Victor Valley Community College District Fiscal Review April 3, 2013 Joel D. Montero

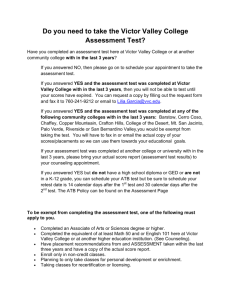

advertisement