Proceedings of 4th European Business Research Conference

Proceedings of 4th European Business Research Conference

9 - 10 April 2015, Imperial College, London, UK , ISBN: 978-1-922069-72-6

New Performance Measurement Models and Management

Control Systems: A Critique of the Literature

Emad Awadallah

Control systems simply exist to direct a business towards growth and the achievement of its objectives. As a prerequisite for this, every business needs an effective and efficient performance measurement model to control its performance. Given how dynamic business markets are, organizations have witnessed a rapid change in their measurement systems in the last three decades with most of the measurement models being more sophisticated. The Wang Corporation in the mid-1980s developed one of the earliest models which later faced several problems. A balanced based scorecard approach was later developed in 1991 by Lynch and Cross. In the year 1992, Kaplan and

Norton redeveloped the balanced which was later revisited in several occasions.

However, it is argued, that the effectiveness of these measurement models is not as accurate and there have been several developed and advanced models which appear to be more promising.

The main aim of this paper is to discuss and review the effectiveness of two new performance measurement models; namely the performance wheel and the performance pyramid; and contrast them with the older; outdated; models. It is argued, that these next generation models are found to be effective in overcoming the limitations of the old models. However, it is noted that the effectiveness of the newly developed models is purely dependent on full management support and belief if the models have to exist and work.

Keywords: Performance Management Models, Management Control Systems,

Performance Wheel, Performance Pyramid

Field of Research: Management Accounting

Introduction

Performance measurement models are ways through which businesses collect information, analyze it and report it concerning the performance of a certain specific group or business. The measurement models basically involve the study of various parameters with the aim of checking if production is in line with that was intended.

Performance measurement models can also be defined as the process of quantifying the effectiveness and efficiency of past actions in a company (Neely, 2002). It is also the process of evaluating how well businesses perform and the manner in which they deliver to their customers and stakeholders (Moullin, 2002). Good performance is the only way that business can measure the capability to prevail in the market.

Business models have for long periods used the financial measurement tools to measure the success of their business. This is a backward way to measure how well a business is performing (Kothari and Sloan 1992). All measurement models should incorporate several other factors apart from the financial aspects. For purposes of management control, it is important to incorporate non-financial information to have the

___________________________________________________________

Dr. Emad Awadallah, Department of Accounting and Information Systems, Qatar University

Dr. Emad Awadallah, Email Address: emad.awadallah@qu.edu.qa

Proceedings of 4th European Business Research Conference

9 - 10 April 2015, Imperial College, London, UK , ISBN: 978-1-922069-72-6 likely indicators of business success or failure. This has led to businesses abandone the most popular systems that are outdated and have started to use the next generation performance scoreboard. The effectiveness of these models depends on various factors among them understanding the meaning of the term control.

Every business needs a model to analyze its performance and this is what has been in use for several years. However, the effectiveness of these models is not accurate and there have been several models that have continually been improved over the years. The integration of various parameters over time has led to the development of the latest performance measurement models that are now commonly used. A look at the historical development of these models will help understand the growth and development of these models over time and the shortcomings they have faced over the years.

The Historical Development of Measurement Models

Organizations have witnessed a rapid change measurement system in the past

20 years with most of the new measurement models being more sophisticated. The

Wang Corporation in the mid-1980s developed one of the earliest models which later faced several problems. This method was based on the traditional cost based parameters. It could be easily reversed or eradicated with new changes in management, like some emergency manufacturing. A balance based scorecard was later developed in 1991 by Lynch and Cross, which was to be an improvement on previous models. Their early stages of development emphasized on using both financial and non-financial measurements. They basically aimed at having both the financial and non-financial metrics measure the same thing and give a similar indication on the direction the business is taking. This meant the companies could reduce the number of workers they have if the cycle time of a product is reduced.

The model developed by Lynch and Cross could later recognize the need for continuous improvement and the need for businesses to shift from the engineered standards to those of the actual performance (Musconi and McNair, 1987). In the year

1992, Kaplan and Norton developed a new version of the balanced scorecard which required measurement and mentalities across all fields. However, this agreement could later be stopped with some models arguing all measurement should be tied to a specific developed strategy that led to „top down' model. The other model argued was the

„bottom up' which was supported by Lynch and Cross. There have been various shortcomings with these two methods leading to the development of the new performance measurement models. The historical developments of these models are important in various aspects having led to the development of the next generation performance measurement models.

The remainder of this paper is structured as follows. The next section introduces the BSC. Section 3 outlines the usage of the BSC, followed by its application in section

4. The limitations of the BSC are outlined in section 5. terature and develops the testable hypotheses. Methods of data collection and methodology are presented in

Section 3. The results and related analyses are presented in Section 4, and finally the research conclusions and suggestions for future work are presented in Section 5.

Proceedings of 4th European Business Research Conference

9 - 10 April 2015, Imperial College, London, UK , ISBN: 978-1-922069-72-6

The BSC: Background

Kaplan and Norton developed the concept of the Balanced Scorecard (BSC) in

1992. The objective was to overcome the inadequacies of the traditional financial-based performance measurement tools. Within a decade, a majority of the Fortune 1000 companies was implementing or had already implemented the BSC (Hendricks, 2004;

Kraaijenbrink, 2012). Today, thousands of private, public and non-for-profit organizations have implemented the BSC (Kaplan, 2010; Basuony, 2014). Martinsons,

Davison and Tse (1999) link the widespread adoption of the BSC to its multidimensional approach to performance measurement. Compared to the traditional performance measurement tools that focused on financial metrics alone, the BSC focuses on three additional performance metrics (customer, internal process, and learning and growth) to provide a holistic performance outlook (Kaplan and Norton,

1992; Kaplan, 2010).

Despite the widespread adoption, the outcomes of implementing the BSC have varied from successful to no tangible results to outright unsuccessful (Casey and Peck,

2004; Antonsen, 2010; BizShifts, 2010; Parmenter, 2012). A growing body of scholarship thus finds limitations in the BSC, particularly in its concept (Neely,

Kennerley and Martinez, 2004; Kraaijenbrink, 2012; Parmenter, 2012), application

(Rillo, 2004; Voelpel et al., 2005; Basuony, 2014), and practice (Molleman, 2007;

Antonsen, 2010). The same body of scholarship contends these limitations could either undermine the effectiveness of the BSC or cause firms to abandon the BSC altogether for better performance measurement alternatives. Therefore, reviewing the scholarship on BSC, this critique systematically examines the usage, application, benefits and limitations of the concept and practice of BSC and recommends an alternative performance measurement tool.

Usage of the BSC

The underpinning conception of the BSC is, “if you cannot measure it, you cannot understand it” (Kaplan, 2010, p. 3). Kaplan and Norton (1992) developed this conception based on multi-company research findings done in 1991 by the Nolan

Norton Institute. The findings indicated that, despite intangible assets playing an increasingly central role in value creation, firms were not measuring nor integrating intangible assets in their management systems. Thus, the original and core objective of the BSC was to measure and integrate intangible assets into a firm‟s performance measurement (Kaplan and Norton, 1992, 2004; Kaplan, 2010). However, since the concept of the BSC is not yet mature, differences in its interpretation and practice have emerged. Depending on interpretation and practice, many organizations have implemented the BSC to support a wide range of strategic organizational objectives.

Some firms use the BSC as a strategic management tool to support decision-making at the strategic management level (Martinsons, Davison and Tse, 1999; Murby and Gould,

2005), to improve management of intellectual capital (Bose and Thomas, 2007), to develop employee incentive system (Ciuzaite, 2008) and to manage (Shadbolt et al.,

2003). However, A majority of firms use the BSC to measure the overall performance of an organization or to implement a strategy (Basu, Little and Millard, 2009; Nzuve and

Nyaega, 2011).

Proceedings of 4th European Business Research Conference

9 - 10 April 2015, Imperial College, London, UK , ISBN: 978-1-922069-72-6

The first and the original use of the BSC was performance measurement (Kaplan and Norton, 1992). When using the BSC to measure performance, firms focus on the four performance metrics – financial, customer, internal process, and learning and growth metrics (Kaplan and Norton, 2002). By measuring the four metrics, the BSC assists firms to track all the important aspects of a firm‟s strategy as well as achieve continuous improvement of partnership and teamwork. The BSC retained financial metrics as the ultimate measure of a firm‟s performance. Measuring financial metrics is important to determine whether a firm‟s strategy and execution are supporting the overall mission of the firm (Murby and Gould, 2005; Madsen and Stenheim, 2014). For private and for-profit organizations, financial metrics focus on profit and market share

(business growth) while for public and non-governmental organizations, financial metrics focus on some projected result-oriented measures (Madsen and Stenheim,

2014). The BSC also measures customer perception of the organization since customers provide direct revenues through sales, their perception of the firm is critical to increase and sustain sales (Casey and Peck, 2004). Under customer perspective, the

BSC measures – time, quality, performance, and cost (Kaplan and Norton, 1992). The

BSC also measures internal process to focus on the activities that enhance customer satisfaction, and innovation and learning to improve the skills of employees and to achieve superior internal business process (Bose and Thomas, 2007).

Martinsons, Davison and Tse (1999) find many organizations are using the BSC as a strategic management tool. In these organizations, the BSC forms the base for the strategic management system. The BSC provide strategic managers with a deep insight into the overall organization and hence assists them to make informed decisions about long and short-term objectives, internal and external performance, and financial and operational performance. The BSC enables managers to transform strategy into tangible performance measures, align strategy with the overall organization mission and vision, and articulate and monitor organization activities to promote, support and enhance the achievement of a strategy. The BSC is also useful for strategic management to coordinate a wide range of management processes such as performance appraisal, goal setting, resource allocation, and employee learning and development. Bose and Thomas, (2007) add that, the learning and growth perspective is particularly important for strategic management to identify, improve and better the performance of intellectual capital. Growing intellectual capital is critical to develop innovative product designs, production, distribution and promotion and to improve the market value of an organization beyond the value of its tangible asset base.

Another common use of the BSC is project management. Basu, Little and

Millard (2009) contend the most important aspect of the BSC to project managers is transforming projects tasks into tangible performance measures. The BSC thus assist project managers to track the progress of project execution, identify tasks that are behind schedule, tasks that require more resources and skills and knowledge required to carry out certain tasks. The BSC is also important in project management to provide a more comprehensive picture of the project outside the traditional objectives of time, cost, risk and safety. The BSC thus enables project managers to focus on intangible drivers and outcomes such as quality. However, in project management, the four categories of the BSC and the relationship between the categories require revision. In projects, customer satisfaction is more important than financial measure and key performance measures are benchmarks, compliance assured, verification planned, work assured and work complete.

Proceedings of 4th European Business Research Conference

9 - 10 April 2015, Imperial College, London, UK , ISBN: 978-1-922069-72-6

Among small-scale organizations, the main use of the BSC is enhancing their chances of survival (Shadbolt et al., 2003). According to Basuony (2014), 68% of small firms having less than five employees and 48% having 5-95 employees fail within the first five years of commencement. The main internal reasons are poor management, owner solely managing all business operations, inadequate financial resources, and the lack of knowledge in planning and controlling business activities. The main external reasons are rapid changes in the external market environment, uncertainty and complexity of the external market environment, intense rivalry and changing macroeconomic situations such as recessions. Giannopoulos et al. (2013) argues that the

BSC could assist small firm to avoid failure by identifying internal and external factors contributing to business failure. In particular, the BSC could assist small organization to measure and address internal failure factors and connecting them to internal business processes and learning and growth perspectives. The BSC could also assist small firms to address external factors by aligning them to customer and financial perspectives and link them to internal business processes. However, Basuony (2014) attributes the slow uptake of the BSC among small firms to scarcity of research, the lack of knowledge on the BSC and insufficient capital.

Application of the BSC

The BSC has been applied to almost all industry sectors and industry sizes – from manufacturing to services industries, from large to small organizations and from public to the private sector (Giannopoulos et al., 2013). Originally, the application of the BSC framework was more appropriate for organizations using intangible assets to create value (Kaplan and Norton, 1992). However, continued revision of the concept widened its application (Madsen and Stenheim, 2014). Thus, this section discusses the application of the BSC in three organizations

– in Fosters Brewing Group as a strategic management tool (Bose and Thomas, 2007), in London Heathrow Airport Terminal 5

Project as a project management tool (Basu, Little and Millard, 2009), and in small-scale

(family farm) business (Shadbolt et al., 2003).

Bose and Thomas (2007) studied the application of the BSC in Fosters Brewing

Group in Melbourne Victoria – now acquired by the SABMiller Plc. Fosters Brewing

Group was experiencing a decline in performance. The CEO decided to adopt the BSC as a strategic management tool to acquire and to improve intellectual capital, and to retain old markets while capturing new ones. Investing in intellectual capital would enhance innovation of products and features to improve and sustain the brewing firm‟s value and its competitive advantages. The application of the BSC reversed the declining performance by improving the market value of Fosters Brewing Group. However, implementation of the BSC had several challenges. It took a long time because the

BSC‟s top-down structure placed a greater emphasis on senior management. The departure of some senior management stalled implementation. The changing nature of the business environment – new competitors and changing customer tastes – required several re-conceptualization of the BSC and multiple revisions of key indicators. The final limitation was the application of the BSC was for meta-change initiative, which requires high costs of maintenance and dedicated leadership, either of which could potentially stall the maintenance of the BSC.

Basu, Little and Millard (2009) studied the application of the BSC in a major public infrastructure project having multiple stakeholders. The project was the

Proceedings of 4th European Business Research Conference

9 - 10 April 2015, Imperial College, London, UK , ISBN: 978-1-922069-72-6 expansion of the Heathrow Airport‟s Terminal 5. The BSC was adopted because of its flexibility enabled project managers to identify, customize and review performance metrics according to the project‟s objective. While the application of the BSC was successful, it raised critical issues (limitations) about its applicability to project management. Unlike in a business organization, the success of a project depends on suppliers, the neighborhood communities and the environment. The four categories also refer to abstract issues in a typical project management. The application thus required significant changes in the concept of the BSC. The leading indicators were changed from learning and growth to “benchmarks agreed” (includes some financial measures), and “verification planned and work supervised” (includes supervisor training). The lagging indicators were changed from customer to “handover agreed and work com plete” and “inspected & protected‟‟ and „„compliance assured‟‟ (include financial measures). The reconceptualization of the BSC was a challenge since the four categories were cross-referencing instead of a one-way linear relationship as perceived by the BSC. The other limitation was the exclusion of suppliers and other key stakeholders especially the government and the environment that were key to the success of the project.

Shadbolt et al. (2003) studied the application of the BSC to small-scale organizations as a strategic management tool. The study aimed to examine the applicability of the BSC and its impact on improving the success of small-scale organizations. The study finds the application of the BSC assists small-scale organizations to avoid failure and to improve performance by linking external factors to learning and growth perspective, and internal processes to the financial perspective.

However, when applying the BSC to a small-scale family-owned farm business, two limitations emerge. The customer perspective was inadequate since farm business puts equal emphasis on the customer and supplier. The customer perspective required renaming to supply chain perspective. The second limitation was deciding which perspective was more appropriate to address family expectations such as time-off, holidays and children education, which are part of business expenses since the family is both owner and employee. To accommodate family expectations, the financial perspective required expansion to include shareholder (family) interests and renaming financial/shareholder perspective.

Benefits of the BSC

The main proponents of the BSC, Kaplan and Norton (1992; 2002), assert the BSC has beneficial values to implementing organizations. In the original conception of the BSC, the main benefits were to assist organizations to develop and implement effective business strategies (Kaplan and Norton, 1992). Madsen and Stenheim (2014) add that, despite a large body of scholarship on the BSC criticizing or remaining skeptical about a clear-cut relationship between the BSC and business performance, the widespread practice of the BSC suggests its use has some beneficial values, whether perceived or real, to thousands of organizations that have implemented it. In fact, Rigby and Bilodeau (2013) argue the extremely first and successful spread of the

BSC among thousands of organizations two decades after its inception is sufficient evidence that implementing organizations are either satisfied with the concept or at least find some aspects of the concept useful and beneficial to enhance performance.

Proceedings of 4th European Business Research Conference

9 - 10 April 2015, Imperial College, London, UK , ISBN: 978-1-922069-72-6

Kaplan and Norton (1992; 2002) contend the BSC derives its benefits from overcoming the inadequacies of the traditional financial-based performance measurement tools. The traditional performance measurement methods such as the return on investment, net present value, internal rate of return, and payback period focused exclusively on financial metrics. These methods faced two serious limitations.

First, financial metrics measures past performance and uses the findings to inform future business strategies. Measuring past performance does not take into account current changes in the business environment and risks a firm missing potentially lucrative emerging opportunities. Second, financial measures are periodic performance measures since they are quarterly, semi-annual, or annual performance measures.

Periodic measures means an organization has to wait for a certain period to elapse to evaluate or to develop strategies to improve performance. Since the current business environment (including budgets and their roles) changes from time to time, periodic measures become less effective in evaluating and remedying performance. By overcoming the two inadequacies, the BSC provides managers with three additional performance metrics to evaluate the overall organization performance as well as the past, present and future performance.

Madsen and Stenheim (2014) supports that the BSC has an overall positive effect on the performance of an organization but finds not all aspects of the BSC are beneficial. While some aspects or uses of the BSC assist to improve performance, others hamper performance. However, Madsen and Stenheim (2014) observe that the differential outcomes of the BSC are because the concept is still developing. They argue that, academics and practitioners should understand that the BSC is not a mature concept and its interpretation and use varies across scholars and practitioners respectively. Because of the interpretive and practice variations, different organizations have implemented the BSC to achieve different purposes especially to improve performance or to improve strategic management. As a result, the BSC has different benefits to organizations depending on the purpose of the implementation. The variations notwithstanding, Madsen and Stenheim (2014) find three common benefits of the BSC to management. First, the BSC assists managers to focus on strategy, structure and vision. The focus is important for management to understand and to guide strategy implementation. Second, the BSC integrates financial and non-financial-based metrics to assist managers to focus on the entire business process and ensure current business activities and events contribute to customer values and to the long-term organizational strategy. Third, the BSC assist managers to monitor the execution of a strategy by mapping cause-and-effect linkages between employee activities and strategy implementation.

Basuony (2014) also finds the BSC benefits organizations but the benefits lean towards large organizations. The main benefit is solving problems associated with organizational characteristics such as changes in organization structure, specialization and different hierarchical levels. The associated problems are communication, coordination and control. The BSC solves these problems through its five principles: translating strategy into operations; aligning organization to strategy; integrating strategy into employees‟ everyday tasks; making strategy a continuous process; and mobilize change through top leadership (Kaplan and Norton, 2002). Basuony (2014) observes aligning organization to the strategy assists in solving the problem of communication especially formal reporting and bureaucracy whereas making the organization strategy an everyday job solves the problem of communication and

Proceedings of 4th European Business Research Conference

9 - 10 April 2015, Imperial College, London, UK , ISBN: 978-1-922069-72-6 coordination. Further, as a control system, the BSC assists large organizations to achieve their strategies by enabling management to articulate, communicate, and monitor strategy implementation. While small firms have not had equal benefits,

Shadbolt (2003) finds the BSC could assist them to reduce their high failure rates.

According to Giannopoulos et al. (2013), the BSC has the potential to assist small organization to connect internal factors to internal business process, and learning and growth perspectives, and external factors to customers and financial perspectives to enhance chances of success.

Casey and Peck (2004) also support that the BSC benefits organization. The

BSC benefits organizations by providing managers with a deeper insight into business operations and into different ways to create value. In particular, strategy maps provide managers with a visual illustration of the inter-relationships between employee activities and strategy implementation. The process of developing strategy maps in itself provides the management with a deep insight into business operations and the potential areas to focus to create value. Thus, strategy maps are especially beneficial to organizations that use the BSC as a strategic management tool. The benefits come from strategy maps providing a common language and a common frame of reference, facilitating discussion, communication and visualization of the organization strategy and channels or activities required to achieve the strategy. Furthermore, Nazim (2015) adds that the

BSC improves achievement of strategy since it transforms a strategy into tangible performance metrics, which managers can track, alter or speed up. It also enables managers to align strategy vertically, from strategic management to operational management as well as horizontally between employees to ensure operations activities promote and support strategy execution.

Limitations of the BSC

The persistence of problems encountered during implementation, high rates of implementation failure and considerable variations in both interpretation and practice of the BSC demonstrates serious limitations in concept and in practice

(Pessanha and Prochnik, 2006). It is expected at the second decade since conception, the concept of the BSc would have matured and its application easily replicated across organizations, which is not the case (Parmenter, 2012). Moreover, despite three conceptual revisions and three generations of the BSC, the concept still attracts considerable number of studies criticizing its concept and application. This criticism therefore explores the limitations of the BSC in concept and in practice based on findings from existing studies on the BSC.

At the conceptual level, Kraaijenbrink (2012) criticizes Kaplan and Norton for the dishonesty of owning a concept that the management of Analog Devices, an engineering and manufacturing firm, had developed earlier. In the criticism,

Kraaijenbrink (2012) posits the BSC is well suited for engineering firms and less for other industry types especially service industries. For instance, the internal process may not be relevant for a consulting firm yet the BSC asserts all the four performance metrics are important. Kraaijenbrink (2012) also disagrees with practitioner-oriented literature suggestions that the BSC improves strategy awareness, communication, execution and achievement. While not doubting the positive results, Kraaijenbrink

(2012) links them to other factors such as increased attention to strategy that the BSC influences rather than to the BSC itself.

Proceedings of 4th European Business Research Conference

9 - 10 April 2015, Imperial College, London, UK , ISBN: 978-1-922069-72-6

Neely et al. (2004) share similar observations with Kraaijenbrink (2012). In a comparative study on the performance of an electrical firm that has implemented the

BSC with a similar electrical firm in the same location, Neely et al. (2004) find the BSC had positive impact on sales, gross profit and net profit, and its removal had negative impact sales, gross profit and net profit. However, further analysis indicates the related electrical firm that had not implemented the BSC had achieved similar financial returns.

The study suspected that factors other than the BSC might have interacted to influence the positive financial returns. For the case of the negative impact of removal of the BSC on sales, gross profit and net profit, Neely et al. (2004) finds that implementation of the

BSC was time intensive for employees and consumed the time they would have otherwise used to execute their assigned responsibilities.

Pessanha and Prochnik (2006) criticize the objectives and the definition of measures of the BSC. The criticism point out that Kaplan and Norton suggestions for the selection of strategic objectives and performance measures leave out several interests of important stakeholders. In fact, the conception of the BSC only caters for the interests of the shareholders while ignoring the interests of other key stakeholders such as suppliers, the government, and the environment. Despite Kaplan and Norton noting the importance of including new perspectives to cater for interests of all stakeholders, they fail to discuss implementation of additional perspectives and the cause and effect linkages between the additional perspectives and performance measures. In addition to stakeholders, Pessanha and Prochnik (2006) criticize the lack of explicit involvement and engagement with the employee in its definition of objectives and measures. While the internal process, and learning and growth performance metrics involves employees, it does not include employee support and at times, the BSC is unfamiliar to the employees.

Parmenter (2012) criticizes how the BSC develops and defines performance measures. The criticism faults Casey, Peck (2004) observation that BSC transforms strategy into tangible performance measures by arguing that, the BSC does not define

KPIs adequately, and hence hampers identification. The criticism compares BSC Key

Performance Indicators (KPIs) to the Winning (Key Performance Indicators) KPIs methodology and find faults in the approach the BSC conceptualizes performance measures. The Winning KPIs indicate the primary role of performance measures is to assist managers to focus on the critical success factors but the BSC perceive the primary role of performance measures is to monitor and to evaluate the performance of strategies. Moreover, the BSC does not indicate critical success factors nor defines them. Since critical success factors are key to finding KPIs, the BSC does not assist managers to identify KPIs. The Winning KPIs suggests KPIs should be non-financial but support financial indicators, and should be less than ten, but the BSC conceptualizes all

KPIs including financial ones as performance indicators, which could be more than ten creating challenges in implementation.

Voelpel et al. (2005) observes rigidity in the conception of the BSC as a performance measurement tool. While Kaplan and Norton (1992), and Casey and Peck

(2004) contend performance measurement is a significant benefit of the BSC, Voelpel et al. (2005) agrees and disagrees. The BSC enables an organization to transform strategy into tangible performance measures but by limiting performance measures to four categories, it introduces rigidity. Rigidity is evident when the four performance measurement categories form the basis of defining key success factors. The BSC thus forces managers to put success indicators into one of the four categories. The result is

Proceedings of 4th European Business Research Conference

9 - 10 April 2015, Imperial College, London, UK , ISBN: 978-1-922069-72-6 the BSC limits the view of an organization by leaving no room for cross-perspectives that have combined effect on strategy execution. Further, there is the danger of an organization neglecting success indicators that do not fall into any of the four categories. The four categories also risk creating confirmation bias, a situation where mangers only take interest in what they want to measures but ignore changes in the external business environment as evident in the case of Encyclopedia Britannica, which almost went out of business because of sticking to its once successful success factors.

In practice, despite widespread use and practitioner-oriented literature suggesting the BSC has beneficial values especially in enhancing organizational performance and strategy achievement, a large body of academics is skeptical about the relationship between BSC and organizational outcomes. In fact, a leading criticism asserts the widespread practice of the BSC in itself does not demonstrate the BSC is beneficial to organizations (Kraaijenbrink, 2012). In support of this assertion, BizShifts

(2010) espouse that, within a decade of its inception, an estimated 44% of organizations worldwide had implemented the BSC; however, only 22% to 50% of these organizations achieved higher return on asset and higher return on equity while an estimated 85% of the organizations experienced problems during implementation. Neely et al. (2004) fault the widespread practice of the BSC to early studies focusing almost exclusively on the benefits of the BSC vis-à-vis the traditional financial-based performance measurement tools with relatively very few studies examining the impact of the BSC on performance.

Molleman (2007) finds the inflexibility of the BSC a significant limitation towards its implementation. This finding contradicts the observation by Madsen and Stenheim

(2014) about the flexibility of the BSC, who argue that the lack of conceptual stability of the BSC presents interpretive space to organizations to implement the BSC according to their business purposes and needs. However, Molleman (2007) finds the BSC is not sufficiently flexible for application in firms in a highly dynamic business environment.

While Kaplan and Norton argue that the BSC assists managers to modify strategies, in a highly dynamic business environment, managers will have to modify their strategies frequently or changing them altogether. The result is increased uncertainty about the usefulness of defined key indicators. Thus, for firms operating in highly dynamic environments requiring frequent changes or modification to strategies, establishing performance measures to go with the modification becomes both difficult and challenging. Moreover, the BSC risks the creation of a static organization. In practice, managers transform strategy into tangible performance measures and align organization activities towards the achievement of the BSC goals. The result is an increased focus on achieving the BSC goals to the exclusion of other goals that go beyond the BSC targets, creating unutilized potential. While an organization achieves the goals of the BSC, the overall potential of the organization is underutilized beyond the targets of the BSC.

Voelpel et al. (2005) and Rillo (2004) find in practice, the BSC hampers a firm‟s innovation capability, which it could derive from external networks. The original and successive conceptions of the BSC perceive firms are in isolation and adversarial to competitors. The BSC framework focuses almost exclusively on a firm‟s internal processes to the exclusion of linkages with related firms and the environment. The main aim of the BSC is enhancing performance and translating strategy into action of the individual firm without consideration of the interlinked and networked business environment. In today‟s business eco-system, firms collaborate within their networks to improve their own performance. For instance, Microsoft allows partners to create

Proceedings of 4th European Business Research Conference

9 - 10 April 2015, Imperial College, London, UK , ISBN: 978-1-922069-72-6 software compatible with their Windows Operating System to increase the perceived value of the Operating System. This kind of innovation driven by external networks is not possible in a firm implementing the BSC.

BizShifts (2010) observe the lack of a bottom line or a unified view of the BSC as a significant limitation during implementation. The concept of the BSC is essentially a list of metrics, which makes implementation difficult and frustrating. Casey and Peck

(2004) add that, the initial step of implementing the BSC is expressing a strategy as measurable goals. However, populating the BSC with goals does not mean transforming strategy into goals. Further, the BSC does not clearly describe strategy or goal formulation nor does the BSC claim it does. Moreover, BizShifts (2010) contends the top-down design of the BSC is a conceptual limitation since it puts the success or failure of the BSC squarely on senior management. This design further demonstrates the BSC perceives firms have bureaucratic leadership, hierarchical structures and clearly delineated job responsibilities were the norm, which is not the case. In addition, the BSC is becoming increasingly deficient since one-way linear cause-and-effect relationships are insufficient to describe the complex nature of today‟s business. For instance, customer perspective is inter-linked with various perspectives such as employee satisfaction, delivery time and product quality. In turn, customer satisfaction could influence employee satisfaction. Thus, the complex and interlinking nature of the business process suggests the way the success indicators are linked in the BSC requires revision to consider the entire system rather than the direct and visible success factors alone.

Rillo (2004) observes the limitation of the BSC in dealing with knowledge creation, learning and growth. Although the BSC has a learning and growth perspective that deals with knowledge creation and innovation, the perspective adopts the traditional logic of innovation, where research and development (R&D) deals with innovation but conceals both the process and the innovation itself from competitors. The only different is the BSC extends the innovation concept from R&D to the entire organization.

However, the traditional logic of innovation is changing from closed to open innovation influenced by increasingly interlinked and networked nature of today‟s businesses. In fact, in the present knowledge economy increased mobility of knowledge workers, advancement in information and communication technology, and improved accessibility to venture capital places a greater emphasis on the open nature of innovation. The practice of the BSC does not take into account the changing nature of innovation and does not provide for performance measures and interlink ages with external partners in developing innovative ideas and products and the implementation of the innovative ideas. The limitation of the BSC is therefore to include and to measures distributed innovation in a highly interlinked and networked market.

The final limitation in the practice of the BSC is the complexity and resource intensive nature of its implementation. According to Antonsen (2010), implementing the

BSC requires an organization to gather new data, which could create work overload for some departments. It could potentially lead to employee resistance and cynicism as well as to managerial resistance due to increased availability of information with the potential to upset the current power balance. In addition to increased workloads, slightly more than half the companies implementing the BSC have no idea about how to identify success factors, developing key performance indicators and cause-and-effect relationships because the BSC does not provide a template nor explicitly define the process.

Proceedings of 4th European Business Research Conference

9 - 10 April 2015, Imperial College, London, UK , ISBN: 978-1-922069-72-6

The new performance measurement models and management control systems

Most companies have incorporated the use of the new performance models and management control systems which give a better indication of how the company is performing. The various demerits from the old models have led to development of better measurement models that incorporate most of the parameters. The two most common models that are used by most of the businesses currently include the performance wheel and the performance pyramid (Watts, T. & McNair-Connolly, 2012). However, the effectiveness of these models is purely dependent on the belief of the model by the management. However, businesses have for long periods poorly applied the models leading to wrong results. The identification of a measurement technique is essential in getting the correct results especially in small businesses where the performance pyramid is used.

The performance wheel

This model suggests the reduction of various control models into one overarching one. This is the model that is commonly used by most businesses. This model builds on the work of CAM-1 and the works of Lynch and Cross combining both traditional and modern parameters on control. Top down and bottom up metrics are well incorporated helping overcome their shortcomings. It also integrates the internal and external stakeholder perspectives and the relationship with the roles of the organization.

For continuous and sustainable improvements, most companies have found this model to be the most efficient and effective.

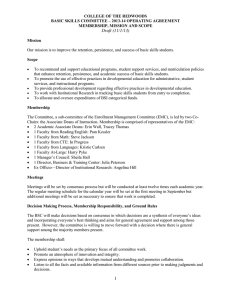

Since the performance wheel model integrates all the other small models, it is capable of identifying the weaknesses of each model and provides the correct remedies for each. This way, it forms a comprehensive model that can be used by most businesses to perform optimally. This model is so powerful, and this can be shown by looking at the four key components that constitute it. The components are the traditional emphasis put on vision, mission, and strategy, the key performance indicators, and the critical success factors. This can be illustrated in the diagram below.

Proceedings of 4th European Business Research Conference

9 - 10 April 2015, Imperial College, London, UK , ISBN: 978-1-922069-72-6

Different level of analysis can be measured in each row with constructs from the

Lynch and Kaplan models been inserted between these traditional measurements. This model differs greatly from the old models that were commonly used. The Lynch and

Cross model was built up to the key performance indicators and used to check on improvements that resonated with the work of the employees. They used to work on quality, productivity, cost and delivery as their main key dimensions of performance.

However, the performance wheel has greatly expanded on this bringing the measurements from customers and the market (Watts, Baard, and McNair, 2009).

Does the wheel performance system support control? Control must be defined both in the large businesses and small businesses before seeing whether the performance wheel supports it. The organizational matters and transfer pricing is the major concern for control in large businesses. In small businesses, control is defined in terms of incentives. Any positive benefits that are called rewards are on in relation to the gains made by the company and nothing more. The performance wheel supports control majorly in large businesses.

According to the early work of organizational theories, omission of incentives usually led to poor performance and dysfunctional consequences. Usually, incentives and other metrics are best incorporated at the lowest level of organization where the management awards employees' bonuses based on their general improvement in productivity. Gain sharing will make workers less disenchanted with six sigma initiatives. The six sigma initiatives is a set of techniques where workers try and improve the quality of processing by removing errors and minimizing all variability. This is usually considered as an extra role for worker and can make them feel enchanted. However,

Proceedings of 4th European Business Research Conference

9 - 10 April 2015, Imperial College, London, UK , ISBN: 978-1-922069-72-6 with gain sharing, the workers will feel less disenchanted. This will change when it comes to middle management where employees need to improve their skills continually.

The middle employees need to work with all employees from all classes and know they can only win when they have met all their goals.

All this will slightly change the top organization where the goals change. The emphasis that is usually put on internal operations will change to external operation where top organizations strive to attain certain objectives which are supposed to meet the stakeholder expectations (Franco, 2009). The external stakeholders must be fully included if the top organization has to control the loop (Maskell and Atkinson, 1997).

The performance wheel control in the small business

Despite the performance wheel being a complex system, it can easily be broken down and applied to small businesses. This model can easily be applied to help solve the problems that most small businesses face. This model is very effective and can easily be translated from large businesses to small businesses. The most effective way to translate the performance wheel from large to small is simply to get rid of the top and middle organization which exist in large businesses and remain with the lower organization. Small businesses are typically handled at an individual level and removing all the top, and middle organization will help show this is a small business being handled by a single person.

An effective entrepreneur will develop a business with a vision and a mode through which to achieve the set objectives. However, most small businesses seem to lack the formal control posing questions over the effectiveness of the model. This is where individuals have to have a clear meaning of control in a small business. Most people think of specific procedures that make up the controls, they think of formal results. However, it is important to note that control can be the nature of the personnel, actions and results. Formal control in small businesses is rarely needed with informal control preferred. The informal control in a small business can easily be managed by the personality and initiative of the entrepreneur.

The key performance indicators are the main metrics needed in measuring the effectiveness of small businesses as long as mutual respect exists. This means that small businesses entrepreneurs need to treat their businesses with the same rules that govern all large business if such businesses have to grow. Mutual respect is when the entrepreneurs in small businesses take their businesses serious following all the business rules for success. That means accounting for all activities taking place within the business. Key performance indicators aressential in helping businesses define the goals and objectives they hold for their businesses. This way, gain-sharing incentive is properly applied, and this can help the businesses yield positive performance.

Gainsharing has been found to be very powerful in motivating operational performance among workers. As a result, one can say, the performance wheel model does support control in small business. However, control of small businesses is the same with an effective operational system. This complemented with gain sharing incentives; workers will be best placed to make individual decisions.

Proceedings of 4th European Business Research Conference

9 - 10 April 2015, Imperial College, London, UK , ISBN: 978-1-922069-72-6

The performance wheel for not for profit businesses and small business

How does the performance wheel model work without the Results and

Determinants Framework? The Results and Determinants Framework is a model that basically classified its measures into those relating to results and those whose main focus was on the detriments of the results. Competitiveness and financial performances

Resource utilization, quality and flexibility, were the detriments. There are very scanty performance measurement systems that are service driven. This is the same for small businesses where most issues remain unaddressed (McNair, & Watts, 2010). What is the correct model to use on search unique categories if at all it exists? The small businesses, service organizations and the nonprofit are categories that appear unique to apply any model. The Results Determinants Framework model has been used for a while in such categories, but it is not the best. The Performance Wheel model, however, seems to be the most effective model having been built over several years. It accommodates the large service organization perfectly. Actions results and beliefs have been found to be the most core systems for success for any business.

The small business performance pyramid

The small businesses usually differ from large businesses in various areas. This means the small businesses will present different kind of challenges when compared to large businesses. This makes it difficult to use the same model for the two types of businesses. The challenges that small businesses face are unique in nature hence the need for a model that will clearly identify and solve them appropriately. To monitor the performance of a small business can be tricky, and one will have to modify the

Performance Wheel model to make it suitable for small models as discussed above.

Proceedings of 4th European Business Research Conference

9 - 10 April 2015, Imperial College, London, UK , ISBN: 978-1-922069-72-6

Modification of the Performance Wheel can be an ideal way to track the growth of small businesses over a period of time. However, the Performance Wheel model is very robust to use hence the need for a small model. The small business performance pyramid was developed to be used on small businesses as a prototype for the performance wheel. The performance pyramid is a modified performance wheel model in which the top and middle management levels have collapsed. Collapsing these areas will leave the model with three major areas which are considered essential for survival and growth of all small businesses (Preda and Watts, 2004). These three dimensions then allow the small business to be expanded into some further operational measures.

The measures will then be used by customers to plan and have control of the operations that connect the customer to the business.

The most common challenge this model faces is adapting it to the needs of small businesses that in most cases are unique. For this model to be adopted perfectly, businesses will have to remove the inventory days which is considered a key performance indicator for most businesses. The early days, when the small businesses are engaged in inventory, should not be used as a key performance indicator since it can give false results. Stability of businesses is rarely achieved in inventory days hence the removal. Flexibility, liquidity, and constant transfer of knowledge to the customers will then remain constant concerns for the small businesses. The value for customers is usually created from bottom up (Richards, et al, 2011).

The main question mostly asked is whether these two models support control.

There is no clear, specific answer to this question, and several factors must be considered when arriving at an answer. Understanding the dynamics and reasons for control will help one know if the models support the control system. Currently, there is no perfect model that meets all the requirement of all the businesses. The performance wheel so far is the best model but still several modifications have to be met for various businesses. All actions in a business need to be directed towards some end. The main use of control systems is to have a unified behavior which will then be evaluated, and the results from such actions are rewarded.

These two next generation performance measurement models are the best and with few adjustments they can be used to direct companies towards growth.

H ow these next generation performance measurement models overcame ‘top down’ and ‘bottom up’ problems.

The „top-down' control is considered to be disrespectful to employees (Parker,

1979). Employees need internal motivation for better performance at work, and this is not supported by these models. These models were specifically created emphasizing on strategy and not operational measures. Motivational aspirations for employees seem to lack in these models. These models failed to add any value creation into the metrics used. The importance of the customer was well recognized in these models but still the appearance of the firms externally in the eyes of the customers was not considered. This is not the same case in the new performance measurement models where the company's image is greatly considered in the eyes of the consumer.

These older models were considered ineffective since they could only be applied in big corporations. There was no model that could be effectively be used to check the growth of small businesses. The application of the models was further complicated by the lack of a clear definition of what a small business was. The models could only be

Proceedings of 4th European Business Research Conference

9 - 10 April 2015, Imperial College, London, UK , ISBN: 978-1-922069-72-6 applied to large corporations without a mechanism of collapsing them to fit small businesses as seen in the performance wheel. In the Balanced scorecard (BSC), reliance on Major Corporation seemed to a fatal flaw in the model (Watts,et al., 2012).

The BSC used to rely on a single performance indicator for its measurement. This was a major flaw since one performance indicator cannot be used to capture the full complexity of large business. These weaknesses are clearly addressed by the performance wheels which can easily be collapsed to cater for the needs of all small businesses. The removal of the top and middle organizational levels leaves the model with only the lower organization level that caters for most of the small businesses

(Gooijer, 2010).

The critical success factors and key performance indicators were not properly linked with other key concepts when measuring performance. These made the model appear unique from the rest but still lacking key components. In the performance wheel model, all success factors are well linked. This model brings together all other small models and combines all financial and non-financial factors (Albert 2013).

The overall measurement models were not tied to all the rewards. The effort put in any business should duly be rewarded but this could not be known since the rewards were not tied to the measures of the model. These models argued that one gets what they measure and reward which is usually not the case. This made these models very unsustainable which topped working the moment the „Hawthorne effect' got evaporated.

The „Hawthorne effect' suggested that businesses usually worked harder when they are the subject of study. This is something that disappeared (evaporates) when the study is over.

These are all shortcomings that have been addressed by the new generation scorecard. The new generation scorecard models have been developed over years and constitute the older models that have been improved upon from time to time. Most of the parameters that were not taken into consideration have been incorporated making businesses have a clear indication of the direction the company is taking.

Conclusion

Within two decades of its inception, the use of the BSC is widespread across all industry sectors, from manufacturing to service industries, from large to small businesses and from public to private projects. The strength of the BSC is integrating three non-financial metrics – customer, internal process, and learning and growth – with the traditional financial metrics. The common uses of the BSC are performance measurement, strategic management and project management. The benefits of the

BSC include overcoming inadequacies of the traditional financial-based performance measurement tools, providing a holistic performance outlook, transforming strategy into tangible performance measures, aligning organization activities to strategy and providing a deeper insight into business operations and ways of creating value.

Despite the widespread use and benefits, the BSC has serious limitations both in concept and in practice. The evidence is a greater number of organizations implementing the BSC have either failed to achieve their intended objectives or encountered serious problems during implementation. The main limitations include. The concept of the BSC has no clearly defined relationship with organization performance, the objective and definitions of measures exclude key stakeholders, lacks the definition of key success factors necessary for identifying KPIs, and the four categories limits the view of the organization. In practice, the BSC focuses resource to achieve its goals leading to underutilization of org anizations‟ potential beyond the targets of the BSC;

Proceedings of 4th European Business Research Conference

9 - 10 April 2015, Imperial College, London, UK , ISBN: 978-1-922069-72-6 hampers inter-organizational innovation; perceives an organization has hierarchical structures, clearly delineated job responsibilities and one-way linear cause-and-effect relationships; and promotes closed innovation. These limitations hamper the effectiveness of the BSC and contribute to some organizations wanting to abandon the

BSC altogether for better alternatives (Kraaijenbrink, 2015). A viable alternative to the

BSC is Performance Prism (Neely, Adams and Kennerley, 2002).

The Performance Prism has five perspectives compared to four of the BSC.

These are stakeholder satisfaction, stakeholder contribution, strategies, processes, and capabilities. The Performance Prism considers the stakeholder perspective as the most important. Organizations have to consider who their key stakeholders are and what they want. Once an organization has addressed the needs and wants of the key stakeholders, then it turns to the strategy perspective. The strategy perspective is about the goals and the roadmap to satisfy those needs and wants. It involves performance measures to track strategy execution, strategy communications, incentivize implementation and monitor implementation (Neely et al., 2002). The Performance

Prism is thus a viable alternative to BSC since it solves the problem of the exclusion of stakeholders other than the customer; directs organization to use stakeholder needs to develop goals and strategies to attain those goals; promotes inter-organizational innovation; and clearly defines employee capabilities and engagement (Neely and

Adams, 2010).

This literature has tried to discuss and review the effectiveness of two of the new performance measurement models and contrasted them with the older models. The literature has majorly focused on the next generation of measurement models giving more attention to the performance wheel and the performance pyramid which are well suited for small businesses. Many concerns of the existing models have been thoroughly discussed showing their numerous weaknesses that have led to development of better models.

The performance wheel has been found to be an effective model that comprises both financial and non-financial parameters with the aim of arriving at a model which works for both the small and large businesses. These next generation parameters were found to be effective in overcoming both the top down and bottom up problems which existed with the old models. Incorporation of various parameters was found to help address most of these problems and help give a clear indication of the growth of the company.

However, the development of this next generation models did not just come by. It incorporated ideas and build up from the old models that have been improved upon.

The nest generation models have immensely gained from the previous old models being a combination of several other small models. However, these models are not perfect and do not meet every criteria of all businesses. However, they do support enterprise control and help in identifying the mission, vision and goals of businesses.

The fact that it can easily be collapsed to meet the requirements of a small business makes it an effective model for measuring the performance of businesses. Businesses, however, have to think through all the dynamics of the control systems and fully understand the true meaning of control if the model has to exist and work. In conclusion, control simply exists to direct a business towards growth. It is a process through which the management ascertains the subordinates are fully involved in the achievement of the company objectives effectively and efficiently. However, performance must have a

Proceedings of 4th European Business Research Conference

9 - 10 April 2015, Imperial College, London, UK , ISBN: 978-1-922069-72-6 vision towards where the businesses see themselves or else any growth or output will be defensible.

Bibliography

Albert, L., 2013, Project Management, Planning and Control: Managing Engineering,

Construction, and Manufacturing . Elsevier Publishers. Vol. 1,.pp 33-47.

Atkinson, H. 2006. Strategy Implementation: A Role for the Balanced Scorecard?

Management Decisions, 44 (10), p. 1441 –146.

Atkinson, A.

1997. “Linking Performance Measurement to Strategy: The Roles of

Financial and Nonfinancial Information”, Journal of Strategic Performance

Measurement. Vol. 1 No. 14, August/September, p. 5 –13.

Antonsen, Y., 2010. The downside of the Balanced Scorecard: A case study from

Norway. The Scandinavian Journal of Management, 30 (1), pp. 40-50.

Basu, R., Little, C., and Millard, C., 2009. Case study: A fresh approach of the Balanced

Scorecard in the Heathrow Terminal 5 project. Measuring Business Excellence,

13 (4), pp. 22-33.

Basuony, M. A. K., 2014. The Balanced Scorecard in large firms and SMEs: A critique of the nature, value and application. Accounting and Finance Research, 3 (2), pp.

14-22.

BizShifts, 2010. Balanced scorecard: Is it a failure? BizShifts-Trends.

Retrieved from http://bizshifts-trends.com/2010/10/21/balanced-scorecard-is-it-a-failure/.

[18/02/2015].

Bose, S., and Thomas, K., 2007. Applying the balanced scorecard for better performance of intellectual capital . Journal of Intellectual Capital , 8 (4), pp. 653-

665.

Casey, W., and Peck, W., 2004. A balanced view of balanced scorecard.

Executive

Leadership Group, White Paper: The Leadership Lighthouse Series.

Ciuzaite, E., 2008. Balanced scorecard development in Lithuanian companies: Cultural implications, Balanced Scorecard development process framework and discussion on interlink with employee incentive system . Thesis, University of

Aarhus Denmark.

Franco, F. 2009. Finance: Capital Markets, Financial Management, and Investment

Management . John Wiley and Sons, Inc., p. 47-89.

Giannopoulos, G., Holt, A., Khansalar, E., and Cleanthous, S., 2013. The use of the balanced scorecard in small companies.

International Journal of Business and

Management, 8 (14), pp. 1-22.

Gooijer, J.D, 2010. Designing a knowledge management performance framework,

Journal of Knowledge Management, Vol. 4 No. 4, p. 303 –310

Hendricks, K. B., 2004. The balanced scorecard: To adopt or not to adopt? Ivey

Business Journal . November/December Issue 2004.

Kaplan, R. S., 2010. Conceptual foundations of the Balanced Scorecard.

Harvard

Business School, Working Paper 10-074.

Kaplan, R. S. 2011. Strategic Performance Measurement and Management in Nonprofit

Organizations. Nonprofit Management & Leadership, 11(3), p. 354

Kaplan, R. S., and Norton, D. P., 1992. The Balanced Scorecard: Measures that drive performance. Harvard Business Review, pp. 172-180.

Proceedings of 4th European Business Research Conference

9 - 10 April 2015, Imperial College, London, UK , ISBN: 978-1-922069-72-6

Kaplan, R.S. and Norton, D.P. 2001. Transforming the balanced scorecard from performance measurement to strategic management: Part 1”, Accounting Horizons, 15

(1) p. 87 –104.

Kaplan, R. S., and Norton, D. P., 2002. The strategy-focused organization: How

Balanced Scorecard Companies thrive in the new business environment, Internal

Auditor , 59 (1), pp. 21-22.

Kaplan, R. S., and Norton, D. P., 2004. Strategy maps: Converting intangible assets into tangible outcomes. Boston: Harvard Business School Press.

Kothari, S .and Sloan G., (1992). Accounting Information and Equity Valuation: Theory

Evidence and Applications. 2 (21), p. 143-179.

Kraaijenbrink, J., 2012. Five reasons to abandon the Balanced Scorecard.

Retrieved from http://kraaijenbrink.com/2012/10/five-reasons-to-abandon-the-balanced-scorecar d/. [18/02/2015].

Kraaijenbrink, J., 2015. Alternative for the Balanced Scorecard: The Performance

Prism.

Retrieved from http://kraaijenbrink.com/2012/10/an-alternative-for-thebalanced-scorecard-the-performance-prism/. [18/02/2015].

Madsen, D. O., and Stenheim, T., 2014. Perceived benefits of balanced scorecard implementation: Some preliminary evidence. Problems and Perspectives in

Management , 12 (3), pp. 81-90.

Martinsons, M., Davison, R., and Tse, D. 1999. The balanced scorecard: A foundation for the strategic management of information systems. Decision Support Systems ,

25, pp. 71 –88.

McNair, C.J. & Watts, T. 2009, The integration of balanced scorecard models, Cost

Management, . 23(5) p. 5 –12.

McNair, C. J. & Watts, T. 2010. The performance wheel and the small business pyramid: The next generation of performances scorecards . Global Accounting and Organizational Change Research Conference 2010. Babson College,

Babson Park,Boston, MA: Babson College. p. 2-21.

Molleman, B., 2007. The challenge of implementing the Balanced Scorecard.

The proceedings of the 6th Twente Student Conference on IT, Enschede, 2nd

February 2007.

Moullin, M. 2007. Performance measurement definitions. Linking performance measurement and organizational excellence. International Journal of Health Care

Quality Assurance , 20 (3), p. 181-183.

Moullin, M. 2002. Delivering Excellence in Health and Social Care, Open University

Press, Buckingham

Murby, L., and Gould, S., 2005. Effective performance management with the Balanced

Scorecard. Technical Report.

London: The Chartered Institute of Management

Accountants.

Nazim, T., 2015. A critical analysis of Balanced Scorecard as a performance measurement tool: an overview of its usage and sustainability.

Retrieved from http://www.academia.edu/6154100/_A_critical_analysis_of_Balanced_Scorecard

_as_a_performance_measurement_tool_an_overview_of_its_usage_and_sustai nability_. [19/02/2015].

Neely, A. D., Adams, C. and Kennerley, M., 2002. The Performance Prism: The scorecard for measuring and managing stakeholder relationships . London:

Prentice Hall.

Proceedings of 4th European Business Research Conference

9 - 10 April 2015, Imperial College, London, UK , ISBN: 978-1-922069-72-6

Neely, A. & Najjar, M.A. 2006, Management learning not management control: The true role of

(3) p. 101 –114. performance measurement? University of California, Berkeley, 48

Neely, A., and Adams, C., 2010. Perspectives on performance: The Performance Prism.

Retrieved from http://www.exinfm.com/pdffiles/prismarticle.pdf. [22/02/2015].

Neely, A., Kennerley, M., and Martinez, V., 2004. Does the balanced scorecard work:

An empirical investigation . The European Operations Management Association

(EurOMA) International Conference, Fontainebleau, 27-29 June 2004

Nzuve, S. N. M., and Nyaega, G., 2011. Application of Balanced Scorecard in performance measurement at Essar Telecom Kenya Limited.

Available at http://ssrn.com/abstract=2231330.

Office of the Chief Information Officer (OCIO) Enterprise Architecture Program (2007).

Treasury IT Performance Measures Guide . U.S. Department of the Treasury.

Orser, B.J., Hogarth-

Scott, S. and Riding, A.L. (2000), “Performance, firm size and management problem solving,” Journal of Small Business Management , Vol. 38

No. 4, pp. 42 –58.

Parmenter, D., 2012. A table without any legs: A critique of the balanced scorecard methodology. In implementing Winning KPIs whitepaper. Retrieved from http://davidparmenter.com/how-to-guides. [18/02/2015].

Pessanha, D. S., and Prochnik, V., 2006.

Practitioners’ opinions on academics’ critics on the Balanced Scorecard . Available at http://ssrn.com/abstract=1094308.

Preda P, & Watts T. 2004, Contemporary accounting Innovations in Australia . Journal

Title 2 (2)

Richards, H., Mills, J., Neely, A., Platts, K., Gregory, M…and Kennerley, M. 2011,

“Performance Measurement Systems Design: Developing and Testing a Process based Approach”, International Journal of Operations & Production Management,

20 (10), p. 1119-1145.

Rigby, D., and Bilodeau, B., 2013. Management Tools ad Trends 2013.

London: Bain &

Company.

Rillo, M., 2004. Limitations of balanced scorecard. Proceedings of the 2nd Scientific and

Educational Conference, Business Administration: Business in a Globalizing

Economy , Parnu, 30-31 January 2004, pp. 155-161.

Shadbolt, N. M., Beeby, N., Brier, B., and Gardner J. W. G., 2003. A critique of the use of the balanced scorecard in multi-enterprise family farm businesses.

Proceedings of the 14th International Farm Management Congress: Pat 1, 602-

609. August 10-15, 2003. Perth, Australia

Voelpel, S., C., Leibold, M., Eckhoff, R. A., and Davenport, T. H., 2005. The Tyranny of the Balanced Scorecard in the Innovation Economy.

Proceedings of the 4th

International Critical Management Studies Conference, intellectual Capital

Stream Cambridge University, United Kingdom, July 4-6, 2005.

Watts, T. Baard, V. and McNair, C.J.

2009, “The Small Business Performance Pyramid”,

Working paper, University of Wollongong, Wollongong, Australia.

Watts, T. & McNair-Connolly, C. J. 2012. New performance measurement and management

226-241. control systems. Journal of Applied Accounting Research, 13 (3),