The Currently Mandated Myopia of Rule Behind the Mutual Fund Curtain

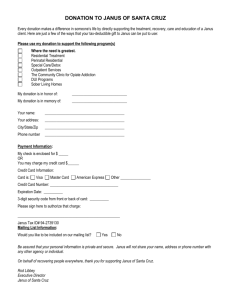

advertisement