Proceedings of 7th Asia-Pacific Business Research Conference

advertisement

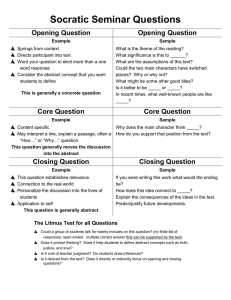

Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 Closing Price Manipulation in Indonesia Stock Exchange: An Empirical Evidence during Financial Crisis 20082009 Steven Gunawan* and Deddy P. Koesindartoto** Closing price is the latest price of a security traded on a certain day. It is the most updated valuation of a stock. Investors can get information about the changes of stock price using the closing price from each day and the information can be used to measure the return and the sentiment from the market to the stock. Closing price of each trading day also indicates the performance of the stock market and it can be used for stocks benchmarking and the portfolio performance. Stock price manipulation can give benefit for the stockholders because they are able to sell the stocks they owned at a higher price at the opening of the market in the next trading day so traders with big net position will try to manipulate the price to gain profits. On the contrary, the closing price manipulation can also cause the realized unsystematic and extreme price movements in closing sessions. This study is to analyse the existence of the closing price manipulation in Indonesia Stock Exchange so that by understanding the price behaviour, many investors can be helped in making the buying or selling decisions. The scope of this study is Indonesia Stock Exchange daily transactions history during the pre-crisis, crisis, and recovery crisis st th and post crisis time from 1 April 2008 until 30 April 2009. The samples are taken from the highest volatility stocks of LQ 45 index and the authors use standard OLS regression model to find the existence of the manipulation. From this analysis, the authors find out that the closing price manipulation is possible in Indonesia Stock Exchange. After knowing the trading behaviour in the Indonesia Stock Exchange, the information can be used for educating investors to make the buying and selling strategies more wisely. The result of this research can be used for further research on how to prevent the closing price manipulation. JEL Codes: 1. Introduction Several extensive researches have been done that show that the movement of stock markets around the world are more active in the opening and the closing session of a certain trading day. The author found it interesting to analyse the existence of closing price manipulation in Indonesia Stock Exchange. Closing price is the latest price of a security traded on a certain day. It is the most updated valuation of a stock. Investors can get information about the changes of stock price using the closing prices from each day and the information can be used to measure the return and the sentiment from the market to the stock. The active movement of the stock markets is supported by the price volatility, volume of trading and the bid – offer orders frequency. *Steven Gunawan, School of Business and Management, Bandung Institute of Technology, Indonesia . Email : steve.gunawan@sbm-itb.ac.id **Deddy P. Koeindartoto, School of Business and Management, Bandung Institute of Technology, Indonesia . Email : deddypri@sbm-itb.ac.id 1 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 Nowadays stock price manipulation has become concern for many people. Some studies have been done, one of them is a study to identify manipulation in derivative security market that is done by Kumar and Seppi (1992), Jarrow (1994) and Kyle (1984). Based on The Capital Market Boards of Indonesia (1995), there are two types of price manipulation: Rule 92 regulates about the Trade-Based Manipulation, a condition in which a trader alters the stock prices by changing the buy orders, sell orders or even both. Rule 93 regulates about the Action-Based Manipulation, a condition where the manipulator issues a misleading information or statement which can influence other traders who believe in the statement. As the consequences, the manipulator can buy low and sell high to gain profits. Stock price manipulation can give benefit for the stockholders because they are able to sell the stocks they owned at a higher price at the opening of the market in the next trading day so traders with big net position will try to manipulate the price to gain profits. Besides that, closing prices of each trading day indicates the performance of the stock market and it can be used for stocks benchmarking and the portfolio performance. On the contrary, the closing price manipulation can also cause irregular and intense price movements in the closing of a certain trading day and lower the volatility which supports these rises. In 2008, Güray Küçükkocaoğlu examines the possibility of manipulation of the closing price in Istanbul Stock Exchange by observing the behaviour of the intra-daily stock returns and close-end stock prices in the Istanbul Stock Exchange (ISE). The result of the research showed that there is possibility of the closing price manipulation to occur in the Istanbul Stock Exchange. Refer to the prior research by Güray Küçükkocaoğlu (2008), the author wants to adapt the methods to process data from the stock exchange to discover the possibility of the closing price manipulation to occur in Jakarta Stock Exchange. This paper consists of six sections. Section 2 explains about the Indonesia Stock Exchange, the research data and also the scope of the research, the intra-day pattern of the selected stocks from LQ45 Index from April 1 st 2008 – April 30th 2009 that is divided into 4 periods (Pre Crisis, Crisis, Recovery Crisis and Post Crisis). The model and method used in this research are presented in section 3. Section 4 explains the findings of the study whether the closing price manipulation exists or not in Indonesia Stock Exchange. Section 5 consists of summary and conclusion of this study. 2. Literature Review 2.1 The Indonesia Stock Exchange (IDX) The Indonesia Stock Exchange (IDX) is a stock exchange which based in Jakarta, Indonesia. Until June 2nd 2014, there are 496 companies that are listed as the members of Indonesia Stock Exchange. The trading system used is Jakarta Automated System so the trading system is fully computerized. The trading sessions in Indonesia Stock Exchange is presented in Table 1. 2 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 Table 1 Indonesia Stock Exchange trading hours from April 1st 2008 – 30th April 2009 Trading Session Day Time Pre Opening Monday-Friday 9:10-9:25 1st Session Monday-Thursday 9:30-12:00 Friday 9:30-11:30 Monday-Thursday 13:30-16:00 Friday 14:00-16:00 2nd Session 2.2 Data Set In this research, the data set is gathered from the daily transaction history of Indonesia Stock Exchange. The data includes trade time, trade price, trade quantity, trade value and the name of the brokerage houses that do the transactions. The data consists of stocks of the LQ45 index companies during the crisis time 1st April 2008 – 30th April 2009, which is divided into four period that is Pre Crisis (1st April 2008 – 31st July 2008), Crisis (1st August 2008 – 28th October 2008), Recovery Crisis (29th October 2008 – 22nd December 2008) and Post Crisis (23rd December 2008 – 30th April 2009). The names of the 5 companies chosen from LQ45 index are listed in Table 2. Table 2 Five Most Volatile Stocks from LQ45 Index Stock Code AALI INCO ITMG PTBA UNTR Company Name PT Astra Agro Lestari Tbk PT Vale Indonesia Tbk PT Indo Tambangraya Megah Tbk PT Bukit Asam Tbk PT United Tractors Tbk 2.3 The Pattern of Intra-day Returns and Standard Deviation After selecting 5 most volatile stocks from the LQ45 index, we inspect the patterns of their intra-day returns and standard deviations before analyzing the existence of the closing price manipulation. When the returns of the stocks are high at the closing of a trading day, whether it is positive or negative, there are possibilities of the closing price manipulation exists. The returns of the stocks are calculated every 15 minutes since the opening of the market until the closing of the market following the formula from Güray Küçükkocaoğlu (2008). Re,t = (pricet+15 – pricet)/ pricet (1) There are 22 calculation of returns for trading day Monday – Thursday and 18 calculations of returns for Friday. From the calculations, we can get the data of the returns of each stock for 15 minutes before the close and 15 minutes after the close. The changes in 3 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 returns of every 15 minutes interval since the opening of the market until the closing of the market for the five stocks during the pre crisis, crisis, recovery crisis and post crisis period are presented in Figure 1. It shows that the returns at the opening of the market are large and positive for Pre Crisis, Recovery Crisis and Post Crisis. Meanwhile, the returns at the opening for Crisis period are negative. The returns at the closing of the market for Pre Crisis, Recovery Crisis and Post Crisis show a positive increase. Figure 1 Intra-day Stock Returns for Pre Crisis, Crisis, Recovery Crisis and Post Crisis Return 0.015 0.01 0.005 16:00 15:45 15:30 15:15 15:00 14:45 14:30 14:15 14:00 13:45 13:30 12:00 11:45 11:30 11:15 11:00 10:45 10:30 10:15 10:00 9:45 -0.005 9:30 0 -0.01 -0.015 Pre Crisis Crisis Recovery Crisis Post Crisis Figure 1 presents the pattern of standard deviations of the five stocks for every 15 minutes interval from the opening of the market until the closing of the market for pre crisis, crisis, recovery crisis and post crisis period. From Figure 1, the standard deviations patterns for all of the periods overall are the same except for the crisis period. In the crisis period, the pattern of the standard deviation is higher at the opening and the closing of the market. 4 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 Figure 2 Intra-day Standard Deviations for Pre Crisis, Crisis, Recovery Crisis and Post Crisis Standard Deviation Pre Crisis Crisis Recovery Crisis 16:00 15:45 15:30 15:15 15:00 14:45 14:30 14:15 14:00 13:45 13:30 12:00 11:45 11:30 11:15 11:00 10:45 10:30 10:15 10:00 9:45 9:30 0.09 0.08 0.07 0.06 0.05 0.04 0.03 0.02 0.01 0 Post Crisis 2.4. Closing Price Manipulation Felixson and Pelli (1999) have done the study by making a regression model to find the existence of closing price manipulation by traders in Helsinki Stock Exchange. From the study, Felixson and Pelli (1999) find that there is only a little possibilities that manipulation of closing price exists in Helsinki Stock Exchange. Güray Küçükkocaoğlu (2008) replicates the model built by Felixson and Pelli (1999) to test whether the closing price manipulation exists in Istanbul Stock Exchange. The result is that it is possible for manipulation of closing price to exist in Istanbul Stock Exchange. Although for both of the studies from Felixson and Pelli (1999) and Güray Küçükkocaoğlu (2008) the statistical results are not significant enough for many stocks, the closing price manipulation still possible in the Helsinki and Istanbul Stock Exchange. 3. The Methodology and Model This study replicates the model developed by Güray Küçükkocaoğlu (2008) in replication of the first model developed by Felixson and Pelli (1999).The model, Return i,close-15 = Intercept + b1*DBuyi,d + b2*DSelli,d + ei,d (2) and Return i,close+15 = Intercept + c1*DBuyi,d + c2*DSelli,d + ei,d (3) Ho : b1 or c2<0, c1 or b2≥0 H1 : b1, c2>0 and c1, b2<0 5 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 The difference with the model used by Güray Küçükkocaoğlu (2008) is we do not use the DBoth dummy variable because only two dummy variable is enough to represent three conditions. We make some assumptions in this model by looking at the last minute of the closing of the trading day. The first one, if the stocks are active at the last minute so the price at the end of the day is higher than one minute before the closing, the dummy variable DBuy is given value 1, the DSell is zero. The second one, if the stocks are active at the last minute so the price at the closing of the trading day is lower than one minute before the closing, the dummy variable DSell is given value 1, the DBuy is zero. Third, if the stocks are active at the last minute so the price at the closing of a certain trading day is the same with one minute before the closing, the dummy variable DBuy and DSell are both given value 0. Last, if the stocks are active at the last minute so the price at the end of the trading day is the same with one minute before the closing but in the one minute range, the price is going up and down so that it becomes lower and higher than one minute before the close, the dummy variable DBuy and DSell are both given value 1. Based on the study from Güray Küçükkocaoğlu (2008), the regression coefficient b1 should be a positive value which means that the return of the stock before the close is higher if the traders are attempting to manipulate the closing price and the b2 should be a negative value which means that the return of the stock before the close is lower if the traders are attempting to manipulate the closing price. If the values of the regression coefficient fulfill the conditions mentioned earlier, the regression coefficient c1 must be negative which shows the stock return after the closing is lower if there is attempts from traders to do the manipulation of closing price on the previous day and the coefficient c2 must be positive which shows the stock return after the closing is if there is attempts from traders to do the manipulation of closing price on the previous day. The intercept in this model represents the normal returns when there is no manipulation attempts from the trader. 4. The findings The results of the model from the pre crisis, crisis, recovery crisis and post crisis periods using standard OLS-Regression are shown in this part. 6 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 4.1. Pre Crisis 4.1.1 Return Before the Close (Rc-15) From the intra-day returns, it is found that in the last 15 minutes the prices have the tendency to decline and it tends to go up in the last minute of the trading days. Result show that intercept for most stocks is negative, except for UNTR, which resemble the stocks returns before the closing are negative if the closing price manipulation does not exist. The positive signs for DBuy are noted in stocks AALI, INCO, ITMG and PTBA. The negative sign for DSell is only noted in stock UNTR. 7 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 4.1.2. Return After the Close (Rc+15) The intercept of the stocks mostly shows a negative signs in accordance to the declining movements of stocks returns in the 15 minutes of the opening in a certain trading day during the pre crisis period. We expect the stocks which DBuy coefficient is negative on the 15 minutes before the closing of the previous day should have negative coefficients after the close. The stocks that show this change are AALI and PTBA. For the DSell, we expect the stocks which have negative coefficients before the close should have positive coefficients after the close. The change is noted in the stock UNTR. Based on the result displayed in Tables 3 and 4, it is possible for closing price manipulation to exist in pre crisis period. We can observe positive DBuy before the close and negative DBuy after the close and negative DSell before the close and positive DSell after the close in the five most volatile stocks of LQ45 Index Stocks. However, the DBuy is more dominant than DSell. We can assume that closing prices of some stocks are manipulated to a higher price in the pre crisis period (April 1st 2008 – July 31st 2008). 8 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 4.2. Crisis Analysis 4.2.1. Return Before the Close (Rc-15) From the intra-day returns, it is found that in the last 15 minutes the prices have the tendency to rise and it tends to decline during the last minute. Result shows that intercept of most stocks is negative, except for AALI, which resemble the stocks returns before closing are negative if the closing price manipulation does not exist. The positive signs for DBuy are noted in stocks INCO, ITMG, PTBA and UNTR. The negative sign for DSell is only noted in stock AALI. 9 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 4.2.2. Return After the Close (Rc+15) The intercept of the stocks mostly shows a negative signs in accordance to the declining movements of stocks returns in the 15 minutes of the opening in a certain trading day during the crisis period. We expect the stocks which DBuy coefficient is negative on the 15 minutes before the closing of the previous day should have negative coefficients after the close. The stock that show this changes are INCO and PTBA. For the DSell, we expect the stocks which have negative coefficients before the close should have positive coefficients after the close. The change is noted in the stock AALI. Based on the result displayed in Tables 5 and 6, it is possible for closing price manipulation to exist in crisis period. We can positive DBuy before the close and negative DBuy after the close and negative DSell before the close and positive DSell after the close in the five most volatile stocks of LQ45 Index Stocks. However, the DBuy is more dominant than DSell. We can assume that closing prices of some stocks are manipulated to a higher price in the crisis period (August 1st 2008 – October 28th 2008). 10 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 4.3. Recovery Crisis 4.3.1. Return Before the Close (Rc-15) From the intra-day returns, it is found that in the last 15 minutes the prices have the tendency to rise and decline a little in the last minute of the trading day. The intercept for most of the stocks is negative, except for AALI and INCO, which resemble the returns of the stocks before the stocks are negative if the closing price manipulation does not exist. The positive signs for DBuy are noted in stocks INCO, ITMG, PTBA and UNTR. The negative signs for DSell are only noted in stock AALI, ITMG and PTBA. 11 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 4.3.2. Return After the Close (Rc+15) The intercept of the stocks mostly shows a positive signs in accordance to the rising movements of stock returns in the opening of a certain trading day in the recovery crisis period. We expect the stocks which DBuy coefficient is positive on the 15 minutes before the closing of the previous day should be negative after the close. The stock that show this changes are INCO, ITMG, UNTR. Meanwhile for the DSell, we expect the stocks which have negative coefficients before the close should have positive coefficients after the close. However, there is not any stocks that fulfill the expectation. Based on the result displayed in Tables 7 and 8, it is possible for closing price manipulation to exist in recovery crisis period. We can only observe positive DBuy before the close and negative DBuy after the close in the recovery crisis period. We can assume that closing prices of some stocks are manipulated to a higher price in the recovery crisis period (October 29th 2008 – December 22nd 2008). 12 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 4.4. Post Crisis 4.4.1. Return Before the Close (Rc-15) From the intra-day returns, it is found that in the last 15 minutes the prices have the tendency to decline and rise in the last minute of the trading day. The intercept for all of the stocks are negative, which resemble the returns of the stocks before the closing are negative if the closing price manipulation does not exist. The positive signs for DBuy are noted in all stocks (AALI, INCO, ITMG, PTBA and UNTR). There is not any negative signs for DSell observed in the before the close of post crisis period. 13 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 4.4.2. Return After the Close (Rc+15) The intercept of the stocks mostly shows a positive signs in accordance to the rising movements of stock returns in the opening of a certain trading day in the post crisis period. We expect the stocks which DBuy coefficient is positive on the 15 minutes before the closing of the previous day should be negative after the close. The stock that shows this change is PTBA. Meanwhile for the DSell, we expect the stocks which have negative coefficients before the close should have positive coefficients after the close. However, there are not any stocks that fulfill the expectation. Based on the result displayed in Table 9 and 10, it is possible for closing price manipulation to exist in post crisis period. We can observe positive DBuy before the close and negative DBuy after the close. There is only change in DBuy that can be observed in this post crisis period. We can assume that closing prices of some stocks are manipulated to a higher price in the post crisis period (December 23rd 2008 – April 30th 2009). Based on the study by observing the regression coefficient of variables of the regression, there is possibility of the closing price manipulation exists in Indonesia Stock Exchange during the four period of the crisis time from April 1st 2008 – April 30th 2009. The manipulation that occurs during all periods is manipulation to make the closing price higher. 14 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 5. Summary and Conclusions This study examines the existence of closing price manipulation in Jakarta Stock Exchange during crisis time 2008 – 2009. Based on the study, it is possible for manipulation of closing price to exist in Indonesia Stock Exchange during the four crisis period of April 1st 2008 – 30th April 2009. The effort to increase the closing price into a higher price is greater than the effort to make the closing price lower. From the result, although in the middle of crisis, mostly the manipulations occur are to increase the prices into higher level. This study is the first study to examine the existence of closing price manipulation in Indonesia Stock Exchange. The result consistent with the previous studies in Helsinki Stock Exchange by Felixson and Pelli (1999) and Güray Küçükkocaoğlu (2008) in Istanbul Stock Exchange, which the results come out with statistical results that are insignificant and weak, shows that closing price manipulation appears possible in these stock exchanges. The manipulation of closing price does not exist every day. The manipulation attempts at close, according to Güray Küçükkocaoğlu (2008) could be covered up by the large volumes of buy and sell orders effected by firm specific and macroeconomic news. The future research of this study could be the mechanism on how the closing price manipulation could be prevented. References Allen, F., Gale, D.(1992)’Stock Price Manipulation’, Review of Financial Studies, Vol. 5, pp. 503-529. Allen, F., Gorton, G.(1992)’Stock price manipulation, market microstructure and symmetric information’, European Economic Review, Vol.36, pp. 624-630. Felixson, K. Pelli, A.(1999)‘Day-end returns – stock price manipulation’, Journal of Multinational Financial Management, Vol. 9, pp. 95-127. Küçükkocaoğlu, G.(2008)‘Intra-Day Stock Returns and Close-End Price Manipulation in the Istanbul Stock Exchange’, Frontiers in Finance and Economics, Vol. 5, No.1, pp 1-39 Jarrow, R.A.(1994)‘Derivative security markets, market manipulation, and option Pricing’, Journal of Financial and Quantitative Analysis, Vol. 29, pp. 241-261. Kumar, P and Seppi,(1992)’D.J. Futures Manipulation with ‘Cash Settlement’’,Journal of Finance, Vol. 47, pp. 1485-1502. Kyle, A.S.(1984)’A Theory of Futures Market Manipulations’, In R.W. Anderson,ed., The I ndustrial Organization of Futures Markets. Lexington,Mass.: Lexington Books. 15