nine-hole games cost less than 18-hole games. Golf lessons can be made simpler, easier and cost effective by offering group lessons, internet lessons, virtual coaching, etc. Targeting a more diverse population to grow the golfer base is another strategy. To increase the number of women and children, more golf courses are offering family membership discounts, as previously mentioned, but also children‟s golf lessons, affordable beginner equipment, and day care for children too young to play. The First Tee is an example of a national program to facilitate accessibility for young people to start playing golf in the US (Wilson, 2011). Minority participation in golf has surged due to an increase in accessibility with the growth in the number of public and municipal courses available (Shepherd, 1999; Mitchelson, 2004). Promotion through the internet is helping golf courses stay connected with its customers. More golf courses are collecting golfer email addresses to be in direct contact with potential customers in a cost effective way. Many are using technology for online tee times, and social media for more guerilla style marketing techniques (Laird, 2011). Others are hosting a local tournament or sponsoring a challenging hole (Vaughn, 2012). 3. Purpose of the Study The successful marketing strategy of golf courses requires the identification of a target market and development of a marketing mix (product/service, place, price and promotion) that will best satisfy the needs of this target market. Golf courses generally offer a similar set of products/services. In addition to the golf links (9 and/or 18 holes), most establishments offer food and beverage services, equipment rental services, pro-shop and golf instruction/lessons. This research was conducted to investigate marketing strategies implemented by seasonal (open May-October) golf courses and whether there were differences in Canada and the United States. Proceedings of Eurasia Business Research Conference 4 - 6 June 2015, Nippon Hotel, Istanbul, Turkey, ISBN: 978-1-922069-77-1 4. Methodology Following a methodology established in recent studies (Heroux, 2002; Heroux and Csipak, 2001, 2005; Heroux and Burns, 2000), this exploratory study, using 18 case studies, was undertaken in the contiguous regions of southwestern Quebec and northern New York/Vermont. There is substantial economic integration and cross-border traffic between the two countries in this region, and the hospitality industry targets business and leisure travelers of both nationalities (Church and Heroux, 1999). For this reason, many similarities have been observed in these studies of the hospitality industry in these two countries. A census of the golf courses in two communities in this cross-border region was included in this research. The online Yellow Pages directory for the United States and Canada was used to identify the sampling frame of golf courses in the contiguous geographic regions along the border. The region under study was expanded until 18 establishments were identified, representing the regions as follows: 9 from Quebec and 9 from New York/Vermont. The typical golf course in this study was an independently owned and operated family business that thus controlled its marketing strategy. Only golf courses with seasonal operations in a similar northern climate were included in the study. Golf courses in the southern region of the United States were not included because their year-round marketing strategies would not have comparable establishments in Canada. A detailed marketing strategy evaluation grid (Heroux, 2002; Heroux and Csipak, 2001, 2005; Heroux and Burns, 2000) was used to collect detailed qualitative observational descriptions and quantitative data of the golf course marketing strategy variables. Marketing strategy refers to the target market of the establishment and the marketing mix variables designed to attract these customers. The marketing mix variables are categorized according to the popular 4P framework (McCarthy and Perreault, 2000): Product; Place; Price; and Promotion. Three of these categories of variables are subdivided in this study to capture the breadth of the categories: Product consists of product variety variables and service-related variables; Place refers to the location of the establishment as well as store atmospherics; and Promotion includes advertising variables and personal selling variables. The comparison framework therefore consists of two cultural/geographic regions by 7 marketing variable ratings. (See table 1). The observational research was conducted by international marketing students who were familiar with the marketing concepts. Observers received training on a variety of dimensions of the research process. They received a detailed explanation of each of the variables in the Marketing Strategy. \ Proceedings of Eurasia Business Research Conference 4 - 6 June 2015, Nippon Hotel, Istanbul, Turkey, ISBN: 978-1-922069-77-1 Table 1: Summary of the Marketing Strategy Variables Evaluation Grid ______________________________________________________________ Marketing Mix (4Ps) Product: Product variety variables: Breadth of product line, assortment of accompanying products, size variations, quality, private labels/brands, special features, overall evaluation. (6 variables, maximum score of 30) Service variables: customer services, customized/standardized, credit cards, empathy, reservations (computerization), hours of operation, guarantees, customer satisfaction (complaint handling), overall evaluation. (8 variables, maximum score of 40) Place: Location variables: Primary/secondary road (visibility), site evaluation (nearness to target market), outside appearance, private/public parking availability, detached building versus strip, general ease of access, overall evaluation. (6 variables, maximum score of 30) Establishment atmospherics: Interior layout (free form, grid, racetrack); atmospherics—scent, lighting, color, mirrors, music, noise, signage; fixtures; cleanliness; size of crowds; type of clientele; access to disabled; overall evaluation. (12 variables, maximum score of 60) Price: Pricing variables: Relative high/low prices, competitive in region, group reductions, coupons/rebates, bundle or value pricing (packages offered), variety of payment options, overall evaluation. (5 variables, maximum score of 25) Promotion: Advertising variables: Newspapers, magazines, trade publications, television, radio, telemarketing, direct mail, internet, special promotions (sales, coupons, contests), outdoor ad and/or signage, advertising theme— testimonial, comparison, informative, humorous, etc., overall evaluation. (6 variables, maximum score of 30) Personal selling variables: Approaching the customers, helpfulness, presenting product/service, making the sale, knowledgeable, art of listening, verbal/non-verbal cues, general appearance of staff, overall evaluation. (8 variables, maximum score of 40) Summary rating: Overall marketing strategy evaluation: addition of the overall rating in the categories. evaluation grid and how each variable is operationalized. They were shown how to find and approach their assigned golf course, how to record their qualitative observations, and how to determine a quantitative score (on a scale of 1 to 5, 5 being superior implementation) for each variable. For Proceedings of Eurasia Business Research Conference 4 - 6 June 2015, Nippon Hotel, Istanbul, Turkey, ISBN: 978-1-922069-77-1 example, for breadth of product line, students would look at the assortment of products on the premises and make a judgment on the rating scale as to its appeal to consumers (5 would represent an outstanding assortment, beyond expectations; 3 would represent an average assortment usually found in pro shops; and 1 would be the minimum one would expect. The trainer and trainees performed a “walk-through” of the research process prior to visiting the golf courses to ensure their understanding and consistent implementation of the data collection. Observation and listening were usually sufficient to gather information about each variable. For example, for the target market, they could look at license plates in the parking lot and see how many cars came from what state or province. They could tell what language, French or English, was spoken by the customers. They could ascertain if they were repeat customers if they appeared familiar with the establishment when they arrived, when they referred to past purchases, or when they were on first name basis with the staff. However, if some variables were difficult to observe, students were given guidelines for asking questions of the staff. Three trained observers visited each establishment together in both regions, spending 4-5 hours in each location to record detailed notes of how each marketing strategy variable was implemented. Then, the three observers had to discuss and come to an agreement on a score (on a scale of 1 to 5, 5 representing superior implementation of the strategy) for each variable in an attempt to quantify the observational data. Since this process resulted in one rating for each variable, inter-judge reliability measures were not relevant. Each item within a variable category was weighted equally in this research. The data collection thus consisted of qualitative data, the recorded observations, and quantitative data, the assigned scores for each variable. 5. Findings The findings are discussed below in terms of quantitative results and qualitative results. Tables 2 and 3 present the quantitative results of the scale ratings for each of the seven variable categories. Although tests of significance cannot be performed because of the small number of cases, inspection of the table reveals that there are more similarities than differences in marketing strategy variables in the two regions, although Quebec golf courses tended to have slightly better ratings on all variables except media promotion. Product. Quebec golf courses provide a better product strategy on all variables observed than New York/Vermont. They offer wider set of product lines, a better assortment of higher quality products, better brand name golfing products, more golf course options (9 holes, 18 holes), better layout and more special features. In both regions, special features include banquet halls for weddings, restaurants, snack bars, bars, golf lessons, and breathtaking views. Quebec golf courses offer more of these features, as well as unique features such as driving ranges, outdoor patio seating, interactive weather radar, night golfing under flood lights, and wedding planning. Proceedings of Eurasia Business Research Conference 4 - 6 June 2015, Nippon Hotel, Istanbul, Turkey, ISBN: 978-1-922069-77-1 Table 2: Summary of Marketing Strategy Ratings Marketing Strategy Variable Ratings Product Variety Services Location Establishment Design Pricing Promotion Personal Selling Marketing Strategy New York/ Vermont N=9 Mean* %** 18.44 61.5% 28.78 71.9% 20.56 68.5% 37.67 62.8% 16.78 67.1% 15.67 52.2% 25.22 63.1% 163.11 64.0% Quebec N=9 Mean* %** 22.22 74.1% 30.89 77.2% 21.56 71.9% 39.78 66.3% 18.11 72.4% 15.11 50.4% 26.78 67.0% 174.44 68.4% Overall Sample N=18 Mean* %** 20.33 67.8% 29.83 74.6% 21.06 70.2% 38.72 64.5% 17.44 69.8% 15.39 51.3% 26.00 65.0% 168.78 66.2% *Mean: Average of the sum of ratings for all variables in the category. **%: The mean results are represented as a percentage of the maximum score that could be achieved for the variable category. Table 3: Comparison of Quebec and New York/Vermont Golf Courses on Marketing Strategy Variables Ratings Variable Product: Product line Assortment Sizes Quality Brands Special features Service: Guest Services Customization Credit Empathy Reservations Hours Guarantees Satisfaction Place-Location Visibility Site evaluation Appearance Parking Building type Accessibility Place-Atmosphere: Layout Scent Lighting Color New York/VT Stan. Mean Dev. Quebec Stan. Mean Dev. Overall Sample Stan. Mean Dev. 2.78 3.11 2.89 3.44 3.00 3.22 1.39 1.54 1.62 1.62 1.32 1.20 3.67 3.67 3.67 4.11 3.22 3.78 1.41 1.12 0.71 0.93 1.39 1.30 3.22 3.39 3.28 3.78 3.11 3.50 1.44 1.33 1.27 1.26 1.32 1.25 3.56 3.11 4.11 3.89 3.56 4.00 2.89 3.56 1.33 1.17 1.17 1.36 1.56 0.87 1.69 1.67 3.56 3.33 4.11 4.00 4.22 4.33 3.22 4.11 1.13 1.00 0.93 1.00 0.83 0.87 1.86 0.60 3.56 3.22 4.11 3.94 3.89 4.17 3.06 3.83 1.20 1.06 1.02 1.16 1.08 0.86 1.73 1.25 3.89 3.44 3.44 2.89 3.33 3.56 0.93 1.24 1.42 1.27 1.32 1.51 3.33 3.89 3.89 3.89 3.33 3.22 1.00 1.27 1.05 1.27 1.50 1.09 3.61 3.67 3.67 3.39 3.33 3.39 0.98 1.24 1.24 1.33 1.37 1.29 3.11 3.67 3.44 3.11 1.05 1.73 1.42 1.36 3.56 3.44 3.33 3.22 1.24 1.51 1.32 0.83 3.33 3.56 3.39 3.17 1.14 1.58 1.33 1.10 Proceedings of Eurasia Business Research Conference 4 - 6 June 2015, Nippon Hotel, Istanbul, Turkey, ISBN: 978-1-922069-77-1 Music Noise Signage Fixtures Cleanliness Crowdedness Clientele type Disable access Price: Price level Competitive Group discount Coupons Value bundling Promotion-Ad: Print ads Broadcast ads Other ads Special promos Outdoor sign Ad theme Promotion-Selling: Approach Helpfulness Presentation Making a sale Knowledge Listening Nonverbal cues Appearance 2.22 3.00 3.11 3.11 3.56 2.67 2.67 3.78 1.39 1.66 1.69 1.45 1.33 1.22 1.32 1.48 3.00 3.44 3.11 3.22 4.22 3.11 2.78 3.56 1.32 1.01 1.45 1.09 0.83 1.27 1.39 1.74 2.61 3.22 3.11 3.17 3.89 2.89 2.72 3.67 1.38 1.35 1.53 1.25 1.13 1.23 1.32 1.57 4.0 3.0 3.3 2.2 2.8 1.3 1.7 1.1 1.3 1.1 4.0 3.8 3.4 2.1 3.4 0.7 0.7 1.5 1.2 0.5 4.0 3.4 3.4 2.2 3.1 1.0 1.3 1.3 1.2 0.9 3.2 2.0 3.1 3.3 2.1 2.2 1.1 1.4 1.2 1.4 1.5 1.5 2.2 2.1 2.8 3.0 2.3 2.7 0.8 1.5 1.2 1.7 1.3 1.3 2.7 2.1 2.9 3.2 2.2 2.4 1.1 1.4 1.2 1.5 1.4 1.4 3.0 3.6 3.2 2.6 3.9 3.2 3.0 2.8 1.6 1.5 1.3 1.7 1.4 1.5 1.6 1.4 3.0 4.0 2.8 2.6 4.2 3.4 3.0 3.4 1.7 1.1 1.4 1.3 1.1 1.7 1.5 0.9 3.0 3.8 3.0 2.6 4.1 3.3 3.0 3.1 1.6 1.3 1.3 1.5 1.2 1.5 1.5 1.2 Service. Guest services are similar in both regions, as is the assortment of credit cards accepted. However, Quebec golf courses tend to have more customized services, better reservation systems, longer hours of operation, guarantees and customer satisfaction policies. Place--Location. New York/Vermont golf courses tend to be more visible from the road and have better access, as well as access to the disabled. However, the external appearance of Quebec golf clubs is more attractive, with better curb appeal, and they offer better parking facilities. Place—Atmospherics. Many golf club atmospheric variables are similar in both regions. Both have similar signage, fixtures, lighting, color schemes, and scent. However, the American golf courses have better access for the disabled, while the Quebec golf courses have better layouts, music selection, and cleaner establishments. Cleanliness is very important in the rural tourism industry, and it is something that can be easily remedied at little or no additional cost. Price. Both regions have similar price strategies, but Quebec is more competitive and offers better value bundling to increase sales. This may take the form of various seasonal packages (e.g., individual, family, group packages), value bundling with other golf courses in the region, or value Proceedings of Eurasia Business Research Conference 4 - 6 June 2015, Nippon Hotel, Istanbul, Turkey, ISBN: 978-1-922069-77-1 packages with other tourism/hospitality operators in the region (e.g., weekend Bed-and-Breakfast with golf passes, restaurant with golf passes, or B&B/golf/dining.) Promotion--Advertising. Promotion received the lowest ratings in both regions. Golf courses appear to do very little advertising to promote their establishment and attract their target market. They often rely on repeat golfers from previous seasons, and do limited advertising in the media to attract new golfers. The New York/Vermont golf courses do more promotions using print media and special promotions. Special promotions in both regions include tournaments in-store sales, and senior discounts. Some Quebec golf courses also have children and student discounts, while the New York/Vermont do more contests/championships and benefits/fundraisers for charity, which supports Huteesing (2013) in the United States, but not the National Allied Golf Association report (2014) in Canada. Promotion—Selling. In both regions, the golf club staff appears to be welltrained and knowledgeable about their products/services. The major difference is that the staff is dressed in more professional-looking golf attire in Quebec. 6. Summary and Conclusion More similarities than differences were found in these regions, although Quebec golf courses tended to have slightly better marketing strategies than New York/Vermont. Quebec golf courses provide a better assortment of higher quality products, better brand name golfing products, more golf course options (9 holes, 18 holes), and special features. They have better reservations systems, hours of operations, guarantees, and customer satisfaction policies. The golf club appearance and layout is more attractive, cleaner, with good parking facilities. The staff is dressed more professionally in golf attire. Both regions have similar price strategies, but Quebec offers better value bundling to increase sales. New York/Vermont golf courses tend to be more visible from the road and have better access, as well as access to the disabled. They do more promotions using print media and special promotions. These golf courses would benefit from visiting the golf courses just a few miles away in Quebec to improve their offerings to their target market and grow their business. Benchmarking with best practices in other golf courses can be a helpful process to identify areas of improvement in one‟s marketing strategy, especially in regions that attract similar target markets across the border. Golf tourism also offers opportunities to increase spending on golf-related goods and activities in a region. By offering value-bundling with other golf courses, each participating golf course gains the opportunity to attract golfers from other areas who might become regular guests if they enjoy their experience there. The golfers might benefit from getting more variety in their golf experience, and travel to more distant locations where they might spend Proceedings of Eurasia Business Research Conference 4 - 6 June 2015, Nippon Hotel, Istanbul, Turkey, ISBN: 978-1-922069-77-1 on food and lodging. Other value-bundling combining food and lodging with golf courses can benefit all tourism operators concerned. It can turn an afternoon activity for the price of a golf fee into a weekend of golf fees, restaurant revenue, and overnight accommodations that support the rural region. These types of sales promotions must be communicated in order to draw golfers. More advertising by the participants in print media, brochures, tourism cards and guidebooks, websites, email and social media would help support the value packages. Hosting golf tournament fundraisers for charitable causes can draw a different type of golfer that may be a potential repeat customer, as well as generate goodwill and publicity for the golf course. The above findings are limited in sample size and in scope, and generalization beyond the regions under observation should be undertaken with caution. The findings apply to seasonal golf courses in northern regions. More research is needed in other Canadian provinces and Northern American states, as well as in other countries with seasonal golfing. Additional research is also needed in warmer climates where golf-courses operate year-round, where the marketing strategies are likely to be different in scope. References Church, NJ and Heroux L 1999. „Canadian and American Travellers: FraternalTwins? An Exploratory Study of Hotel Macro-Choice Criteria‟, Proceedings of the Administrative Sciences Association of Canada Conference, C Ralston, ed. Saint John, New Brunswick, Vol. 20, No. 23, pp. 22-30. Golf Profit Builders 2015. “Golf Course Business Trends”, N.p. n.d. Web 03/16/2015. http://www.golfprofitbuilders.com/ Gregory, S 2013. “A Hole in Half”, Time, 182(5), October 10. Heroux, L 2002. Restaurant Marketing Strategies in the United States and Canada: A Comparative Study, Journal of Foodservice Business Research, Vol. 5, No. 4, pp. 95-110.Heroux L and Burns L 2000. „Comparative Marketing Strategies of Bed-and-Breakfasts in Canada and the United States: An Exploratory Study‟, Proceedings of the Administrative Sciences Association of Canada Conference, NJ. Church, ed., Vol. 21, No. 23, pp. 21-28. Heroux, L and Csipak J 2001. „Comparative Marketing Strategies of Motels in Canada and the United States: An Exploratory Study‟, Proceedings of the Administrative Sciences Association of Canada Conference, L Heroux, ed., London, Ontario, Vol. 22, No. 23, pp. 35-44. Heroux, L and Csipak J 2005. Marketing Strategies of Bars in the United States and Canada: A Comparative Exploratory Study, Journal of Foodservice Business Research, Vol. 8, No. 2, pp. 55-72. Huteesing, N 2013a. „According to Golf, the Economy is Out of the Rough‟, BloombergBusiness, July 31. www.bloomberg.com/news/articles/201307-31. Accessed 03/11/2015. Huteesing, N 2013b. „The Real Economic Impact of Golf‟, BloombergBusiness, July 26. www.bloomberg.com/news/articles/201307-26. Accessed 03/11/2015. Laird, K 2011. Golf Town Tees up US Expansion Plan, Marketing, March 11. Proceedings of Eurasia Business Research Conference 4 - 6 June 2015, Nippon Hotel, Istanbul, Turkey, ISBN: 978-1-922069-77-1 McCarthy, JE. and Perreault WD 2000. Essentials of Marketing, 8th Edition, Irwin. Mitchelson, RL and Lazaro MT 2004. The Face of the Game: AfricanAmericans‟ Spatial Accessibility to Golf, Southeastern Geographer, Vol. 44, No. 1, pp. 48-73. National Allied Golf Association (2012). Canadian Golf Consumer Behaviour Study, http://Canadagolfs.ca/canadian-golf-consumer-behaviour-study/. Accessed 03/11/2015. National Allied Golf Association (2014). Economic Impact of Golf in Canada, http://Canadagolfs.ca/economic-impact-of-golf-in-canada/. Accessed 03/11/2015. National Golf Foundation (2014). Golf Participation in the US. http://www.ngf.org/pages/golf-participation-US. Accessed 03/16/2015. Newport, JP 2007. Golf Journal: Nine is Enough: Short Courses may Lack Fancy Amenities, but they‟re often more Fun to Play than 18-holers, Wall Street Journal, September 1. Petrick, J and Backman S 2002. An Examination of the Construct of Perceived Value for the Prediction of Golf Travelers‟ Intentions to Revisit, Journal of Travel Research, Vol. 41, No. 1, pp. 38-45. Shepherd, C 1999. Driving for the Green: Marketing your Community‟s Golf Course, Parks and Recreation, Vol. 34, pp. 72-79. Vaughn, J 2012. Marketing your Brand on the Golf Course, Michigan Chronicle, July. Wilson, B 2011. „Global Golf Industry Facing Challenges‟, BBC News Business, April 1, www.bbc.com/business-12731099. Accessed 03/11/2015.