Proceedings of Paris Economics, Finance and Business Conference

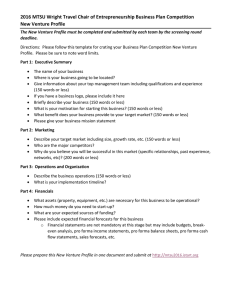

advertisement