Proceedings of Annual Shanghai Business, Economics and Finance Conference

advertisement

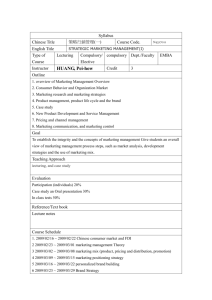

Proceedings of Annual Shanghai Business, Economics and Finance Conference 3 - 4 November 2014, Shanghai University of International Business and Economics, Shanghai, China ISBN: 978-1-922069-63-4 Analysis of Success and Failure for Non-Chinese Companies Building Brand Value in China R.K. Marjerison The objective of this paper is to present an overview of lessons learned on marketing in China, specifically creating and managing brand value for western and non-Chinese businesses and on how to and how not to build brand awareness and brand value in the Chinese market. The first case considers the failure, against all odds, of eBay; and the second case considers the enormous success of Kentucky Fried Chicken (KFC) in the same market. In the summary section we conclude that the definitive difference between the two cases, and a likely driving force in their respective failure and success , is the extent to which each company was able, or willing, to localize and regionalize their respective products/services to meet the expectations, preferences and cultural norms of the Chinese consumers. In doing so, KFC was able to build a powerful and valuable brand, while eBay achieved suffered crushing losses and eventual withdrawal from the market. JEL Codes: F20, F23, M14, M31 1. Introduction As large international and multinational corporations continue to pursue opportunities in China, targeting the immense and steadily growing consumer marketplace, they face a complicated business environment. Much has been written about the nature of joint venture structures and operations in China however, this paper considers the complicated nature of creating and managing brand value in China. The first generation of western brands that entered the Chinese market were very successful primarily based on their appeal as western and unique. Subsequently, as Chinese consumers’ behavior and purchasing patterns have evolved, it is no longer enough to have international or western brand value in the Chinese market. *Associate Professor R.K. Marjerison, Business Department, Royal Thimphu College, Bhutan. Email: RMarjerison@gmail.com 1 Proceedings of Annual Shanghai Business, Economics and Finance Conference 3 - 4 November 2014, Shanghai University of International Business and Economics, Shanghai, China ISBN: 978-1-922069-63-4 2. Methodology - Case Studies To learn more about what characteristics contribute to success or failure of large multinational organizations seeking to enter the Chinese market, we compared the strategies or two well-known and established international brands; one, eBay a pronounced failure and the other KFC, a resounding success and one,. Considered were the respective marketing strategies, the respective philosophies regarding the recruitment of senior and mid-level management, and the extent to which the core activities of the organizations were adapted, revised or modified from the way they operate in their original or ―home‖ markets. 3. eBay While the Chinese economy has continued to grow at an incredible rate in nearly every measureable manner, eBay floundered and failed where few considered such failure was possible. Given the considerable strengths and assets that eBay enjoys in the North American market, particularly its powerful brand recognition and brand value, how then could the company have done so poorly in Asia in general, and in China in particular? A systematic evaluation of the impact of eBay’s leveraging of its assets and core strengths in China should include the mention of eBay’s considerable liquid financial assets, which, while necessary in any attempt to penetrate the Chinese market on a large scale in any industry, does not set the company apart in any meaningful manner. There are many wealthy companies willing to invest in growing their businesses in China, as well, there is no shortage of investment capital available worldwide for investment in China. Therefore, eBay’s wealth, and the willingness to invest in the Chinese market is neither a critical success factor nor a key differentiator. A second major asset of eBay is its brand value. Many companies entering into new or developing markets, including some expanding into China, have leveraged their brand value to play a role in their business strategy and success. In the case of eBay, the brand was relatively unknown in China, and moreover, unlike the case of some consumer goods or luxury brands known for their quality or for fashion/status/prestige value, eBay does not itself have a brand that can be worn by, or displayed by consumers. Therefore, the eBay brand, while very valuable in the North American market, proved to have little to no value in China. This unique situation could have been an advantage, or a disadvantage for eBay in China depending how it was incorporated into a strategy of brand value creation and management. The eBay website, arguably the core of eBay’s very successful business model, differs stylistically from typical Chinese websites which tend to be less menu-driven and have much more content per page. As well, the color scheme of the eBay page is very different from what Chinese users are accustomed to, or expect. While the stylistic or fashion perspective of a website may not seem to be a critical matter in the success or failure of an e-commerce website/business, ease of use and how intuitive a website is for users is typically very important to end-user satisfaction and ―usability‖. Just as important, perhaps more telling is 2 Proceedings of Annual Shanghai Business, Economics and Finance Conference 3 - 4 November 2014, Shanghai University of International Business and Economics, Shanghai, China ISBN: 978-1-922069-63-4 that eBay did not attempt to adapt its user interface, (website), for Chinese users. This could be seen as either lacking in awareness of the differences, poor due diligence, or possibly simply not recognizing the stylistic differences between western and Chinese web design and the importance of adapting to the customers’ preferences and expectations. Evidence on the importance of adapting to local or regional user preferences include the findings of Quaddus; ―The results indicate that a subject’s norms, trust and behavioral control have significant impact on the buying intention via on-line auction but personal innovativeness and attitude don't.‖ (Quaddus, 2007) This is important as it envelops the core of the significant cultural differences between China and the U.S. ―When eBay entered the China market, Jack Ma, founder and CEO of Alibaba, was alarmed that ―someday, eBay would come in our direction.‖ He knew too well that there was no clear distinction between small businesses and individual consumers in China. As a defensive strategy, Ma decided to launch a competing consumer-to-consumer (C2C) auction site, not to make money, but to fend off eBay from taking away Alibaba’s customers.‖ (Wang, 2010) The new Web site named Taobao—meaning ―digging for treasure‖—was launched free of charge for individuals buying and selling virtually any consumer goods, from cosmetics to electronic parts. It is important to note the differing ways in which relationships are created, developed and maintained in China and the importance of doing so. Research on the success of eBay’s main competitor in China, Taobao, makes clear the importance of managing social and social media based relationships; ―The largest Chinese online auction company Eachnet, was purchased by eBay but faced tough competition from a new Chinese online auction company, Taobao. Now Taobao's market share is twice as large as eBay's. Why has eBay quickly lost its market share to the newly launched Taobao? What is the nature of this market? On the premise of the customer relationship management (CRM) process model, we conduct a case study to describe the whole picture of this market and to find out what strategies are most suitable to the current Chinese market and likely to lead to success. Our study shows that the company to customer (C2C) market in China is a young and experience‐ seeking market whose customers are price‐sensitive, willing to try new services and new vendors, and comfortable with switching. The market is also a social environment where customers' loyalty to a vendor can be built more easily by the vendor's social relationship management service than by the transaction service. The findings suggest that vendors in China's C2C market should not only provide a functional service to acquire customers, but also foster the development of social marketing to retain customer loyalty. The social marketing design should be tailored to Chinese culture.‖ (Chen, 2007) 3 Proceedings of Annual Shanghai Business, Economics and Finance Conference 3 - 4 November 2014, Shanghai University of International Business and Economics, Shanghai, China ISBN: 978-1-922069-63-4 This indicates clearly that marketing, at least in this case, is more effective when it is word of mouth than when it is managed through the vendor’s website. Consistent with the evidence above is the fact that eBay did not incorporate the important functionality in the website design that would allow a forum for buyer feedback which may have served as a partial substitute for personal referral. Customer feedback is an important part of the U.S. based eBay model and proved to be even more important in the Chinese market where much depends upon relationships and personal recommendations. To grow brand awareness in China, any company should consider a marketing strategy that has at its core the ability to leverage existing personal relationships between its customers and its potential customers. Chinese are hesitant to do business with someone with whom they have absolutely no relationship with and no introduction or recommendation. This recommendation or referral concept is a deeply imbedded part of Chinese culture and while imprecisely defined in Western business texts, is very important in personal and commercial relationships in China. There is some uncertainty as to the scalability of this concept, known as ―Guanxi‖, as it is based on personal relationships, not inter-corporate relationships, but it is very real, and very important. ―Guanxi means good connections. Although guanxi is often said to be the source of sustained competitive advantage for foreign companies doing business in China, there is little theoretical basis for this view. What is known is that guanxi has to be valuable, rare, and imperfectly imitable before it can lead to a sustained advantage. Even if a certain advantage is gained, it can be difficult to sustain, because guanxi can be disrupted by something as simple as staff mobility. By suggesting ways for companies to protect their guanxi, it is hoped that this important aspect of Chinese management may be made more understandable to westerners and its use by western managers enhanced and encouraged.‖ (Tsang 1998) Research makes known the importance of acknowledging and adapting business strategies and policies to reflect the preferences and culture of the local or regional customers and business partners. ―Cultural conditioning is so powerful that it defines thought, determines behavior, and limits expression. If you understand your counterpart’s cultural conditioning, you will have a great advantage. An understanding of how foreign cultures dominate and permeate foreign economies, politics, and business is vital for negotiating and managing abroad.‖ (Leppert, 1994) Another related aspect of personalization of the user experience that was not included in the China version of the eBay website is a forum for public feedback. While still not based on personal relationships, such feedback may have given users enough of a level of comfort to use the eBay service because such functionality is similar and vaguely related to the Guanxi notion of relationships or referrals. The ample research on customer feedback made public is well represented by the following: 4 Proceedings of Annual Shanghai Business, Economics and Finance Conference 3 - 4 November 2014, Shanghai University of International Business and Economics, Shanghai, China ISBN: 978-1-922069-63-4 ―This study revealed cross effects of negative ratings on the performance of a seller. By separating the cross effects of magnitude and reputation of negative ratings, this study demonstrated that positive ratings have a significant positive impact on the performance of sellers, while negative ratings have negative reputation effects and positive magnitude effects. (Ye, 2009) The public feedback functionality has proven to be important and valuable in the U.S. operations of eBay. Whether and to what extent such functionality would be useful or of what importance to eBay China is uncertain, however, researcher Fong’s work indicates its importance; ―The important influence of peer recommendations on consumer purchases has been strongly established. However, recent growth in electronic discussion boards has increased the potential for electronic word-of-mouth (eWOM) between people who have never met. This study examines and compares the extent of eWOM on electronic discussion boards within U.S. and China-based websites. Using online surveys (N = 214) and observation of discussion postings (N = 3,029), data was collected from the ―Digital Photography‖ discussion boards on eBay, Yahoo, and Google (U.S. based websites) and EachNet, Sina, and Netease (China based websites). The findings indicated both similarities and differences in the information giving and seeking behaviors, with the U.S. participants more likely to provide information than Chinese participants, resulting in the U.S. based discussion boards containing a richer source of information relative to requests.‖ (Fong, 2006) In review of the issues surrounding the eBay website, appearance and functionality, we consider the following findings; ―The second challenge is the localization of market services. Online businesses originating from the western countries seem to have difficulties in adapting to the Chinese environment and localizing their business and web sites. It seems ineffective to simply apply previous business strategies from western countries to the Chinese marketplaces.‖ (Li, 2008) With a different philosophy and a very different approach the market, Alibaba was able to capitalize and and seize market share in China even though the brand was virtually unknown the U.S. ―In 2004, eBay had just entered China and was planning to dominate the China market. Alibaba was a local Chinese company that helped small- and medium-sized enterprises conducting business online. Most people in the West had barely heard about it.‖ In summary, we see that the assets and strengths of eBay in the North American market, its brand value, available cash, web-site functionality and strategic integration with the payment processer and the logistics organizations, are all either of questionable value in China, or of no value at all. Further, combined with the lack of due diligence and localization or adaptation 5 Proceedings of Annual Shanghai Business, Economics and Finance Conference 3 - 4 November 2014, Shanghai University of International Business and Economics, Shanghai, China ISBN: 978-1-922069-63-4 to cultural differences, the inability to create brand awareness and brand value made eBay’s foray into China a dismal failure. 4. KFC (Kentucky Fried Chicken) In contrast to the failure of eBay in China we consider KFC, an unparalleled success in the Chinese market for a U.S. based company, building both brand awareness and brand value. The reasons for the success of KFC may be numerous and varied, and there has been much speculation and research on this topic. In comparing KFC China to eBay China and attempting to identify the contrasts between the two, we are able to identify some patterns and some likely explanation for their different results in the Chinese market. ―No company illustrates Asia’s potential better than Yum! Brands, the proprietor of KFC and Pizza Hut. KFC opened its first restaurant on China’s mainland in 1987, and now operates 2,497 in the country (compared with 5,253 in the United States), and counts on it for nearly 30 percent of global revenue. Yum!’s total sales there, which soared 31 percent last year, helped the company shrug off the US recession. CEO David Novak, who tells investors that Yum!’s business in China is merely ―in the first inning of a nine-inning ball game,‖ vows the company will eventually have more than 20,000 restaurants in the country. He says KFC in China ―can be every bit as big as McDonald’s in the US.‖ (Yang 2011) One aspect of doing business in China is the different behavior of consumers in general, and more specifically the behavior of the market demographic on which KFC relies for its customer base. KFC in China was able to reposition itself in a distinct manner, differently than its traditional brand image in the U.S.. Research by Witkowski helps explain this change; ―This research measured and compared the brand identity of Kentucky Fried Chicken (KFC) in China and the United States. Brand identity was defined as the customer impressions of four different KFC identity elements – properties, products, presentations, and publications. A survey of young consumers in the two countries (n = 795), showed that the Chinese respondents were more apt to eat within KFC restaurants, and spend more time doing so, than the Americans. The Chinese also had much more positive impressions of KFC than their American counterparts. Brand identity impressions were correlated with overall customer satisfaction and with future patronage intentions for both groups, but much more so for the Americans. These findings support a model where differences in cultural frames of reference lead consumers to actively localize the brand identity of this nominally globalized product.‖ (Witkowski, 2003) 6 Proceedings of Annual Shanghai Business, Economics and Finance Conference 3 - 4 November 2014, Shanghai University of International Business and Economics, Shanghai, China ISBN: 978-1-922069-63-4 There is extensive research supporting the idea that Chinese consumers enthusiastically embrace Western products and brands as they become available in China. According to the Financial Times; ―China swallows fast food at an even faster rate than ever, the success of Kentucky Fried Chicken (KFC) and McDonald's in China is the result of a transformation of China's lifestyles, which are becoming more geared to speed and convenience. There is also some sense of curiosity and faddishness on the part of Chinese youth toward Western fast food restaurants. There are now over 800 KFCs and half as many McDonald's in China.‖ (Cheng, 2003) This is one example of many research reports on this topic of Chinese consumers perceiving Western brands, in this case fast food brands, not only as dining alternatives, but as prestige brands, meaning that at least part of the value is in the status or brand alone, not just in the value of the food. Note the date on the Cheng research as 2003; this is important in tracking trends in the rapidly changing market conditions of China. In contrast to the research of Cheng, done just over ten years ago, there was already evidence of a rebound effect in consumer behavior away from favoring Western brands toward favoring Chinese brands. While some will argue that this shift in consumer behavior is a result of more and better local products/services, others believe it is a shift in perception of brand value or ―prestige‖ value. For example; ―In the People’s Republic of China (PRC), consumers have recently shown a tendency to shift away from foreign products in preference for local offerings. Some commentators have speculated that this new market phenomenon is a result of government intervention, consumer ethnocentrism, and improvement in the quality of local products. In this study, the authors offer an alternative reason, which pertains to the fading symbolic value of foreign products in the PRC market.‖ (Zhou, 2003) This indicates that there was already a trend towards the de-glamorization of Western brands in China which would be entirely reasonable as the novelty of those brands’ offerings wore off and consumers returned to their pre-Westernization preferences. ―The results challenge the conventional wisdom that improvement in the quality of local products is the main cause of the decreasing competitiveness of foreign products in the PRC.‖ (Zhou, 2003) Timing of the research related to brand value and brand preference, specifically as a factor in the success of KFC is important. Research results that appear to conflict may in fact be a function of overlapping time lines in rapidly changing market conditions. For example, supporting the idea that part of the success of some Western brands, in this case the fast food brands of KFC and McDonalds is the novelty or foreign and exotic nature of the product brand is this research by Shen; ―The empirical analysis based on these predictions consistently suggests that market learning is more likely to explain the positive effect of KFC on 7 Proceedings of Annual Shanghai Business, Economics and Finance Conference 3 - 4 November 2014, Shanghai University of International Business and Economics, Shanghai, China ISBN: 978-1-922069-63-4 McDonald's and that demand expansion is more plausible with McDonald's positive spillover on KFC. In other words, the results are consistent with the presence of KFC signaling market demand potential and growth to McDonald's and the presence of McDonald's helping to cultivate consumer taste and generate demand for Western fast food, which benefits KFC.‖ (Shen, 2014) The implication from this research is that the two brands, KFC and McDonalds are not competing for a share of the fast food market business in China, but rather are part of a trend towards favoring Western brands by Chinese consumers. More importantly, the indication is that brand value is a key factor in the success of both companies. In considering the different positions that KFC has managed to place its brand in the US and China, and how such brand positioning has been accomplished it is useful to consider the different ways that consumers react to marketing and brand positioning between the two countries. In research on this topic Cui reports that; ―Previous research has attributed the differences in consumer attitudes toward marketing between countries to either the life cycle of consumerism development or cultural values such as individualism. We conducted a crosscultural study of China and Canada to test the two competing hypotheses. The survey results suggest that Chinese consumers are more positive about marketing and have a higher level of satisfaction than their Canadian counterparts. But the Chinese report more problems with marketing and less positive attitudes toward consumerism than the Canadians. While Chinese consumers are less likely to complain or engage in negative word-of-mouth, they are more supportive of government actions and public resolution. Consumerism and individualism have significant negative correlations with consumer attitudes toward marketing for the Canadians, but not for the Chinese. The cross-cultural variations may reflect the cultural values (i.e. individualism) and the role of government institutions, which are different between the two countries. These findings have significant implications for managing customer relationships in different countries and for interpreting the differences in consumer attitudes in cross-cultural studies. (Cui, 2008) While Cui’s research is on Canadian vs. Chinese consumer behavior and perceptions, it can be useful in generalizing the differences between cultures in general, and assuming a similarity between American and Canadian consumers can help to understand the success of the positioning of the KFC brand in China. Perhaps the key factor in the success of KFC in China is that from the onset KFC understood the importance of localization or regionalization in its business and marketing strategies. The importance of such a strategic view is critical and well put by Guild; ―McKinsey’s experience suggests that even the most sophisticated multinationals must change significantly to realize Asia’s growth potential. The region is as diverse as it is vast. Its markets come in a bewildering assortment 8 Proceedings of Annual Shanghai Business, Economics and Finance Conference 3 - 4 November 2014, Shanghai University of International Business and Economics, Shanghai, China ISBN: 978-1-922069-63-4 of sizes and development stages, and its customers hail from a multitude of ethnic and cultural backgrounds. Their tastes and preferences evolve constantly. The speed and scale of change in Asian consumer markets can surprise even experienced executives. To meet the challenge, global companies will have to organize themselves regionally to coordinate strategy and use resources in the most efficient way while at the same time targeting the tastes of consumers on a very local level.‖ (Guild, 2009) This philosophy was embraced by KFC and evidenced through implementation on two levels as both the menu offerings were adapted to Chinese regional and local tastes, and the HR strategy included hiring local Subject Matter Experts, (SMEs) as part of the management of the business, as well as unskilled or semi-skilled labor to work in the restaurants. Recognizing the importance of deeply imbedded cultural traditions, KFC was able to work within the Chinese culture, rather than at odds with traditions. This is evidenced by KFC including the Chinese matter of Guanxi into its business strategy. ―For instance, when KFC opened its largest chain store in Tiananmen, Beijing, in 1987 its good Guanxi with Chinese central government helped them, to a large extent, to get the building permission.‖ (Luo, 2000) It has been hypothesized that the importance of traditional ways of conducting business in China, including Guanxi, has diminished since the opening up of trade with the west. This idea is contradicted by the research of Yang, who concludes just the opposite - that in fact Guanxi remains a critical part of success even for multi-national corporations seeking to do business or build brand awareness or value in China. ―Many scholars argue that the importance of Guanxi has declined since China’s opening-up and reform policies have reached an advanced stage. So, this paper has also discussed whether the importance of Guanxi to multinational companies in China has declined or not. It reached to the conclusion that Guanxi remains significant for international enterprises doing business in China.‖ (Yang, 2011) It is certain that KFC is enjoying considerable success in China, and all indicators are pointing towards a high probability that the success will continue for the foreseeable future. 5. Relevant Findings and Recommendations Perhaps the key factor in the success of KFC in China is that from the onset KFC understood the importance of localization or regionalization in its business and marketing strategies. This was implemented on two levels as both the menu was adapted to Chinese regional tastes, and the HR strategy included hiring local Subject Matter Experts, (SMEs) as part of the management of the business as well as unskilled or semi-skilled labor to work in the restaurants. The importance of engaging support of local ―experts‖ or ―consultants‖ in China simply cannot be overemphasized and is well put by Barr; 9 Proceedings of Annual Shanghai Business, Economics and Finance Conference 3 - 4 November 2014, Shanghai University of International Business and Economics, Shanghai, China ISBN: 978-1-922069-63-4 ―There are many barriers to doing business in China: most notably, language. Only a very small percentage of the population speaks English and very few factories have English speaking personnel. There are also many rules and regulations as to how business can be conducted in China and they are changing rapidly and are in a major state of flux.‖ (Barr, 2003) Further support of the idea that sensitivity to local or regional preferences is critical can be found in research on related businesses to KFC. ―Brands are powerful symbols that reflect not only the image with which marketers hope to imbue them but also the cultural milieu in which they are imbedded. If that milieu is in a state of flux, brands can come to represent some surprising ideas and values to which marketing efforts must be sensitive. In this research, the authors relate the nature of societal change, a common occurrence in many developing markets and especially China, to evaluation of a brand by a broad cross-section of urban Chinese consumers. Using the methodology of scenario completion, the authors reveal that the McDonald’s brand is evaluated in the context of societal norms and values that are brought up in various usage situations. Brand evaluations can be inconsistent and often paradoxical depending on the context. The results suggest that marketers should be closely involved with the way their brand is interacting with cultural values in transitional markets.‖ (Eckhardt, 2002) Depending on the product or service being considered, and the demographic of the target or identified consumer it can be necessary to shape the marketing strategy very differently in China. For example, Chinese in rural areas have very different purchasing patterns than those in urban areas. Many Western brands, including KFC, have identified their target consumers as primarily urban and with greater discretionary income. Marketing to such a demographic is a specialized task and may require rapid identification and execution of marketing strategies such as the use of social or innovative media. This is supported by research conducted by Accenture Consulting. ―Accenture research shows that creating a successful brand in this environment requires a sophisticated understanding of what segments of the Chinese markets value in a brand and a willingness to reach China's increasingly choosy consumers through innovative media.‖ (Nunes, 2010) Further evidence of the rapidly changing nature of the Chinese consumer is provided by Michael of BCG, ―China may still be classified as an emerging market, but on the internet it has arrived. By 2015, China will add nearly 200 million users, reaching an internet population of more than 700 million—almost double the combined number of Japan and the U.S.‖ (Michael, 2012) While this research concerns internet usage, not direct brand promotion, it can be generalized that internet technology savvy consumers will be likely to respond to nontraditional means of brand promotion as reported by Michael; ―China has become a major 10 Proceedings of Annual Shanghai Business, Economics and Finance Conference 3 - 4 November 2014, Shanghai University of International Business and Economics, Shanghai, China ISBN: 978-1-922069-63-4 internet market with increasingly sophisticated consumers, who are online 3.6 hours a day. In a few years, it will likely become the largest online retail market in the world. Companies that want to win in China must understand the rapidly evolving digital lifestyles of these consumers.‖ (Michael, 2012) In summary, the very demographic that is sought by prestige or status-oriented brands will be a demographic that is more likely to be reached over time through innovative media as evidenced by Nunes (above). It is difficult to hit the fast moving target that is the Chinese consumers’ preferences and behavior, nevertheless, some facts that may be useful in marketing strategy development do stand out. As China overtakes the U.S. for the largest number of internet users, it will be important for any organization seeking to build brand value to use the web effectively. ―The Internet is an exciting new avenue for the advertising industry: it increases the value of advertising by making it measurable and targetable as never before. Spending on online advertising in China was a paltry 6 billion RMB in 2006, but had risen to 32 billion in 2010, a CAGR of nearly 50%. That trend is expected to continue, with forecasts putting the total spend for 2011 at around 51 billion RMB, at RMB 80 billion in 2012, and approaching RMB 100 billion in 2013.‖ (Cainey, 2012) From these findings we can draw some conclusions both regarding the reasons the failure of eBay and for the success of KFC, specifically that western multi-nationals wishing to successfully do business in China must regionalize and adapt to Chinese culture and customs, as well as to customer expectations and preferences. We can also identify some areas of focus for KFC going forward as it attempts to continue its success through brand value creation and maintenance. It is noteworthy that some of the marketing strategies used by KFC in the past, and suggested as part of an ongoing strategy, might very well be generalized as useful for other brands seeking to establish, maintain or build brand value in China. 6. Suggestions for Additional or Related Research Finally, a suggestion for further research would be to consider the health implications of introducing higher processed western fast food to the population of China. This consideration comes to light as no discussion of the introduction of Western brands, particularly of fast food restaurant and food brands into China would be complete without mention of some of the potential downside issues for the Chinese consumers and well worthy of further consideration. Foods that have traditionally been part of the local dietary habits are being marginalized or at least partially replaced by non-local foods. For example, Hagen Daaz ice cream is popular in many cities in China, even though dairy has not traditionally been a part of the local dietary habits in many of these areas. Another good example of this consideration would be noted by Witkowski; ―Anti-globalization critics have accused marketing in developing countries of undermining local cultures, placing intellectual property rights ahead 11 Proceedings of Annual Shanghai Business, Economics and Finance Conference 3 - 4 November 2014, Shanghai University of International Business and Economics, Shanghai, China ISBN: 978-1-922069-63-4 of human rights, contributing to unhealthy dietary patterns and unsafe food technologies, and promoting unsustainable consumption.‖ Witkowski (2005) 12 Proceedings of Annual Shanghai Business, Economics and Finance Conference 3 - 4 November 2014, Shanghai University of International Business and Economics, Shanghai, China ISBN: 978-1-922069-63-4 References Barr, Asia, S. E. 2003. Doing business in China. World Pumps, 36. Cainey, A., Xu A., Hendrichs, M., & Wong, T. 2012. China’s Digital Champions. Booz & Compant. Chen, J., Zhang, C., Yuan, Y., & Huang, L. 2007. Understanding the Emerging C2C Electronic Market in China: An Experience‐Seeking Social Marketplace. Electronic Markets, 17(2), 86-100. Cheng, T. O. 2003. Fast food and obesity in China. Journal of the American College of Cardiology, 42(4), 773-773. Cui, G., Chan, T. S., & Joy, A. 2008. Consumers' attitudes toward marketing: a cross-cultural study of China and Canada. Journal of International Consumer Marketing, 20(3-4), 8193. Eckhardt, G. M., & Houston, M. J. 2002. Cultural paradoxes reflected in brand meaning: McDonald’s in Shanghai, China. Journal of International Marketing,10(2), 68-82. Fong, J., & Burton, S. 2006. Electronic Word-of-Mouth: A Comparison of Stated and Revealed Behavior on Electronic Discussion Boards. Journal of Interactive Advertising, 6(2), 7-62. Gaff, B. M., Choy, K., & Chan, J. 2012. Doing Business in China. Computer,45(8), 11-13. Guild, T. 2009. Think regionally, act locally: Four steps to reaching the Asian consumer. McKinsey Quarterly, (4). Leppert, P. A. 1994. Doing business with China. Jain Publishing Company. Li, D., Li, J., & Lin, Z. 2008. Online consumer-to-consumer market in China–a comparative study of Taobao and eBay. Electronic Commerce Research and Applications, 7(1), 5567. Luo, Y. D. 2000. Guanxi and Business. Singapore: World Scientific Nunes, P. F., Piotroski, S. A., Teo, L. L., & Matheis, R. M. (2010). Seven lessons for building a winning brand in China. Strategy & Leadership, 38(1), 42-49. Michael, D. C., & Zhou, Y. 2012. China’s digital generations 3.0: Digital The Online Empire. Boston Consulting Group. 13 Proceedings of Annual Shanghai Business, Economics and Finance Conference 3 - 4 November 2014, Shanghai University of International Business and Economics, Shanghai, China ISBN: 978-1-922069-63-4 Quaddus, M., Xu, J., & Hoque, Z. 2005, August) Factors of adoption of online auction: a China study. In Proceedings of the 7th international conference on Electronic commerce (pp. 93-100). ACM. Shen, Q., & Xiao, P. 2014. McDonald's Companions?. Marketing Science and KFC in China: Competitors or Tsang, E. W. 1998. Can guanxi be a source of sustained competitive advantage for doing business in China? The Academy of Management Executive, 12(2), 64-73. Wang, H. H. 2010. The Chinese dream: The rise of the world's largest middle class and what it means to you. Bestseller Press. Witkowski, T. H., Ma, Y., & Zheng, D. 2003. Cross-cultural influences on brand identity impressions: KFC in China and the United States. Asia Pacific Journal of Marketing and Logistics, 15(1/2), 74-88. Witkowski, T. H. 2005. Antiglobal challenges to marketing in developing countries: exploring the ideological divide. Journal of Public Policy & Marketing,24(1), 7-23. Ye, Q., Li, Y., Kiang, M., & Wu, W. 2009. The impact of seller reputation on the performance of online sales: evidence from taobao buy-it-now (bin) data.ACM SIGMIS Database, 40(1), 12-19. Yang, F. 2011. The Importance of Guanxi to Multinational Companies in China. Asian Social Science, 7(7). Zhou, L., & Hui, M. K. 2003. Symbolic value of foreign products in the People’s Republic of China. Journal of international marketing, 11(2), 36-58. . 14