Proceedings of 3rd European Business Research Conference

advertisement

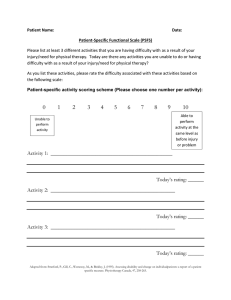

Proceedings of 3rd European Business Research Conference 4 - 5 September 2014, Sheraton Roma, Rome, Italy, ISBN: 978-1-922069-59-7 The Effects of Sovereign Downgrades on the Italian Stock Market Angelo Marinangeli* There are few studies that tak e into consideration the effects of the Italian rating downgrade in the context of the current crisis. This paper analyzes the impact of the Italian downgrades on the stock mark et, with the aim to identify the relation between downgrade announcements and the returns of Italian stock mark et. More specifically, the study analyses a sample of shares belonging to the k ey sectors i.e. finance, technology, fashion, food and beverage and health sectors. In addition, the analysis is conducted in order to verify if the “border downgrade” have an amplified impact than the other ones. It was found, through the event study dummy approach methodology, that the transitions from a grade to another have had a greater impact than transitions into the same grade. Moreover, the first Italian downgrade has had an important impact on the stock mark et returns, because this downgrade represented the alarm bell that the crisis was intensifying also in Italy. Only in the technology industry the first downgrade had no effect, because the high tech industry is more robust because it can be defined the most innovative industries, and so it perceived the crisis more later. Keywords: Financial Crisis, Sovereign Rating, Italian Downgrades, Stock Market, Event Study. JEL Codes: G01, G12 and G14 1. Introduction In last years the concept of rating took an important role in the economic world; in fact the rating agencies assessments on the sovereign credit produced effects on political and economic sphere. This paper is interested to the last phase of the crisis occurred in the last two years after the sovereign rating review by the rating agencies. The first sovereign rating downgrade occurred in US on August 5, 2011 when Standard & Poor‟s downgraded the United States credit rating from AAA to AA+ with the motivation that the plan that the Congress and the Administration agreed could not stabilize the government‟s medium-term debt dynamics. This announcement caused a financial crisis which spread like a domino on other countries. Afterwards, other downgrades occurred in European countries that caused an upheaval on the European financial market. An interesting aspect for this survey is the following: such downgrades have had different impacts depending on the macroeconomic conditions. The paper represents an empirical investigation because it applies the inductive reasoning, is based on the observation of a large number of cases, states the hypothesis and provides a generalization about the events observed. _______________________________________________________ *Angelo Marinangeli, University of Rome Tor Vergata, Italy. 1 Proceedings of 3rd European Business Research Conference 4 - 5 September 2014, Sheraton Roma, Rome, Italy, ISBN: 978-1-922069-59-7 The scientific approach is used because we search for knowledge by starting from the literature contributions, formulating the question and the hypotheses of research, collecting data, developing the survey and finally we analyze the findings and make conclusions through the generalization of our results. This research is a quantitative analysis because it analyzes quantitative data represented by the values of the share prices observed in the established time period. In addition the present research is knowledge oriented because it is focused on generating fundamental knowledge. The work wants to fill a gap in the literature because there are few studies that take into consideration the effects of the Italian rating downgrade announcements, or more generally of sovereign rating changes, in the context of the current crisis. In addition it wants to extend the past existing literature that analyzes the impact of the rating announcements or sovereign rating announcements but not in the current context. Research on sovereign credit ratings can be divided into two categories: studies which analyze the determinants of sovereign credit ratings and studies which examine the price impact of rating announcements; the latter group usually focuses on the sovereign bond market; while this research analyzes the impact of the Italian downgrades on the stock market and more specifically the key sectors. The sovereign rating change announcements produce effects not only on the cost of the sovereign credit but also on the financial market, as also emerged from literature. This paper come from the desire to answer to the following research questions: • Which are the effects of Italian downgrades on the stock returns? So, this survey investigates the relation between downgrade announcements and financial market trend, and it aims to quantify the strength of this relation (if any). With more details, the paper analyzes if particular types of downgrades named “border downgrades” have an amplified impact on financial market compared to others. Cantor and Packer (1996) show that the impact of rating announcements for belowinvestment-grade sovereign bonds is stronger than the impact for investment-grade sovereign bonds. In addition, Creighton et al. (2007) analyze the effects of corporate rating changes on the Australian financial market; they find the greater effects for downgrades from “investment grade” to “speculative grade” . It would be interesting to verify if this results are generalizable to sovereign rating changes. So, the aim of the survey is to verify if downgrades that represent transitions have an amplified effect on the stock returns of our sample shares. We expect to replace the results of Creighton et al., that is to find a greater impact in transitions from a grade to another than downgrades into the same grade. In addition, by analyzing the rating change announcements of the three rating agencies, so it is possible identify to which rating agency the Italian financial market is more sensitive. Norden and Weber (2004) show that financial market is more sensitive to Standard & Poor‟s announcements than Moody‟s and Fitch Rating ones. We attend to verify that also the Italian stock market is more sensitive to a rating agency than others and to a specific type of downgrading than others. It represents the effective and real reason of the study, it could be the aspect of relevance of the paper if the analysis confirmed the attended results that could be used to better understand the movement of the Italian stock market to downgrade announcements. The attended result is that the transitions from upper medium grade to lower medium grade produce a greater impact on the stock market compared with the transitions in 2 Proceedings of 3rd European Business Research Conference 4 - 5 September 2014, Sheraton Roma, Rome, Italy, ISBN: 978-1-922069-59-7 the same grade and the transitions from high grade to upper medium grade. We believe that the transitions from upper medium grade to lower medium grade have a higher impact because they are relevant for the solvibility and the reputation of a Country and so they are significant for the financial decisions of investors. In the next section it is presented the literature review, that is divided into four sub-sections. In the third section they are presented the methodology, model and data divided into four subsections to explain the methodological approaches used and why they are chosen. In the fourth section findings are described, in the fifth section conclusions are developed and finally there are references. 2. Literature Review Reviewing the literature on the subject, three fields of research can be identified. The first field analyzes the impact of corporate rating changes on the dynamic of shares or corporate bonds. The second field studies the effects of sovereign rating changes on the trend of sovereign bonds or financial market. Finally the third field focuses on the analysis of the Emerging Countries rating changes and their effects on the development of such Countries. 2.1. The effects of corporate rating changes on the financial market The first field of literature studies the effects of rating announcements on corporate stocks, corporate bonds, commercial papers and credit default swaps. For all types of instruments it highlights the impact of announcements on share prices, the most obvious impact in the event of a downgrade, although some studies show that a positive rating change produces a positive abnormal return in the days around the announcements (Barron et. al., Cellier and Chollet, Creighton et al.), other interesting results are found on CDSs (Micu et al., Norden and Weber and Crabbe and Post), on the effects of watchlistings (Barron et al., Steiner and Heinke) and final on the relation between shareholders and bondholders when a rating change occurs (Abad-Romero and Robles Fernandez). Unlike the other authors analyzed in this research field, Barron et al. (1997) analyze the effects of rating changes but also new ratings and credit watches on bonds, stocks and also the commercial papers; while Cellier and Chollet (2011) analyze the effects of the rating announcements related to corporate social responsibility. The analysis of Barron et al. is made on daily data published by Standard and Poor‟s between 1984 and 1992, the results show that, around the announcement date of a positive credit watch, stock returns are positive. An interesting aspect of this work is relative to new ratings, which conversely have no significant effects on stock returns; this result is verified in both the short and long time. We could explain this aspect by stating that companies submitted to their first rating are not widely known on the market, so the latter is not very sensitive to new rating announcements. The analysis of Cellier and Chollet is made on rating announcements published by Vigeo between 2004 and 2009. Vigeo is a rating agency specialized on assessment related to corporate social responsibility. The sample analyzed by the authors is composed by shares and index prices; shares‟ dividends are extracted from Datastream while market value and book to market are obtained from Worldscope. The results, obtained through the event study methodology with the procedure detailed by Renneboog et al. (2008a), show a significant positive influence on the two days preceding the announcement and the next two days. Clearly, as evidenced by studying the content of the announcements, only a few types of announcements have a significant role on stock returns; in addition, some announcements 3 Proceedings of 3rd European Business Research Conference 4 - 5 September 2014, Sheraton Roma, Rome, Italy, ISBN: 978-1-922069-59-7 have positive effects and other ones have negative effects on stock returns. The work sheds a new light on the relationship between corporate social ratings and financial performance. To tackle possible error measurement, all models include an intercept. The survey conducted by Creighton et al. (2007) analyze the effects of changes on the pricing of financial assets in Australia. The interesting feature of their work is the limited role of credit ratings in the Australian system of financial regulation, then the impact of rating changes is observed without regulatory effects. The sample of events for which the authors consider both rating changes and yield spread data includes 33 announcements consisting of 21 downgrades and 12 upgrades. The bonds in question are all issued in Australia and denominated in Australian dollars. The results, obtained through the standard event study techniques „market model‟, show that after both positive and negative rating announcements, share and bond prices highlight small movements towards the expected direction. Rating announcements showing the most important effects refer to small businesses and rating changes from investment grade to speculative grade. Even with respect to CDSs, several works show the impact in the presence of rating announcements (Micu et al., Norden and Weber and Crabbe and Post), only the work of Crabbe and Post (1994) shows the lack of effects in the days around the date of announcement. The survey is conducted between 1986 and 1991 on the issues of commercial papers and CDSs (Credit Default Swap) by bank holding companies after a credit rating downgrade, in order to test the model of Diamond (1991). He argues that the company reputation influences the choice of raise funds directly from the market or using intermediaries. The Authors show that in the period 1986-1991 the average cumulative abnormal returns decreased of 6.69% in the first two weeks after the downgrade and 11.05% in the next twelve weeks. Regarding the CDSs issued by the member banks, unlike commercial papers issued by bank holding companies, there are no significant changes in the period around the date of downgrade. The study shows that the direct borrowing from market through commercial papers is sensitive to the downgrades of companies, in line with Diamond, the rating being a measure of corporate reputation. While, taken into account the other paper analyzed on CDSs, Micu et al. (2006) define what types of rating announcements have an impact on CDSs spreads. The survey collects daily data on CDSs spreads and rating announcements. Data on CDSs spreads were obtained from Markit, a London-based distributor of credit pricing data. Data on rating announcements of Moody‟s, S&P and Fitch are obtained from Bloomberg. The methodology applied is the event study with the market model method. Four market indices INDg,t are constructed, corresponding to the whole letter rating categories AA, A, BBB, BB. The value of the index on a given day is set equal to the median spread for the relevant rating category. The analysis reveals that all types of changes, including those in the rating look out, have a significant impact on spreads. The impact is greater for firms with split ratings, small-cap companies and those with a score close to investment grade. The study of Norden and Weber (2004) analyzes the effect of rating change announcements on stock market and CDS market. This survey is conducted on international level for the period from 2000 to 2002. The dataset consists of market-wide CDSs spreads, corresponding stock prices and credit rating data. CDSs data was gratefully provided by a large European bank which is among the world‟s top 25 credit derivatives counterparties. Time series of daily common stock closing prices obtained from Thomson Financial DataStream. Additionally, we add time series for three stock market indices (Stoxx 50, S&P 500, and Topix 100), rating agencies taken in account are: Moody‟s, Standard & Poor‟s, and 4 Proceedings of 3rd European Business Research Conference 4 - 5 September 2014, Sheraton Roma, Rome, Italy, ISBN: 978-1-922069-59-7 Fitch Ratings. The results, obtained through the event study with the index adjuster and market model approach, show that no relevant effects correspond to positive ratings (upgrades) announcements, while significant negative abnormal returns correspond to Standard & Poor‟s downgrades announcements. Such findings are verified around the announcement day, in both stock market and CDSs market. For Moody‟s announcements, no abnormal returns are found in the stock market, while significant changes are identified in the CDSs market in the days around the announcement. For Fitch rating downgrades, no abnormal returns in both markets are found. The study shows, therefore, that in the years when the analysis is conducted there is greater attention by the stock market to announcements by Standard & Poor's, probably related to the better knowledge of this agency by investors. Furthermore, taken into consideration the contributions that investigate on the effects of watchlisting announcements, it emerged that abnormal positive returns occurred for positive credit watch announcements (see, e.g., Barron et al., 1997). In addition, Steiner, Heinke (2001) show that significant price reactions can be identified to negative watchlisting announcements, while no effects on share prices occur for upgrades and positive watchlisting announcements. This survey, more particularly, identifies the rating influence on Eurobonds prices, by analysing daily price effects on the announcements of watchlisting and rating changes made by Standard & Poor's and Moody's. They note that the announcements of downgrades and negative watchlistings lead to significant reactions on prices, and vice versa no effects on share prices occur for announcements of upgrades and positive watchlistings. In addition, they show that type and nationality of the issuer are key factors in determining the prices reactions after the downgrade. In fact, the prices reactions are particularly intense for downgrades of speculative securities. Moreover, the announcement impact can be explained as the effect of the prices pressure caused by regulatory constraints rather than rating changes. Finally, another interesting aspect emerged by the analysis of this research field is the relation between shareholders and bondholders, this linkage is highlighted by Abad-Romero and Robles Fernandez (2006). They analyze the impact of corporate rating changes on the bonds and shares of the Spanish stock market. This survey investigates the effects on returns and systematic risks. This study applies an extension of the event study dummy approach methodology and is based on the rating changes of Moody‟s, Standard and Poor‟s and Fitch ratings between 1990 and 2003. The results are characterized by the relation between shareholders and bondholders. This hypothesis states that there is a conflict of interest between bondholders and stockholders. Thus, a credit rating downgrade reduces bond value, which is expropriated from bondholders to stockholders, causing the increase of share prices. In the case of rating upgrades the wealth redistribution is in the reverse direction. 2.2. The effects of the sovereign rating changes With regard to the second field of research, sovereign ratings summary the information of macroeconomic indicators such as Income per person, GDP growth, level of economic development, inflation, external debt, and they are therefore related to the spread of securities. Research on sovereign credit ratings can be divided into two categories: studies which analyze the determinants of sovereign credit ratings and studies examining the price impact of rating announcements; the latter group usually focuses on the sovereign bond market. Unlike corporate ratings, sovereign ratings have no effects on single firms but on the market as a whole, as evidenced by the survey of Brooks et al. (2004), and on Sovereign bonds. The 5 Proceedings of 3rd European Business Research Conference 4 - 5 September 2014, Sheraton Roma, Rome, Italy, ISBN: 978-1-922069-59-7 study of Brooks et al. analyzes the impact of sovereign rating changes on the market looking at both local and foreign rating changes. Consistently with the findings observed for corporate changes ratings, credit rating downgrades have a negative impact on returns. Downgrades have a negative impact on both local market and Dollar Area Countries one. Among the four agencies examined, only Standard & Poor's and Fitch ratings downgrades appear to have a significant effect on yields. Another interesting aspect are the asymmetric effects to the sovereign rating announcements, as highlighted by the studies of Klimavičienė (2011), Ferreira and Gama (2007) and Gande and Parsley (2005). The first contribute investigates about the relevance of sovereign rating announcements in the Baltic stock market testing the degree of anticipation and price reaction. The methodology used is the event study with the market-model-adjusted method (or “market model”) where the return on the market is approximated by the MSCI EM Small Country, in particular the aim is to analyze the price impact of sovereign rating announcements by Moody‟s, Standard & Poor‟s and Fitch ratings on the price. Through this survey it emerged that sovereign rating announcements contain relevant pricing information; in fact the price impact of negative events is sometimes larger than the impact of positive events. In addition, the impact of rating announcements is relevant in the announcements day although some announcements are anticipated. The second contribute analyzes the effects of Standard & Poor‟s sovereign rating of 29 countries, both emerging and developed. The results, obtained through the event study methodology, show that sovereign rating upgrades are associated with a positive effect on stock market prices relative to the US and downgrades are associated with a negative effect. When a country is downgraded the remaining countries do much worse than the US market. Negative news in the sovereign debt market, but not positive news, seem to have a significant impact on the stock markets of non-event countries. Gande and Parsley (2005) show the effects of sovereign downgrades on sovereign debt markets. They apply the event study methodology with the market model regression, the expected return on the market index as predicted from the (OLS) coefficients is estimated in the market model regression. They find that there is an asymmetric impact on sovereign debt markets: downgrades abroad are associated with a significant increasing in sovereign bond spreads. One possible explanation for the asymmetric effects to rating news is that upgrades are partially anticipated by market participants, unlike downgrades. Sovereign ratings affect not only the financial system but also political aspects related to macroeconomic variables. Taking into account, as it emerged, that negative announcements have strong effects and positive announcements have weak effects, you can understand how much important the sovereign rating is. At the same time, it is possible to understand why that assessment is particularly complex, given the often irreversible nature of its effects. A different and more specific result on the impact of sovereign rating changes emerged by the survey of Cantor and Packer (1996) that investigates which announcements have a greater effects than others, in particular they argue that the assessments of rating agencies affect market returns. The analysis applies the event study methodology and confirms the authors‟ hypothesis that announcements of sovereign rating changes are followed by significant movements in the yields bonds (Sovereign Bond and dollar bond spreads as the difference [(yield - Treasury) / Treasury]) in the expected directions. The regression includes four variables for actual rating changes, positive events, Moody‟s decisions, or speculative grade sovereigns. Three proxies are used: the change in relative spreads (in the direction of the anticipated change); the rating gaps between the agencies (the sign of the gap between the rating of the agency making the announcement and the other agency‟s rating); the third proxy is an indicator variable that 6 Proceedings of 3rd European Business Research Conference 4 - 5 September 2014, Sheraton Roma, Rome, Italy, ISBN: 978-1-922069-59-7 equals 1 if another rating announcement of the same sign had occurred during the previous sixty days. All proxies measure conditions before the announcement. A final regression adds all three anticipation proxy variables simultaneously to the basic regression; the results are robust to the addition of the proxy variables. The sample is composed by dollar-bond spreads and sovereign bond spreads. The results show that the impact of rating announcements for below-investment-grade bonds is stronger than investment-grade sovereign bonds. In addition, the rating announcements already anticipated have a greater impact than less predictable announcements. For this reason the assessments of rating agencies have a predictable component. Regarding the effects of sovereign rating announcements on the CDSs (Afonso et al., Arezki et al.), also for the sovereign rating announcements it emerged that negative events cause significant reactions. More specifically, Afonso et al. (2011) analyze the effects of announcements by credit rating agencies Standard & Poor's, Moody's and Fitch ratings on the returns of Sovereign Bonds and CDSs. The methodology used is the event study on daily data. The results show significant abnormal returns on government bonds, especially in the case of negative announcements, being more tenuous in the case of positive announcements. Moreover, Countries downgraded from less than 6 months have higher spreads than Countries with the same rating but not downgraded in the last 6 months. Another interesting result is that while there is a significant reaction of sovereign yield spreads and particularly CDS spreads to negative events, the reaction to positive events is much more muted. Arezki et al. (2011) study the impact of sovereign rating announcements on European financial markets in the period 2007-2010, the methodology is the event study, the dummy approach event analysis takes into account the potential linkages between markets through the Vector Autoregression (VAR) framework, the dummy is equal to 1 at time t and zero otherwise. The results show that the effects depend from the type of announcements, and how the country lives the downgrade; in addition new rating downgrades have a stronger effects than revisions of outlooks which could be explained by banking regulation, ECB collateral rules, CDS contracts or investments mandates. Finally, Pukthuanthong-Le et al. (2007) study the effect of sovereign ratings announcements on stock and bond markets. The methodology is the event study; the market model is applied by using a world stock index and U.S. Treasury bond returns as benchmark. The sample contains rating changes and rating reviews of 34 Countries for the period 19902000. The results show that both share and bond prices react to downgrades but not to upgrades; in addition sovereign bond yields anticipate rating downgrades. With regards to the Rating reviews, both positive and negative, they do not affect a country‟s stock market, but they lead to a price reaction in sovereign bond markets. It is consistent with previous studies in the literature, which generally conclude that only negative credit rating announcements have significant impacts on yields and CDS spreads. By the analysis of this research field it emerged that emerging markets are particularly sensitive to rating changes. This result provides the opportunity to understand how the third field of research, explained in the next section, was born. 2.3. The effects of sovereign rating changes of Emerging Countries The third field of research analyses the impact of emerging countries sovereign credit ratings and studies the probability to reproduce these effects, at macroeconomic level, to other countries. In addition, it examines the role of rating agencies in international finance, in the 7 Proceedings of 3rd European Business Research Conference 4 - 5 September 2014, Sheraton Roma, Rome, Italy, ISBN: 978-1-922069-59-7 equilibrium of international production processes and in the development opportunities of emerging countries after positive or negative evaluations. Analyzing the third field of research, it emerged that investors with a high risk profile are careful to the assessments of rating agencies in order to invest their assets in the assessed countries. As evidenced by Biglaiser et al. (2008), the effects of rating changes are more marked during the crisis and ratings contribute to instability of financial markets, like Kaminsky and Schmukler highlight, and finally rating agencies can reduce capital flows to emerging countries when they are excessive (Larrain et al.). Biglaiser et al., (2008) study panel data for 50 developing countries between 1987 and 2003 to test the effects of rating changes on the flows of foreign portfolios. The investment in Emerging Countries combines a high risk to a proportionally high yield, the study therefore predicts that investors with a high risk profile are careful to the assessments of rating agencies in order to invest their assets in the assessed countries. The work, which studies rating changes together with the “democracy” factor, using a two-stage Heckman model, determines: - The importance of ratings, which have positive effects on the countries that receive most of the flows of assets; - Countries where new political institutions arise, and countries in a period of economic challenge, have a greater chance of being selected by investors because they offer higher risk premiums. Ratings and democracy have, therefore, a stronger link in the poor Countries. Kaminsky and Schmukler (2002) analyze the influence of changes in soverei gn ratings of Emerging Countries, discovering effects which have a direct impact not only on sovereign bonds but also on the stock market. An interesting feature emerged from the work is that the effects of rating changes are more marked during the crisis, and downgrades occur during crisis. This finding could suggest that ratings contribute to the instability of financial markets. In addition, downgrades occur in recession periods, because the assessments contain macroeconomic aspects. This is what leads to believe that credit rating announcements cause turmoils and financial instability. Larrain et al. (1997), through the methodology panel data analysis and event studies, find conclusions in line with the previous studies. Among the full data set on government dollar bond yields, obtained from Datastream, Bloomberg, JP Morgan, Merrill Lynch and the Federal Reserve Bank of New York, with a sample of 26 countries against a total of 60 countries whose sovereign debt has been rated during part of the observation period. The event study with the market model approach is applied with the aim to investigate the shortrun impact of press releases observation window spanning from 40 trading days before the press release (day 0) to 40 trading days after. They used a Granger causality tests based on an unbalanced panel data set with yearly averages for ratings and yield spreads. They demonstrate that changes in credit ratings have a significant impact on international financial markets. The innovative aspect of their findings is the demonstration that sovereign rating can reduce capital flows to emerging countries, when they are excessive, through negative rating announcements. Sovereign ratings have, thus, a more relevant role as indicators for the investors attracted by high risk. They act as a moderator, through negative rating announcements, when there are excessive investment flows to emerging markets. In addition to ratings, also democracy has an important role in financial markets, as well as the establishment of new governmental institutions due to higher investment returns. Finally, another interesting aspect is the role of the rating agencies on size and volatility of Emerging Country market as Kräussl (2005) find analyzing the impact of sovereign credit ratings on financial stability in emerging economies. 8 Proceedings of 3rd European Business Research Conference 4 - 5 September 2014, Sheraton Roma, Rome, Italy, ISBN: 978-1-922069-59-7 The results, obtained through the event study, show that rating agencies have an important influence on size and volatility of Emerging Countries credit markets. Effects are more pronounced in the case of downgrade. 2.4. Literature review: the focus on the methods used The studies described in the literature review subsection use the event study methodology because it represents the typical statistic method to identify the impact of unexpected events on financial series. With more details, some differences are found in the approaches of the event studies used. The most common models are: the constant-mean-return model and the market model. The former assumes that the average return on a given security is constant over time; the latter assumes a stable linear relationship between market returns and security returns. In addition, there are alternative statistical models, developed in recent decades. They are: the market adjusted return model, applied when the data set is restricted; the factor and multifactor models, applied when the sample is composed by companies similar for capitalization or activity industry, because they reduce the variance of abnormal returns by explaining a greater proportion of the variation of normal returns; the dummy approach, that extends the «estimation window» up to contain the «event window» [Binder (1998) ] associating to dummy variables the value 1 for the event window days and the value 0 for otherwise; the generalized least squares, that consider standardized abnormal returns, applied when the specific event date cannot be identified; finally the ARCH and GARCH models, applied in the case of heteroshedasticity. The economics models are statistical models in which some constrains are imposed in order to obtain a more specific estimation of returns. So, these models apply the economic hypothesis to statistical model parameters. The capital asset pricing model (CAPM) establishes that, in competitive markets, expected returns on securities are directly proportional, in an equilibrium position, to expected returns for market risk indicated by the β coefficient. The arbitrage pricing theory (APT) determines the risk/return relationship through risk sources different from market. By the analysis of literature focused on the methodology used, it emerged that the method mainly used by the authors is the market model because it generally is the most used event study approach. Other methodological approaches are used to the presence of particular conditions or to take advantage by the opportunities that have particular methodological approaches. For instance, Cellier and Chollet (2011) apply the procedure detailed by Renneboog et al. (2008a) to tackle possible error measurements; Cantor and Parker (1996) make an event study through a multiple regression that includes four indicator variables; while Abad-Romero and RoblesFernandez (2006) and Arezki et al. (2011) use the event study dummy approach because this method allows to consider multiple events. Due to its advantages this approach, better explained in the next section, it is chosen for this analysis. 3. The Methodology and Model The methodology applied is the event study. It represents, as viewed in the literature review, the typical statistic method to identify the impact of unexpected events on financial series. More specifically it is applied a particularly model based on the event study dummy approach studied in order to investigate the impact of the Italian Downgrades on the stock market. 9 Proceedings of 3rd European Business Research Conference 4 - 5 September 2014, Sheraton Roma, Rome, Italy, ISBN: 978-1-922069-59-7 3.1. The SHES methods The first step of an event study analysis is to define the time horizon amplitude, generally named “estimation window”, on which we have to estimate the normal return; while the event window is the period that contains the event date. Binder (1998) finds the common use of an estimation windows of about 250 days, for the daily data analysis, and about 5-7 years for the analysis based on monthly data. In this analysis the short time horizon is used, because the SHES (Short Horizon Event Study) method is correctly specified and sufficiently powerful when the specific dates of events are known; the sovereign rating announcements generally are spread by media (news, newspaper, etc.) so everyone come to know the announcements even people who do not follows the financial news. In addition, the effective identification of the abnormal returns decreases when the time horizon amplitude increases. Brown and Warner (1980, 1985) find that the long time horizon decreases the powerful of the statistic test. 3.2. The event study dummy approach The event study dummy approach is chosen because this methodology allows to consider a multiple event and to solve the «volatility clustering» problem. In this approach, differently to the event study, the estimation window is extended up to contain the event window [Binder (1998)]. Fig.1 The timeline of an event study dummy approach Source: own processing The dummy variable is equal: • to 0 for the observation of the estimation window, period of the time line (Figure 2) that precedes the event window; • to 1 for the observation of the event window 3.3. Impact of Italian downgrades on the stock market: The model 10 Proceedings of 3rd European Business Research Conference 4 - 5 September 2014, Sheraton Roma, Rome, Italy, ISBN: 978-1-922069-59-7 In order to answer to the second research question on the Impact of the Italian downgrades on the stock market we try to verify one of the following hypotheses: H0: there is not a relation between the Italian downgrade announcements and the Italian stock market; H1: there is a relation between the Italian downgrade announcements and the Italian stock market; We used the following model: - the dummy variable regression, developed through the methodology described above, can be represented as: Rit = α + βRmt + γt Dt + ξit (1) Where: α is the regression constant; Rit is the return on the stock i at the time t; Rmt is the return on the market at time t, approximated through the FTSE Italia All-Share index; D t is the dummy variable, γt is the coefficient of dummy variable and represents the abnormal return on stock i at day t; ξit is the stochastic variable. The estimation window is 487 days and contains eight event windows, we chose to use event windows of three days following Afonso et.al. (2011) and Ferreira and Gama (2007) because this time horizon is long enough for a correct analysis. We apply this model to analyze multiple events, so the regression is: Rit = α + βRmt + γ1t D 1t+ γ2t D2t + …+ ξit (2) Where: γ1t , γ2t , etc… are the coefficients of the dummy variables D 1t, D 2t and so on. As better specified in the next section, we have six coefficients γt relating to six dummy variables, because we take into account six announcement events. So, we have: γ1, γ2, γ3,… showing the effects of the first, the second, the third announcement and so on… of sovereign rating downgrade on stock returns. With the aim to verify the significance of the regression coefficients we use the t-test, which in the event stud y analysis can be used also to test the abnormal returns, and the Durbin Watson test to verify the absence of autocorrelation among variables; in addition the VIF coefficients are analysed to test the absence of multicollinearity. 3.4. Data Table 1 represents all the Italian downgrade announcements occurred in the period between th 4 October 2011 and 9 July 2013. Among all downgrades we select the first one, the third one, the fifth one, the sixth one, and finally the seventh and the eighth one. We discard the second downgrade because it is closed to the first one so it is difficult to separate the effects 11 Proceedings of 3rd European Business Research Conference 4 - 5 September 2014, Sheraton Roma, Rome, Italy, ISBN: 978-1-922069-59-7 of the first and those of the second downgrade; therefore for the same reason the fourth downgrade is discarded. Table 1 The events taken into consideration by the survey Event dates Rating agencies Downgrades Transitions grade 10/04/11 Moody‟s Aa2 to A2 High to Upper medium 10/07/11* Fitch AA- to A+ High to Upper medium 01/13/12 S&P A to BBB+ Upper medium to Lower medium 01/27/12* Fitch A+ to AUpper medium (no transition) 02/13/12 Moody‟s A2 to A3 Upper medium (no transition) 07/13/12 Moody‟s A3 to Baa2 Upper medium to Lower medium 03/08/13 Fitch A- to BBB+ Upper medium to Lower medium 07/09/13 S&P BBB+ to BBB Lower medium (no transition) * discarded downgrade; source: own processing The sample is composed by shares belonging to various sector with the aim to capture the rating downgrade impact of different industries. With more details, it includes 106 shares of companies belonging to: finance (bank, insurance, financial services), technology, fashion, food and health sectors. They are chosen because they represent the Italian market key sectors. More specifically, the sample is composed by the company included in the indices FTSE Italia fashion, FTSE Italia finance, FTSE Italia food and beverage, FTSE Italia health and care and FTSE Italia technology. Total return prices (which include stock dividends) are extrapolated by Thomson Reuters Datastream, stock returns are calculated through the logarithm of the ratio between the price at time t and t-1. (3) Where: pit : is the total return price at time t; pi(t-1) : is the total return price at time t-1. 4. The findings The findings show that the Italian downgrade announcements caused different effects on different sectors analysed, especially regarding the border downgrade and more specifically the transition from upper-medium grade to lower medium grade. More particularly by the analysis emerge that there is a negative relation between the Italian downgrades announcements and the stock market returns but this relation is especially related to specific downgrades. It‟s an interesting result because we started this analysis with the aim to understand which downgrades could demonstrate more pronounced effects in the crisis context and, then, to study the develop of the current crisis. 12 Proceedings of 3rd European Business Research Conference 4 - 5 September 2014, Sheraton Roma, Rome, Italy, ISBN: 978-1-922069-59-7 Table 2 shows that downgrades that represent a transition from upper medium grade to lower medium grade have had a significant impact on the Italian stock market. In addition, it also has had an important impact on the stock market returns the first Italian downgrade of October 4, 2011. The possible explanation of it is that this downgrade occurred in a context of general review of the sovereign credit rating so it represented the alarm bells that the crisis was intensifying also in Italy; another important aspect is that this downgrade from Aa2 to A2 is a transition from high grade to upper medium grade. The first Italian downgrade has expressed its impact, more specifically, on the sectors: fashion (γ1: -0,004), finance (γ1: -0,011), food and beverage (γ1: -0,020) and health and care (γ1: -0,010); only in the mobile and communication industry and in the technology industry the first downgrade had no effects maybe because the high tech industries are more robust because they can be defined the most innovative industries, and so they perceived the crisis more later. In all industries analysed the transition from upper medium grade to lower medium grade had a negative impact, specifically, in addition to the first downgrade analysed previously: - fashion industry: the 2nd (γ2: -0,03) and the 5th (γ5: -0,03) downgrade; - finance industry: the 4th (γ4: -0,02) and the 5th (γ5: -0,03) downgrade; - food and beverage industry: the 2 nd (γ2: -0,002) and the 5th (γ5: -0,004) downgrade; - health and care industry: the 4th (γ4 : -0,01) and 5th (γ5: -0,01) downgrade; - technology: the 4th (γ4: -0,01) and the 5th (γ5: -0,015) downgrade. The VIF test (always close to 1) and the Durbin Watson test (always close to 2) show that there is no correlation and multicollinearity among the variables. SECTOR Table 2. Summarize of the regressions results γ1 D2 γ2 D 2 γ3 D3 γ4 D 4 γ5 D5 γ6 D6 INDUSTRIE 10/04/11 01/13/12 02/13/12 07/13/12 03/08/13 07/09/13 Fashion -0,004** -0,003*** 0* 0 -0,003* 0 Finance -0,011*** 0 0,001** -0,02**** -0,003* 0,001 Food and beverage -0,020**** -0,002*** 0,002* 0,003 -0,04* 0,001 Health and -0,010*** 0 0 -0,01** -0,012*** 0,001 0,004** 0,010 0,003 -0,010** -0,015*** 0* S care Technology Durbin Watson test is always close to 2 and VIF is always close to 1 Significance level: *90%; **95%; ***99%; ****99,9%. Source own processing 13 Proceedings of 3rd European Business Research Conference 4 - 5 September 2014, Sheraton Roma, Rome, Italy, ISBN: 978-1-922069-59-7 5. Summary and Conclusions This paper is interested to the last phase of the crisis occurred in the last two years after the sovereign rating review of the rating agency. The first sovereign rating downgrade occurred in US when Standard & Poor‟s downgraded the United States credit rating from AAA to AA+. This announcement caused a financial crisis which spread like a domino on other countries. Afterwards, other downgrades occurred in the European countries that caused an upheaval on the European financial market. The aim of the survey is to verify if those downgrades that represent a transition have an amplified effect on the stock returns of our sample shares. We believe that the transitions from Upper medium grade to lower medium grade have a higher impact because they are relevant for the solvibility and reputation of a Country and so they are significant the financial decisions of investors. The findings highlight that there is a negative relation between the Italian downgrade announcements and the stock market returns and this relation is especially referred to specific downgrades. The downgrades representing a transition from upper medium grade to lower medium grade have had a significant impact on the Italian stock market. In addition, the first Italian downgrade has had an important impact on the stock market returns, maybe because this downgrade occurred in a context of general review of the sovereign credit rating so it represented the alarm bells that the crisis was intensifying also in Italy. The first Italian downgrade has expressed its impact, more specifically, on the sectors: fashion, finance, food and beverage and health care. Only in the technology industry the first downgrade had no effects, maybe because the high tech industry is more robust because it can be defined the most innovative industry, and so it perceived the crisis more later. References Abad-Romero P. , Robles-Fernandez M.D. (2006) Risk and Returns Around Bond Rating Change: New Evidence from the Spanish Stock Market; in Journal of Business Finance & Accounting, June/July. Afonso A., Furceri D., Gomes P. (2011) Sovereign Credit Ratings and Financial Market Linkage. Application to European Data, European Central Bank Working Paper Series, June. Barron M.J., Clare A.D., Thomas S.H. (1997) The Effect of Bond Rating Changes and New Ratings on UK Stock Returns, in Journal of Business Finance & Accounting, April. Biglaiser G., Hicks B., Huggins C. (2008) Sovereign Bond Rating and the Democratic Advantage Portfolio Investment in the Developing World, in Comparative Political Studies, August. Binder J.J. (1998) The Event Study Methodology Since 1969, in Review of Quantitative Finance and Accounting, Vol. 11. Brooks R., Faff R.W., Hillier D., Hillier J. (2004) The National Market Impact of Sovereign Rating Changes, in Journal of Banking and Finance, Vol. 28. Brown S. and Warner K. (1980) Measuring Security Prices Performance, in Journal of Financial Economics, Vol. 8. Brown S. and Warner K. (1985) Using Daily Stock Returns: the Case of Event Studies, in Journal of Financial Economics, Vol.14. 14 Proceedings of 3rd European Business Research Conference 4 - 5 September 2014, Sheraton Roma, Rome, Italy, ISBN: 978-1-922069-59-7 Cantor R., Packer F. (1996) Determinants and Impacts of Sovereign Credit Ratings, in FRBNY Economic Policy Review, October. Cellier A., Chollet P. (2011) The Impact of Corporate Social Responsibility on Stock Prices: An Event Study of Vigeo Rating Announcement, International Conference of the French Finance Association (AFFI), May 11-13. Crabbe L., Post M.A. (1994) The Effect of a Rating Downgrade on Outstanding Commercial Paper, in The Journal of Finance, March. Creighton A., Gower L., Richards A.J. (2007) The Impact of Rating Changes in Australian Financial Markets, in Pacific-Basin Financial Journal, January. Diamond D.W. (1991) Monitoring and Reputation: The Choice between Bank Loans and Directly Placed Debt, in Journal of Political Economy, August. Fama E.F., Fisher L., Jensen M., Roll. R. (1969) The Adjustments of Stock Prices to New Information, in International Economic Review, 10. Ferreira M.A., Gama P.M. (2007) Does sovereign debt ratings news spill over to international stock markets?, Journal of Banking & Finance 31 (2007) 3162–3182 Gande, A. & Parsley, D. C.(2005), "News Spillovers in the Sovereign Debt Market," Journal of Financial Economics, Elsevier, vol. 75(3), March. Hill P., Faff R. (2010) The Market Impact of Relative Agency Activity in the Sovereign Rating Market, in Journal of Business Finance & Accounting, November/December. Kaminsky G., Schmukler S.L., (2002), Emerging Market Instability: Do Sovereign Ratings Affect Country Risk and Stock Returns?, in Oxford Journal World Bank Economic Review, Volume 16. Klimavičienė A. (2011) Sovereign Credit Rating Announcements and Baltic Stock Markets, in Organizations and Markets in Emerging Economies, Vol. 2, No 1 (3) Kräussl R. (2005) Do Credit Rating Agencies Add to the Dynamics of Emerging Market Crises?, in Journal of Financial Stability, April. Larraìn G., Reisen H., von Maltzan J. (1997) Emerging Market Risk and Sovereign Credit Rating, OECD Development Centre Working Papers No124 Micu M., Remolona E., Wooldridge P. (2006) The Price Impact of Rating Announcements: Which Announcements Matter?, Bank for International Settlements (BIS) Working Papers, No 207. Norden L., Weber M (2004) Informational Efficiency of Credit Default Swap and Stock Markets: The Impact of Credit Rating Announcements, in Journal of Banking & Finance, November. Pukthuanthong-Le, K., Elayan, F.A., & Rose, L.C. (2007). Equity and debt market responses to sovereign credit ratings announcement. Global finance journal, 18, 47-83. Steiner M., Heinke V.G. (2001) Event Study Concerning International Bond Price Effects of Rating Actions, in International Journal of Finance & Economics, April. 15