Proceedings of Annual Tokyo Business Research Conference

advertisement

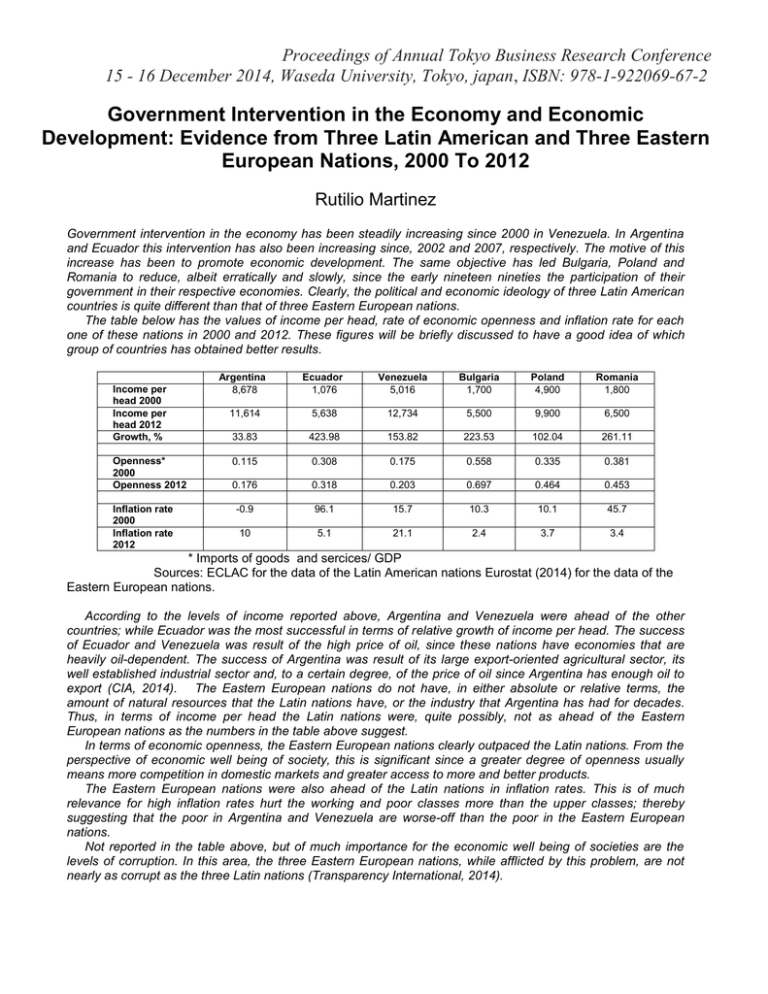

Proceedings of Annual Tokyo Business Research Conference 15 - 16 December 2014, Waseda University, Tokyo, japan, ISBN: 978-1-922069-67-2 Government Intervention in the Economy and Economic Development: Evidence from Three Latin American and Three Eastern European Nations, 2000 To 2012 Rutilio Martinez Government intervention in the economy has been steadily increasing since 2000 in Venezuela. In Argentina and Ecuador this intervention has also been increasing since, 2002 and 2007, respectively. The motive of this increase has been to promote economic development. The same objective has led Bulgaria, Poland and Romania to reduce, albeit erratically and slowly, since the early nineteen nineties the participation of their government in their respective economies. Clearly, the political and economic ideology of three Latin American countries is quite different than that of three Eastern European nations. The table below has the values of income per head, rate of economic openness and inflation rate for each one of these nations in 2000 and 2012. These figures will be briefly discussed to have a good idea of which group of countries has obtained better results. Income per head 2000 Income per head 2012 Growth, % Openness* 2000 Openness 2012 Inflation rate 2000 Inflation rate 2012 Argentina 8,678 Ecuador 1,076 Venezuela 5,016 Bulgaria 1,700 Poland 4,900 Romania 1,800 11,614 5,638 12,734 5,500 9,900 6,500 33.83 423.98 153.82 223.53 102.04 261.11 0.115 0.308 0.175 0.558 0.335 0.381 0.176 0.318 0.203 0.697 0.464 0.453 -0.9 96.1 15.7 10.3 10.1 45.7 10 5.1 21.1 2.4 3.7 3.4 * Imports of goods and sercices/ GDP Sources: ECLAC for the data of the Latin American nations Eurostat (2014) for the data of the Eastern European nations. According to the levels of income reported above, Argentina and Venezuela were ahead of the other countries; while Ecuador was the most successful in terms of relative growth of income per head. The success of Ecuador and Venezuela was result of the high price of oil, since these nations have economies that are heavily oil-dependent. The success of Argentina was result of its large export-oriented agricultural sector, its well established industrial sector and, to a certain degree, of the price of oil since Argentina has enough oil to export (CIA, 2014). The Eastern European nations do not have, in either absolute or relative terms, the amount of natural resources that the Latin nations have, or the industry that Argentina has had for decades. Thus, in terms of income per head the Latin nations were, quite possibly, not as ahead of the Eastern European nations as the numbers in the table above suggest. In terms of economic openness, the Eastern European nations clearly outpaced the Latin nations. From the perspective of economic well being of society, this is significant since a greater degree of openness usually means more competition in domestic markets and greater access to more and better products. The Eastern European nations were also ahead of the Latin nations in inflation rates. This is of much relevance for high inflation rates hurt the working and poor classes more than the upper classes; thereby suggesting that the poor in Argentina and Venezuela are worse-off than the poor in the Eastern European nations. Not reported in the table above, but of much importance for the economic well being of societies are the levels of corruption. In this area, the three Eastern European nations, while afflicted by this problem, are not nearly as corrupt as the three Latin nations (Transparency International, 2014). Proceedings of Annual Tokyo Business Research Conference 15 - 16 December 2014, Waseda University, Tokyo, japan, ISBN: 978-1-922069-67-2 The figures discussed above present a limited view of the economic progress experienced by these six nations. This limited view suggests, however, that the Eastern European nations are obtaining better results than the Latin American nations; which also suggests that a large and growing involvement of government in the economy may restrain rather than stimulate economic growth. _____________________________________________________________________________________________ Rutilio Martinez, Monfort College of Business, University of Northern Colorado, rutilio.martinez@unco.edu