Proceedings of 29th International Business Research Conference

advertisement

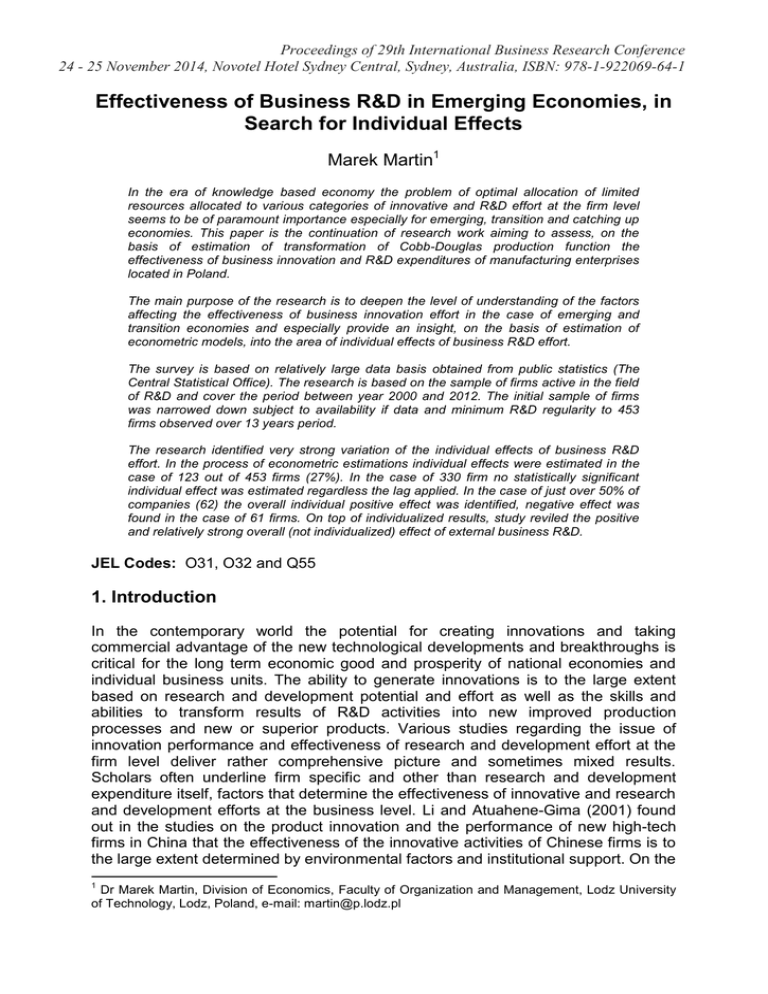

Proceedings of 29th International Business Research Conference 24 - 25 November 2014, Novotel Hotel Sydney Central, Sydney, Australia, ISBN: 978-1-922069-64-1 Effectiveness of Business R&D in Emerging Economies, in Search for Individual Effects Marek Martin1 In the era of knowledge based economy the problem of optimal allocation of limited resources allocated to various categories of innovative and R&D effort at the firm level seems to be of paramount importance especially for emerging, transition and catching up economies. This paper is the continuation of research work aiming to assess, on the basis of estimation of transformation of Cobb-Douglas production function the effectiveness of business innovation and R&D expenditures of manufacturing enterprises located in Poland. The main purpose of the research is to deepen the level of understanding of the factors affecting the effectiveness of business innovation effort in the case of emerging and transition economies and especially provide an insight, on the basis of estimation of econometric models, into the area of individual effects of business R&D effort. The survey is based on relatively large data basis obtained from public statistics (The Central Statistical Office). The research is based on the sample of firms active in the field of R&D and cover the period between year 2000 and 2012. The initial sample of firms was narrowed down subject to availability if data and minimum R&D regularity to 453 firms observed over 13 years period. The research identified very strong variation of the individual effects of business R&D effort. In the process of econometric estimations individual effects were estimated in the case of 123 out of 453 firms (27%). In the case of 330 firm no statistically significant individual effect was estimated regardless the lag applied. In the case of just over 50% of companies (62) the overall individual positive effect was identified, negative effect was found in the case of 61 firms. On top of individualized results, study reviled the positive and relatively strong overall (not individualized) effect of external business R&D. JEL Codes: O31, O32 and Q55 1. Introduction In the contemporary world the potential for creating innovations and taking commercial advantage of the new technological developments and breakthroughs is critical for the long term economic good and prosperity of national economies and individual business units. The ability to generate innovations is to the large extent based on research and development potential and effort as well as the skills and abilities to transform results of R&D activities into new improved production processes and new or superior products. Various studies regarding the issue of innovation performance and effectiveness of research and development effort at the firm level deliver rather comprehensive picture and sometimes mixed results. Scholars often underline firm specific and other than research and development expenditure itself, factors that determine the effectiveness of innovative and research and development efforts at the business level. Li and Atuahene-Gima (2001) found out in the studies on the product innovation and the performance of new high-tech firms in China that the effectiveness of the innovative activities of Chinese firms is to the large extent determined by environmental factors and institutional support. On the 1 Dr Marek Martin, Division of Economics, Faculty of Organization and Management, Lodz University of Technology, Lodz, Poland, e-mail: martin@p.lodz.pl Proceedings of 29th International Business Research Conference 24 - 25 November 2014, Novotel Hotel Sydney Central, Sydney, Australia, ISBN: 978-1-922069-64-1 other hand A. Leiponen (2000) in the study related to the finish economy highlights the fact that profiting from innovation requires strong complimentary capabilities between R&D and i.e. marketing and manufacturing. The research suggest that even in the field of micro-econometric studies, the more firm specific and individualised approach to the problem of effectiveness of business R&D effort seems to be required in order to identify more firm specific factors that determine the effects of R&D effort on the microeconomic level. This study is aiming to identify on the basis of the available data obtained from national statistics, the individual effects of internal business research and development of manufacturing companies located in Poland. The analysis and considerations presented in this article are based on estimation of transformations of Cobb-Douglas production function. This research seems to address the important gap in the effectiveness of business R&D territory. As far as the issue of econometric estimations of individualized effects of business R&D is concerned the research evidence seem to be very scarce, especially in the case of emerging and transition economies. 2. Literature Review Business R&D effectiveness is a very complex and multidimensional issue. Results of research and development effort are in many cases and aspects indirect and difficult to measure. According to The World Economic Forum Global Competitiveness Report 2012-13 (2013) Poland is still in transition between the effectiveness and innovation-driven stages of economy, which theoretically should limit the general effectiveness of business innovation and R&D effort. The main reasons for this situation include the relatively low innovative potential and infrastructure, together with the fact that Poland‟s economy is to a large extent driven by basic factors of production (factordriven economy). The development level of the local economy might at least in theory hinder the effectiveness of innovation and R&D undertaken by business entities, because at this stage of development more effective paths to increased productivity and competitiveness are related to raising the efficiency of production processes and higher product quality. Which in turn may result in higher investment in effectiveness oriented options, rather than accepting the higher risk in the field of innovation and R&D. According to European Innovation Scoreboard (2006) the level of business innovation and R&D spending is rather low by international standards, and Poland‟s economy is classified as the catching up economy in that respect. The research evidence devoted to the issue of effectiveness of business research and development effort is fairly comprehensive especially in the case of developed countries. On the basis of the research evidence it is generally recognized that innovation, and research and development, improve the competitiveness and economic wellbeing of probably all national economies. The effects of innovation at the macroeconomic level are in general unquestionable in today‟s world. In the process of classical (from the current point of view) research, it has been estimated that innovation, and especially the commercial applications of science and technological developments, account for up to 75% of economic growth. According to E.F. Denison (1962), social wealth is determined by technical progress in up to 90%. These findings are in line with more recent studies and the economic findings done by R.M. Sollow (1957) and P.M. Romer (1990), who indicate technical change as a Proceedings of 29th International Business Research Conference 24 - 25 November 2014, Novotel Hotel Sydney Central, Sydney, Australia, ISBN: 978-1-922069-64-1 major source of long-term productivity growth. According to L. Sveikauskas (2007), the overall rate of return to R&D is quite impressive; it is estimated at 25% for private returns and at a total of 65% in terms of overall social returns. Nevertheless, the issue of transferring a company‟s innovation expenditure into sales growth and product development is by no means straightforward at the microeconomic level. The results of business innovation and R&D are often unclear, indirect, and difficult to measure. Drake, Sakkab (2006), Jonash (2006), stress the importance of so called “behind innovation”. In that respect effectiveness of commercialization strategy is vitally important. The cost of innovation must include creation of novelty, development and commercialization. The overall effect of innovation process depends on proper product positioning, well-tailored pricing policy along the product life cycle. Therefore identification of effective individualized paths for maximizing return on business innovation seems to be relatively important issue. On top of their impact on the firm‟s market value, innovation and R&D may have an influence on the firm‟s financial performance in terms of income and sales growth. Other research indicate the relationships between R&D and firm‟s financial performance. According to Brenner (1989) and Rushton (1989) the firms which have higher R&D spending obtain the higher average sales growth than the market average. A study done by M. Pianta (2007) and A. Vaona (2007) indicates important differences in terms of innovation-related factors determining the productivity growth of European companies in general (represented in the survey by Austrian, French, Dutch, and British firms) and of Italian companies in particular. This may suggest important variation regarding factors determining the effects of innovative activities even among advanced economies representing a similar level of economic development. In another study Hashia (2013) and Stojcicc (2013) found that there is a positive relationship between innovation activities and productivity. In making decisions regarding innovation activities firms rely on the knowledge accumulated from previously abandoned innovations and cooperation with other firms and institutions and other members of their group. Results of the study reveal several differences in behavior of firms in two groups of countries. Western Europe and advanced transition economies from Central and Eastern Europe. Triguero (2013) and Corcoles (2013) found that R&D (input) and innovation (output) are highly persistent at the firm level. Among external/environmental factors, market dynamism affects R&D and innovation. Past innovative behavior is clearly more decisive in explaining the current state of R&D and innovation activities than external factors or firm-level heterogeneity. The research done by Pandit (2011), Wasley (2011) and Zach (2011) indicate that firms which have more productive R&D, exhibit higher and less volatile future operating performance. One contribution of this study is that it demonstrates that the relation between R&D expense (input) and future operating performance is better understood by incorporating information about the productivity (output) of a firm‟s R&D outlays in the form of patent counts and citations. Gundaya, G (2011), Ulusoya, G (2011), Kilic K (2011) and Alpkan, L (2011) studied effects of the organizational, process, product and marketing innovations on various aspects of firm performance in Turkey. The results indicate the positive effects of all four types of innovation on firm performance in manufacturing industries. Proceedings of 29th International Business Research Conference 24 - 25 November 2014, Novotel Hotel Sydney Central, Sydney, Australia, ISBN: 978-1-922069-64-1 3. The Methodology and Model The survey presented in this paper, regarding the individualised effectiveness of business research and development activities in the case of emerging economies, is based on the estimation of the regression function that is based on the transformation of Cobb-Douglas production function. The final version of the linear mathematical regression model was created on the basis of logarithm of both sites of classical Cobb-Douglas equation. The model is based on relative increases (i.e. expenditures), instead of levels of capital. This approach is expected to better capture and reflect small changes of independent variables and is easier to implement and estimate. The model, despite the fact that it is easy to implement and estimate, allows for decomposition and examination of the impact of various categories of independent variables (innovation expenditure) over specified dependent variable, for details see Martin (2010, 2011, 2012, 2013, 2013a, 2014, 2015). The selection of dependent variable allows for examination of unique and potentially practical relationships. For the purpose of the study the dependent variable was defined as the relative growth of sales. The data utilized in the estimation of the regression functions is obtained from public statistics (The Central Statistical Office) and represents the time series of innovation and R&D expenditures and output measures exemplified by sales and sales relative growth. The econometric estimations are based on the total sample of 453 firms active in the field of R&D over the observed 13 year period. The data cover the period between year 2000 and 2012. Estimations include the 0 to 3 years lag of independent variables which results with the maximum of 4077 observations for the sample of firms taken under consideration in estimations presented in the paper. The impact of innovation expenditure on sales or profit growth is not contemporaneous. The actual lag between the expenditure and the observed effect exemplified by sales relative growth may vary significantly depending for instance on a given branch of industry. In various cases the lag may extend to more than 10 years, like in some intensively knowledge based industries i.e. biotechnology. The 3 year maximum lag applied represent a hopefully realistic trade-off between the data, model limitations and estimation procedures (individualised estimations require larger number of degrees of freedom) on one hand and maximum expected lag between innovation expenditure and its effects in the case of certain firms included in the sample. It seems to be advisable to further investigate the issues of more lagged effects in the course of the future research. The firms covered by the survey represent medium and large (by EU standards) manufacturing companies located in all parts of Poland. Only medium and large companies, that employ 50+ persons are taken into consideration in the study, since smaller (employing less than 50 persons) are not covered by the yearly survey of innovative activities (PNT-02 survey) carried out by The Central Statistical Office in Poland. The initial version of the regression function is specified underneath. Proceedings of 29th International Business Research Conference 24 - 25 November 2014, Novotel Hotel Sydney Central, Sydney, Australia, ISBN: 978-1-922069-64-1 EMPt EMPt 1 R & DIntt R & DExtt NIEt Sales*t Sales*t 1 0 1 2 3 4 * EMPt 1 yt yt yt Sales t 1 5 RIEt yt Description of Variables: Sales – Total sales revenue, EMP – total employment, R&DInt – internal research and development expenditure, R&DExt – external research and development expenditure, NIE – non-innovation capital expenditure, RIE – remaining innovation expenditure, that includes all the others categories of innovation expenditure (innovation expenditure on new technologies, innovation expenditure on software, innovation expenditure on buildings (associated with innovative activities or investment), innovation expenditure on domestically made machinery, innovation expenditure on imported machinery, innovation expenditure on training (associated with innovative activities or investment), innovation expenditure on marketing). On the basis of available data and common standards, business R&D expenditure is divided into two broad categories: • Internal business research and development: Activities carried out by a particular business entity regardless of the sources of funds utilized to finance them. Internal R&D expenditure includes both running costs and capital expenditure. • External business research and development: includes R&D activities financed by a given firm and performed outside of a particular business entity by both domestic and foreign contractors. In the process of model testing and refinement independent variables included in the initial version of the model were proposed to the model in various combinations. The software package GRETL, that was taken advantage of for econometric calculations and estimations, that includes, among others features, the procedure for identification and exclusion of collinear variables from the model. 4. The Findings In order to estimate the individual effects of internal business R&D a number of rounds of econometric calculations were executed. The table 1 presents the results of model estimation. The table 1 includes only statistically significant non-individualised variables. Maximum up to three years lag was applied. The research sample consists of 543 firms and 4077 observations. The detailed statistics (values of the coefficients, standard errors, T statistics and p levels), for non-lagged and up to 3 years lagged individualised effects of internal business research and development expenditure are Proceedings of 29th International Business Research Conference 24 - 25 November 2014, Novotel Hotel Sydney Central, Sydney, Australia, ISBN: 978-1-922069-64-1 omitted in the table 1 for paper limitation purposes (the inclusion of detailed individualised statistics would make the table and paper around 5 pages longer). The transformed individualized effects of internal business R&D are presented in the table 2. Table 1: Results of the Model Estimations Estimated Value of the Standard coefficient coefficient error Const 0,0630913 0,00629331 Employment relative 0,759009 0,0266033 growth non-lagged Employment relative growth lagged two -0,0519818 0,0241069 years R&D EXT to Sales 2,07485 0,566851 lagged one year NIE to Sales non-0,169109 0,0445149 lagged NIE to Sales lagged 0,110872 0,0447869 two years RIE to Sales non-0,171238 0,0416508 lagged RIE to sales lagged 5,33152e-07 1,58249e-07 two years T statistics p level 10,0251 <0,00001 *** 28,5306 <0,00001 *** -2,1563 0,03113 ** 3,6603 0,00026 *** -3,7989 0,00015 *** 2,4755 0,01335 ** -4,1113 0,00004 *** 3,3691 0,00076 *** Note: ***, **, and * indicate significance levels of 1, 5 and 10 percent, respectively. Dependent variable average = 0,059726 Standard deviation of dependent variable = 0,248862 Sum of squares of residual = 119,4740 Standard error of residual = 0,187372 Within R2 = 0,464260 LSDV R2 = 0,526714 LSDV F(673, 3403) = 5,627276 Value of p for F test = 1,1e-252 Log likelihood ratio = 1410,930 Akaika information criterion = -1473,859 Schwarz-Bayesian information criterion = 2781,181 Hannan-Quinn information criterion = 32,98187 Autocor of residual - rho1 = -0,197753 Stat. Durbin-Watson = 2,152028 The statistically significant (at the minimum 10% significance level) non-lagged and lagged up to three years effects of individualized (individual firm specific) estimations (values of the coefficients) are presented in the Table 2, values of non-lagged and lagged up to three years coefficients are added together and in the process the compound individual effectiveness index was calculated for each individual company, that allowed to create the ranking of companies subject to decreasing compound internal business R&D effectiveness index. For the purpose of the paper limitations values of standard errors, T statistics and p levels are excluded from the Table 2. Proceedings of 29th International Business Research Conference 24 - 25 November 2014, Novotel Hotel Sydney Central, Sydney, Australia, ISBN: 978-1-922069-64-1 Table 2: Estimated individualised effects of internal business research and development activities. Ranking of companies subject of compound internal business R&D effectiveness index Non lagged effects for individual companies A B 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 n313 n181 243,9 700,4 n419 -32,4 n6 316,3 One year lagged Two years effects for lagged effects for individual individual companies companies A B A B n117_2 1201,7 n378_1 1495,9 n378_2 -881,3 n313_1 189,5 Three years The sum of lagged effects for estimated individual coefficients companies A B Sum of B n117_3 516,7 1718,3 n378_3 607,0 1221,6 n313_3 610,7 1044,0 700,4 n419_1 n419_3 n302_3 n388_3 85,0 n419_2 n275_1 812,5 n397_2 -404,5 41,2 529,2 122,2 n138_1 117,0 117,0 n87_1 n250_1 n119_1 -35,5 -54,4 92,3 n137 41,2 n137_1 39,0 n426_1 48,0 n87_2 105,0 n250_3 n395_1 n298_1 n199_1 n426_2 n135_2 27,9 58,7 250,8 68,9 42,8 n300_2 n227_2 28 29 30 31 71,6 32 33 34 35 n88_3 34,1 n202_3 49,0 n199_3 1,0 40,0 37,5 n214 -21,6 n7_2 n409_1 n214_1 n375_1 32,6 49,0 45,1 44,8 43,9 -37,0 28,2 -14,0 31,9 31,5 28,2 27,9 31,9 24,6 n291_2 n375_2 75,8 58,7 51,6 40,0 37,5 35,6 34,6 n414_3 n7 65,5 110,1 102,8 92,3 80,2 17,5 -205,8 -24,1 239,6 222,1 200,1 170,2 n221_1 n364_1 40,7 91,7 n395 n298 222,1 73,9 170,2 150,7 24 25 26 27 447,5 333,3 332,6 150,7 124,7 122,2 n87 n250 n88 283,1 333,3 332,6 -572,8 n224_3 n275_3 n326_3 n238_2 n221 325,3 316,3 n397_1 n275 -128,5 35,6 n214_3 28,5 n375_3 9,4 Proceedings of 29th International Business Research Conference 24 - 25 November 2014, Novotel Hotel Sydney Central, Sydney, Australia, ISBN: 978-1-922069-64-1 36 37 38 39 40 41 42 43 n402 -23,0 n209 -14,9 n402_1 n349_1 n295_1 36,3 39,5 44 n242_1 5,2 45 46 47 n213_1 n73_1 n398_1 9,5 137,3 -27,2 49 50 51 n73 n310 n198 -25,9 -66,5 5,0 2,2 60 61 62 63 64 65 66 67 n256 n101 n26 n165 n146 n169 -51,8 -82,3 -16,7 -18,2 -454,4 -3,5 68 n172 n105 -11,2 21,1 69 70 71 n151 n247 n189 -24,3 -11,0 -4,7 72 n23 -4,7 73 74 75 76 n248 -3,0 77 -8,5 n402_3 23,8 n209_3 n76_3 39,9 24,9 n437_2 n255_2 n133_2 n398_2 n198_2 n153 n354 -5,6 -52,2 n292_1 70,3 n97_1 4,3 27,9 25,3 24,9 24,9 13,1 12,5 -57,6 -79,4 53,1 n255_3 n133_3 59,0 50,3 12,5 11,7 10,5 n242_3 4,9 10,1 -61,4 -18,9 9,5 9,4 6,9 n73_3 n398_3 2,6 n107_3 52 53 54 55 56 57 58 59 n402_2 13,1 n255_1 n133_1 48 n255 35,6 25,3 n292_2 4,5 -65,9 n301_3 3,6 n287_3 -10,1 4,3 3,6 3,2 3,0 n445_1 n287_1 -6,8 13,1 n445_2 n256_1 n101_1 n26_1 57,9 84,4 18,1 n256_2 108,5 n256_3 -111,9 n86_2 n363_2 1,2 -7,3 n363_3 8,4 2,7 2,1 1,4 1,2 1,0 -2,0 -0,1 -0,5 -0,5 n165_1 n146_1 n169_1 18,1 453,9 4,9 n131_1 -1,8 n167_1 3,1 n105_1 -27,3 n151_1 n247_1 39,6 12,0 10,0 5,0 4,8 4,5 4,4 n169_3 -1,8 n167_2 n172_2 n105_2 -5,4 8,6 15,5 n151_2 -18,5 n279_3 -2,3 n105_3 -12,4 n247_3 -4,3 -2,3 -2,4 -2,6 -3,0 -3,1 -3,3 -4,7 -4,7 n248_3 n354_1 n82_2 -5,3 n226_2 -6,5 46,1 -2,2 -5,2 -5,3 -5,6 -6,2 -6,5 Proceedings of 29th International Business Research Conference 24 - 25 November 2014, Novotel Hotel Sydney Central, Sydney, Australia, ISBN: 978-1-922069-64-1 78 79 n60 n203_1 -1,1 -15,7 n60_2 n203_2 -5,4 -6,5 80 81 82 83 n319 -54,7 84 n319_1 n299_1 39,2 -11,2 n126_1 -11,8 85 86 87 n3 n66 11,6 -15,6 n3_1 -26,6 88 n265 -14,6 n265_1 13,6 n197_1 -17,2 n385_1 6,9 89 90 91 n257 n385 -18,7 -17,8 92 n332 -22,0 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 n25 n11 n134 n120 202,6 n442_1 -32,0 n63_2 n3_2 n385_2 n451_2 n65_2 48,3 -24,2 -12,1 30,9 14,6 n264_3 -8,4 -8,4 n58_3 n319_3 -57,3 29,7 -9,0 -10,0 -11,2 n3_3 -30,4 n265_3 -15,1 -8,1 -23,4 -229,5 -36,4 -47,2 -49,9 -67,8 31,7 -75,0 -36,4 -47,2 -49,9 n453_1 -63,8 n453_3 n246_2 n261 n450 -224,0 965,8 112 n124 -153,0 n220 116 n130 n211 -67,0 -38,2 -67,8 -70,2 -75,0 -82,8 -82,8 545,3 -98,7 -110,2 -112,8 n13_1 -655,6 n196_1 -137,3 n13_2 -112,8 n176 n12 113 114 115 -67,0 -98,7 109 110 111 n176_1 -137,3 317,3 n400_1 n220_1 n93_1 -307,0 179,8 -630,5 -4944,9 n130_1 3456,1 -8564,7 n111_1 n211_1 -941,6 -5107,7 -797,6 -16,1 -22,0 -23,4 -26,9 -31,0 -32,0 n70_3 n368 n453 n421 -11,8 -12,1 -14,4 -15,6 -17,2 -18,7 -19,0 -31,0 108 117 118 n65_1 n58_2 n319_2 n203_3 -6,5 -7,5 A - Number of company and lag applied n93_2 -125,4 n269_3 n176_3 n12_3 -160,1 -275,9 -1192,7 -160,1 -182,6 -226,9 n124_3 -139,2 -292,2 55,5 -307,0 -617,8 -700,5 n93_3 -1488,8 n111_2 n211_2 -1831,4 -7223,8 n211_3 -8157,6 -2772,9 -29053,8 Proceedings of 29th International Business Research Conference 24 - 25 November 2014, Novotel Hotel Sydney Central, Sydney, Australia, ISBN: 978-1-922069-64-1 B – Value of the estimated coefficient In the process of extensive estimations of initial version of the model the statistically significant individual estimations and values of coefficients for 118 companies out of 453 firms initially qualified for the survey sample were calculated. As far as not individualized results of model estimations are concerned one can draw the following conclusions: (1) the overall (not individualized) effectiveness of external business R&D lagged one year is highly statistically significant (at 1% level of significance) and the value of the estimated coefficient equals 2,07, (2) the statistically significance values of estimated coefficients for remaining innovative expenditure (RIE) were calculated for non-lagged effects and two years lagged effects. Both close to zero effect, slightly negative for non-lagged effect and marginally positive for two years lagged effect, (3) the statistically significance values of estimated coefficients for noninnovative expenditure (NIE) were calculated for non-lagged effects and two years lagged effects. The values of both coefficients are also close to zero effect, slightly negative for non-lagged effect and slightly positive for two years lagged effect. The buildup of positive effects of various categories of business capital expenditure (innovative or non-innovative) for more lagged estimations is in line with general understanding of the problem and other research evidence. The interpretations of statistics and coefficients for lagged and non-lagged relative employment growth were omitted as inconsequential from the point of view of the specified field of research. 5. Summary and Conclusions The results of the econometric estimations presented in the paper proved to be promising in terms of the model and method ability to investigate individual (single firm specific) effects of business R&D effort. In the process of econometric estimations individual effects were obtained in the case of 123 out of 453 firms (27%). In the case of 330 firm no statistically significant individual effect was estimated regardless the lag applied. The research identified very strong variation of the individual effects of business R&D effort. In the case of just over 50% of companies 62 out of 123 the overall individual positive effect was identified, negative effect was found in the case of 61 firms. The study also allowed to identify the positive and relatively strong overall (not individualized) effect of external business R&D and statistically significant but marginal in terms of their impact over dependent variable effects of non-innovative capital expenditure and remaining innovative expenditure. The slight build-up of positive effects in line with the larger lag applied was observed in this territory. The prospects of the future research in the specified field seem to be quite significant and might include the model modification and application of different dependent variables. The identification of individual characteristics of selected business units, although potentially very interesting and promising, might encounter formal issues related to confidentiality of data. Proceedings of 29th International Business Research Conference 24 - 25 November 2014, Novotel Hotel Sydney Central, Sydney, Australia, ISBN: 978-1-922069-64-1 Acknowledgments The research paper was funded by National Science Centre in Poland under the project number N N112 316238 with the funds allocated to science in the years 20102013 as the research project. Author would like to express special thanks to Prof. Jan Jacek Sztaudynger from Faculty of Economics and Sociology of University of Lodz and Prof. Marek Szajt from Faculty of Management of Czestochowa University of Technology for their support in the field of model specification and refinement. Without this support and suggestions the work that has led to this and other research papers would have been impossible. Author would like also to thank the Lodz Statistical Office for the support and provision of data regarding the input and output measures of manufacturing enterprises and especially Dr Artur Mikulec for his important support in the field of data handling and processing. References Brenner, MS and Rushton, BM 1989, „Sales Growth and R&D in the Chemical Industry‟, Research-Technology Management, Vol. 32, No. 2, 1989, pp. 8-15. Denison, EF 1962, „The Sources of Economic Growth in the United States and the Alternatives Before Us‟, Committee for Economic Development, New York, p. 256-286. Drake, MP, Sakkab, N and Jonash, R 2006, „Maximizing Return on Innovation Investment: Spending More on Innovation does not Necessarily Translate into Accelerating Sales, Market Share or Profit‟, Research-Technology Management, Nov-Dec, 2006. European Innovation Scoreboard 2006, European Commission, Luxembourg 2006. Gundaya, G, Ulusoya, G, Kilic, K and Alpkan, L 2011, „Effects of Innovation Types on Firm Performance‟, International Journal of Production Economics, 133 (2011), pp 662–676. Hashia, I and Stojčićc, N 2013, „The Impact of Innovation activities on Firm Rerformance Using a Multi-stage Model: Evidence from the Community Innovation Survey 4‟, Research Policy, Volume 42, Issue 2, March 2013, Pages 353–366. Leiponen, A 2000, „Competencies, Innovation and Profitability of Firms‟, Economics of Innovation & New Technology’, Jan 2000, Vol. 9, Issue 1, p. 1123-1143. Li, H and Atuahene-Gima, K 2001, „Product Innovation Strategy and the Performance of the New Technology Ventures In China‟, Academy of Management Journal, Dec. 2001, Vol. 44, Issue 6. Martin, M, 2010, „The Effectiveness of Business Research and Development in Emerging Economies‟, The Regional Analysis, Global Conference On Business and Finance Proceedings volume 5, Number 2, 2010, p. 440-452, http://www.theibfr.com/archive/issn-1941-9589-v5-n2-2010.pdf Martin, M, 2011, „The Impact of Business Innovation on Domestic and Export Sales In Emerging Economies‟: the Regional Analysis [in:], A. Chiu, M-L. Tseng, Proceedings of 2011 International Conference on Asia Pacific Business Innovation & Technology Management (APBITM) 2011. Martin, M, 2012, „Maximizing the Return on Business Innovation Expenditure in the Case of Emerging Economies; Regional Analysis‟, [in:], S. Baby, V.K. Banga Proceedings of 29th International Business Research Conference 24 - 25 November 2014, Novotel Hotel Sydney Central, Sydney, Australia, ISBN: 978-1-922069-64-1 (ed.) International Conference Proceedings of PSRC Penang Malaysia 2012, p 145-149, http://psrcentre.org/images/extraimages/212094.pdf Martin, M, 2013, „The Effectiveness of Business Innovative Activities in the Case of Emerging Economies; The Exploitation of Relative Sales Growth Model‟, INTENSITY, International Journal of Applied Social Science Research, Vol. 02, June 2013, p. 60-66. Martin, M, 2013a, „The Effectiveness of Business Innovative Activities in the Case of Emerging Economies; in Search for the Lagged Effects‟, International Journal of Business, Management & Social Sciences, Vol. II, Issue 10 (II), June 2013, p. 77-81. Martin, M, 2014, „Effectiveness of Business Innovation in Emerging Economies; Exploitation of Relative Profit Growth Model‟, World Review of Business Research, Vol. 4. No. 2. July 2014 Issue. Pp. 34 – 48, http://www.wrbrpapers.com/static/documents/July/2014/3.%20Marek.pdf Martin, M, 2015, „Effectiveness of Business Innovation and R&D in Emerging Economies; The Evidence from Panel Data Analysis‟, Journal of Economics Business and Management, Vol. 3, No. 4, April 2015, pp. 440-446, http://www.joebm.com/papers/225-A00033.pdf Pandit, S, Wasley, ChE, Zach, T 2011, „The Effect of Research and Development (R&D) Inputs and Outputs on the Relation between the Uncertainty of Future Operating Performance and R&D Expenditures‟, Journal of Accounting, Auditing & Finance, Jan2011, Vol. 26 Issue 1, p121-144. Pianta, M and Vaona, A 2007, „Innovation and Productivity in European Industries‟, Economics of Innovation & New Technology, Vol. 16(7), pp. 485-499. Romer, PM 1990, „Endogenous Technical Change‟, Journal of Political Economy, 98, 1990, pp. 71-102. Sollow, RM 1957, „Technical Change and the Aggregate Production Function‟, Review of Economics and Statistics, Volume 39, pp. 312-320. Sveikauskas, L 2007, „R&D and Productivity Growth: A Review of the Literature‟, US Bureau of Labour Statistics, Working Paper, No 408. Triguero, A and Corcoles, D 2013, „Understanding innovation: An Analysis of Persistence for Spanish Manufacturing Firms‟, Research Policy, Volume 42, Issue 2, pp. 340–352. WEF 2013, „The Global Competitiveness Report 2012-13‟, World Economic Forum, Switzerland, 2013.