Proceedings of 7th Asia-Pacific Business Research Conference

advertisement

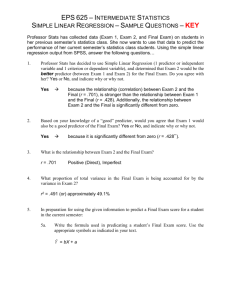

Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 The Impact of Profitability Ratios, Market Ratios and Leverage Ratio toward Stock Return of LQ45 during 2004-2013 Dhika Febrianov* and Anggoro Budi Nugroho** Gaining the return is the first reason by investors to invest their money. Before investing their money, investors will need some information as the consideration to invest in stock market. One of way to analyze the stock performance is by using fundamental analysis. Fundamental analysis is used to analyze the strength or the weakness of company financial performance. It can be analyzed by calculating the company year-to-year financial ratio. So, by looking the financial ratio, investor can analyze the performance and firm financial condition as the consideration to invest In this research, there will be explanation about the impact of Return on Assets (ROA), Earning per Share (EPS), Price to Earning Ratio (PER), Price to Book Value (PBV) and Debt to Equity Ratio (DER) toward stock return of issuers that listed in LQ45 for period of 2004-2013. LQ45 is chosen because it has high liquidity of stocks, good financial performance and are expected to provide a high return. Sample of this research are issuers that consistently listed in LQ45 during 2004-2013. Based on those criteria, there are seven companies that become the sample of this research. The result of this research shown that Earning Per Share (EPS) and Pricebook Value (PBV) have positive and significant effect toward stock return with level of significance of 5%. Then, Price-earning Ratio (PER) has negative and significant effect toward stock return. Return on Asset (ROA) and Debt-equity Ratio (DER) does not significantly impact the return of LQ45 for the period 2004-2013. The result of F-test also shows that three of independent variables from the regression model (EPS, PER and PBV) simultaneously impact the stock return. Keywords: LQ45, return, profitability, market, leverage, ratio, regression. 1. Introduction Stock market is being an interesting investment media for investor to invest. According to director of development of Jakarta Composite Index on jurnas.com, investors also have high expectations with the profile of Indonesia in the future. Factors that lead to positive perceptions because Indonesia is considered have stable economic growth, GDP continues to rise, the fourth largest population in the world, Indonesia is one of the G20 member countries, etc. McKinsey survey also predicted that Indonesia would be the seventh largest economy in the world by 2030. One of way to analyze the stock performance is by using fundamental analysis. Fundamental analysis is used to analyze the strength or the weakness of company financial performance. Empirical research suggests that financial ratios have a significant effect on stock returns. But, there was any phenomenal gap between empirical researches, because the conclusions generated in each study is using different data and year-of-observation. *Dhika Febrianov, School Of Business & Management Institute Technology Bandung, Indonesia. Email: dhika@sbm-itb.ac.id **Anggoro Budi Nugroho, MBA, Lecturer of School of Business and Management, Institut Teknologi Bandung, Indonesia. Email: anggoro@sbm-itb.ac.id 1 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 Therefore, to determine the effect of the ratio of shares Stock return, the research about effect of financial ratio toward Stock return conducted. In this study, the data used is stocks in LQ-45 Index because it has high liquidity and good financial performance. 2. Literature Review 2.1 LQ45 Index According to Indonesia Stock Exchange (IDX), LQ45 index is a market capitalizationweighted index that captures the performance of 45 most liquid companies listed on the Indonesia Stock Exchange (the “IDX”). The LQ45 Index covers at least 70% of the stock market capitalization and transaction values in the Indonesia Stock Market. The Index is denominated in Indonesia rupiah (“IDR”) and is published throughout the trading hours of the IDX. 2.2 Hypothesis 2.2.1. Return on Assets (ROA) H0: ROA does not significantly affect the stock return H1: ROA significantly affects the stock return. 2.2.2. Earning Per Share (EPS) H0: EPS does not significantly affect the stock return. H3: EPS significantly affects the stock return. 2.2.3. Price Earning Ratio (PER) H0: PER does not significantly affect the stock return. H4: PER significantly affects the stock return. 2.2.4. Price to Book Value (PBV) H0: PBV does not significantly affect the stock return. H5: PBV significantly affects the stock return. 2.2.5. Debt to Equity Ratio (DER) H0: DER does not significantly affect the stock return. H5: DER significantly affects the stock return. 2.3 Ratios Definition 2.3.1 Return On Assets Gitman (2012:82) stated that return on common assets (ROA) measures the return earned on the common stockholders’ investment in the firm. According to Ross, Westerfield and Jaffe (2010:55), this ratio is used to measure of company performance. ROA is usually measured as: 2 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 Bodie (2014: 477) also stated that higher ROA should be better ROE measures effectiveness of management in generating profit with its assets and should be better able to raise money in security markets because they offer prospects for better returns on the firm’s investments. 2.3.2 Earning Per Share Fabozzi (2011:20) explain that earning per share is earning available for common shareholders, divided by the number of common share outstanding. This ratio indicates each shares portion of how much is earned by the company given accounting period and shows net profit obtained by company to each share. EPS usually measured as: According to Gitman (2010:81), earning per share (EPS) is considered as an important indicator of corporate success and is watched by investing public. 2.3.3 Price Earning Ratio According to Little (2014), price-earning ratio looks at the relationship between the stock price and the company’s earnings. The P/E gives an idea of what the market is willing to pay for the company’s earnings. Gitman (2010:82) also stated that market ratio is measured to know the amount that investors are willing to pay for each value of money of a earning that is generated by a firm. The level of this ratio indicates the degree of confidence that investors have in the firm’s future performance. The formula of PER is: The higher the P/E indicates more the market is willing to pay for the company’s earnings. Some investors read a high P/E as an overpriced stock and that may be the case, however it can also indicate the market has high hopes for this stock’s future and has bid up the price. 2.3.4 Price-Book Value Ratio Peavler (2014) stated that the market to book financial ratio or the price to book ratio, measures to know the market value of a company relative to company’s book or accounting value. The market to book ratio is used by security analysts to determine if a stock is undervalued or overvalued. The price is expected to rise if the price is undervalued. The price is expected to fall if it is overvalued. The formula of PBV/MBV ratio is: 3 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 High PBV indicates if the firm has high value by investors and it also increasing the firm’s share price on stock market. 2.3.5 Debt-equity Ratio (DER) Debt-equity ratio is a leverage ratio that measures the total of firm’s debt financed to firm’s equity. According to Ross (2010), the formula for Debt-equity Ratio is: 3. The Methodology 3.1 Data Collection 3.1.2 Types of Data Type of data in this research is quantitative data. Quantitative data is a numeric data. According to the data type, quantitative data can be processed or analysed by using mathematics calculation technique or statistics. Used data for this research is secondary data, where the data is obtained or collected by author is derived from existing sources. (Suryana:2010). 3.1.3 Sources of Data Sources of the data in this research is obtained from yearly report and financial report of companies that listed in Jakarta Composite Index (JCI), where all of data that needed in this research is obtained by Indonesia Stock Exchange’s website (www.idx.co.id), IDX Office (Veteran 10, Bandung), ICMD, Yahoo! Finance and www.sahamok.com. Used data in calculating of variables for this research are: 1. List of companies that listed in LQ-45 for period of 2004-2013 which obtained from www.idx.co.id 2. Historical data of stock for each company that obtained from Yahoo! Finance. 3. Yearly report and financial report during 2004-2013 that obtained from IDX. 4. Company financial ratio that obtained from ICMD 2005-2013. 5. Interest rate and exchange rate that obtained from www.bps.go.id and www.data.worldbank.org 6. List of 7 companies that listed consistently during 2004-2013 from idx.co.id by using Ms.Excel. Population in this research is listed companies in LQ-45. For the sampling technique, author is using purposive sampling method, where the sampling is using some criteria that used by author. Used criteria in this research are: 1. Listed on LQ-45. 2. Actively traded in LQ-45 during 2004-2013 or twenty times in a row, because LQ45 published twice per year. 3. Not a banking company, because it has different financial ratio. 4. Never suspended by Indonesia Stock Exchange. 4 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 5. Have the yearly report and financial report during 2004-2013. Based on these criteria, so the author can selected 8 companies from 45 companies that is used as the sample in this research. List of used companies in this research can be seen on Table 3.2 below: Table 3.2 List of Sample NO 1 2 3 4 5 6 7 LISTS OF COMPANY CODE PT Astra Agro Lestari Ltd AALI PT Astra International Ltd ASII PT Vale Indonesia Ltd INCO PT Indofood Sukses Makmur Ltd INDF PT Tambang Bukit Asam Ltd PTBA PT Telekomunikasi Indonesia Ltd TLKM PT United Tractor Ltd UNTR 4. The Findings 4.1 Regression Analysis This research is using multiple regression analysis. This regression analysis purpose is to analyse the impact of profitability ratios, market ratios and leverage ratio toward stock return. This research is using panel data, where the data is the combination between time series data and cross section data. In panel data, there are three methods are used as approach to regression model in panel data: 1. Pooled Least Square Pooled Least Square method is combining the time series data and cross section data to estimate regression by using Ordinary Least Square and it assumes the data behaviour is similar for some period. 2. Fixed Effect Method Fixed effect method is a regression model that use dummy variable to detect the intercept differences. It assumes the slope of coefficient regression between cross section and time series is different. 3. Random Effect Method Random effect method is including differences of parameter between cross section and time series to error. In order to know the best model that will be used in regression, Hausman test are tools to determine best panel data model that will be used. 4.1.2 Hausman Test Hausman test is a test that aims to choose the best model in panel data by using eviews software. This test aims to choose the best regression model between Fixed Effect Model and Random Effect. In this test, the used hypothesis’ are: 5 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 H 0 : use random effect model H 1 : use fixed effect model If the value of probability is smaller than 0.05, H0 can be rejected and H1 is accepted, but if the probability is bigger than 0.05, it means that H0 can be accepted and H1 can be rejected. This table below is the result of Hausman Test: Table 4.1.2 Hausman Test Test Summary Cross-section random Chi-Sq. Statistic Chi-Sq. d.f. Prob. 4.481906 5 0.4823 From the table above, known if the value of probability is 0.4823. This value is bigger than 0.05, it means that the best model that used in this panel data is random effect model. The result of software Eviews to analyze random effect regression can be seen on the table below: Table 4.1 Multiple Regression Analysis Table Variable Coefficient T-Statistics Probability Constant -0.000094600 -0.101552 0.9194 ROA -0.007428000 -1.519461 0.1336 EPS 0.000000471 2.244347* 0.0283* PER -0.000025200 -2.035333** 0.0460** PBV 0.000600000 3.848345* 0.0003* DER 0.000025500 0.053936 0.9572 Then, the result from table above is inserted to the multiple linier regression equation and the obtained multiple regression equation is: Y = -0.0000946 -0.007428ROA+0.000000471EPS-0.0000252PER+0.000600PBV+ 0.0000255DER + e Note: * positive, significant level at 0.05 ** negative, significant level at 0.05 4.2 The impact of ROA (X1), EPS (X2), PER (X3), PBV (X4), DER (X5) toward Return (Y) 4.2.1 Relationship Between ROA and Stock Return Return on Asset (ROA) does not significantly affect the stock return of LQ45. From the partial test (t-test), the value of t-statistics (-0.101552) indicates if ROA has negative relationship toward stock return. T-statistics (-0.101552) is bigger than t table (1.990), it means the ROA does not significantly affect the stock return. 6 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 4.2.2 Relationship Between EPS and Stock Return EPS has positive relationship with stock return in this research and significantly affect the stock return. Because t calculation (2.44347) > t table (1,990), it means H1 can be accepted. So, it can be concluded if EPS positive significantly affect the return (Y). Based on the regression equation, he value of EPS is positive with value of 0.000000471, it means if EPS is increasing by 1, the stock return will increase by 0.000000471 with the assumption that the other independent variables are fixed. 4.2.3 Relationship Between PER and Stock Return PER has negative relationship with stock return in this research and significantly affect the stock return. Because t calculation (-2.035333) < -t table (-1,990), it means H1 can be accepted. So, it can be concluded if PER significantly affect the return. Based on the regression equation, the value of PER is negative with value of 0.0000252, it means if the PER is increasing by 1, the stock return will decrease by 0.0000252 with the assumption that the other independent variables are fixed. 4.2.4 Relationship Between PBV and Stock Return PBV has positive relationship with stock return in this research and significantly affect the stock return. Because t calculation (3.848345) > t table (1,990), it means H1 can be accepted. So, it can be concluded if PBV significantly affect the return.Based on the regression equation, the value of PBV is 0,000600, it means if EPS value is increasing by 1, the stock return will increase by 0,000600 with the assumption that the other independent variables are fixed. 4.2.5 Relationship Between DER and Stock Return DER has positive relationship and does not significantly affect the stock return. Because t calculation (0.053936) < t table (1,990), it means H0 can be accepted. So, it can be concluded if DER does not significantly affect the return. Based on the regression equation, the value of DER is 0,0000255, it means if DER value is increasing by 1, the stock return will increase by 0,0000255 with the assumption that the other independent variables are fixed. 4.3 Compound Annual Growth Rate Compound Annual Growth Rate (CAGR) is used to measure the year-over year rate of an investment over a specified period. It is an imaginary of rate at an investment would have grown if it grew at steady rate and it is not an actual return in reality. So, by using CAGR the author can get more specific which company that has relationship to the positive and significant variables of the research’s results. The used formula for CAGR is: 7 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 ( ( ) ) Table 4.3 Compound Annual Growth Rate CAGR ROA EPS PER PBV AALI -6.68% 9.41% 20.47% 6.78% ASII -3.08% -10.75% 8.78% 1.88% INCO -22.94% -35.57% 22.79% -0.82% INDF 6.86% 24.39% 1.38% -1.88% PTBA -1.14% 16.73% 6.93% 6.91% TLKM 4.27% -8.19% -0.85% -5.16% UNTR -7.10% 14.40% 11.53% 0.00% DER -2.91% -1.61% -2.11% -9.29% 3.32% -9.07% -6.98% Based on the research analysis results, known if PBV and EPS has positive relationship and significantly affect the stock return. PT. Tambang Batubara Bukit Asam Ltd. (PTBA), PT.Astra Agro Lestari Ltd. (AALI) and PT. Astra Agro Lestari Ltd. (ASII) have the largest CAGR of PBV. Then, the companies that have the largest CAGR of EPS are PT. Indofood Sukses Makmur Ltd. (INDF), PT. Tambang Batubara Bukit Asam Ltd. (PTBA), PT.United Tractors Ltd. (UNTR) and PT.Astra Agro Lestari Ltd. At final, the companies that have the highest CAGR of PBV and EPS are PT. Tambang Batubara Bukit Asam Ltd. (PTBA), PT.Astra Agro Lestari Ltd. (AALI) and PT. United Tractor (UNTR) 5. Conclusions There are many conclusions resulted from this research: 1. Return on Asset (ROA) does not significantly affect the stock return of LQ45. From the partial test (t-test), the value of t-statistics (-0.101552) indicates if ROA has negative relationship toward stock return. T-statistics (-0.101552) is bigger than t table (1.990), it means the ROA does not significantly affect the stock return. 2. EPS has positive relationship with stock return in this research and significantly affect the stock return. Because t calculation (2.44347) > t table (1,990), it means H1 can be accepted. So, it can be concluded if EPS positive significantly affect the return (Y). 3. PER has negative relationship with stock return in this research and significantly affect the stock return. Because t calculation (-2.035333) < -t table (-1,990), it means H1 can be accepted. So, it can be concluded if PER significantly affect the return. 4. PBV has positive relationship with stock return in this research and significantly affect the stock return. Because t calculation (3.848345) > t table (1,990), it means H1 can be accepted. So, it can be concluded if PBV significantly affect the return. 5. DER has positive relationship and does not significantly affect the stock return. Because t calculation (0.053936) < t table (1,990), it means H0 can be accepted. So, it can be concluded if DER does not significantly affect the return. 6. ROA, EPS, PER, PBV and DER simultaneously affect the stock return by significance level of 5%. 8 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 7. There are three companies that have the highest CAGR of PBV and EPS: PT. Astra Agro Lestari Ltd. (AALI),) and PT. Tambang Batubara Bukit Asam Ltd. (PTBA) an PT. United Tractor Ltd. (UNTR). References Ross, Stephen A., Randolph W. Westerfield & Jeffrey Jaffe, 2010, Corporate Finance, New York: McGraw-Hill. Gitman, Lawrence J & Zutter, Chad J, 2010, Principles of Managerial Finance, Boston: Prentice Hall. Van Horne, James C & Wachowicz, John M, 2008, Fundamentals of Financial Management, London: Prentice Hall. Gujarati, Damodar N., 2004, Basic Econometrics, McGraw-Hill. Fabozzi, Frank J. & Pamela Peterson Drake, 2009, Finance: Capital Markets, Financial Management, and Investment Management, Canada: John Wiley & Sons. Prihantini, Ratna, 2009, Analisis Pengaruh Inflasi, Nilai Tukar, ROA, DER, dan CR Terhadap Return Saham, retrieved from www.eprints.undip.ac.id. Nurdina, Iffa, 2014, Analisis Pengaruh Faktor Fundamental Terhadap Beta Saham, retrieved from www.eprints.undip.ac.id. Hagaina Bukit, Inka Natasya, 2012, The Effect of Price to Book Value (PBV), Divident Payout Ratio (DER), Return On Equity (ROE), Return On Asset (ROA) and Earning Per Share (EPS) toward Stock Return of LQ 45 for The Period of 2006-2011, retrieved from www.sibresearch.org. Miranti, Nuza, 2012, The Influence of Debt Equity Ratio, Market Capitalization and Turnover Ratio in Listed Companies in Jakarta Islamic Index Period of 2005-2010, retrieved from www.staff.ui.ac.id Dewiyanti, Emily, 2013, The Relationship between Profitability Ratios and Stock Return in The Consumer Goods Sector in Indonesia Stock Exchange (2004-2012), retrieved from www.library.sbm.itb.ac.id. Novitasari, Ryan, 2013, Analisis Pengaruh Fundamental terhadap Return Saham (Studi pada perusahaan LQ45 tahun 2009-2012), retrieved from www.eprints.undip.ac.id Hernendiastoro, Andre, 2005, Pengaruh Kinerja Perusahaan dan Kondisi Ekonomi Terhadap Return Saham dengan Metode Intervalling (Studi Kasus pada saham LQ45), retrieved from www.eprints.undip.ac.id. ECFIN, (2005), Indonesian Capital Market Directory 2004. ECFIN, (2006), Indonesian Capital Market Directory 2005. ECFIN, (2007), Indonesian Capital Market Directory 2006. 9 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 ECFIN, (2008), Indonesian Capital Market Directory 2007. ECFIN, (2009), Indonesian Capital Market Directory 2008. ECFIN, (2010), Indonesian Capital Market Directory 2009. ECFIN, (2011), Indonesian Capital Market Directory 2010. ECFIN, (2012), Indonesian Capital Market Directory 2011. ECFIN, (2013), Indonesian Capital Market Directory 2012. Appendix Hausman Test Correlated Random Effects - Hausman Test Equation: Untitled Test cross-section random effects Test Summary Cross-section random Chi-Sq. Statistic Chi-Sq. d.f. Prob. 4.481906 5 0.4823 Regression Result Dependent Variable: RETURN Method: Panel EGLS (Cross-section random effects) Date: 08/12/14 Time: 21:13 Sample: 2004 2013 Periods included: 10 Cross-sections included: 7 Total panel (balanced) observations: 70 Swamy and Arora estimator of component variances Variable Coefficient Std. Error t-Statistic Prob. C ROA EPS PER PBV DER -9.46E-05 -0.007428 4.71E-07 -2.52E-05 0.000600 2.55E-05 0.000931 0.004889 2.10E-07 1.24E-05 0.000156 0.000473 -0.101552 -1.519461 2.244347 -2.035333 3.848345 0.053936 0.9194 0.1336 0.0283 0.0460 0.0003 0.9572 Effects Specification S.D. Cross-section random Idiosyncratic random 0.000000 0.001990 Rho 0.0000 1.0000 Weighted Statistics R-squared Adjusted R-squared 0.261929 0.204267 Mean dependent var S.D. dependent var 0.001023 0.002204 10 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 S.E. of regression F-statistic Prob(F-statistic) 0.001966 4.542497 0.001317 Sum squared resid Durbin-Watson stat 0.000247 1.990624 Unweighted Statistics R-squared Sum squared resid 0.261929 0.000247 Mean dependent var Durbin-Watson stat 0.001023 1.990624 DATA CODE AALI ASII INCO INDF YEAR 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2004 2005 2006 2007 2008 2009 2010 2011 ROA 0.2367 0.2476 0.2251 0.3687 0.4035 0.2294 0.2393 0.2448 0.2029 0.1271 0.1381 0.0892 0.0641 0.1026 0.1138 0.1399 0.1507 0.1373 0.1248 0.1042 0.1763 0.1623 0.2418 0.6216 0.1949 0.0836 0.1997 0.1378 EPS 509 502 500 1253 1671 1098.37 1280.7 1527.59 1530.57 1143.93 1335 1348 917 1610 2271 3073.84 3548.6 4393.14 479.73 479.63 2496 2652 4666 10663 395 187 481 367 2012 0.0269 12 2013 2004 2005 2006 2007 0.0169 0.0241 0.0084 0.0406 0.0332 47.73 40 13 70 104 PER 6.09 9.76 25.2 22.34 5.87 21.53 20.46 13.68 12.64 32.54 7.19 7.57 17.12 16.95 4.65 14.83 15.37 14.03 13.7 15.33 5.67 4.96 6.64 9.03 4.88 19.48 10.14 8.72 204.3 2 35.97 19.98 69.3 19.28 24.81 PBV 2.36 2.94 7.22 10.86 2.99 5.82 5.72 4.06 3.31 4.26 2.36 2.02 2.84 4.1 1.29 3.69 4.48 3.95 3.43 2.79 1.4 1.04 2.03 7.64 1.15 2.1 2.64 1.64 DER 0.6 0.19 0.24 0.28 0.23 0.24 0.19 0.21 0.33 0.46 1.18 1.81 1.41 1.17 1.21 1.02 1.1 1.02 1.03 1.02 0.4 0.29 0.26 0.36 0.21 0.29 0.3 0.37 RETURN 0.00239874 0.002027717 0.003836216 0.003387788 -0.003076352 0.003221475 0.000510593 -0.000625386 -0.000379378 0.001403959 0.002726804 0.000424356 0.001850203 0.002263266 -0.002618858 0.004643837 0.002018134 0.001511481 -0.0039194 -0.000248412 0.000908925 0.000763458 0.004072641 0.005597939 -0.005219388 0.002745446 0.001145899 -0.001121035 7.45 0.36 -0.001921944 1.3 1.78 1.99 2.53 3.41 0.33 2.5 2.33 2.1 2.62 0.000395346 0.00018861 0.000640509 0.001566641 0.002778983 11 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 PTBA TLKM UNTR 2008 2009 2010 2011 2012 2013 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2004 2005 2006 2007 2008 2009 2010 2011 2012 0.0098 0.0707 0.0832 0.0913 0.0806 0.0438 0.176 0.1645 0.1563 0.1935 0.2796 0.3378 0.2292 0.2684 0.2286 0.1588 0.1089 0.1286 0.1465 0.1567 0.1164 0.1638 0.1591 0.1501 0.1649 0.1586 0.1624 0.0988 0.0827 0.1148 0.1165 0.1577 0.1305 0.127 0.1144 118 236.42 336.3 350.46 371.41 285.16 197 203 211 330 741 1184.54 871.86 1339.26 1258.66 792.55 304 397 547 644 527 792.47 572.27 543.9 637.4 140.92 386 369 326 524 800 1157.15 1164.13 1581.96 1549.45 7.89 14.84 14.5 8.05 10.54 22.61 7.75 8.88 16.72 36.37 9.31 13.38 26.32 12.95 15.33 14.17 15.87 14.88 18.46 15.76 14.05 15.36 13.89 9.18 9.92 14.7 5.89 9.96 20.08 20.82 5.5 13.05 20.44 16.76 12.54 0.96 3.23 2.55 1.28 1.5 1.5 1.93 2.02 3.54 9.88 3.98 7.42 8.31 4.9 4.09 3.52 4.8 5.11 7.25 6.06 4.35 5.08 3.61 2.33 2.72 2.98 2.09 2.55 4.07 5.42 1.32 3.85 4.91 3.57 2.27 3.11 2.68 1.34 0.7 0.74 1.04 0.41 0.38 0.35 0.4 0.51 0.38 0.36 0.41 0.5 0.55 1.53 1.4 1.39 1.16 1.38 1.28 0.98 0.69 0.66 0.65 1.17 1.58 1.44 1.26 1.05 0.74 0.84 0.69 0.56 2013 0.0837 1295.85 15.73 2.09 0.61 -0.003496763 0.005498298 0.001321357 -0.00004238 0.000929788 0.000675228 0.002434058 0.000855483 0.002977151 0.005255314 -0.000676658 0.003866574 0.001277161 -0.001057086 -0.000893314 -0.001394863 0.001310851 0.000915997 0.0022586 0.000289623 -0.001070703 0.001314658 -0.000532326 0.000062297 0.001173437 0.000734301 0.002702567 0.002132403 0.00251823 0.002167298 -0.002133855 0.005242923 0.001737207 0.000631244 -0.001276191 0.0000041272 7 12