Proceedings of Annual Tokyo Business Research Conference

advertisement

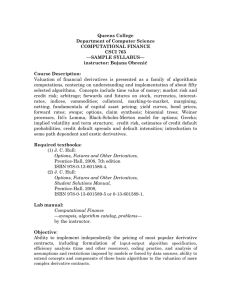

Proceedings of Annual Tokyo Business Research Conference 15 - 16 December 2014, Waseda University, Tokyo, japan, ISBN: 978-1-922069-67-2 Explaining Credit Default Swap Spreads by Means of Realized Jumps and Volatilities in the Energy Market Jose Da Fonseca1, Katja Ignatieva2 and Jonathan Ziveyi3 This paper studies the relationship between credit default swap spreads (CDS) for the Energy sector and oil futures dynamics. Using data on light sweet crude oil futures from 2004 to 2013, which contains crisis period, we examine the importance of volatility and jumps extracted from the futures in explaining CDS spread changes. The analysis is performed at an index level and by rating group; as well as for the pre-crisis, crisis and post-crisis periods. Our findings are consistent with Merton's theoretical framework. At an index level, futures' jumps are important when explaining CDS spread changes, with negative jumps having higher impact during the crisis. The continuous volatility part is significant and positive indicating that futures volatility conveys relevant information for the CDS market. Negative jumps have an increasing importance as the credit rating deteriorates while futures volatility becomes more important for higher rating categories. For the highest rating category the CDS spread depends very weakly on both, futures' jumps and volatility. The relation between the CDS market and the futures market is stronger during volatile periods and strengthens after the Global Financial Crisis. JEL Classification: G12, G13, C14 Keywords: Oil Futures, CDS Spread, Realized Jumps, Realized Volatility ____________________________________________________________________________ 1 Auckland University of Technology, Business School, Department of Finance, Private Bag 92006, 1142 Auckland, New Zealand. Phone: +64 9 9219999 extn 5063. Email: jose.dafonseca@aut.ac.nz 2 The University of New South Wales, Australian School of Business, Risk and Actuarial Studies, Sydney, NSW2052, Australia. Phone: + 61 2 9385 6810. Email: k.ignatieva@unsw.edu.au 3 The University of New South Wales, Australian School of Business, Risk and Actuarial Studies, Sydney, NSW 2052, Australia. Phone: + 61 2 9385 8006. Email: j.ziveyi@unsw.edu.au