Proceedings of 4th European Business Research Conference

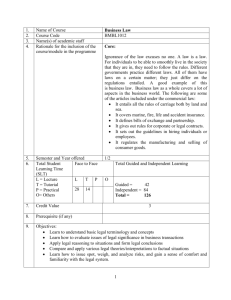

advertisement

Proceedings of 4th European Business Research Conference 9 - 10 April 2015, Imperial College, London, UK, ISBN: 978-1-922069-72-6 The Concept of New Public Management: The Adoption Case in Malaysian Public Sector Agnes Paulus Jidwin* and Rasid Mail** This article presents an analysis of literatures on the extent of the New Public Management (NPM) ideology, which has been implemented in the Malaysian Public Sector. The empirical part consists of an extensive search and analysis of academic articles and government publications related to NPM initiatives implementation. The results of the study clarify different outcomes, where some significant organisational gains are achieved although at the same time, the government still receives many criticisms and complaints. JEL Codes: H1 and H83 1. Introduction From 1980s to present, public sectors have been experiencing significant reform with both rhetoric and reality focus on change in performance reporting regimes. The public sector institutions all over the world have been subjected to a more drastic change due to both internal and external environmental factors such as economic, politic and social pressures. Central to the issues of public sector change is the demand for a more efficient, effective and transparent management approach. The New Public Management (NPM) ideology was promoted by the new generation of econocrats and accountocrats in public sector offices (Hood, 1995). The NPM promotes changes in administrative policy and financial management with the adoption of private sector best practices (Drechsler, 2005) to improve the management of service delivery, that put an emphasis on efficiency, economy and effectiveness (Larbi, 1999) as well as accountability (Hood, 1995) both in administrative and financial aspects. In this reformed effort, various strategies have been adopted including corporatisation (Kasim, 2006), demonisation, decentralisation, market-based public administration, resultbased management (Pollitt, 1990; Hood 1991), privatisation, managerialism (Kearney and Hays, 1998) internationalisation and informatisation as well as accountingisation (Hood, 1995). Migration to accrual accounting has been the main strategy implemented by many public sectors such as in New Zealand, Australia, United Kingdom, United States and Canada, under financial reforms. Implementation of accrual accounting in the public sector accounts has never been smooth and some countries experience problems until today and has been equivocally debated in public sector accounting literatures. The move from cash to accruals accounting by many governments is viewed as an aspect of NPM agenda designed to achieve a more business-like and performance focused public sector (Hyndman and Connolly, 2011). As such it is generally accepted that the traditional cash accounting system does not provide adequate accounting information which is necessary for the government to operate efficiently and effectively. Therefore, the number of countries adopting the accrual accounting system is increasing. _____________________________________________________________________ *Agnes Paulus Jidwin , Faculty of Accounting, University Teknologi MARA, Malaysia, Email: agnes.pj@gmail.com **Assoc. Prof. Dr. Rasid Mail, University Malaysia Sabah, Malaysia. Proceedings of 4th European Business Research Conference 9 - 10 April 2015, Imperial College, London, UK, ISBN: 978-1-922069-72-6 Presently, the Malaysian public sector is in the midst of migrating to accrual accounting from modified cash basis accounting beginning from financial year 2015 (Salleh et al., 2014). Hence, the purpose of this study is to review the literature of Malaysian Public Sector Accounting and the NPM ideology adoption in the Malaysian public sector. 2. Malaysian Public Sector Accounting Central to the effort to transform Malaysian public sector is the efficiency of management process and the effectiveness of resource optimisation. Such economic and managerial concerns lead to the re-consideration process on accounting managerial roles, both as a tool and product of transformation process. It is comparable to the cases of transforming public sector in other developed and developing countries where accounting practice has been realigned to suit the need to support the institutionalisation process of the efforts. Accounting has been traditionally defined as the system of identifying, classifying, recording, summarising, analysing and reporting of financial data and information of an organisation in the accordance with the accepted principles, concepts, conventions, standards and regulation (Fatimah et al., 2008). Accounting and financial reporting for public sector are based on distinctive concepts, standards and procedures, designed to accommodate their environment and the needs of their accounting information users (Fatimah et al., 2008). However, accounting practised in public sector is different as compared to accounting practised in the private sector. One of the most obvious distinguishable characteristics between the two is the legal framework, which regulates the practice. In Malaysia, the public sector accounting system is designed to comply with the Federal Constitution, statutory and other legal requirements, while the practice in the private sector is subjected to the international standards code of practice. The Central and State Governments have been adopting modified cash basis of accounting to present their financial statements. Under the modified cash basis of accounting, expenditures which are incurred in the prior year will be paid in January of the new financial year and are reported as expenses for the prior financial year (Salleh et al., 2014). The cash accounting focuses on cash flows and cash surpluses or deficits while the accrual accounting focuses on revenues, expenses and profits or losses, therefore the net income reported by each method will not be the same. The accrual accounting has long been the primary focus of the private sector financial statements. To enable consistency and comparability among the financial statements of these private sectors, accounting standards have been developed and mandated. Accounting standards for the government sector are not progressing along the similar path as those taken by the private sector (Tickell, 2010). As a developing country, Malaysia does not prepare to standardise the government account wholly as each level of the government is an accounting entity by itself and is subjected to different Laws and regulations that are being enforced (IPSASB, 2005). In the Malaysian government context, the financial provisions of Federal Constitution 1957 and the Financial Procedure Act 1957 describe in detail the financial provisions with regards to the accountability and enforcement matters (Zakiah, 2007). Salleh et al. (2014) stated the objectives of the Financial Procedure Act 1957 as follows: 1. to provide guidance for the control and management of public finance for the whole nation 2. to provide financial and accounting procedure 3. to provide guideline for collection, custody and payment of public monies Proceedings of 4th European Business Research Conference 9 - 10 April 2015, Imperial College, London, UK, ISBN: 978-1-922069-72-6 4. 5. 6. 7. to provide procedure for purchase, custody and disposal of public properties to provide authority for the investment of money standing in the consolidated funds to define and explain the three accounts of the consolidated funds to enforce provisions of Federal Constitution relating to finance. The Government Accounting Standards has been set up by the Accountant General Department since 2002. Its objective is to prescribe the standards and the basis for preparation of government financial statements in accordance with the requirements of the Federal Constitution and the Financial Procedures Act 1957 (Revised 1972). The Malaysian Public Sector Accounting Standards (MPSAS) is set out based on the International Public Sector Accounting Standards (IPSAS). The objective is to prescribe the manner in which general purpose financial statements should be presented to ensure comparability both with the entity‟s financial statements of previous periods, and with the financial statements of other entities. To achieve this objective, the Standards sets out overall considerations for the presentation of financial statements, guidance for structure, and minimum requirements for the content of financial statements prepared under the accrual basis of accounting. The recognition, measurement and disclosure of specific transactions and other events are dealt with in other MPSASs. 3. NPM in Malaysia In the past, many researchers recognised that Malaysia inherited the custodial role of the British colonial administration played a limited developmental role (Joon-Chien, 1981; A. Khalid, 2008). Therefore, a shift of goals from a rule-bound bureaucratic tradition to be a more proactive, flexible and adaptable style has becoming imperative under the Malaysian Incorporated Concept (A. Hamid1, 1995). Consequently, the Malaysian public sector has undergone various transformations from being an engine of the country‟s economic growth and development to become a facilitator to the private sector and service provider to the public. It is widely acknowledged that the broad thrust of the public management reforms is framed within the NPM (Guthrie, Olson and Humphrey, 1999) and has introduced a new set of market-like and managerial principles into the public realm (Hood, 1991; 1995). Like many other countries, Malaysian government has accepted the philosophy of NPM during the mid-1980s, with the purpose of improving their organisational efficiency, effectiveness and accountability in the provision of services (Joseph, et al., 2014). Under this new environment, the civil service operates in an era where the customer is paramount (A. Hamid, 1995), sought to address such inefficiency and ineffectiveness through administrative reform and reorganisation (Tooley, Hooks and Basnan, 2009). The Malaysian government has embraced the belief that expanding the role of the private sector will improve the efficiency and effectiveness of public service. Nor-Aziah and Scapens (2007) acknowledge this belief as a reflection of global trends which are grounded in a perception that public sector management is inefficient and can only be challenged by the introduction of private sector management ideas and thinking. Nor-Aziah and Scapens (2007) stated that „the Malaysian government views the application of private sector management techniques as it preferred solution to the problem of financial inefficiency in the public sector.‟ Total Quality Management (TQM), Quality Control Circle (QCC), Malaysia Incorporated Policy, Service Recovery Systems, Client Charters, ISO 1 Tan Sri Dato’ Seri Ahmad Sarji bin Abdul Hamid was then Vice President of CAPAM, Chief Secretary to the Government of Malaysia and Head of the Civil Service and Secretary to the Cabinet at the Prime Minister’s Department. Proceedings of 4th European Business Research Conference 9 - 10 April 2015, Imperial College, London, UK, ISBN: 978-1-922069-72-6 9000 Quality Management Standard (QMS), Public-Private Partnership, Privatisation, Outsourcing, and Online Public Services are some examples of the various practices and approaches introduced at all levels of government to re-engineer the public sector (Abdullah and Kalianan, 2008). Apart from the above-stated programs, Malaysian public sector has also introduced several efforts on performance measurement through Annual Work Objective, and competency evaluation under Malaysia Pension Scheme and benchmark best practices through Quality Awards in civil service (Romli and Ismail, 2014). The efforts were introduced in the late 1980s and early 1990s (A. Khalid, 2008). These aimed to instill the perception to provide excellent customer services. However, Romli and Ismail (2014) in their study claim that the Public Complaints Bureau had stated in its website, there was still a significant number of complaints filed by the public due to delays in taking actions and providing services to them. Under this performance based appraisal system, the matrix salary schedule was introduced where the reward and promotion of a civil servant is based on job performance. In that manner there are four possible types of salary increments; static (no increment), horizontal (normal i.e. one increment), vertical (merit increments, which range from greater than one to double the normal increment), and diagonal (merit increment, which range from double to triple increments). A. Karim (1995) elaborated the basic concepts in the creation of quality management culture in the public service in Malaysia. According to him: „The public service was guided by the following five basic concepts in creating the quality management culture in the public service. These concepts are; (1) Quality is meeting customer requirements, (2) Quality is maintained through prevention, (3) The standard of performance is “zero defect”, (4) Cost of quality is non-conformance to standards, and (5) All work is a process.‟. (A. Karim, 1995, pp. 12-13) TQM was introduced in Malaysian public sector client charter in 1993 after the guidelines on TQM in the public service issued in 1992 (A. Karim, 1995). Based on the above core concepts, the Malaysian Government introduced a number of reforms and a series of circulars to foster the achievement of national objective which is to institutionalise culture. The TQM focuses on the need for organisation-wide efforts to implement quality improvement (A. Karim, 1995) and has been adopted as an approach to mobilise all available resources in public sector agencies to meet customer requirements (A. Hamid, 1995). The client charter is a written commitment made by all agencies pertaining to the delivery of services to their respective customers as an assurance of their compliance with the declared quality standards, provided with performance indicators that can be used continuously to improve the services rendered. Proper directional signs and guides pertaining to forms used, procedures, work flow and processes are prominently displayed for customers‟ convenience. With reference to the circular regarding the TQM implementation guidelines, the A. Karim (1995) illustrates: „The circular (Guidelines on TQM in the public sector) identified seven principles that are to be emphasized by top management; (a) support and commitment of top management, (b) strategic quality planning, (c) customer focused, (d) training and recognition, (e) teamwork, (f) performance measurement, and (g) quality assurance...(and)....the circular “Guidelines for quality improvement strategies in the public service”, outlines seven Proceedings of 4th European Business Research Conference 9 - 10 April 2015, Imperial College, London, UK, ISBN: 978-1-922069-72-6 quality programmes to be implemented in public sector agencies: (a) a quality suggestion system, (b) quality processes, (c) quality inspection, (d) quality day, (e) quality slogan, (f) feedback on quality, and (g) quality information. Another circular, “Guidelines on productivity improvement in the public service”, was issued with the objective of assisting heads of departments to plan and implement productivity improvement in their own organisations....It also identifies the eight common factors that organisation should focus on to attain higher productivity; workforce, systems and procedures, organisational structure, management style, work environment, technology, materials, and capital equipment. By eliminating wasteful practices in one or more of the eight areas, and organisation would be able to decrease costs and increase output, thereby increasing productivity.‟ (A. Karim, 1995, p. 14) There was a strong and positive association between TQM, overall service performance and customer satisfaction and an emphasis on quality would result in organisational gains (Agus, 2007). However, recent research by Romli and Ismail (2014) indicates that even though Malaysia has launched the TQM program for more than 20 years, the performance of the government in Malaysia still receives much criticisms and complaints. They suggested that this institution still unable to deliver high quality services to meet the public‟s expectations. Hood (1991) demonstrated that the development of information technology in the production and distribution of public services is one of four administrative “megatrends” which are connected with the NPM principle. The use of information technology in public sector agencies has created a major office automation to replace the manual systems, such as the use of computerised text processing, information storage and retrieval, and communication systems to increase efficiency and enhance productivity, and reducing cost through paperwork reduction. A. Hamid (1995) states: „We have to come to terms with the fact that our people are no longer content just to grumble about below par services they may receive. The paradigm shift in the civil service is being effected under two strategies: first, improvements in civil service, systems, rules and regulations and information technology; second, inculcating the values of quality, productivity and accountability into the civil service.‟ (A. Hamid, 1995, page 267) Moreover, online Public service is one of the various practices and approaches introduced at all levels of government to re-engineer the public sector under the public sector reform program in Malaysia (Joseph et al., 2014). The example provided by them is the website for e-PBT (Malaysian for Electronic Local Authority). It is one of the initiatives implemented under the Smart Local Government Governance Agenda (SLGGA) by the Local Government Department in 2002. Its aim is to improve public service delivery by using information technology as well as to strengthen the elements of transparency, accountability and effectiveness. In this initiative, the government has provided RM15 million under the Ninth Malaysian Plan for developing the e-PBT. Another NPM tool introduced in Malaysian public sector is the Quality Control Circle (QCC), which was launched in 1983. Under this program, small groups comprising relevant personnel are formed to identify, select and analyze problems, and suggest solutions to the top management for further consideration and implementation (A. Karim, Proceedings of 4th European Business Research Conference 9 - 10 April 2015, Imperial College, London, UK, ISBN: 978-1-922069-72-6 1995). The guidelines for QCC implementation was issued in 1991, and since then, QCC conventions are held yearly at local, regional and national levels. Through QCC, human resources, that constituting the most critical element to increase productivity (A. Karim, 1995), are empowered to solve works related problems and make decisions without having to refer to the higher hierarchical chain. Line staff must be empowered to take charge of the performance expected from them and the processes are facilitated and supported by the management accordingly. Hence, government agencies and individuals who have contributed innovative ideas to improve the quality of services or outputs of their respective organisations are given special recognition, such as the Prime Minister‟s Quality Award for the agencies and Public Service Innovation Award for individuals. According to A. Karim (1995), some of the implemented innovations, through the above initiative, proven to be beneficial in reducing waiting time in hospitals, reducing processing time for examinations of tenders, facilitating file movements, improving services in local authorities and the collecting of additional arrears. The introduction of private sector practices such as performance based pay system (A. Hamid, 1995: A. Khalid, 2008) and the Key Performance Indicators (KPIs)(A. Khalid, 2008), implementation of ISO 9000 and improvement of administrative work process and procedures are among the tools used to improve the service delivery system in Malaysian public organizations. The government has issued a directive that requires all public agencies to formulate, evaluate and report their key performance indicators (KPIs) and their associated benchmark. Under the monitoring and evaluation of Malaysian Administrative Modernization and Management Planning Unit (MAMPU), the KPIs practice was initially implemented in six government organizations, i.e. state hospital, national registration, municipal council, police unit, immigration department and land office. Although the cost-benefit issues of the implemented system debated continuously, the role of KPIs system in providing data for head of organizations to make better human resources allocation and improve public sector service delivery is acknowledged. Meanwhile, the implementation of performance-based culture is believed to be an effective tool to strengthen institutional and implementation capacity of the public sector (A. Khalid, 2008). However, the implementation of the various techniques of NPM has not led to significant changes (A. Khalid, 2008). As A. Khalid (2008) stated the NPM adoption in Malaysia as; „Malaysia has accepted the philosophy of NPM since the 1980s with the implementation of a privatisation policy and various administrative programmes... [and] ...Most of the account of impact and consequences towards managerialism and accountability in Malaysia are based on selfdescriptions. After so many programmes for improvements made in the last 20 years, the search for efficient and effective delivery has not produced major impact...The Malaysian public sector continued to be impeded with a host of problems including the lack of financial discipline and accountability.‟ (A. Khalid, 2008, p. 82). The move toward NPM in Malaysia was precipitated by various factors, one of which is the incumbency of Mahathir Mohammad as premier in 1981. Two crucial policies were implemented within the two years of his premiership, i.e. the Look East Policy in 1982 and the Malaysian Incorporated and Privatisation Policy in 1983 (A. Khalid, 2008). The Malaysian public sector continues to suffer from inefficiency, the lack of financial discipline and accountability (Siddique, 2006; A. Khalid, 2008) despite unabated belief that the Proceedings of 4th European Business Research Conference 9 - 10 April 2015, Imperial College, London, UK, ISBN: 978-1-922069-72-6 private sector practices and techniques could improve the public sector service delivery system. A. Khalid (2008) states that: ..the use of KPIs may lead to increase inaccountability of the agencies and also its officers. The KPI data provide visibility and transparency of the individuals‟ and agencies‟ performance..., the KPI system provided information regarding the individual output and the responsibility of their officers..(and)...it (the KPI) was also used as a basis for a better allocation of human resources in those organisations... The system of KPIs is a continuation of the managerialism of the Malaysian public sector. (A. Khalid, 2008, page 6) The New Public Financial Management (NPFM) is part of NPM reforms agenda. In operationalising the NPM concepts, the quality of the management accounting information is crucial and important (Lapsley and Pallot, 2000). NPFM concerns accounting and financial management reforms aiming to improve the effectiveness and accountability of government through such means as accrual accounts, devolved budgets, performance measurement, transparent costing and output-based budgeting (Olson et al., 2001). The processes and outputs of NPFM are driven by providing financial knowledge for more responsible, decentralised, equitable and transparent decision-making in government (Romzek, 2000). In Malaysia, financial reforms were introduced principally through the Modified Budgeting System (MBS), the Micro Accounting System (MAS) and a new internal auditing system (Stiles et al., 2006). Under the NPFM ideology, accrual accounting is placed on the instrumental basis (Olson et al., 2001; Hood, 1995), presumed to contribute to enhancing transparency and improving decision making. Accrual accounting provides a better overview of the financial activities and the financial position of the government. In most recent development in Malaysian public sector, the government has decided to adopt the accrual accounting for prudent fiscal management and performance measures (Salleh et al., 2014). The accrual accounting adoption has been included as one of the initiatives in New Economic Model (NEM), which was launched in 2010. The main objective of the NEM is to transform the government by stimulating the economic growth, in supporting the „Vision 2020‟ aspiration to make Malaysia a developed nation by year 2020. 4. Conclusion The above literature reviews reveal that the Malaysian government has implemented some initiatives under NPM doctrine and ideology which have been introduced since the 1980s. Associated concepts like TQM, QCC, Client Charters, ISO 9000, QMS, Public-Private Partnership, Privatisation, Outsourcing, Online Public Services, benchmarking best practice, and several efforts on performance measurement through Annual Work Objective were literally imported from the private sector. In most recent development in Malaysian public sector, the government has decided to adopt the accrual accounting for prudent fiscal management and performance measures. Prior researches have suggested that there is a strong and positive association between TQM, overall service performance and customer satisfaction and an emphasis on quality would result in organizational gains. However, the most recent study has demonstrated that the public service performance still receives much criticisms and complaints from the public. Thus, this study provides some insights on the extent of NPM philosophy Proceedings of 4th European Business Research Conference 9 - 10 April 2015, Imperial College, London, UK, ISBN: 978-1-922069-72-6 implementation in Malaysian public sector. Although this study is not empirical in nature, it provides additional information related to NPM acceptance in Malaysia. A better understanding on issues and challenges faced by the government in the NPM adoption could be gathered if future research could be performed. Therefore, future empirical studies in this area are strongly recommended. References A. Hamid, AS 1995, Government in transition: building a culture of success-the Malaysian experience. Public Administration and Development. 15(3) pp. 267-269. A. Karim, MR 1995, Improving the efficiency of the public sector: A case study of Malaysia. Working paper was presented in twelfth meeting of experts on the United Nations Programme in Public Administration and Finance New York, 31 July – 11 August 1995. A. Khalid, SN 2008, New Public Management in Malaysia: In Search of Efficiency and Effective Service Delivery. International Journal of Management Science, pp. 69-90. Abdullah, HS and Kalianan, M 2008, From Customer Satisfaction To Citizen Satisfaction: Rethinking Local Government Service Delivery in Malaysia. Asian Social Science, 4(11), pp. 87-92. Agus, A 2007, TQM as a focus for improving overall service performance and customer satisfaction: an empirical study on a public service sector in Malaysia. Total Quality Management and Business Excellence. 15(5-6), pp. 615-628. Drechsler, W 2005, The re-emergence of “weberian” public administration after the fall of new public management: the central and eastern european perspective. Halduskultuur, 6, pp. 94-108. Fatimah, AR, Haslinda, Y, Normahiran, Y, Usha Rani, P, Saluana, CS and Radiah, O 2008, Public Sector Accounting: Malaysian Context, Pearson Hall, Malaysia. Guthrie, J, Olson, O and Humphrey, C 1999, Debating developments in the New Public Management: the limit of global theorizing and some new ways forward. Financial, Accountability and Management, 15(3), pp. 209-228. Hood, C 1995, The New Public Management in the 1980s: Variations on a Theme. Accounting, Organization and Society, 20(2-3), pp. 93-109. Hood, C 1991, A public management for all seasons?. Royal Institute of Public Administration, 69, pp.3-19. Hyndman, N and Connolly, C 2011, Accruals accounting in the public sector: A road not always taken. Management Accounting Research, 22, pp.36–45. IPSASB 2005, IFAC International Public Sector Accounting Standards Board IFAC IPSASB Meeting, Country Report – Malaysia. Retrieved from: www.ifac.org/PublicSector/MeetingFileDL.php Proceedings of 4th European Business Research Conference 9 - 10 April 2015, Imperial College, London, UK, ISBN: 978-1-922069-72-6 Joon-Chien, D 1981, Modernizing the Budget System: The Malaysian Experience. Public Administration & Development. Oct-Dec 1981, 1(4), pp. 291-305. Joseph, C, Pilcher, R and Taplin, R 2014, Malaysian local government internet sustainability reporting. Pacific Accounting Review. 26(½), pp. 75-93. Kasim, ANA 2006, Stories of accounting change during financial reform of public enterprises. Pertanika Journal of Social Science and Humanities, 14(2), pp. 111-119. Kearney, CR and Hays, WS 1998, Reinventing government, the new public management and civil services systems in international perspective. Review of Public Personnel Administration, pp. 38-54. Lapsley, I And Pallot, J 2000, Accounting, Management and organizational change: A comparative study of local government. Management Accounting Research. 11, pp. 213229. Larbi, AG 1999, The new public management approach and crisis states. UNRISD Discussion Paper No. 112, The United Nations Research Institute for Social Development. Likierman, A 2003, Planning and Controlling UK public expenditure on a resource basis. Public Money and Management. pp. 45-50. Nor-Aziah, AK And Scapens, RW 2007, Corporatization and Accounting Change. The Role of Accounting and Accountants in a Malaysian Public Utility. Management Accounting Research. 18, pp. 209-247. Olson, O, Humphrey, C, and Guthrie, J 2001, Caught in an Evaluatory Trap: A Dilemma for Public Services Under NPFM. European Accounting Review, 10(3), pp. 505-522. Pollitt, C 1990, Managerialism and the Public Services: The Anglo-American Experience. Blackwell, Oxford. Romli, AAN and Ismail, S 2014, Quality management practices towards customer satisfaction in local authority public services website. International Journal of Public Policy and Administration Research. 1(3), pp. 80-93. Romzek, BS 2000, Dynamics of Public Sector Accountability in an Era of Reform. International Review of Administrative Sciences, 66(1), pp. 21-44. Salleh K, Ab-Aziz R and Abu-Bakar YN 2014, Accrual accounting in government: IS fund accounting still relevant?. Procedia – Social and Behavioral Sciences 164 (2014), pp.172179. Siddiquee, NA 2006, Public Management Reform in Malaysia: recent Initiatives and Experiences. International Journal of Public Sector Management, 19(4), pp. 339-358. Stiles, DR, Karbhari, Y and Mohamad, MHS 2006, The new public financial management in Malaysia. Proceedings of 4th European Business Research Conference 9 - 10 April 2015, Imperial College, London, UK, ISBN: 978-1-922069-72-6 Tickell, G 2010, Cash to Accrual Accounting: One Nation‟s Dilemma. International Business and Economics Research Journal, 9(11), pp. 71-78. Tooley, S, Hooks, J and Basnan, N 2009, Stakeholders‟s perceptions on the accountability of Malaysian Local Authorities. Advances in Public Interest Accounting. Zakiah S 2007, Malaysian Governmental Accounting: National Context and User Orientation. International Review of Business Research Papers, 3(2), pp.376 – 384.