Proceedings of Annual Shanghai Business, Economics and Finance Conference

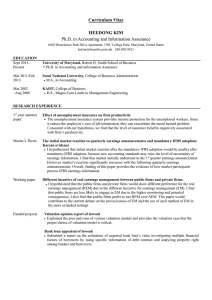

advertisement

Proceedings of Annual Shanghai Business, Economics and Finance Conference 3 - 4 November 2014, Shanghai University of International Business and Economics, Shanghai, China ISBN: 978-1-922069-63-4 Earnings Management by Top Chinese Listed Firms in Response to the Global Financial Crisis Guanglu Xu* and Xu-Dong Ji** This paper examines Chinese firms’ earnings management behaviors, including both accrual and cash flow based earnings management, before and during the Global Financial Crisis (GFC) from 2004 to 2009. The results show that the top Chinese listed firms, especially those covered by the government stimulus package, engaged in income-increasing cash flow based earnings management. The results reflect the positive impact of the 4 trillion RMB stimulus package launched by the Chinese government. In addition, our findings show that managers increasingly prefer real earnings manipulations to accrual based earnings management. JEF Codes: M21, M41 and M48 1. Introduction At the start of the Global Financial Crisis (GFC) in 2008 China’s economy experienced a significant downturn, which could be illustrated by the considerable decreases in China’s GDP, export, and the stock market value. As a response to these influences of the GFC, the Chinese government launched a series of measures within which the most remarkable measure is the so-called 4 trillion RMB stimulus package. Thanks to these swift and effective governmental interventions China’s economy came back to its normal level in a quite short period (Yu, 2009). The primary objective of this paper is to examine the earnings management of the top Chinese listed firms in response to the GFC through both accrual based earnings management and real activities manipulations, while taking into consideration the influence of Chinese government’s interventions. Our results show that the top Chinese listed firms, especially those covered by the stimulus package, engaged in income-increasing cash flow based earnings management by manipulating production costs downwards in response to the GFC. On the other hand, no significant results are found that the top Chinese listed firms using discretionary accruals to manipulate earnings during GFC period. The results are robust after controlling the influence of firm characteristics, such as size, leverage, audit quality, performance, and growth, etc. Our study contributes to the literature in the following aspects. Firstly, it investigates the top listed Chinese firms’ earnings management behaviors in response to the GFC. Secondly, it assesses the effectiveness of the stimulus package launched by the Chinese government, and it demonstrates that firms covered by the stimulus package managed earnings upwards to boost or to smooth performance rather than taking a bath. Thirdly, this study provides the evidence supporting the argument that managers increasingly prefer real earnings manipulations to accrual based earnings management nowadays (Roychowdhury, 2006; Li, McDowell and Moore, 2008; Cohen et al, 2008). *Guanglu Xu, Department of Accounting, La Trobe University, Australia. Email: g5xu@students.latrobe.edu.au **Dr. XuDong Ji, Department of Accounting, La Trobe University, Australia. Email :x.ji@latrobe.edu.au Proceedings of Annual Shanghai Business, Economics and Finance Conference 3 - 4 November 2014, Shanghai University of International Business and Economics, Shanghai, China ISBN: 978-1-922069-63-4 This paper is structured as follows. Section 2 presents the literature review of earnings management. Section 3 discusses the hypothesis development and research methodology. The empirical results are interpreted in Section 4. Finally, Section 5 contains the conclusion and possible future research opportunities. 2. Literature review Managers have different incentives to engage in earnings management (Healy and Wahlen,1998). Managers would manipulate the reported earnings to increase their awards and personal wealth when their compensation and bonus are tied to firm performance (Watts, 1977; Watts and Zimmerman, 1978; Healy, 1985); to avoid the violations of the restrictive covenant in the lending or debt contracts, otherwise, such violations would impose heavy costs on firms (Defond and Jiambalvo, 1994; Ahmed and Saleh, 2005); to influence their stock prices or the book value of their assets prior to acquisitions, buyouts or IPOs (Teoh et al, 1998; Scott, 2009); or to minimize the political cost as a result of the violations of governmental or industrial regulations (Wong, 1988). During a management turnover, new managers are also likely to deliberately manage earnings downwards in order to blame their predecessors for poor performance, which also allows them to report higher growth during their term of office (Godfrey et al, 2003). Scott (2009) classifies earnings management into four major patterns: taking a bath, (Healy, 1985; DeAngelo, 1988), income minimization (Shuto, 2007), income maximization (Guidry et al, 1998), and earnings smoothing (McNichols and Wilson, 1988). Two major earnings management methods are employed by firms to realize the four patterns of earnings management: accrual-based and cash flow-based earnings management. Cohen and Zarowin (2010) argue that the major distinction between accrual based and cash flow based earnings management activities is that cash flow based earnings management involves the manipulations of real business activities, such as the increases in sales or reductions in inventories that involve cash transactions. Therefore, real earnings management has the direct impact on cash flows. Roychowdhury (2006) reports that managers engage in real earnings management activities in order to avoid reporting annual income losses or to increase reported earnings. These activities include (1) offering price discounts or more lenient credit terms to temporarily increase sales, (2) aggrandizing production in order to lessen cost of goods sold, and (3) reducing discretionary expenditures, including research and development costs, sales and distribution expenses, advertising expenses, etc. The literature has provided limited empirical evidence regarding firms’ reactions to financial crisis by means of earnings management. Ahmed and Saleh (2005) examine the earnings management of financially distressed firm in debt renegotiation during the Asian Financial Crisis. They find that financially distressed firms manipulate earnings downward during the 1997 Asian Financial Crisis in Malaysia. Kim and Yi (2006) explore the earnings management behavior of firms in Korea during the 1997 Asian Financial Crisis. Their results indicate that public firms engage in earnings management to a larger extent than private firms. Chia et al (2007) find that service-oriented firms in Singapore engaged in income-decreasing earnings management or taking a bath during the period of the 1997 Asian Financial Crisis. Charoenwong and Jiraporn (2009) also examine the reactions of firms in Singapore and Thailand to the 1997 Asian financial crisis. Their results reveal that firms that Proceedings of Annual Shanghai Business, Economics and Finance Conference 3 - 4 November 2014, Shanghai University of International Business and Economics, Shanghai, China ISBN: 978-1-922069-63-4 were less affected by financial crisis in these two countries use earnings management to avoid reporting losses and negative income growth. However, these studies investigate only one type of earnings management, either accrual based earnings management or real activities manipulations. 3. Methodology Financial crisis or economic recession would provide corporate managers with various incentives to manipulate earnings. It shows that financial crisis tends to force firms to be financially distressed. For example, Ahmed and Saleh (2005) report that during the 1997 Asian Financial Crisis most Malaysian corporations suffered a significant falloff in both output and profitability. Besides the financially distressed firms, it is also possible that firms that are less affected by the financial crisis could engage in income-increasing earnings management in order to avoid reporting losses and negative earnings growth (Charoenwong and Jiraporn, 2009). This argument is relevant to the situation in China during the GFC because the top Chinese listed firms were less affected by the GFC and had incentives to engage in income-increasing earnings management. Firstly, for export-oriented firms that experienced significant decrease in export as a result of the decrease in the consumption levels of major developed economies, China’s domestic market is still huge, which allows them to transfer their sale from overseas market to domestic market. More importantly, the Chinese government always strives to keep the development of the national economy at a stable pace. In order to protect China’s economy and Chinese firms from the influence of the GFC, a series of measures were initiated, and the most remarkable measure was the 4 trillion RMB stimulus package. Because of these effective governmental interventions, the economic recession in China did not last for more than a quarter. The sales and financial performance of Chinese firms, especially the firms covered by the stimulus package, were not affected severely. One of the reason we suspect is that top Chinese listed firms, especially those covered by the stimulus package, would engage in income-increasing earnings management to further boost their financial performance during the GFC. Based on the above discussions, our hypotheses are established as follows. H1: Top Chinese listed firms did engage in accrual based earnings management during the Global Financial Crisis (GFC). H1a: Top Chinese listed firms, covered by the stimulus package, engaged in income-increasing accrual based earnings management during the Global Financial Crisis (GFC). H2: Top Chinese listed firms did engage in cash flow based earnings management during the Global Financial Crisis (GFC). H2a: Top Chinese listed firms, covered by the stimulus package, engaged in income-increasing cash flow based earnings management during the Global Financial Crisis (GFC). In this study discretionary accruals are estimated by using Kothari (2005) model. In order to estimate discretionary accruals, total accruals are calculated by using the Proceedings of Annual Shanghai Business, Economics and Finance Conference 3 - 4 November 2014, Shanghai University of International Business and Economics, Shanghai, China ISBN: 978-1-922069-63-4 balance sheet approach. This approach is prevalently used in the literature (Healy, 1985). In our study, the cross-sectional Kothari (2005) model is used because this model is argued to be more powerful in estimating discretionary accruals (Bartov et al, 2001; Ahmed and Saleh, 2005): TAit Salesit PPEit 1 k1 k2 k3 k4 k5 ROAit it Assetsi ,t 1 Assetsi ,t 1 Assetsi ,t 1 Assetsi ,t 1 (1) where, for fiscal year t and firm i: TAit NCCAit CLit DEPit AMOit (2) TAit = total accruals, which is defined using the balance sheet approach as above; Assetsi ,t 1 = beginning total assets; Salesit = the sales changes net of the change in accounts receivables; PPEit = the net amount of property, plant and equipment; ROAit = the return on assets ratio, it is calculated as net income divided by total assets; NCCAit = the change in non-cash current assets; CLit = the change in current liabilities; DEPit = depreciation expenses; AMOit = amortization expenses. For each financial year, equation (1) is estimated for each of the ten industry groups classified by the four-digit GICS code. This approach could control for the differences among industry groups that may have impacts on total accruals and allow the coefficients to change over the sample period as suggested by Defond and Jiambalvo (1994) and Cohen and Zarowin (2010). The coefficients estimated from equation (1) are used to estimate the non-discretionary accruals (NA): NAit k1 k 2 Salesit PPEit 1 k3 k4 k 5 ROAit Assetsi ,t 1 Assetsi ,t 1 Assetsi ,t 1 (3) Therefore, discretionary accruals (DA) are estimated as the prediction errors (εit ) in equation 1, which are the difference between total accruals (TA) and the estimated non-discretionary accruals (NA). The cross-sectional Roychowdhury (2006) model is applied to detect cash flow based earnings management. Three metrics are considered: the abnormal levels of CFO, production costs and discretionary expenditures. Roychowdhury (2006) explains the three methods of real earnings manipulations as follows: 1. Sales manipulations: this involves to offer price discounts or more lenient credit terms by managers with the purpose of increasing current fiscal year’s sales. Sales manipulations would lead to abnormally low CFO and high production costs. Proceedings of Annual Shanghai Business, Economics and Finance Conference 3 - 4 November 2014, Shanghai University of International Business and Economics, Shanghai, China ISBN: 978-1-922069-63-4 2. Reduction of discretionary expenses: this involves to postpone discretionary expenditures to future periods which leads to abnormally low discretionary expenses and high CFO. 3. Overproduction: this involves to produce surplus goods in order to manipulate earnings upwards. This behavior leads to abnormally high production costs and low CFO. However, in our study we argue that the situation in China in regard to production costs is different to Roychowdhury’s explanation. Roychowdhury (2006) suggests that when firms engage in overproduction to increase current period’s reported earnings, there will be positive abnormal production costs because of the additional production and holding costs on the overly produced inventory. In the Chinese context, as we have explained earlier, the Chinese government initiated mass infrastructure constructions and encouraged firms to increase outputs in order to stimulate China’s economic growth during the GFC. The products of the top Chinese firms were not overly-produced and appeared to be subsequently sold right after production, thus there wouldn’t be excessive inventory or additional holding costs. For example, the products of the construction material manufacturing firms would be directly sold and used in the construction projects, such as the construction of railways, highways and airports. Therefore, we expect that top Chinese firms engaging in income-increasing real earnings manipulations would have positive abnormal CFO and negative abnormal production costs. Following previous studies, normal CFO is expressed as a linear function of sales and change in sales and the equations below are run for each year and each of the ten industry groups classified by 4-digit GICS code: CFOit Salesit Salesit 1 k1 k2 k3 k4 it (4) Assetsi ,t 1 Assetsi ,t 1 Assetsi ,t 1 Assetsi ,t 1 where CFOit is the cash flows from operating activities. Salesit is the change in sales defined as Salesit Salesit Salesi ,t 1 . Cost of goods sold (COGS) is modeled as a linear function of contemporaneous sales: COGSit Salesit 1 k1 k2 k3 it Assetsi ,t 1 Assetsi ,t 1 Assetsi ,t 1 (5) Change in inventory is presented as the linear function of contemporaneous and lagged sales growth: Salesi ,t 1 INVit Salesit 1 k1 k2 k3 k4 it Assetsi ,t 1 Assetsi ,t 1 Assetsi ,t 1 Assetsi ,t 1 (6) where INVit is the change in inventory. As the production costs are defined as the sum of COGS and change in inventory, the normal level of production costs is estimated using regression (7), Proceedings of Annual Shanghai Business, Economics and Finance Conference 3 - 4 November 2014, Shanghai University of International Business and Economics, Shanghai, China ISBN: 978-1-922069-63-4 Salesi ,t 1 PRODit Salesit Salesit 1 k1 k2 k3 k4 k5 it Assetsi ,t 1 Assetsi ,t 1 Assetsi ,t 1 Assetsi ,t 1 Assetsi ,t 1 (7) where PRODit is the production costs. According to Roychowdhury (2006) and Cohen and Zarowin (2010), the normal level of discretionary expenses is estimated by using the lagged sales rather than current sales: Salesi ,t 1 DISEXPit 1 k1 k2 k3 it Assetsi ,t 1 Assetsi ,t 1 Assetsi ,t 1 (8) where DISEXPit is the discretionary expenses. All the abnormal levels of CFO, production costs and discretionary expenditures are estimated as the prediction errors (εit ) in equations (4) to (8). Again, all variables in these equations are scaled by opening total assets and a constant is included in order to reduce heteroskedasticity. We estimate the following regressions to investigate the earnings management of top Chinese listed firms as a reaction to the GFC. 𝐴𝐸𝑀𝑖𝑡 = 𝛼 + 𝛽1𝑃𝑂𝑆𝑇𝑖𝑡 + 𝛽2 𝑆𝑇𝐼𝑀𝑈𝐿𝑈𝑆𝑖𝑡 + 𝛽3 𝐶𝐹𝑂𝑅𝑖𝑡 + 𝛽4 𝐴𝑈𝐷𝐼𝑇𝑖𝑡 + 𝛽5 𝐿𝐸𝑉𝑖𝑡 +𝛽6 𝑀𝐵𝑖𝑡 + 𝛽7 𝑆𝐼𝑍𝐸𝑖𝑡 + 𝛽8 𝑌𝐸𝐴𝑅𝑖𝑡 + 𝛽9 𝐼𝑁𝐷𝑈𝑆𝑇𝑅𝑌𝑖𝑡 + 𝜀𝑖𝑡 𝑅𝐴𝑀𝑖𝑡 = 𝛼 + 𝛽1 𝑃𝑂𝑆𝑇𝑖𝑡 + 𝛽2 𝑆𝑇𝐼𝑀𝑈𝐿𝑈𝑆𝑖𝑡 + 𝛽3 𝑅𝑂𝐴𝑖𝑡 + 𝛽4 𝐴𝑈𝐷𝐼𝑇𝑖𝑡 + 𝛽5 𝐿𝐸𝑉𝑖𝑡 +𝛽6 𝑀𝐵𝑖𝑡 + 𝛽7 𝑆𝐼𝑍𝐸𝑖𝑡 + 𝛽8 𝑌𝐸𝐴𝑅𝑖𝑡 + 𝛽9 𝐼𝑁𝐷𝑈𝑆𝑇𝑅𝑌𝑖𝑡 + 𝜀𝑖𝑡 (9) (10) AEM is the dependent variable in regression (9), which refers to the discretionary accruals (DA) estimated by using Kothari (2005) model. The dependent variable RAM in regression (10) is the abnormal levels of real activities manipulations, including the abnormal CFO, the change in inventory, COGS, production costs and discretionary expenditures. We include two dummy variables, POST and STIMULUS, to examine the influences of the GFC and the stimulus package on firms’ earnings management in models 9 and 10. POST indicates if a firm-year observation is in the post-GFC period, and STIMULUS shows if a sample firm is covered by the 4 trillion RMB stimulus package. 4. Findings The sample in this study includes 1,392 firm-year observations for 232 firms from 2004 to 2009. This sample period allows the comparison of the sample firms’ earnings management behaviors before and after 2008 when the GFC started, which helps to investigate whether top Chinese listed firms engaged in earnings management as a response to the economic crisis. The data is collected from the OSIRIS and ThomsonONE databases, and it has been winsorized at both 1 st and 99th percentiles in order to relieve the impact of outliers on the results. The sample selection procedure is illustrated in Table 1. Proceedings of Annual Shanghai Business, Economics and Finance Conference 3 - 4 November 2014, Shanghai University of International Business and Economics, Shanghai, China ISBN: 978-1-922069-63-4 Table 1: Summary of Sample Selection Firm-year observations are selected from OSIRIS database Chinese firms in OSIRIS database Firms selected from 10 industries by 4-digit GICS codes Top 200 firms selected by total assets from 2007 to 2009 Sample period from 2004 to 2009 Final sample 2,383 2,383 1,822 1,822 232 232 1,392 1,392 1,392 Table 2 reports the descriptive statistics for the major measures of earnings management and the control variables used in this paper. In Panel A, the mean of absolute value of total accruals 0.134 and median is 0.089. The mean of absolute value of discretionary accruals (DA) is 0.081 and mean is 0.061. In Panel B, the means of the absolute values of cash flow-based earnings management measures, CFO, ∆INV, GOGS, PROD and DISEXP, are 0.047, 0.033, 0.058, 0.053 and 0.134 respectively. For the control variables in Panel C, AUDIT refers to the total remuneration of auditors over opening balance of total assets, on average, the audit fees account for about 0.1% of the total assets. The average leverage ratio (LEV) is 60.3%, which indicates that top Chinese listed firms are highly leveraged. The average market-to-book ratio (MB) is 45.1%. The average return on assets ratio (ROA) of 5.5% shows that top Chinese listed firms have comparatively low financial performance. Table 3 compares the means of the unsigned or absolute values of earnings management indicators before and during the GFC period. The results show that the average absolute values of discretionary accruals (DA) increased significantly from 0.024 to 0.055 after 2008; the means of the abnormal levels of CFO, COGS, the change in inventory, production costs and discretionary expenses have all changed significantly. Table 4 reports the results of the regression model (9). The results show that the independent variables, POST and STIMULUS, do not have significant influence on the dependent variable discretionary accruals (DA). Therefore, H1 cannot be supported, which indicates that top Chinese listed firms, as well as the firms covered by the stimulus package, did not engage in accrual based earnings management during the GFC. Table 5 presents the results about the sample firms’ cash flow based earnings management during the GFC. Firstly, in the regression with abnormal production costs (PROD) as the dependent variable, the coefficient of POST is -0.0282 that is significant at the level of 5%. This shows that top Chinese listed firms as whole engaged in income-increasing earnings management through the downward manipulation of production costs. Secondly, the coefficient of STIMULUS is significantly positive (0.0199) in the regression of abnormal CFO (CFO) and is significantly negative in the regression of PROD. This confirms our expectation that, in the Chinese context, firms engage in mass production to manage reported earnings upwards. Based on these results, H2 and H2a hold true. Top Chinese listed firms, especially the ones supported by the stimulus package, engaged in Proceedings of Annual Shanghai Business, Economics and Finance Conference 3 - 4 November 2014, Shanghai University of International Business and Economics, Shanghai, China ISBN: 978-1-922069-63-4 income-increasing earnings management through the downward manipulation of production costs in the post-GFC period. Table 2: Descriptive Statistics for Major Earnings Management Indicators and Control Variables Variables Mean Median Maximum Minimum Std. Dev. Panel A: Accrual-based earnings management indicators TA 0.134 0.089 3.767 0.000 0.229 DA 0.081 0.061 0.719 0.000 0.083 NA 0.118 0.089 3.682 0.001 0.207 Panel B: Cash flow-based earnings management indicators CFO 0.047 0.029 0.709 0.000 0.063 ∆INV 0.033 0.005 1.613 0.000 0.079 COGS 0.058 0.036 0.747 0.000 0.077 PROD 0.053 0.016 1.557 0.000 0.097 DISEXP 0.134 0.047 5.677 0.000 0.313 Panel C: Control variables employed in the regression models AUDIT 0.001 0.000 0.031 0.000 0.002 CFOR 0.103 0.088 1.805 -0.298 0.137 LEV 0.603 0.620 0.965 0.171 0.175 MB 0.451 0.000 1.000 0.000 0.498 ROA 0.055 0.049 0.483 -0.394 0.065 SIZE 14.221 14.097 17.636 12.173 0.888 TA refers to the absolute value of total accruals, which is calculated following the balance sheet approach as the change in non-cash current assets minus the change in current liabilities less total depreciation and amortization expenses, scaled by lagged total assets; DA and NA refer the absolute value of the discretionary and non-discretionary accruals generated following Kothari (2005) model for each industry group in each observation year, and non-discretionary accruals are defined as total accruals minus discretionary accruals; CFO, ∆INV, COGS ,DISEXP and PROD are the absolute values of abnormal levels of CFO, change in inventory, COGS, discretionary expenses and production costs, which are generated following Roychowdhury (2006) model; AUDIT refers to the total auditor remuneration deflated by the opening total assets; CFOR is the cash flow from operations divided by beginning total assets; LEV is leverage calculated by dividing current total liabilities by current total assets; MB refers to the market-to-book ratio; ROA is the return on assets ratio calculated as the net income divided by current total assets; SIZE is the natural log of current total assets. Proceedings of Annual Shanghai Business, Economics and Finance Conference 3 - 4 November 2014, Shanghai University of International Business and Economics, Shanghai, China ISBN: 978-1-922069-63-4 Table 3: Comparison of the means of unsigned discretionary accruals and the abnormal levels of real activities manipulations during the GFC Earnings management indicators Mean Standard Deviation P value Pre-crisis Post-crisis Pre-crisis Post-crisis DA 0.024 0.055 0.057 0.080 0.000*** CFO 0.041 0.060 0.064 0.058 0.000*** COGS 0.053 0.069 0.078 0.075 0.000*** ∆INV 0.022 0.055 0.056 0.107 0.000*** PROD 0.040 0.081 0.083 0.115 0.000*** DISEXP 0.157 0.088 0.369 0.141 0.000*** *, ** and *** indicate levels of significance at p<0.1, p<0.05 and p<0.01, respectively. DA refers to the absolute value of the total residual generated following Kothari (2005) model, which is the indicator of accrual-based earnings management. CFO, COGS, ∆INV, PROD and DISEXP are the absolute values of the five indicators of cash flow-based earnings management, which are the abnormal levels of CFO, COGS, and change in inventory, production costs and discretionary expenses. Proceedings of Annual Shanghai Business, Economics and Finance Conference 3 - 4 November 2014, Shanghai University of International Business and Economics, Shanghai, China ISBN: 978-1-922069-63-4 Table 4: Regression results about accrual based earnings management of top Chinese listed firms as a reaction to the GFC DA Variables Coefficient P value C 0.011 0.878 POST 0.005 0.605 STIMULUS 0.005 0.615 CFOR -0.112 0.000*** AUDIT 0.342 0.835 LEV -0.018 0.426 MB 0.006 0.426 SIZE 0.000 0.977 Year Dummy yes Industry dummy yes R-squared 0.058 Adjusted R-squared 0.016 *, ** and *** indicate levels of significance at p<0.1, p<0.05 and p<0.01, respectively. DA is discretionary accruals estimated following Kothari (2005) model; POST takes the value of 1 if a firm-year observation is in the post-crisis period; STIMULUS indicates if a sample firm is covered by the stimulus package; AUDIT refers to the total auditor remuneration deflated by the opening total assets; CFOR is the cash flow from operations divided by beginning total assets; LEV is leverage calculated by dividing current total liabilities by current total assets; MB is a dummy variable that takes the value of 1 if current market-to-book ratio is below 1, and 0 otherwise; SIZE is the natural log of current total assets. Proceedings of Annual Shanghai Business, Economics and Finance Conference 3 - 4 November 2014, Shanghai University of International Business and Economics, Shanghai, China ISBN: 978-1-922069-63-4 Table 5: Regression results about cash flow based earnings management by top Chinese listed firms during the GFC ∆INV CFO COGS PROD DISEXP Coefficient P value Coefficient P value Coefficient P value Coefficient P value Coefficient P value C -0.006 0.933 -0.232 0.000*** 0.243 0.001*** -0.148 0.085* 0.433 0.116 POST 0.005 0.636 -0.025 0.011** -0.013 0.207 -0.028 0.028** 0.065 0.112 STIMULUS 0.020 0.061* -0.037 0.000*** -0.034 0.002*** -0.051 0.000*** -0.066 0.125 AUDIT -0.664 0.682 3.528 0.022** -2.703 0.106 1.876 0.360 -17.007 0.010*** LEV -0.052 0.025** 0.049 0.026** 0.052 0.031** 0.103 0.001*** -0.018 0.845 MB 0.010 0.195 0.008 0.270 -0.002 0.816 -0.002 0.824 -0.035 0.262 ROA 0.505 0.000*** 0.062 0.275 -0.855 0.000*** -0.472 0.000*** 0.116 0.634 SIZE 0.000 0.933 0.014 0.003*** -0.014 0.006*** 0.009 0.141 -0.028 0.150 Year Dummy Industry dummy yes yes yes yes yes yes yes yes yes yes R-squared 0.1892 0.1325 0.3411 0.1750 0.2482 Adjusted R-squared 0.1542 0.0951 0.3127 0.1394 0.2158 *, ** and *** indicate levels of significance at p<0.1, p<0.05 and p<0.01, respectively. RFO, GOGS, ∆INV, PROD and DISEXP are the absolute values of the abnormal levels of CFO, COGS, the change in inventory, production costs and discretionary expenses; Proceedings of Annual Shanghai Business, Economics and Finance Conference 3 - 4 November 2014, Shanghai University of International Business and Economics, Shanghai, China ISBN: 978-1-922069-63-4 4. Conclusion Although earnings management continues to be an important issue in the financial accounting, the literature so far has provided limited evidence on firms’ earnings management behaviours as a reaction to the Global Financial Crisis (GFC), especially in developing countries, such as China. Our results show that top Chinese listed firms did manage reported earnings upwards in order to boost performance or to achieve income smoothing through the manipulation of production costs rather than discretionary accruals. The results reflect the positive impact of the 4 trillion RMB stimulus package launched by the Chinese government. We argue that the purpose of such governmental intervention is to keep China’s economic growth stable even under the situation of the GFC and to enhance China’s international image, as well as people’s confidence in China’s economy. In addition, our findings also provide the empirical evidence supporting the argument that managers increasingly prefer real earnings manipulations to accrual based earnings management. There may still be some limitations. Firstly, our sample firms are selected from the exported-oriented industries only. A more diversified sample could help to provide a more comprehensive picture about earnings management used by Chinese firms in response to the GFC. Secondly, the GFC started since 2008 had lasted for few years, it may take longer time for firms to react to it. The sample period in this study may be inevitably not long enough. Therefore, in the future, the research could be extended in these aspects. References Ahmed, K and Saleh N, M, 2005, Earnings management of distressed firms during debt renegotiation, International Journal of Accounting, Auditing and Performance evaluation, 4, 6, 589-607 Charoenwong, C. and Jiraporn, P., 2009, Earnings management to exceed thresholds: evidence from Singapore and Thailand, Journal of Multinational Financial Management, 19, 3, 221-236 Chia, Y.M., Lapsley, I. and Lee, H.W., 2007, Choice of auditors and earnings management during the Asian financial crisis, Managerial Auditing Journal, 22, 2, 177-196 Cohen, D.A. and Zarowin, P., 2010, Accrual-based and real earnings management activities around seasoned equity offerings, Journal of Accounting and Economics, volume 50, 2-19 DeAngelo, H., DeAngelo, L. and Skinner, D., 1994, Accounting choices of troubled companies, Journal of Accounting and Economics, 17, 113-143 Defond, M.L. and Jiambalvo, J., 1994, Debt Covenant Violation and Manipulation of Accruals, Journal of Accounting and Economics, 17, 145-176 Godfrey, J., Mather, P. and Ramsay, A., 2003, Earnings and Impression management in Financial Reports: The case of CEO changes, Abacus 39, 95-123 Guidry, F., Leone, A. and Rock, S., 1998, Earnings-based bonus plans and earnings management by business-unit managers, Journal of Accounting and Economics, 26, 113-142 Proceedings of Annual Shanghai Business, Economics and Finance Conference 3 - 4 November 2014, Shanghai University of International Business and Economics, Shanghai, China ISBN: 978-1-922069-63-4 Healy, P.M., 1985, the Effect of Bonus Schemes on Accounting Decisions, Journal of Accounting and Economics, 7, 85-107 Healy, P.M. and Wahlen, J.M., 1999, A Review of the Earnings Management Literature and Its Implications for Standard Setting, Accounting Horizons, 13, 4, 365-383 Kim, Y. and Yi, C.H., 2006, Ownership Structure, Business Group Affiliation, Listing Status, and Earnings Management: Evidence from Korea, Canadian Academic Accounting Association, Contemporary Accounting Research, 23, 2, 427-464 Koh, K., Matsumoto, D. and Rajgopal, S., 2008, Meeting or Beating Analyst Expectations in the Post-Scandals World: Changes in Stock Market Rewards and Managerial Actions, Contemporary Accounting Research, 25, Issue 4, 1067-1098 Kothari, S.P., Leone, A.J. and Wasley, C.E., 2005, Performance matched discretionary accrual measures, Journal of Accounting and Economics, 39, 163– 197 Li, S. F., McDowell, E., and Moore, E. A., 2008, Accrual Based Earnings Management, Real Transactions Manipulation and Expectations Management: U.S. and International Evidence, Journal of Global Business Management, 4 (2) McNichols, M., and Wilson, G.P., 1988, Evidence of Earnings Management from the Provision from Bad Debts, Journal of Accounting Research, 26, 1-31 Roychowdhury, S., 2006, Earnings management through real activities manipulation, Journal of Accounting and Economics, 42, 335–370 Scott, W.R., 2009, Financial accounting theory, 5th edition, chapter 11. Shuto, A., 2007, Executive compensation and earnings management: Empirical evidence from Japan, Journal of international Accounting, Auditing and Taxation, 16, 1-26 Teoh, S.H., Welch, I. and Wong, T.J., 1998, Earnings management and the long-run market performance of Initial Public Offerings, The Journal of Finance, 53, 6, 1935-1974 Watts, R.L., 1977, Corporate finance statements, a product of the market and political processes, Australian Journal of Management, April, 53-75 Watts, R.L. and Zimmerman, J., 1978, Towards a positive theory of the determination of Accounting standards, Accounting Review, Jan. 112-134 Wong, J., 1988, Political costs and an intra-period accounting choice for export tax credits, Journal of Accounting and Economics, 10, 1, 37-51 Yu, Y., 2009, China’s reaction to the global economic crisis, Research institute of Economy, Trade and Industry report, number 112