Bank Stock Performance and Bank Regulation around the Globe Matthias Pelster

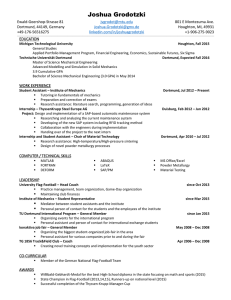

advertisement

Bank Stock Performance and Bank Regulation around the Globe Matthias Pelster*, Felix Irresberger† and Gregor N.F. Wei߇ We analyze the effect of bank capital, regulation, and supervision on the annual stock performance of global banks during the period of 1999-2012. We study a large comprehensive panel of international banks and find that higher Tier 1 capital decreases a bank’s stock performance over the whole sample period. However, during turbulent times stocks of more highly capitalized banks perform significantly better. Additionally, we find strong evidence that banks that are more likely to receive government bailout during financial distress realize smaller stock performance. In contrast, we find no convincing evidence that banks that generate higher non-interest income have a higher performance. Keywords: Bank stock performance, bank regulation, capital, implicit bailout guarantee. JEL Classification: G01, G21. __________________________________________________________ * Corresponding author: Otto-Hahn-Str, 6a, D-44227 Dortmund, Germany, e-mail: matthias.pelster@udo.edu. † Otto-Hahn-Str. 6a, D-44227 Dortmund, Germany, e-mail: felix.irresberger@tu-dortmund.de. ‡ Otto-Hahn-Str. 6a, D-44227 Dortmund, Germany, e-mail: gregor.weiss@tu-dortmund.de. All TU Dortmund University